Wondering what history tells us about @federalreserve 🏦 tightening vs. loosening 💵cycles? If so, you're not alone! Here's a thread that breaks down the data 📊, #interestrates pause/pivot, & more... 🧵/👇🏼

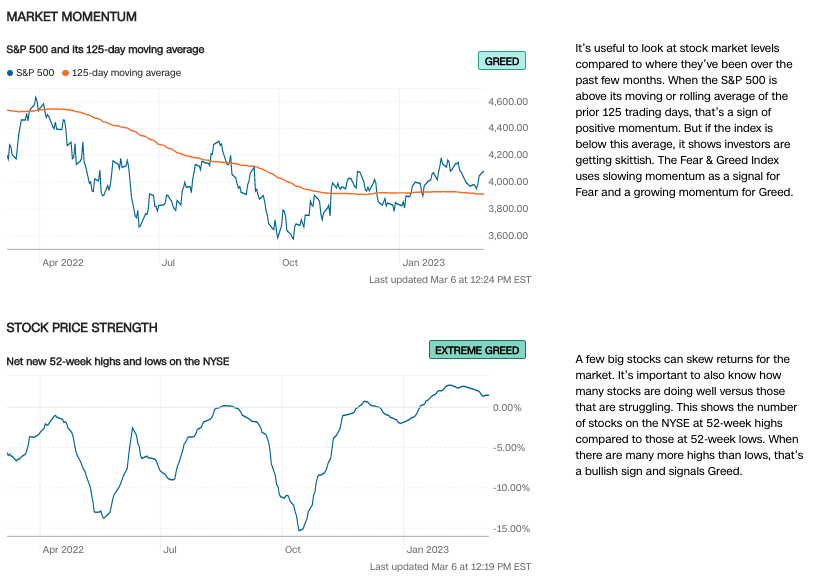

#StockMarket #FederalReserve @LizAnnSonders

#StockMarket #FederalReserve @LizAnnSonders

https://twitter.com/LizAnnSonders/status/1601191755218550785?s=20&t=ISkNIn3CktJORjxLJjPpmQ

1/🧵 @WinfieldSmart @SoberLook @MacrobondF #FederalReserve #interestrates #StockMarket

https://twitter.com/WinfieldSmart/status/1570002668805914624?s=20&t=ISkNIn3CktJORjxLJjPpmQ

2/🧵 @WinfieldSmart @BankofAmerica #FederalReserve #interestrates #StockMarket

https://twitter.com/WinfieldSmart/status/1570002982716022785?s=20&t=ISkNIn3CktJORjxLJjPpmQ

3/🧵 @NDR_Research @edclissold #FederalReserve #interestrates #StockMarket

https://twitter.com/edclissold/status/1588166628835053568?s=20&t=Cm7-irXLSWYKbPM3QkuNbA

5/🧵 @WinfieldSmart @MacrobondF @OxfordEconomics #FederalReserve #interestrates #StockMarket

https://twitter.com/WinfieldSmart/status/1585589171934076931?s=20&t=ISkNIn3CktJORjxLJjPpmQ

6/🧵 @WinfieldSmart @thedailyshot @SoberLook #FederalReserve #interestrates #StockMarket

https://twitter.com/WinfieldSmart/status/1600097022581051393?s=20&t=ISkNIn3CktJORjxLJjPpmQ

7/🧵 @WinfieldSmart @thedailyshot @SoberLook #FederalReserve #interestrates #StockMarket

https://twitter.com/WinfieldSmart/status/1592124540918075392?s=20&t=ISkNIn3CktJORjxLJjPpmQ

8/🧵 @BankofAmerica @business @markets #FederalReserve #interestrates #StockMarket

https://twitter.com/BanksterCorp/status/1578097994158600192?s=20&t=ISkNIn3CktJORjxLJjPpmQ

9/🧵 @M_McDonough #FederalReserve #interestrates #StockMarket

https://twitter.com/M_McDonough/status/1600866346744500224?s=20&t=PvhxmDTkcVS8tsK6h48IrA

10/🧵 @WinfieldSmart @insidefinance #FederalReserve #StockMarket #interestrates $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/WinfieldSmart/status/1592123537305010177?s=20&t=RZ5JDvbzS4frqZOe4SjRjg

11/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256934975639553?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

12/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256938024468485?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

13/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256940059127808?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

14/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

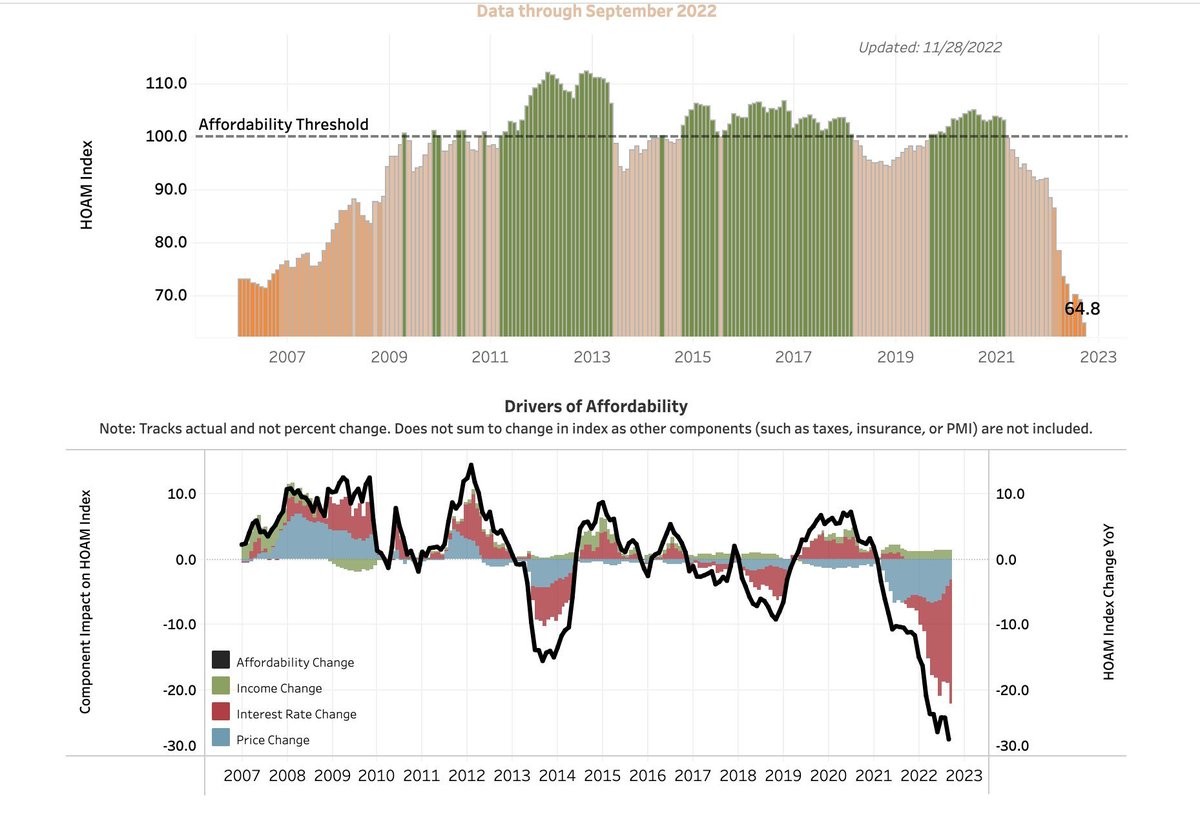

https://twitter.com/TimmerFidelity/status/1601256943234191360?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

15/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256947764039680?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

16/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256953678036992?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

17/🧵 @TimmerFidelity @Fidelity #FederalReserve #StockMarket #interestrates #ism $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/TimmerFidelity/status/1601256956559118336?s=20&t=Y_WbGb2wl7wCsjr1a8B9mQ

18/🧵 @SethCL @DeutscheBank $DS @business @markets #StockMarket #interestrates $SPY $ES $SPX

https://twitter.com/SethCL/status/1598294903729324032?s=20&t=C8Ry9EzFrlXfPrZzaR0SAw

19/🧵 @WallStJesus @business @markets @TDAmeritrade #FederalReserve #StockMarket #interestrates

https://twitter.com/WallStJesus/status/1601686202406821888?s=20&t=Dam6I_LmeDdjBNNFcU-qmA

20/🧵 @WallStJesus @business @markets @TDAmeritrade #FederalReserve #StockMarket #interestrates

https://twitter.com/WallStJesus/status/1601686289480548352?s=20&t=Dam6I_LmeDdjBNNFcU-qmA

21/🧵 @WallStJesus @SocieteGenerale #FederalReserve #StockMarket #interestrates

https://twitter.com/WallStJesus/status/1601603971009105921?s=20&t=XA7dy2KPUjrATPEsqT1Ppw

22/🧵 @ArnobBiswas18 #FederalReserve #StockMarket #interestrates #FOMC #FED

https://twitter.com/ArnobBiswas18/status/1602338166354370561?s=20&t=fh94vU7Qsoz-qmPt1KLxHA

23/🧵 @JeffWeniger #FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $ES $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/JeffWeniger/status/1604224918215720960?s=20&t=awlBRIJKt0KQCdBBpjiCxQ

24/🧵 Can the @federalreserve pull of a "soft-landing"? Here's what history tells us about previous tightening cycles...

@BigBullCap @GoldmanSachs #FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

@BigBullCap @GoldmanSachs #FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/bigbullcap/status/1604675079258132481?s=46&t=0gnT-qb58pT_dHZkblfVYg

25/🧵 "Net change in the Fed Funds Target around recessions" via @M_McDonough @markets @business

#FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

26/🧵 "The calendar year during which the economy enters a recession has seen the S&P500 rise 5.8%, on average." @SethCL @FactSet @BMO

#FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FOMC #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/SethCL/status/1602283850645864449?s=20&t=zUE3ZdPKUIb5fTUeEdY0og

27/🧵 Per @LanceRoberts, "History suggests there is more downside risk to markets next year if we hit a #recession." @markets @business @SoberLook @thedailyshot

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/LanceRoberts/status/1603355529434353666?s=20&t=1XiDf_Oqvl1rTaPE5FpcJg

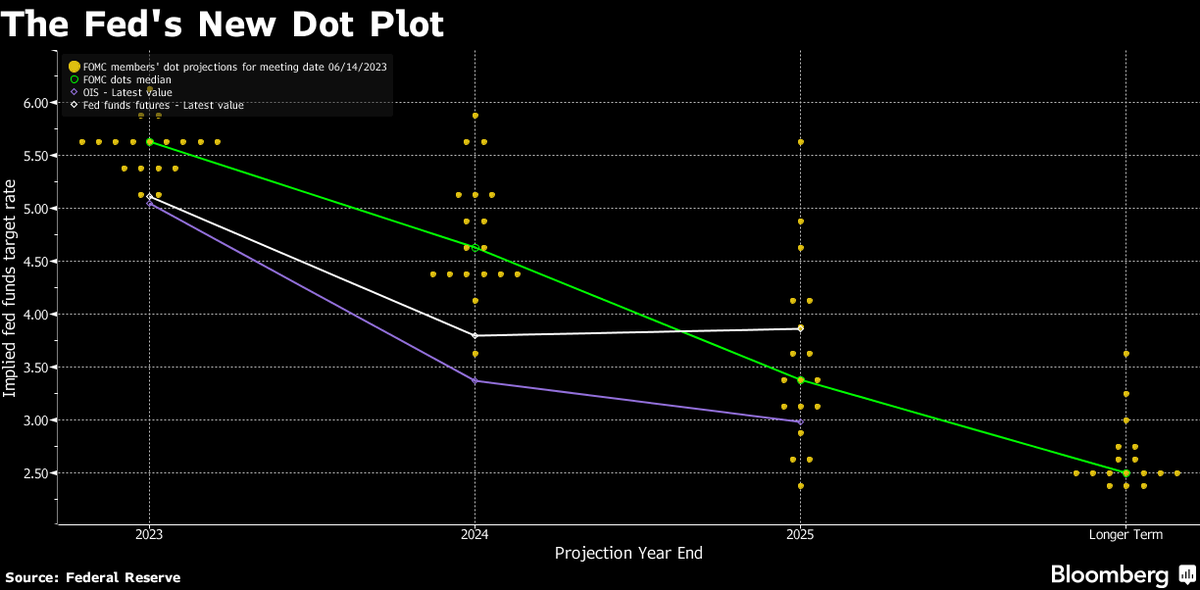

28/🧵 Looking to the 23' market cycle, here is a @federalreserve pause/pivot prediction to keep in min... h/t @3F_Research

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

29/🧵 Keep in mind if the @federalreserve "talks the talk" & hikes further, this could put more pressure on financial markets... h/t @KKR_Co @SethCL

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/SethCL/status/1608808051758489600?s=20&t=DC_r_30gJTN_kTcop1aWoA

30/🧵 Is the @federalreserve getting close to their terminal rate? Here is what @GoldmanSachs $GS predicts... 🔮🏦

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

#FederalReserve #StockMarket #interestrates #FED $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT

https://twitter.com/isabelnet_sa/status/1608785350738214914?s=46&t=LpiJLSc52XRozYVOKP7W4A

31/🧵 Great chart from @rhemrajani9 that highlights the @federalreserve pivot in #interestrates vs. $SPX...

#FederalReserve #StockMarket #FED $SPY $QQQ $NQ $DIA $DJIA $IWM $RUT #recession

#FederalReserve #StockMarket #FED $SPY $QQQ $NQ $DIA $DJIA $IWM $RUT #recession

https://twitter.com/rhemrajani9/status/1608529764587032576?s=20&t=NWe3uKBoZ46Ler1edY92ZA

32/🧵 Always good to take a look back at historical event(s), & in this case the @federalreserve vs. market setup 08' vs. 23' $SPX #inflation #interestrates @ism @SPGlobalPMI etc., is worth watching... h/t @CiovaccoCapital

#FederalReserve #StockMarket

#FederalReserve #StockMarket

33/🧵 Is the market wrong about expecting a @federalreserve pause/pivot in 23'? h/t @FedGuy12

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP

https://twitter.com/FedGuy12/status/1603034554574700544?s=20&t=BCZTz05mwC3NVew8qU_UoA

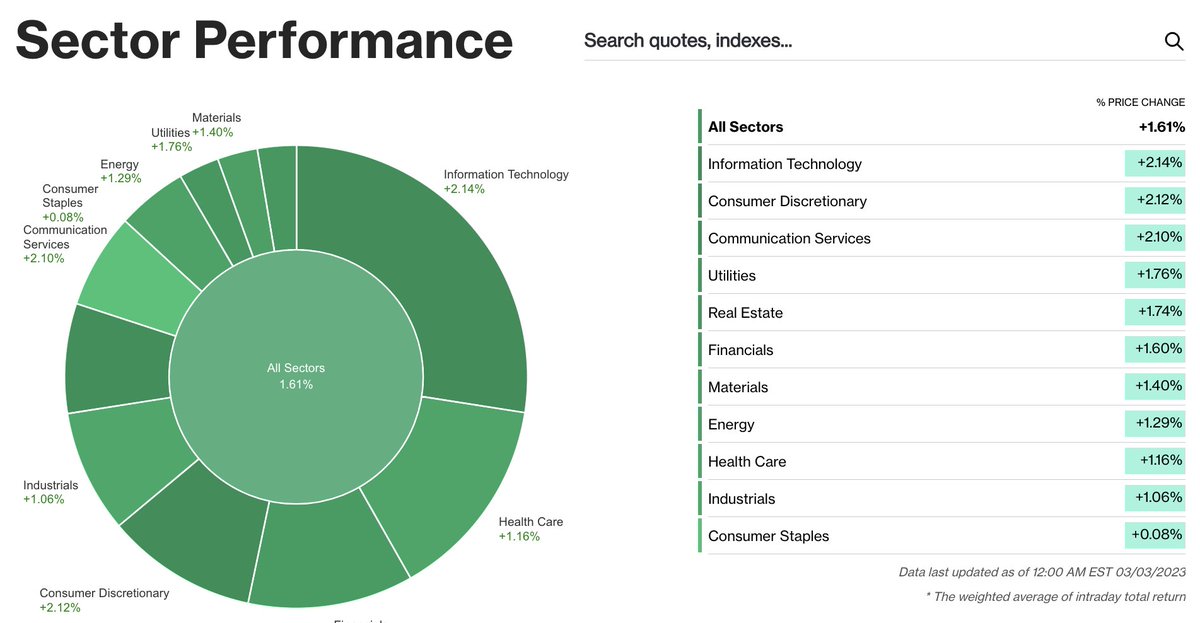

34/🧵 "Rate of Change" in focus as global central banks 🏦📈 ramp up #interestrates & QT... h/t @topdowncharts @LanceRoberts @insidefinance

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP

https://twitter.com/lanceroberts/status/1608078284092485636?s=46&t=Pxmi9vn__GkDjlo_RT98Eg

35/🧵 "Historically, equities will soften leading into (5-10% correction) and then rally post-pause." 📉 h/t @3F_Research

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

https://twitter.com/3F_Research/status/1610374527397117952?s=20&t=W-Pgm-t73XVI2YYBE9pb8A

36/🧵 "Following a @federalreserve pause, #bonds have a flawless record." 📈 h/t @3F_Research

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

https://twitter.com/3F_Research/status/1610377111151464449?s=20&t=AW-HoD8cwr0nomA-XlWQbw

37/🧵 Consensus trade(s) are for a @federalreserve "pause" in 23', "pivot" in 24'... h/t @LanceRoberts @business @markets 🔮🏦

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $NQ $DIA $DJIA $RUT $IWM #recession #GDP #FOMC $HYG $TLT $DXY

https://twitter.com/LanceRoberts/status/1610598932324798465?s=20&t=vdPEXd_xxh0pysK-BgQ5sw

38/🧵 "Back in 94/95', the @federalreserve engineered a soft landing by staying ahead of the bond market...TODAY, the fed is behind the curve." ⚠️🚨 h/t @WarrenPies @3F_Research

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $DIA $IWM #recession #GDP $HYG $TLT $DXY

#FederalReserve #StockMarket #interestrates $SPY $SPX $QQQ $DIA $IWM #recession #GDP $HYG $TLT $DXY

39/🧵 Retiring @federalreserve Charles Evans: "Going forward the deceleration in goods-prices #inflation has been important, noteworthy." @WSJ @WSJbusiness @NickTimiraos

(cont'd...)

https://twitter.com/NickTimiraos/status/1612192468069392386?s=20&t=LazHVAaR0EldlWHB68Bs1w

(cont'd...)

40/🧵 "It’s the service side and how that behaves that I think is going to be a little more indicative of whether or not policy’s adequately restrictive or something more has to be done." @WSJ @WSJbusiness @NickTimiraos

#FederalReserve #interestrates #inflation #CPI

#FederalReserve #interestrates #inflation #CPI

41/🧵 "Most aggressive @federalreserve #interestrates hiking cycle on record, in terms of front-end ROC (Rate of Change)"

📊h/t @Mayhem4Markets @FactSet @Bloomberg

#interestrates #inflation #CPI #macroeconomics

📊h/t @Mayhem4Markets @FactSet @Bloomberg

#interestrates #inflation #CPI #macroeconomics

42/🧵 "While this would be a notable step down from the rapid pace of monetary policy tightening over the course of 2022, the @fedralreserve will want to avoid signaling any intention of pausing the tightening cycle." @GregDaco

📊h/t @EY_Parthenon #interestrates #inflation #CPI

📊h/t @EY_Parthenon #interestrates #inflation #CPI

43/🧵 "The Fed might be close to done, but the policy digestion is just getting started." @MichaelKantro ⏳📉

📊 @ism #manufacturing New Orders vs. @federalreserve Fed Funds (Inverted)

#ISM #PPI #GDP #inflation #CPI #recession #FederalReserve #interestrates

📊 @ism #manufacturing New Orders vs. @federalreserve Fed Funds (Inverted)

#ISM #PPI #GDP #inflation #CPI #recession #FederalReserve #interestrates

44/🧵 Remember the 1970's #inflation spike(s)? If you don't, keep in mind that the @federalreserve does... 📉⚠️📈

📊h/t @marketdesk @SoberLook @WinfieldSmart

#GDP #inflation #CPI #recession #FederalReserve #interestrate

📊h/t @marketdesk @SoberLook @WinfieldSmart

#GDP #inflation #CPI #recession #FederalReserve #interestrate

45/🧵 Is the @federalreserve (lagging) fight against #inflation getting ready to hit 🇺🇸 (global) #GDP in 23'? Data implying 5% #FederalReserve 🏦🎯 says YES...

📊h/t @IMFS_Frankfurt @SrivatsPrakash

#interestrates #macro #CPI #JobsMarket

📊h/t @IMFS_Frankfurt @SrivatsPrakash

#interestrates #macro #CPI #JobsMarket

46/🧵 Keeping in mind @federalreserve #interestrates policy lags, & the initiation of tightening very late in the cycle — here's the latest predictions for #FederalReserve pivot... ⏳📉

📊h/t @LanceRoberts @Bloomberg

#inflation #CPI #StockMarket #bonds $TLT $DXY

📊h/t @LanceRoberts @Bloomberg

#inflation #CPI #StockMarket #bonds $TLT $DXY

• • •

Missing some Tweet in this thread? You can try to

force a refresh