Telegram's Wallet Bot and Cryptobot 🤖

Here's how they are lowering barriers to crypto

A thread🧵->

Here's how they are lowering barriers to crypto

A thread🧵->

1/n

Traditionally, crypto wallets can be a hassle and have a high barrier to entry for the general public.

Traditionally, crypto wallets can be a hassle and have a high barrier to entry for the general public.

2/n

Some reasons include:

1. Complexity -

New users find it difficult to navigate the UI, generate and manage addresses, and securely store and transfer their assets.

Some reasons include:

1. Complexity -

New users find it difficult to navigate the UI, generate and manage addresses, and securely store and transfer their assets.

3/n

2. Limited accessibility -

Traditional wallets are not always easy to access.

Accessing your hot wallet on a new device requires you to import secret phrases

2. Limited accessibility -

Traditional wallets are not always easy to access.

Accessing your hot wallet on a new device requires you to import secret phrases

4/n

(1) Wallet bot

This enables users to store and manage their crypto portfolio in Telegram.

It allows users to store, receive, and send crypto like #BTC and #ETH directly from within Telegram

(1) Wallet bot

This enables users to store and manage their crypto portfolio in Telegram.

It allows users to store, receive, and send crypto like #BTC and #ETH directly from within Telegram

5/n

Once it's bound to your Telegram account, its easy to access on the web or app versions.

Simply put, the barrier to entry is non-existent

Users familiar with the Telegram UI will find it significantly easier to use - reason why I believe they might catch up to MetaMask

Once it's bound to your Telegram account, its easy to access on the web or app versions.

Simply put, the barrier to entry is non-existent

Users familiar with the Telegram UI will find it significantly easier to use - reason why I believe they might catch up to MetaMask

6/n

(2) CryptoBot

A more versatile version of Wallet Bot, which I believe targets projects, merchants/sellers and buyers on Telegram.

(2) CryptoBot

A more versatile version of Wallet Bot, which I believe targets projects, merchants/sellers and buyers on Telegram.

7/n

You could argue hot wallets have UI to directly access dApps from the wallet, but Crypto Bot has an advantage.

It has 3 unique functions - Checks, Invoices, Crypto Pay

Why is that significant?

You guessed it:

-> Projects/Sellers/Services facilitated through Telegram

You could argue hot wallets have UI to directly access dApps from the wallet, but Crypto Bot has an advantage.

It has 3 unique functions - Checks, Invoices, Crypto Pay

Why is that significant?

You guessed it:

-> Projects/Sellers/Services facilitated through Telegram

9/n

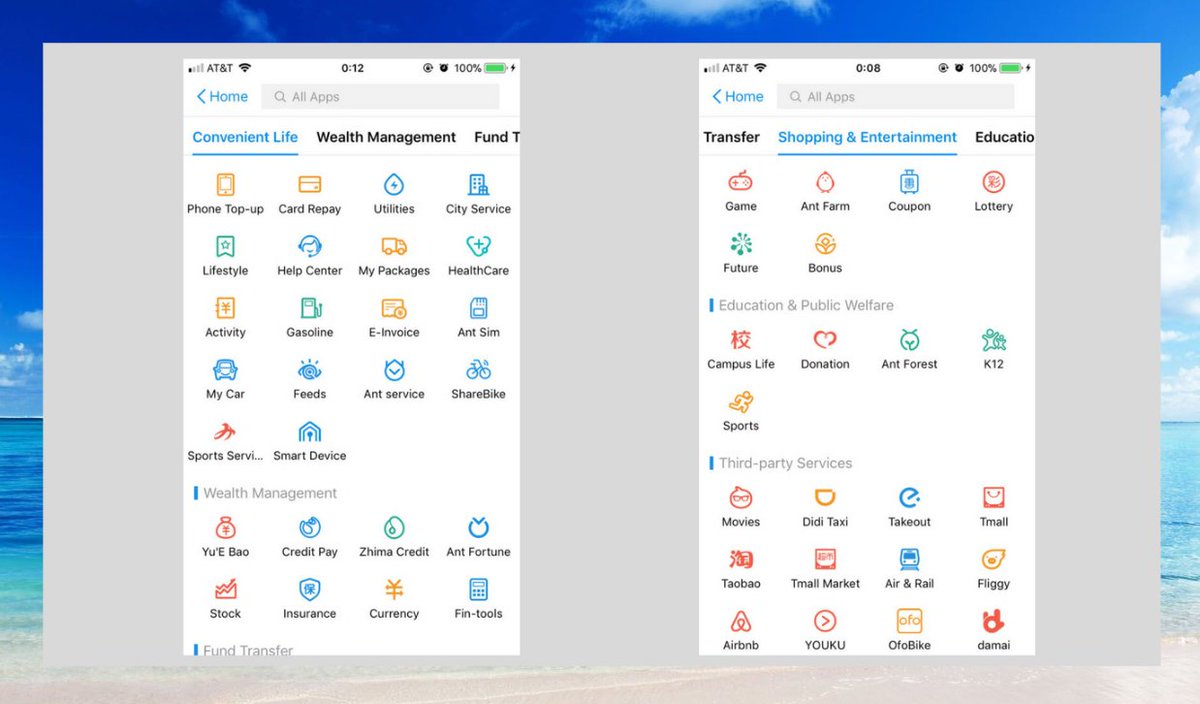

The purpose for building these can be linked back to the goal of becoming a superapp -- a web3 defi social media super app.

Why is telegram bringing in Wallet Bot and CryptoBot to achieve this goal? Here's my hypothesis:

The purpose for building these can be linked back to the goal of becoming a superapp -- a web3 defi social media super app.

Why is telegram bringing in Wallet Bot and CryptoBot to achieve this goal? Here's my hypothesis:

10/n

1. Introducing an entire DeFi ecosystem on Telegram and working towards interoperability for TONchain shifts value from third-party launchpads to Telegram.

1. Introducing an entire DeFi ecosystem on Telegram and working towards interoperability for TONchain shifts value from third-party launchpads to Telegram.

11/n

As the bull market hit, Telegram became the hub for web3 community-building.

Billions of $$ in ICOs/IDOs were indirectly facilitated through Telegram.

As the bull market hit, Telegram became the hub for web3 community-building.

Billions of $$ in ICOs/IDOs were indirectly facilitated through Telegram.

12/n

For example, when launching an IDO using Binance launchpad, BNB is used and Binance gets all the fees associated with the launch.

Telegram was used to announce the sale, release official announcements, fight scams, answer questions, etc.

For example, when launching an IDO using Binance launchpad, BNB is used and Binance gets all the fees associated with the launch.

Telegram was used to announce the sale, release official announcements, fight scams, answer questions, etc.

13/n

With TONchain and $TON bridge-able to ERC-20 and BEP-20, Telegram could retain the revenue instead:

$TON -> wrapped $TON -> IDO/ICO token.

OR they might release a launchpad and make it more frictionless:

$TON -> IDO/ICO token.

With TONchain and $TON bridge-able to ERC-20 and BEP-20, Telegram could retain the revenue instead:

$TON -> wrapped $TON -> IDO/ICO token.

OR they might release a launchpad and make it more frictionless:

$TON -> IDO/ICO token.

14/n

2. The shift towards being a decentralized social media superapp.

The current state of web3 social is built around protocols aimed to create decentralized, uncensorable and open protocols

A big name in this space is Lens Protocol:

2. The shift towards being a decentralized social media superapp.

The current state of web3 social is built around protocols aimed to create decentralized, uncensorable and open protocols

A big name in this space is Lens Protocol:

15/n

Lens leverages the ERC-721 standard to build their decentralized ecosystem.

Creating a Lens profile mints an NFT in your #ETH wallet.

Following someone mints a “Follower” NFT on-chain. And so on for any posts that you “collect”, make or share (called “mirroring”).

Lens leverages the ERC-721 standard to build their decentralized ecosystem.

Creating a Lens profile mints an NFT in your #ETH wallet.

Following someone mints a “Follower” NFT on-chain. And so on for any posts that you “collect”, make or share (called “mirroring”).

16/n

I believe Telegram is leaning towards becoming a "SocialFi superapp" whereby ownership over digital identity is a core feature with usernames and DNS's being registrable and purchasable as NFTs.

I believe Telegram is leaning towards becoming a "SocialFi superapp" whereby ownership over digital identity is a core feature with usernames and DNS's being registrable and purchasable as NFTs.

#telegram #TONcoin #crypto #cryptocurrecy #stablecoin #USDC #USDT #BUSD #binance #FTX #Metamask #Arbitrum #Airdrop #blockchain #Celsius #BlockFi #Genesis #Bitboy #Web3 #FOMC #Bybit #uniswap #BNB #MAGIC

• • •

Missing some Tweet in this thread? You can try to

force a refresh