As we kickoff 23', here's a thread w/ the latest data 🏦💵🖨 on #StockMarket liquidity, credit, & financial conditions within the broader markets... 🧵/👇🏼

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

1/🧵 One of the indicators we watch is the @federalreserve 'Net Liquidity' as this tracks the markets very closely....

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

https://twitter.com/fkronawitter1/status/1603692159529525248?s=20&t=qkVJ9UZ35pu96u6mfkdRKA

2/🧵 In addition to this, investors also have to look past the @federalreserve as global Central Banks 🏦 have joined in QT against the #inflation backdrop...

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

https://twitter.com/LanceRoberts/status/1608078284092485636?s=20&t=IjNhyHbGy5s5EZmCvM6RJw

3/🧵 Here is the latest 🇺🇸 'Financial Conditions Index', which has clearly contracted in 22'...

📊 h/t @WallStJesus @TDAmeritrade @markets @business

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @WallStJesus @TDAmeritrade @markets @business

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

https://twitter.com/WallStJesus/status/1601685960584224769?s=20&t=xufskqSKj3_8M5dUxBy0Dw

4/🧵 Keep in mind that it's not a linear pathway (QT) either as liquidity is still influencing markets...

📊 h/t @crossbordercap #FederalReserve #interestrates #stockmarket #Crypto $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @crossbordercap #FederalReserve #interestrates #stockmarket #Crypto $SPY $ES $SPX $QQQ $DIA $IWM

https://twitter.com/crossbordercap/status/1601569674311139328?s=20&t=iukP9mUhh8sO_5oTymP15w

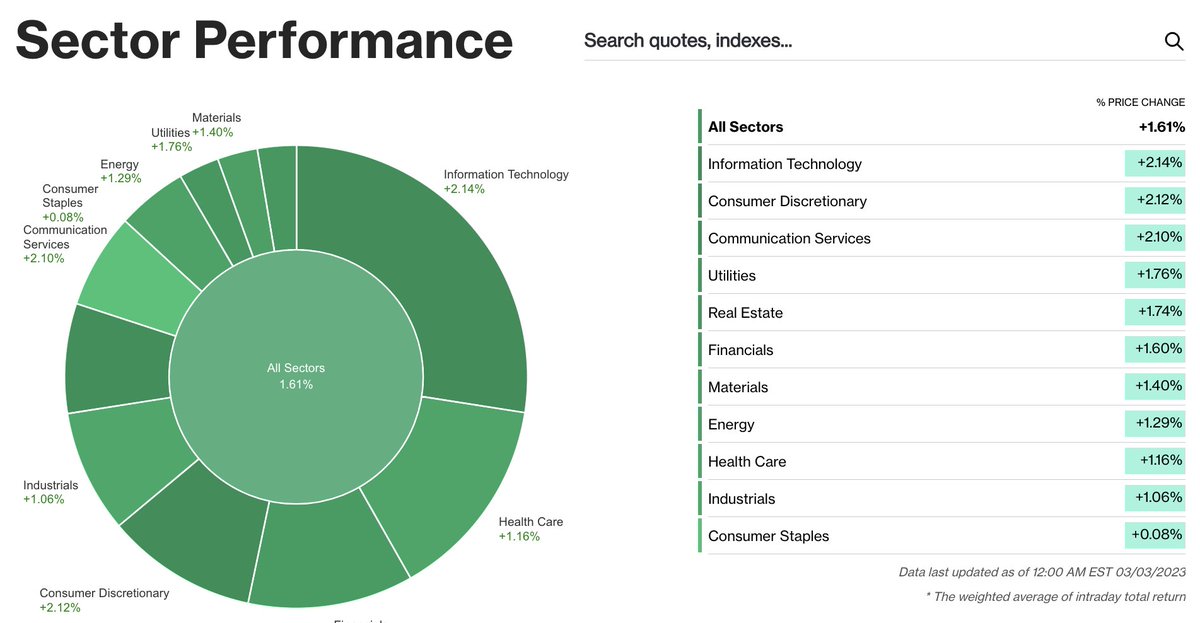

5/🧵 As we move into 23', one thing to keep an eye on is how decreasing liquidity affects market movements...

📊 h/t @LanceRoberts @JPMorganAM @ISABELNET_SA #FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $DIA $IWM

📊 h/t @LanceRoberts @JPMorganAM @ISABELNET_SA #FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $DIA $IWM

https://twitter.com/LanceRoberts/status/1602628913590575107?s=20&t=OXQgEx0LbpbIqiJp3-wyQQ

6/🧵 Something else to consider is how passive investing is affecting market liquidity. Should there be a further 📉, would this exacerbate the move?

h/t @SethCL #FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $DIA $IWM

h/t @SethCL #FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $DIA $IWM

https://twitter.com/SethCL/status/1603733867130765314?s=20&t=MJEChI9pvWimenQeq2BSoQ

7/🧵 What do you think of @AndreasSteno's 🎯 of $3,500 $SPX, based on @federalreserve liquidity projections?

#FederalReserve #interestrates #stockmarket #Crypto $SPY $QQQ $DIA $IWM #stocks

#FederalReserve #interestrates #stockmarket #Crypto $SPY $QQQ $DIA $IWM #stocks

https://twitter.com/AndreasSteno/status/1602240289514684416?s=20&t=rsDlgQDtd76aDpcVb3WYwQ

8/🧵 As @fkronawitter1 points out, it's important to see the whole picture of liquidity in the financial system...🏦💵

#FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks

#FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks

https://twitter.com/fkronawitter1/status/1604860615834599424?s=20&t=ItjGjZJk2bau1G4gEHobyg

9/🧵 Will banks tighten their lending standards in 23' as the economy potentially weakens? 🏦💵 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS

#FederalReserve #interestrates #stockmarket #Crypto $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS

https://twitter.com/fkronawitter1/status/1605136513087393793?s=20&t=TW97Olr8v5Aj4CWznEh_HQ

10/🧵 Something to keep an eye on in 23' is the trajectory of bankruptcy 📑, specifically in #smallbusiness... 📊 h/t @TaviCosta

#FederalReserve #interestrates #stockmarket #recession $SPY $SPX $QQQ $DIA $DJIA $IWM $RUT $JPM $BAC $WFC $AXP $MA $V $GS

#FederalReserve #interestrates #stockmarket #recession $SPY $SPX $QQQ $DIA $DJIA $IWM $RUT $JPM $BAC $WFC $AXP $MA $V $GS

https://twitter.com/TaviCosta/status/1607552393503473665?s=20&t=ca2b0ldVLSfI5BkWeRawQw

11/🧵 Also, watch high-yield/junk bond spreads as #interestrates take their toll on the markets & overall economic growth... 📊 h/t @WallStJesus

#FederalReserve #stockmarket $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS

#FederalReserve #stockmarket $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS

https://twitter.com/WallStJesus/status/1608451419689869319?s=20&t=MLtLs03PCh_20PCSGUa9Fg

12/🧵 As @joosteninvestor highlights, interesting divergence in the #StockMarket & bonds vs. contracting 🏦 lending... h/t @SoberLook

#FederalReserve $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG

#FederalReserve $SPY $SPX $QQQ $NQ $DIA $DJIA $IWM $RUT #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG

https://twitter.com/joosteninvestor/status/1600625039736508424?s=20&t=JYptRL1Aw-pbq3sGJUHh0w

13/🧵 Will the @federalreserve & other 🏦 be able to pull off balance sheet reductions w/o breaking financial markets? h/t @DisruptorStocks @MorganStanley

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/DisruptorStocks/status/1599435842354716672?s=20&t=KYbihglaB_yV_D8ty44BQw

14/🧵 How will the @federalreserve #interestrates ROC (Rate of Change) affect markets in 23'?😳 h/t @lord_fed

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/lord_fed/status/1603897133328961539?s=46&t=oJ6k6mY73pXx479ix1JNcA

15/🧵 @RaoulGMI makes an interesting observation that global liquidity (could) be on the verge of a turn back up... 🏦💵📈

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/RaoulGMI/status/1602268141870014464?s=20&t=lNJFp4FraQ3GNMavIbXnbg

16/🧵 If you are interested in watching 🏦 lending, here's a 📊 to watch in 23' via the @federalreserve FRED database... h/t @LynAldenContact

#FederalReserve #interestrates $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve #interestrates $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

17/🧵Global Credit Impulse back to GFC levels... 🚨🏦 h/t @MacroAlf

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM #stocks $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/MacroAlf/status/1606059074235387905?s=20&t=3Bq53AHD8IUBOIqLlyQPGg

18/🧵 Very important to keep in mind, as highlighted by @MichaelKantro is the LAG that the @federalreserve 🏦policies have on markets...

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/michaelkantro/status/1608079705390858240?s=46&t=Pxmi9vn__GkDjlo_RT98Eg

19/🧵 Increasing credit spreads a sign of health, or stress in financial markets? 🏦⚠️

📊 h/t @the_red_deer @BankofAmerica

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

📊 h/t @the_red_deer @BankofAmerica

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/the_red_deer/status/1594492100879732736?s=46&t=BMj4Qo7IPMbuRw9dwYkLmw

20/🧵Banks tightening lending standards a sign of slowdown/stress in the system? 🏦🚫💳

📊h/t @WallStJesus @JPMorganAM @jpmorgan

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

📊h/t @WallStJesus @JPMorganAM @jpmorgan

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS

https://twitter.com/WallStJesus/status/1600168388478631950?s=20&t=JFnkwBCgoBLMvSBJD4elYQ

21/🧵 @warrenbachman1 highlights a great observation: $SPX vs. @federalreserve Net Liquidity — See any correlation? 🧐📉

#FederalReserve #interestrates #recession $SPY $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS #stocks

#FederalReserve #interestrates #recession $SPY $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS #stocks

https://twitter.com/warrenbachman1/status/1602075893567987713?s=20&t=Wn-QWXuy_cRPN_u2iVpXKA

22/🧵 Same correlation: $SPX vs. @federalreserve Net Liquidity 🔮💸

📊 h/t @Lvieweconomics

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS #stocks

📊 h/t @Lvieweconomics

#FederalReserve #interestrates #recession $SPY $SPX $QQQ $DIA $IWM $JPM $BAC $WFC $AXP $MA $V $GS $TLT $HYG $MS #stocks

https://twitter.com/Lvieweconomics/status/1600874142949167106?s=20&t=wKXFLmpZz0y27-3lG3DTgg

23/🧵 h/t @AndreasSteno for the thread on @federalreserve 'Net Liquidity' — Covering the RRP, TGA, & #federalreserve Balance Sheet & how they affect the financial markets...

#stockmarket #interestrates #recession #stocks #bonds $SPY $SPX $QQQ $DIA $IWM

#stockmarket #interestrates #recession #stocks #bonds $SPY $SPX $QQQ $DIA $IWM

https://twitter.com/andreassteno/status/1602240268698271745?s=46&t=ecDaOyEE8QaWVaLRriWSjQ

24/🧵 If you're interested in learning more about what could happen in the 23' Liquidity Cycle 🏦💵🛟— great @Twitter Space w/ @profplum99 @crossbordercap & @EMcArdleInvest...

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM

https://twitter.com/EMcArdleInvest/status/1605940131835179008?s=20&t=MrcgWm-rp3FfHZSRagzHIg

25/🧵 Latest update on "Financial Conditions" from @MichaelMOTTCM... 💵📉

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM @Bloomberg @markets @economics

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM @Bloomberg @markets @economics

https://twitter.com/MichaelMOTTCM/status/1611002005698256897?s=20&t=_Wlag091cIDoqrpaN1Fe3A

26/🧵 Pairing that with the above, the @ChicagoFed Financial Conditions signals an opposite in conditions... 💵📈 h/t @MichaelMOTTCM

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM @Bloomberg @markets @economics

#stockmarket #interestrates #recession #bonds $SPY $SPX $QQQ $DIA $IWM @Bloomberg @markets @economics

https://twitter.com/michaelmottcm/status/1610998311686897664?s=46&t=C2tX1NQZJQ9sJiq1tf0urQ

27/🧵 Latest @ChicagoFed National Financial Conditions Index (NFCI)📊...

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

https://twitter.com/macrodailyco/status/1611393876832444416?s=20&t=TUeWZesyB-KIX4Nz4vMXtQ

28/🧵 Update on @federalreserve "Net Liquidity" readings from @SophiaKnowledge...

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

https://twitter.com/SophiaKnowledge/status/1611123283004383232?s=20&t=i--1vTzCDVF69KvMu0CCog

29/🧵 Something to keep an eye on is the @federalreserve QT (Rate of Change). Good note by @TXMCtrades... 🏦📉

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

30/🧵 @federalreserve REPO 💸👀

📊h/t @themacrotweet

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

📊h/t @themacrotweet

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates

31/🧵 @federalreserve Balance Sheet... 🏦📉

📊h/t @biancoresearch

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates $HYG

📊h/t @biancoresearch

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates $HYG

32/🧵 @crossbordercap @FedGuy12 @FinancialTimes @rbrtrmstrng

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates $HYG

#StockMarket #bonds $DXY $TLT #FederalReserve $SPY $SPX #interestrates $HYG

https://twitter.com/crossbordercap/status/1611289829362237440?s=20&t=RfQ5METOpC_bVyKWD_9E2w

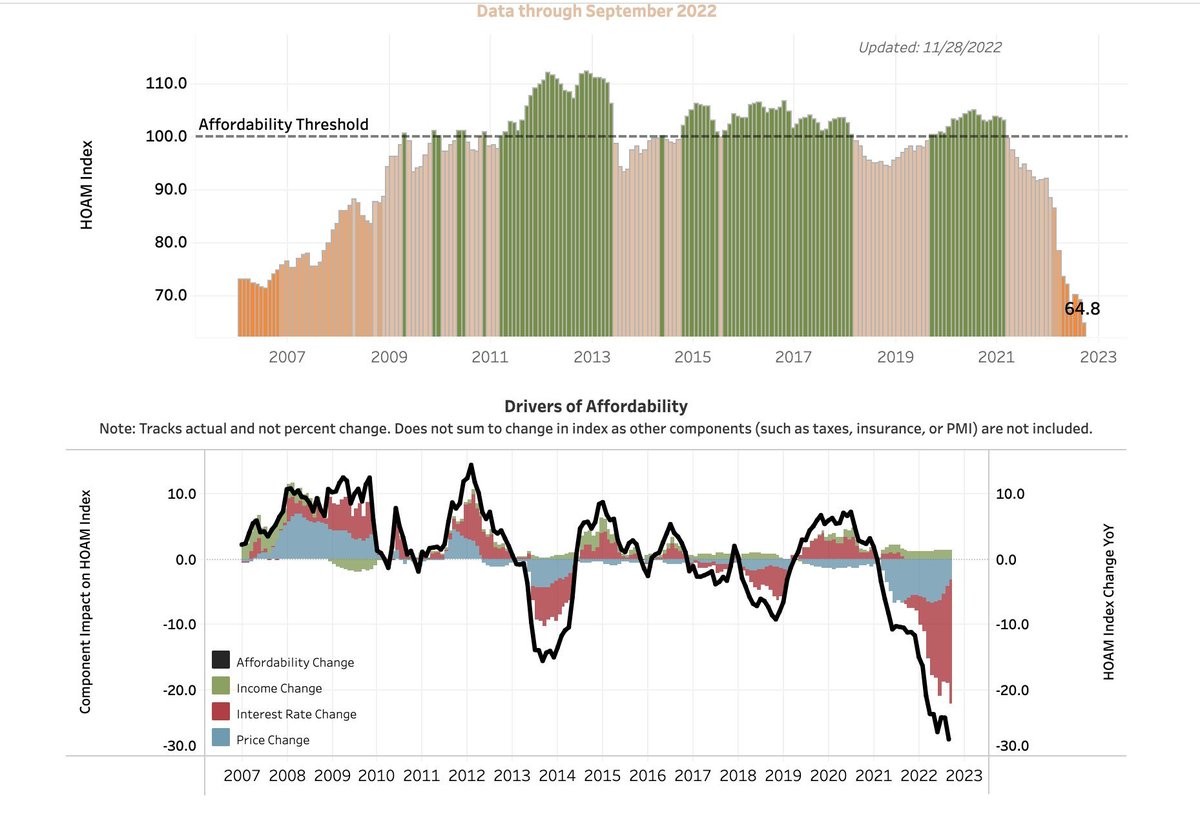

33/🧵 Financial Conditions vs. 30-Year Mortgage 🏡📉 📈

📊h/t @DisruptorStocks

#FederalReserve #interestrates #realestate #mortgage

📊h/t @DisruptorStocks

#FederalReserve #interestrates #realestate #mortgage

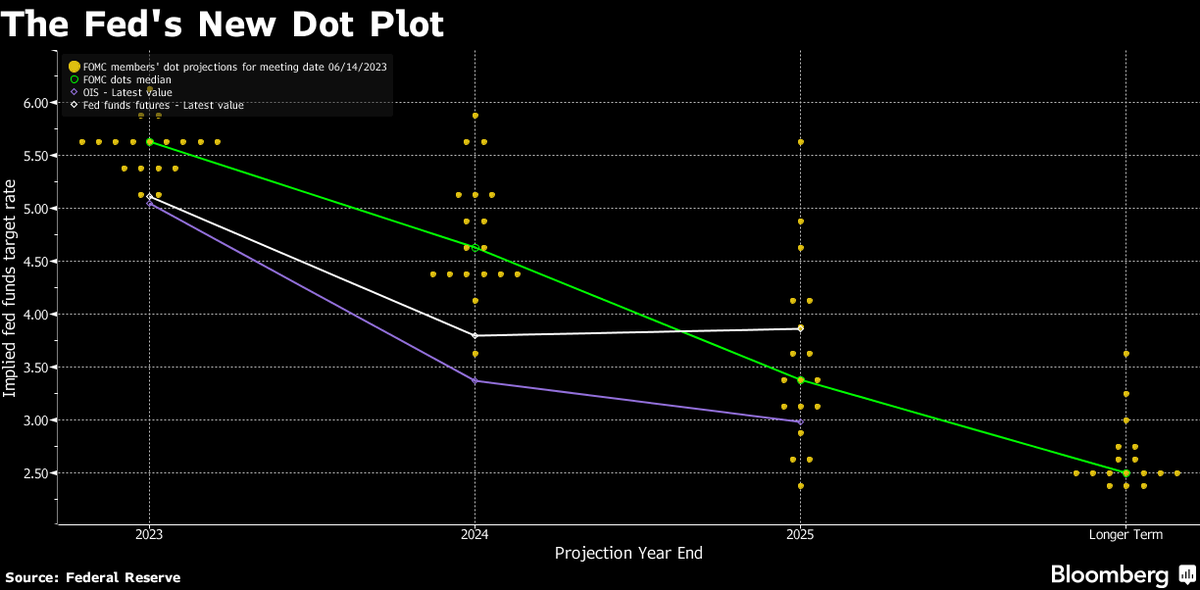

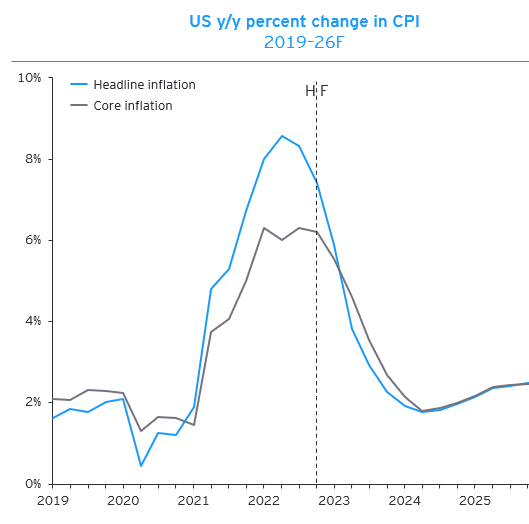

33/🧵 "We assume the Fed will continue to favor hawkish communication to offset the easing of financial conditions." 🇺🇸🏦💵📉

📊h/t @GregDaco @EY_Parthenon

#FederalReserve #netliquidity #StockMarket #bonds #interestrates

📊h/t @GregDaco @EY_Parthenon

#FederalReserve #netliquidity #StockMarket #bonds #interestrates

34/🧵 "While disinflation is well underway, #inflation remains historically elevated, & the current easing of financial conditions is challenging the #FederalReserve's narrative that it will continue raising the federal funds rate above 5%."

📊h/t @GregDaco @EY_Parthenon

📊h/t @GregDaco @EY_Parthenon

35/🧵 🇺🇸 Financial Conditions vs. #recession

📊h/t @BlacklionCTA #Bonds #StockMarket #FederalReserve #interestrates

📊h/t @BlacklionCTA #Bonds #StockMarket #FederalReserve #interestrates

36/🧵 @Bloomberg🇺🇸 Financial Conditions vs. 30yr Fixed-Rate Mortgage 💵🏠

📊h/t @DisruptorStocks

#Bonds #StockMarket #FederalReserve #interestrates #realestate #realtor #mortgagerates

📊h/t @DisruptorStocks

#Bonds #StockMarket #FederalReserve #interestrates #realestate #realtor #mortgagerates

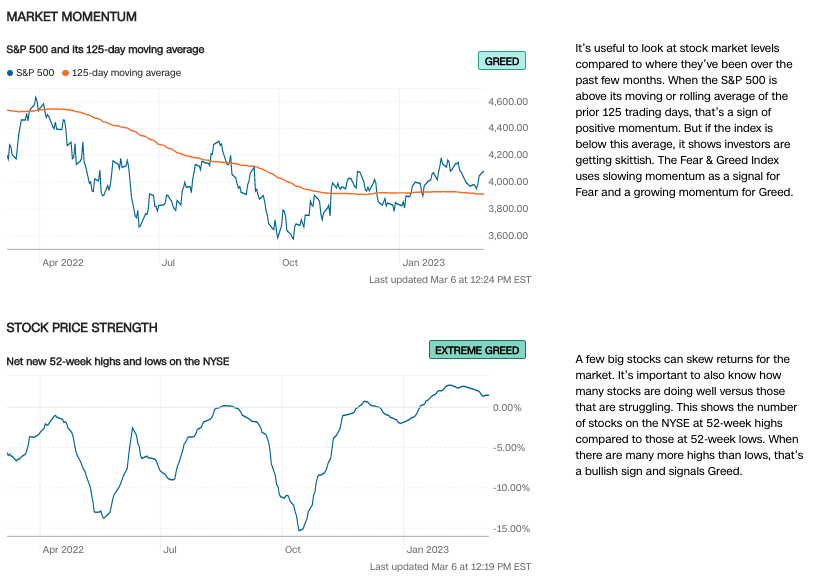

37🧵 Financial Conditions Index (easing) 💵📈 — HINT: This gives the @federalreserve room to continue "higher for longer"...

📊h/t @WallStJesus @GoldmanSachs $GS

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

📊h/t @WallStJesus @GoldmanSachs $GS

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

38/🧵 @Bloomberg Financial Conditions Index (easing) 💵📈 ANOTHER HINT: This gives the @federalreserve room to continue "higher for longer"...

📊h/t @KathyJones

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

📊h/t @KathyJones

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

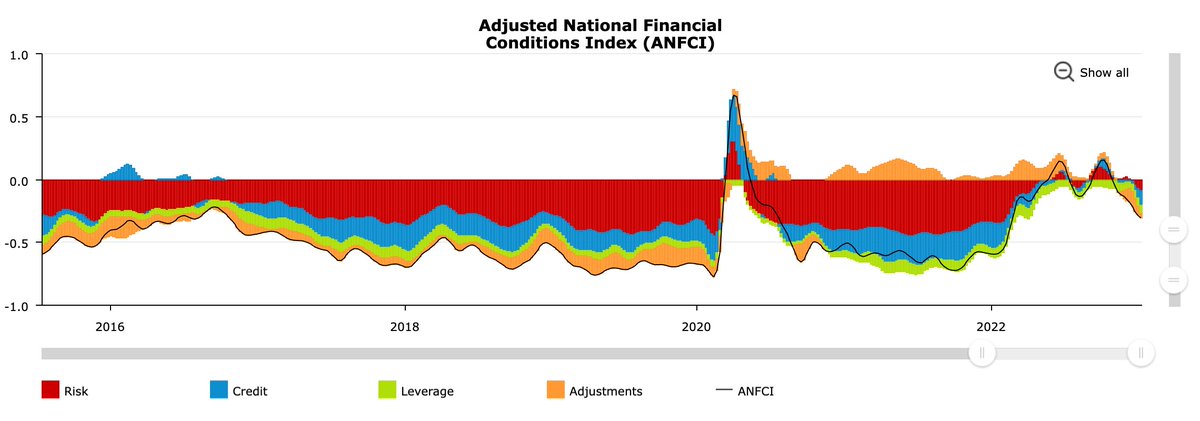

39/🧵 Latest @ChicagoFed "Adjusted National Financial Conditions Index" (ANFCI) 📊💵

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

40/🧵 @Barclays 🇺🇸 Financial Conditions Index, showing "Conditions Tighter than Normal"... ⚠️📈

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

#Bonds #StockMarket #FederalReserve #interestrates #realestate $SPY $SPX $DJIA $DIA $QQQ $NQ $RUT $IWM

41/🧵 With M2 leading #inflation lower, can investors expect @federalreserve shift in monetary policy that (could) affect overall liquidity? 🏦💵🤔

📊h/t @true_insights_ @jsblokland

#centralbanks #federalreserve #interestrates #monetaryPolicy #bonds #stocks

📊h/t @true_insights_ @jsblokland

#centralbanks #federalreserve #interestrates #monetaryPolicy #bonds #stocks

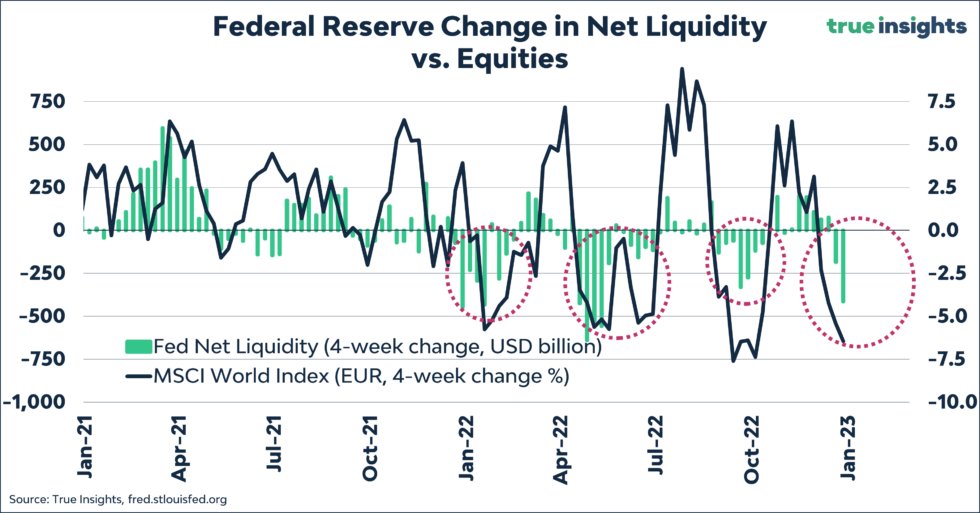

@federalreserve @true_insights_ @jsblokland 42/🧵 Great chart from @jsblokland @true_insights_ highlighting the change in @federalreserve "Net Liquidity" vs. MSCI World Index — interesting correlations to keep a close eye on... 📈🏦📉

#centralbanks #federalreserve #interestrates #monetaryPolicy #bonds #stocks $SPY $SPX

#centralbanks #federalreserve #interestrates #monetaryPolicy #bonds #stocks $SPY $SPX

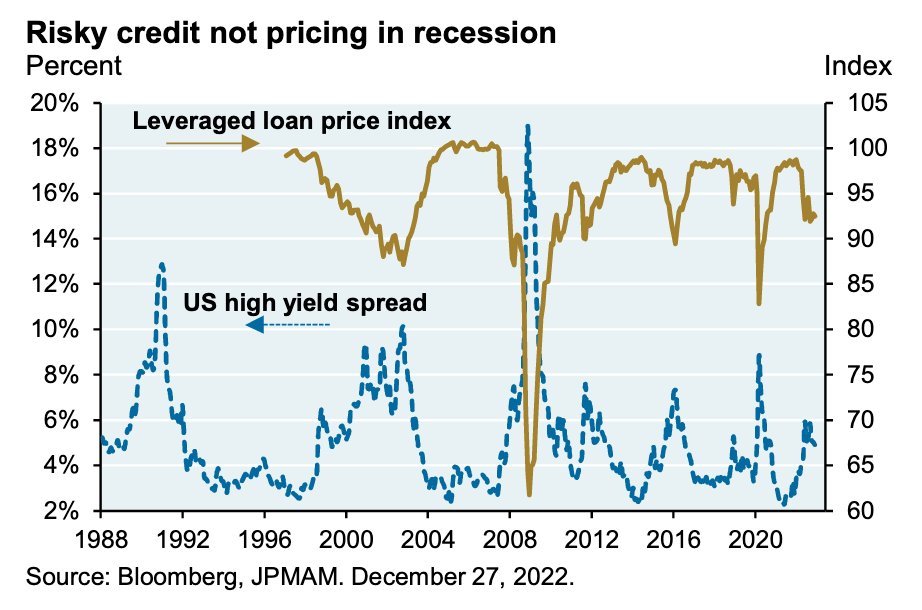

43/🧵 "High-yield junk bond spreads reflect an economy that is avoiding #recession. But almost all the leading indicators of recession are flashing 🚨 (PMI surveys, deeply inverted yield curve, LEI's, M2 💵 growth)." ⚠️ @jennablan

📊h/t @GregObenshain

#bonds #interestrates

📊h/t @GregObenshain

#bonds #interestrates

44/🧵 "ICE @BankofAmerica US 🇺🇸High Yield Index Options-Adjusted Spread" w/in the mid-range of ⚠️ , w/ a key level to watch around 4.20... 🎯

#bonds #stockmarket #stocks #macro #earnings

#bonds #stockmarket #stocks #macro #earnings

45/🧵 Are the credit markets under-estimating the potential for a #recession?

h/t📊 @Mayhem4Markets @Bloomberg @JPMorganAM

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

h/t📊 @Mayhem4Markets @Bloomberg @JPMorganAM

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

46/🧵 Just a friendly reminder headed into the rest of 23'...

"Percent of bonds maturing in less than or equal to 1yr = (approx. 70%)." 🏦⏰⏳

📊h/t @FrancoisTrahan @iv_technicals

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

"Percent of bonds maturing in less than or equal to 1yr = (approx. 70%)." 🏦⏰⏳

📊h/t @FrancoisTrahan @iv_technicals

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

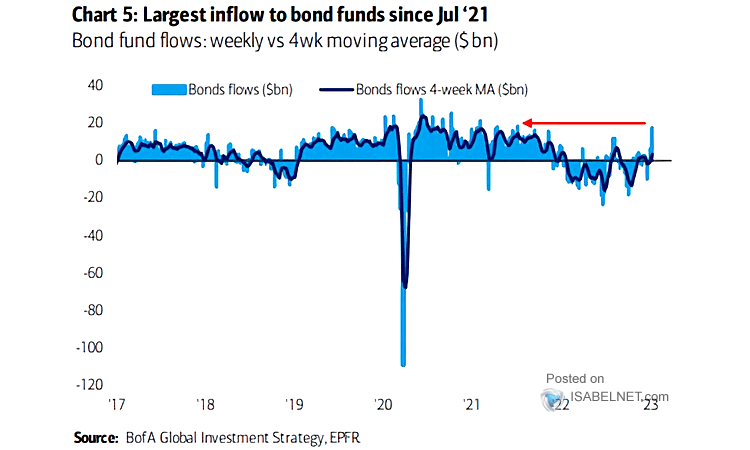

47/🧵 #bond fund flows... 💵📈

📊h/t @ISABELNET_SA @BankofAmerica

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

📊h/t @ISABELNET_SA @BankofAmerica

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

48/🧵 #bond fund flows (cont'd)... 💵📈

📊h/t @ISABELNET_SA @BankofAmerica

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

📊h/t @ISABELNET_SA @BankofAmerica

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

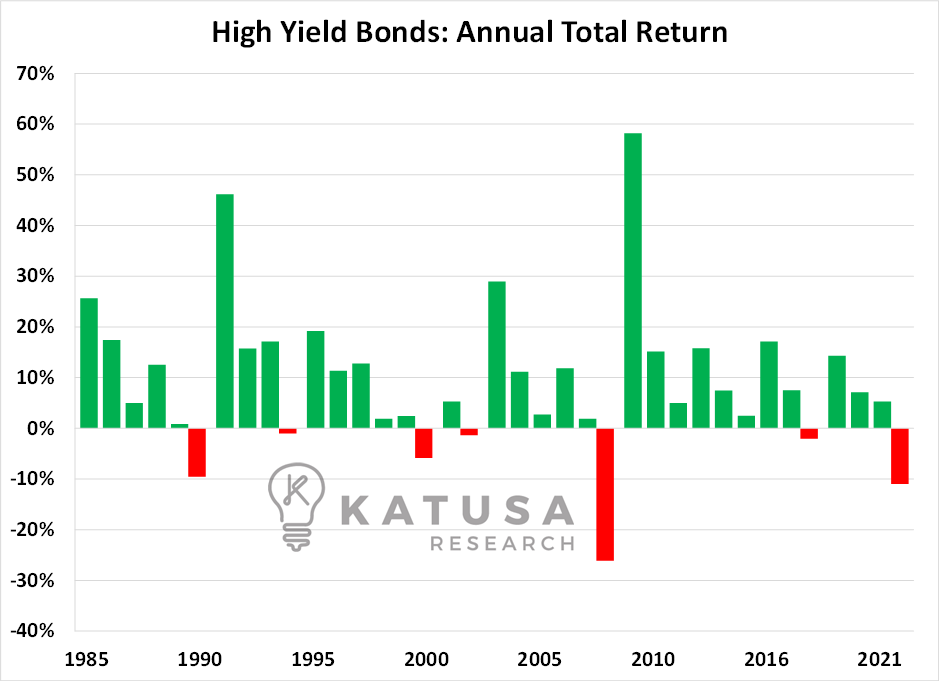

49/🧵 "Going down to almost the bottom of the bond market food chain is the 'High Yield' segment. 2022 was the SECOND WORST year since 1985."

📊h/t @KatusaResearch

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

📊h/t @KatusaResearch

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW

50/🧵 "Discover see credit card delinquencies hitting 3.5-3.9% in 2023 (2011 levels), yet high yield sees no problems..."

📊h/t @PPGMacro @Bloomberg

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW $DFS $V $MA $AXP

📊h/t @PPGMacro @Bloomberg

#bonds #stockmarket #stocks #macro #earnings $HYG $TLT $HYGH $HYGW $DFS $V $MA $AXP

51/🧵 "Financial conditions have eased significantly over the last 3mo. In the last 20yr, the only two periods of time where conditions loosened further were toward the end of the 08'-09' #recession & mid-20'."

📊h/t @GoldmanSachs $GS @LizYoungStrat #macro #StockMarket #bonds

📊h/t @GoldmanSachs $GS @LizYoungStrat #macro #StockMarket #bonds

52/🧵 "🇺🇸 financial conditions loosened substantially recently & are now back where they were back in Feb. 2022, when the @federalreserve FFR was at 0%."

📊h/t @f_wintersberger #macro #economy #FederalReserve #interestrates

📊h/t @f_wintersberger #macro #economy #FederalReserve #interestrates

53/🧵 Latest readings from @ChicagoFed show a further easing in their "Financial Conditions Index"...

#FOMC #macro #economy #FederalReserve #interestrates #bonds #StockMarket

#FOMC #macro #economy #FederalReserve #interestrates #bonds #StockMarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh