#Illinois Senate Bill SB1887 would drive out #blockchain #node operators, #miners, and #validators, waste judicial resources, and confuse existing law in a quixotic attempt to protect Illinois consumers. Let's examine the mess in a #thread:

as a preface, This is a stunning reverse course for a state that was previously pro -innovation. Instead we now get possibly the most unworkable state law related to #crypto and #blockchain I’ve ever seen. A shocking turn of events for the #tech community in #illinois /2

SB1887 focuses on consumer protection (this is GOOD). But, the manner in which it seeks to protect consumers is to require #node operators ##miners & #validators to do impossible things, or things that create for themselves new criminal & civil liability at pain of fines/ fees /3

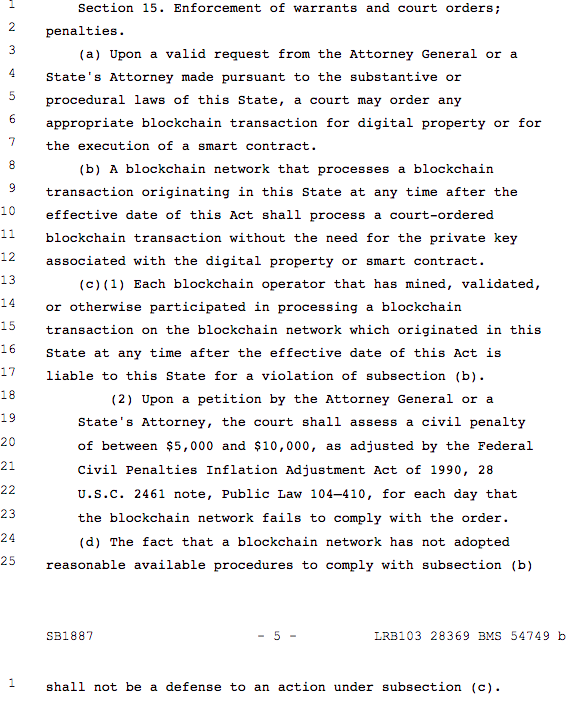

The Act would allow a court, upon receipt of an order from the Attorney General or State’s Attorney, to order any appropriate blockchain transaction for digital property or for the execution of a smart contract and require a blockchain network /4

that processes a blockchain transaction originating in this State at any time after the effective date of this Act shall process a court-ordered blockchain transaction without the need for the private key for with the digital property or smart contract, and hold any /5

blockchain operator that has mined, validated, or otherwise participated in processing a blockchain transaction on the blockchain network which originated in this State at any time after the effective date of this Act is liable to this State for a violation of subsection (b). /6

so, any node operator, miner or validator can be charged with complying with a court order to transact on a blockchain if they have mined or updated their ledger to include a transaction originating in Illinois. Ugh. Here's the kicker: /7

Subject to fines of $5k-10k per day. AND “The fact that a blockchain network has not adopted reasonable available procedures to comply with subsection (b) shall not be a defense to an action under subsection (c). /8

if you mine /validate or run a node ANYWHERE may be subject to $10k/day fines if you don’t do something that’s generally impossible or could be a crime or civil violation of law. SMDH. AND it doesn't matter that compliance is impossible /would likely be illegal. /9

If you thought that was bad. Get ready to #Illinoize your blockchain! Yes, #Illinois is going to force you to re-write your blockchain- specifically by including smart contract code capable of responding to court orders. And if you don’t, you can be sued /10

and if you don't modify your blockchain smart contract to aceept court orders, the plaintiff’s remedy will be for you to return all digital property/value you have received and payment of attorney’s fees and costs. /11

but wait, there's more. A court can order a blockchain transaction as a remedy for a lost private key if the owner loses the key or is dead & the key is unknown to the administrator, or order a blockchain transaction to refund a victim in case of fraud/mistake /12

Of course, the fact that what the court is ordering is technically impossible is not a defense to an action under this section. The Act comes to the aid of secured creditors (again, in an entirely unworkable way). /13

The Act would allow a court to order a blockchain transaction upon a “valid request” by a secured party, without a private key and of course, hold the node operators and validators liable for failure to comply, including actual damages, attorneys fees and costs. /14

Finally, the Act allows for service on a blockchain network by “leaving a copy” of the pleading, paper, filing, or order with a #miner, #validator or #node operator who has participated in the blockchain network at any time after the effective date of this Act /15

so, what does this mean? if you're a #miner, #node operator or #validator, you can be fined if you don't seize third party's assets, even if that's impossible, and even if doing so would subject you to criminal or civil liability.

also, i didnt paste the link to the law up top, which is my bad. ...here we go: legiscan.com/IL/bill/SB1887…

so, lets count the harms here: 1. courts will serve node operators/validators/miners and have to argue impossibility claims in response to contempt orders and appeals of fines. If miners/validators leave Illinois, there will be added enforcement complexities; /16

the service law will be challenged in other states, particularly if a miner/validator/node operator cant' be found in Illinois. /17

Further, if a node operator/validator/miner can't be found in Illinois, would this law apply in an action brought in federal court? /18 @ohaiom would likely have some thoughts.

And then there's the issue of impossibility not being a defense; there are likely some constitutional issues that will be brought up every single time this is litigated. /19

• • •

Missing some Tweet in this thread? You can try to

force a refresh