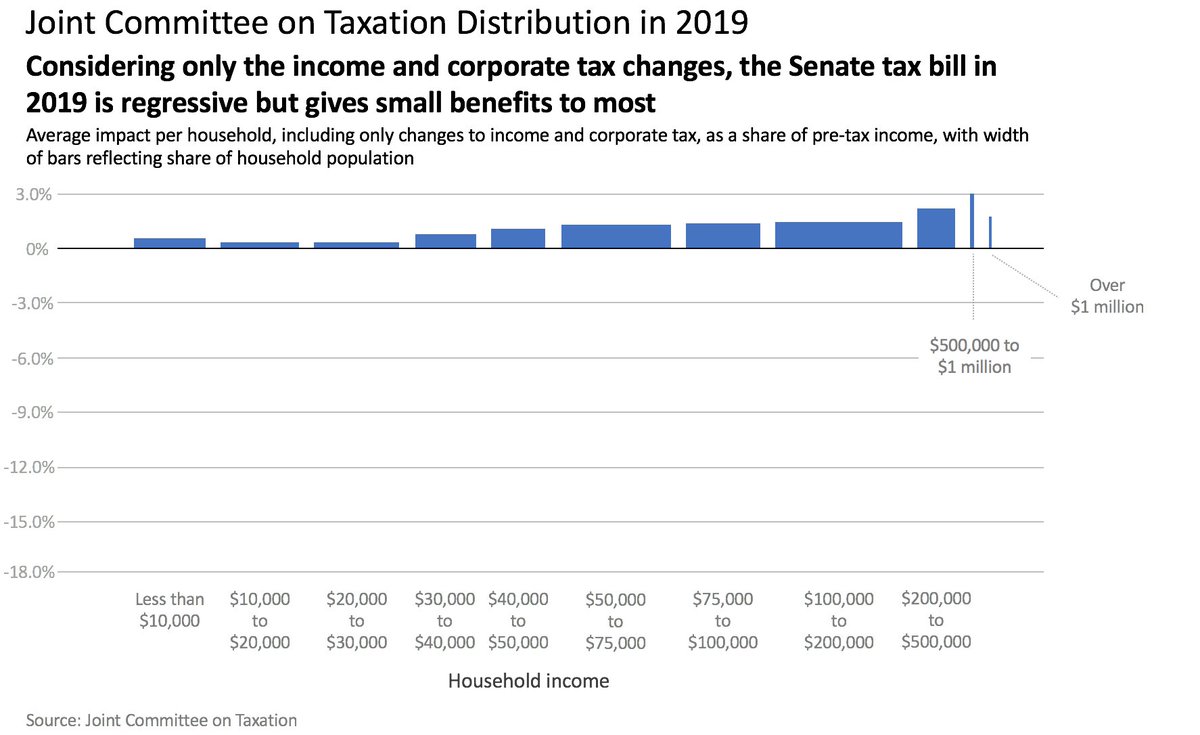

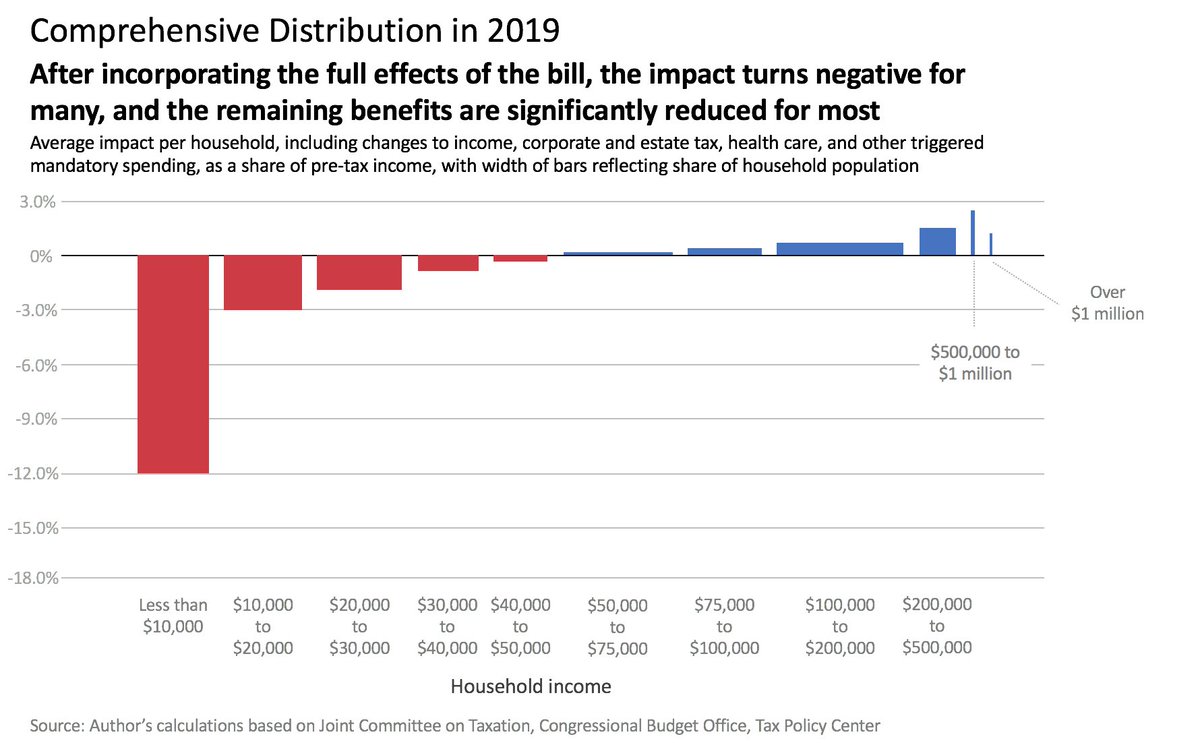

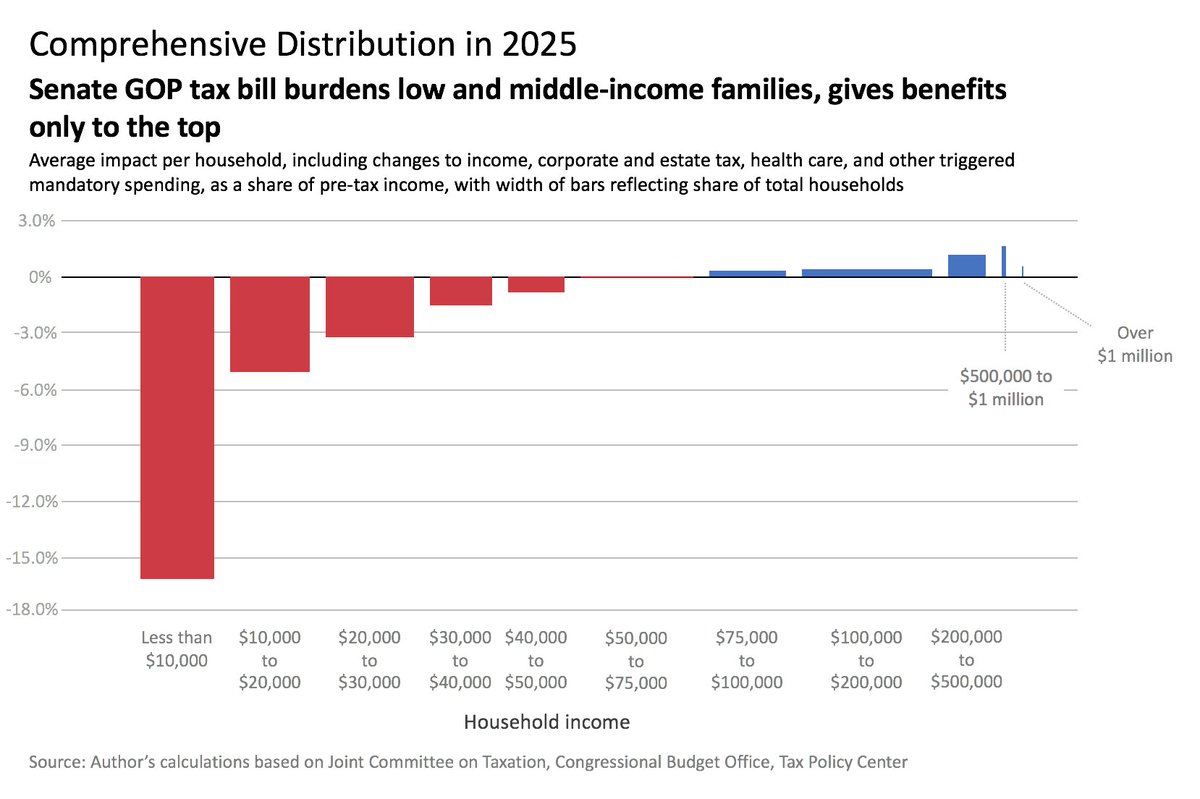

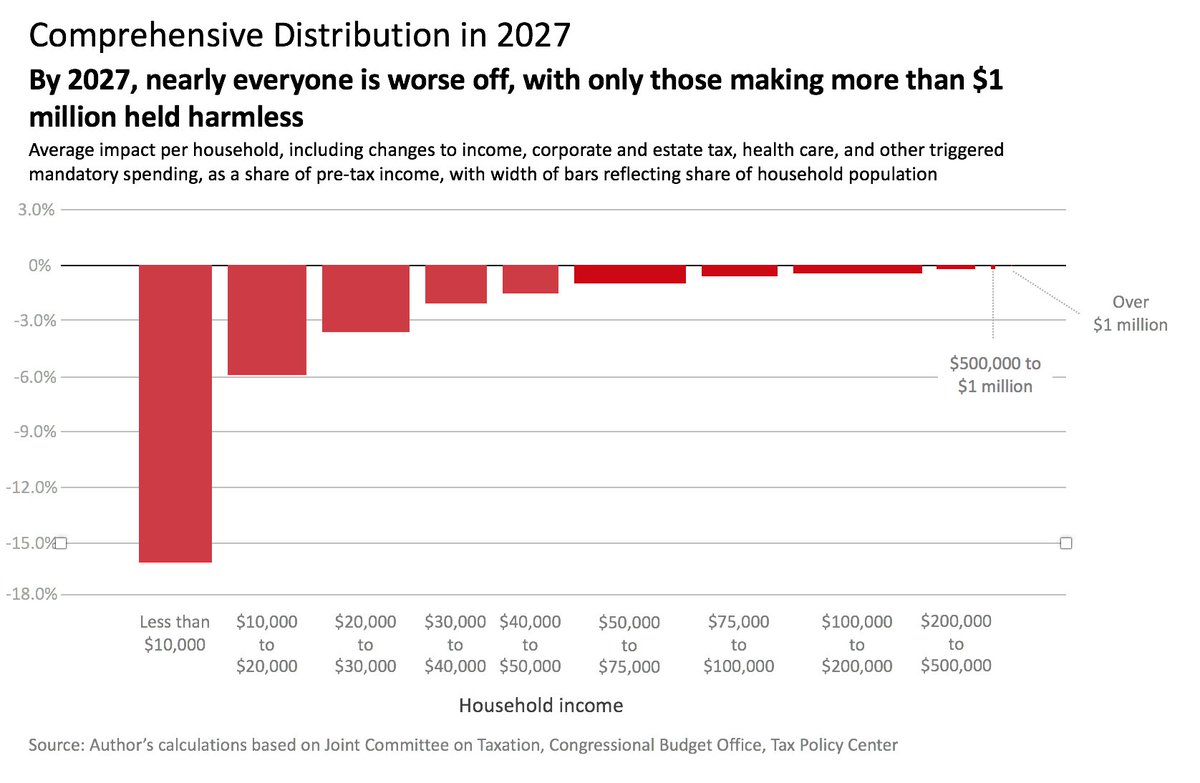

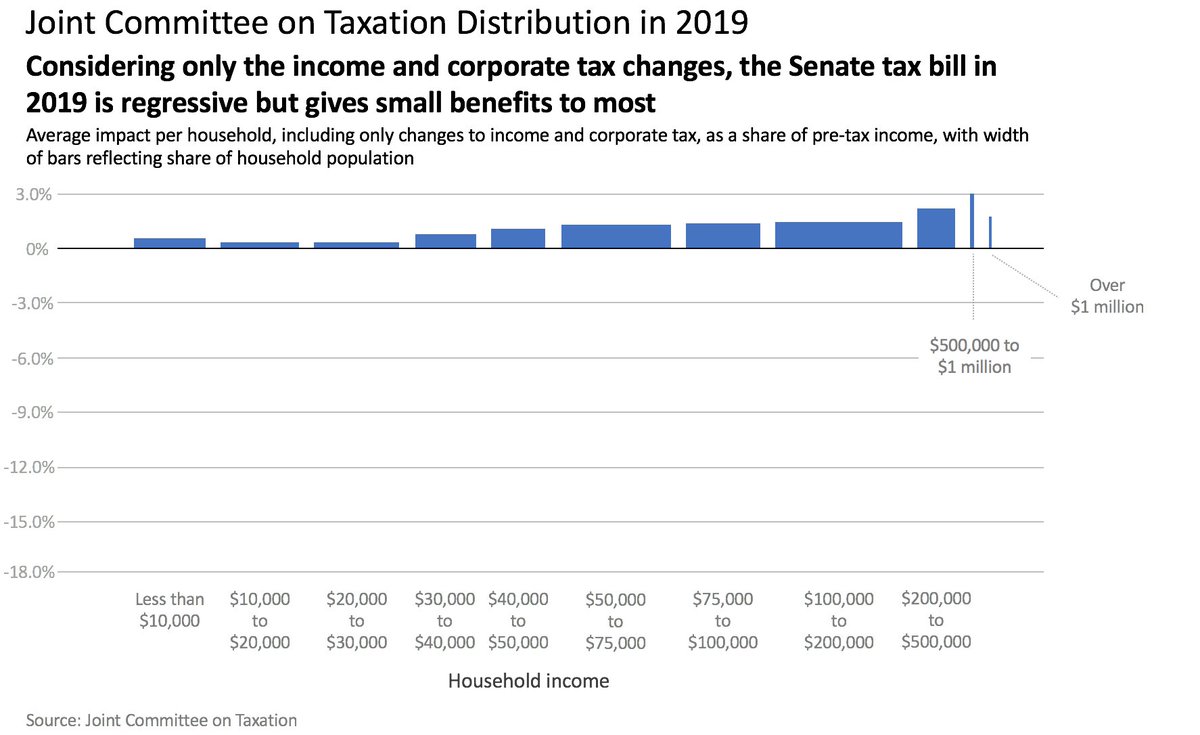

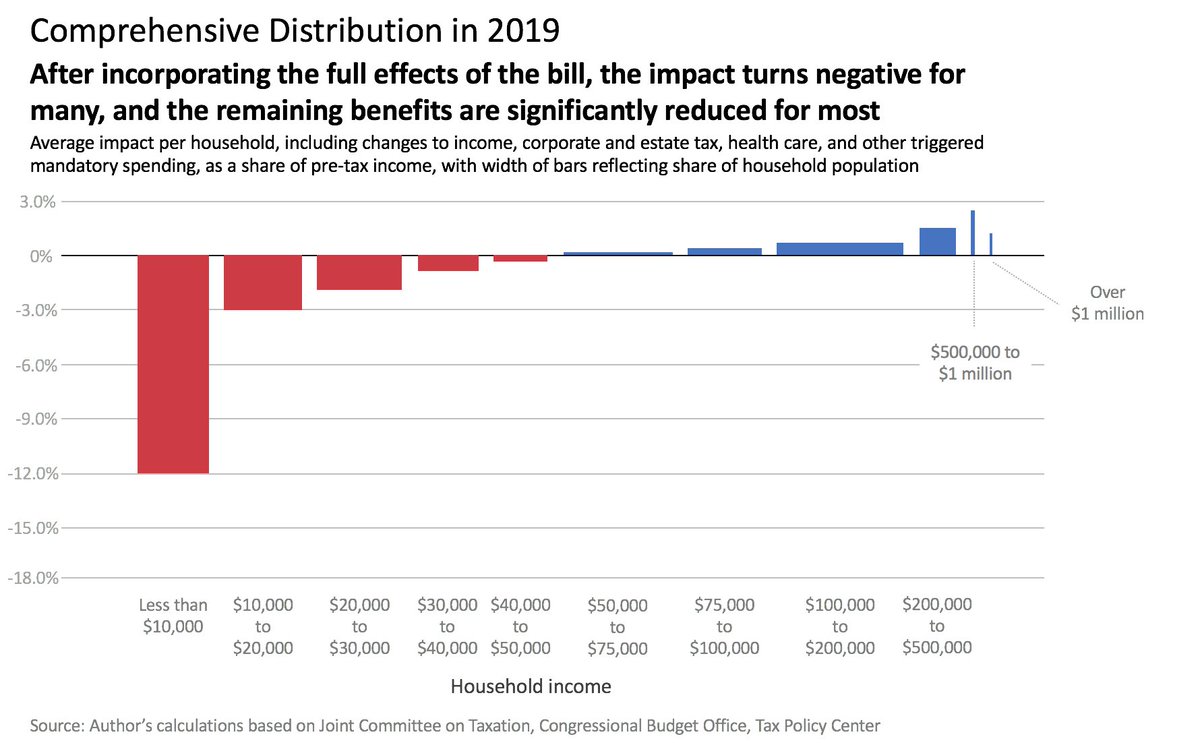

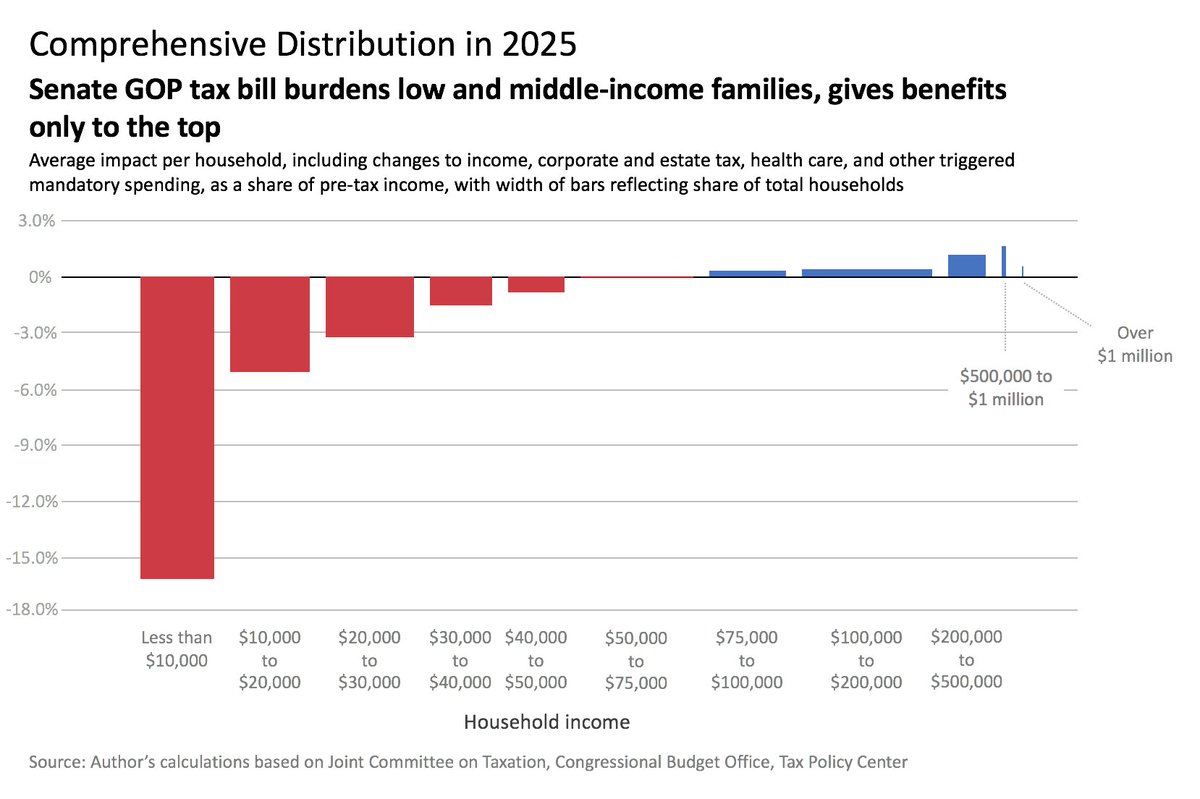

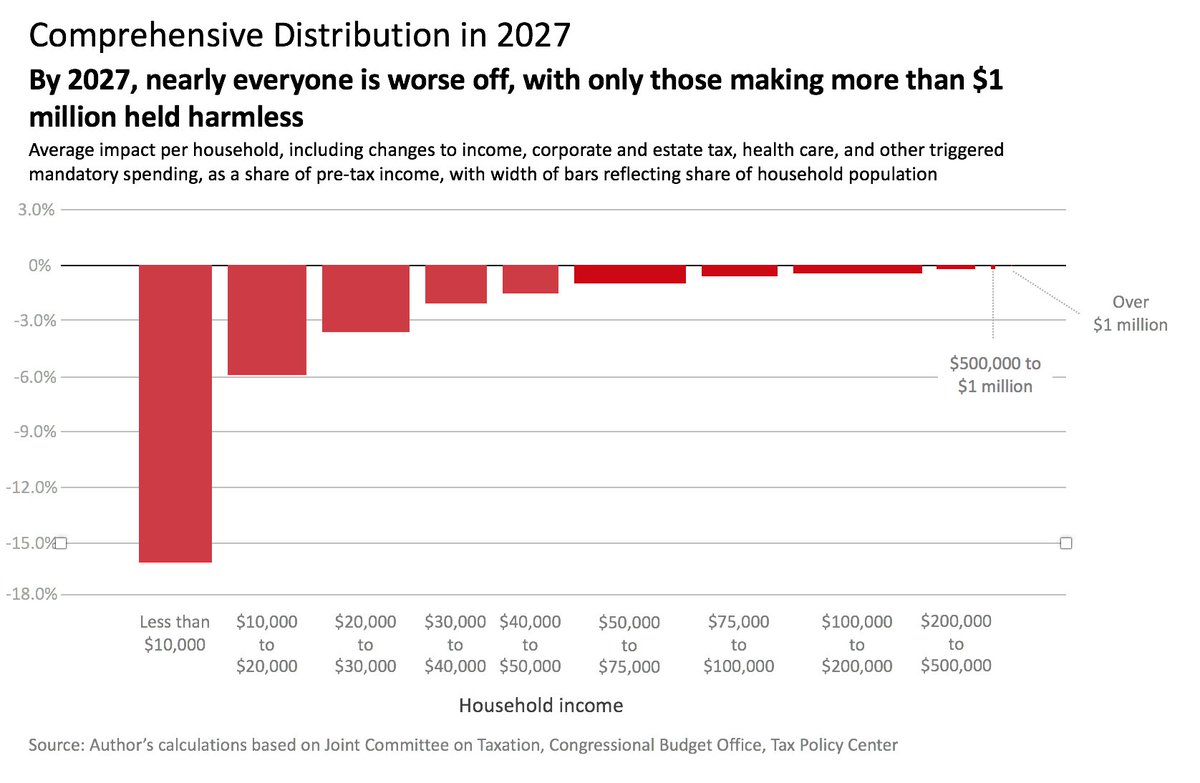

But, really, it's even worse than that. Once you include the spending-side changes, the bill looks even worse. THREAD TIME. 1/

rooseveltinstitute.org/who-really-pay…

rooseveltinstitute.org/who-really-pay…

We've got to stop this bill. /end

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!