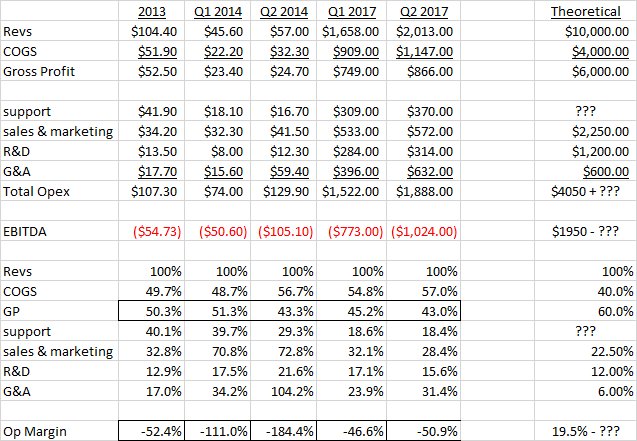

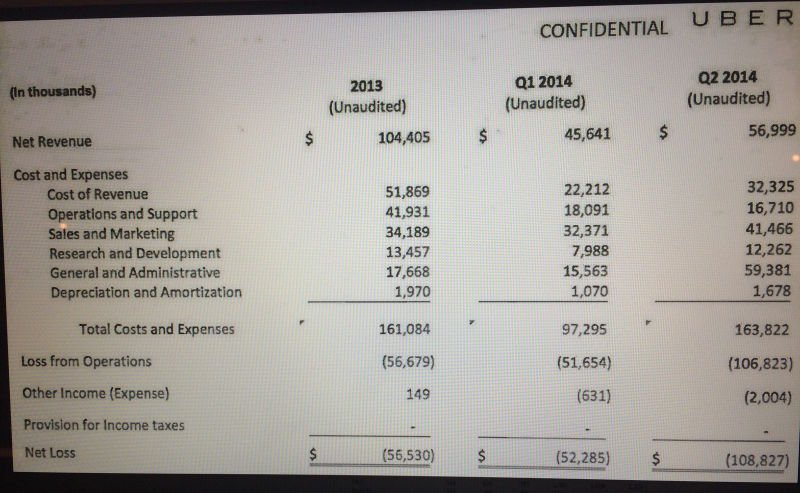

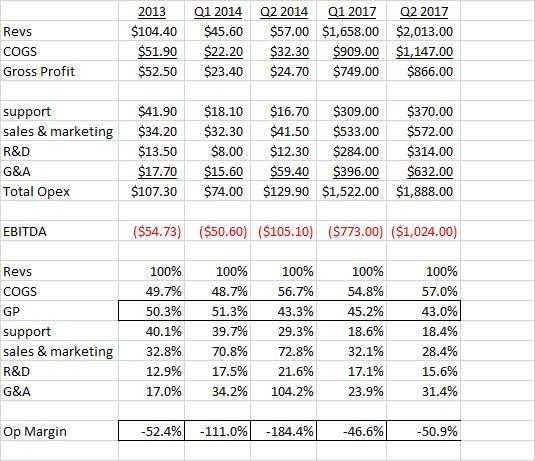

2. S&M has leveraged and is about inline with internet cos

3. R&D looks a little high as % of revs

4. G&A hasn't leveraged and is way too high

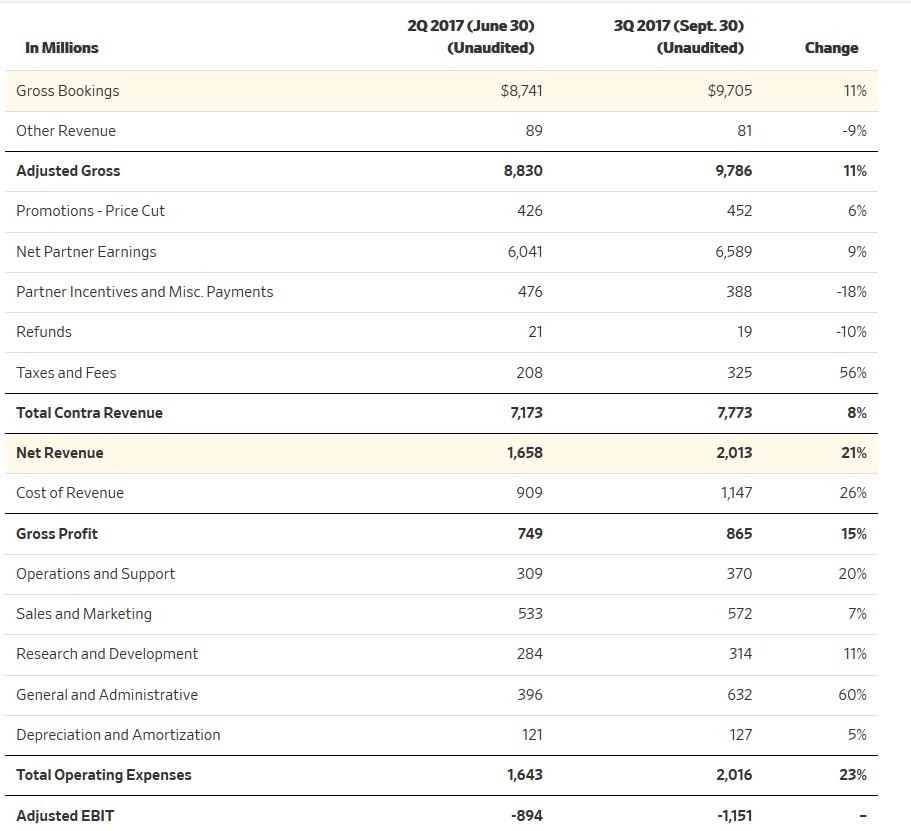

5. WTF is operations and support and why isn't it in COGS?

40% COGS

20-25% S&M

10-15% R&D

5-7% G&A

Which results in a 19% margin. But with Operations and Support not accounted for, totally changes steady state margins.