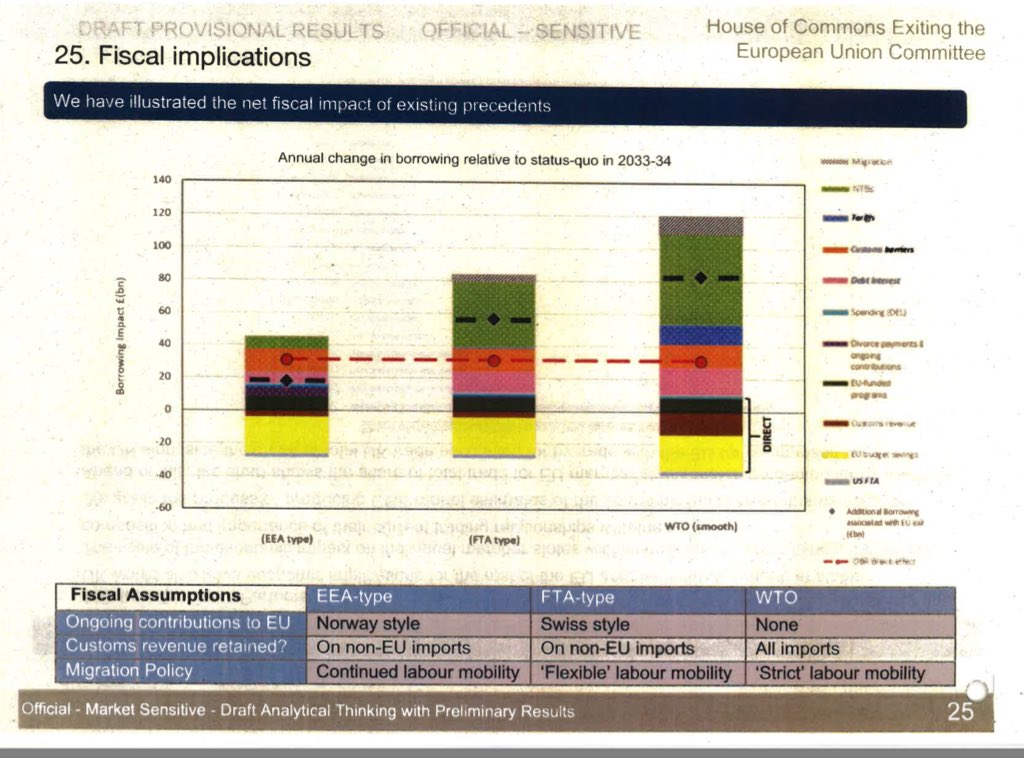

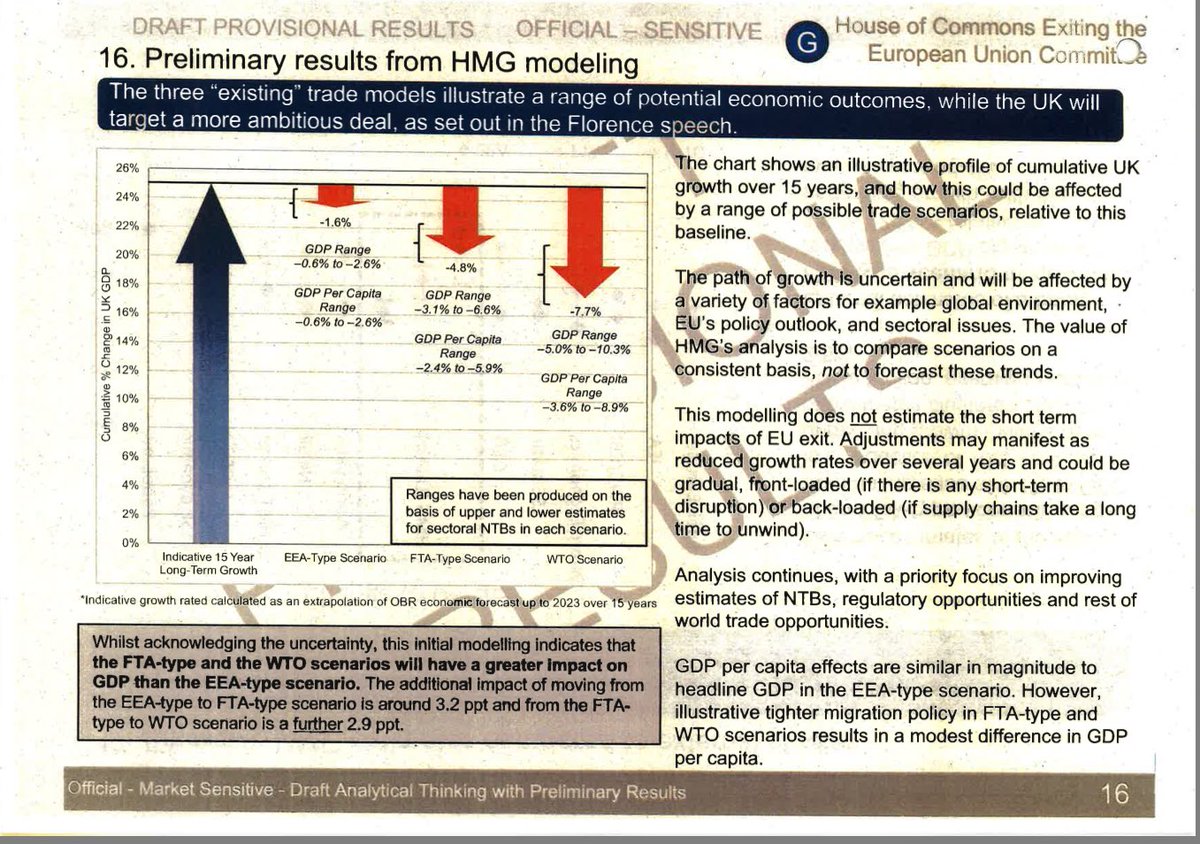

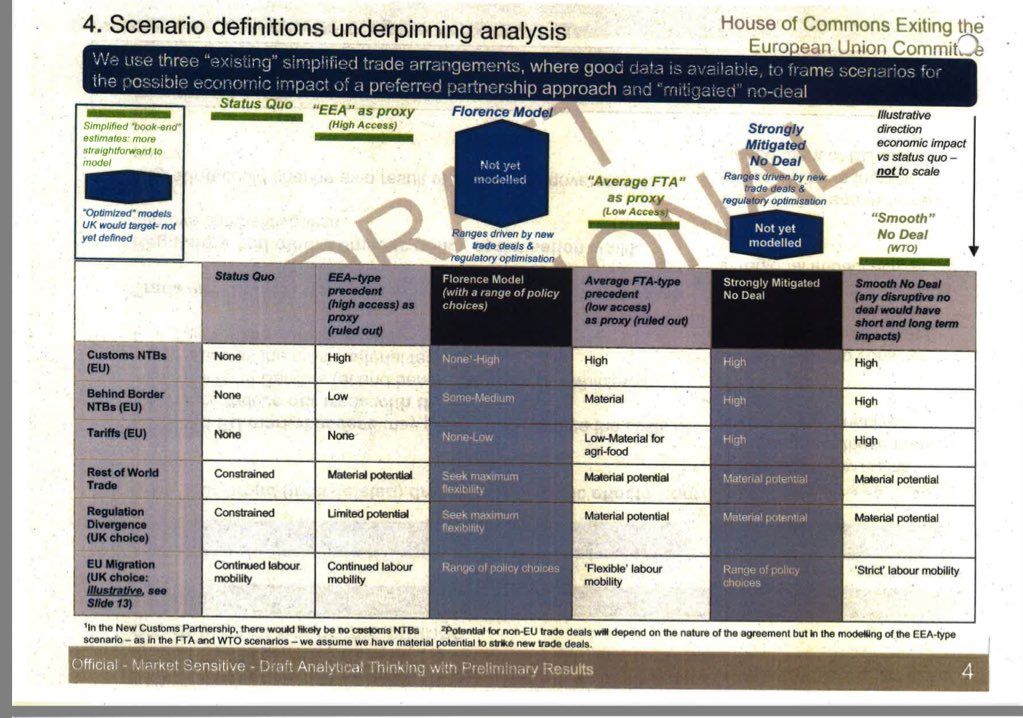

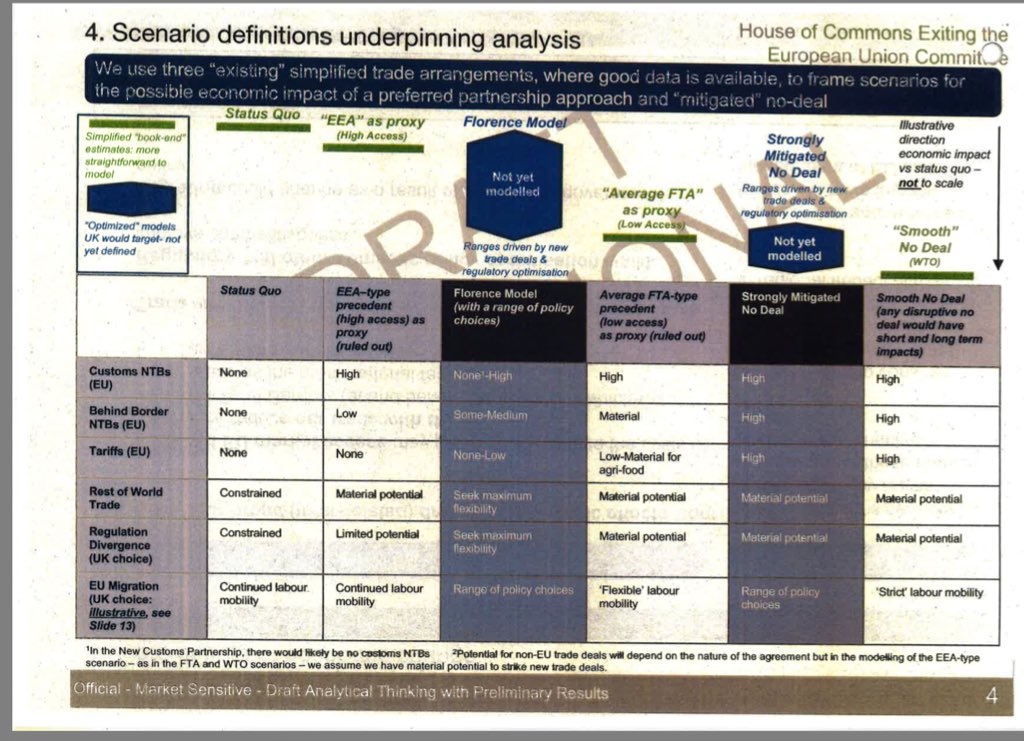

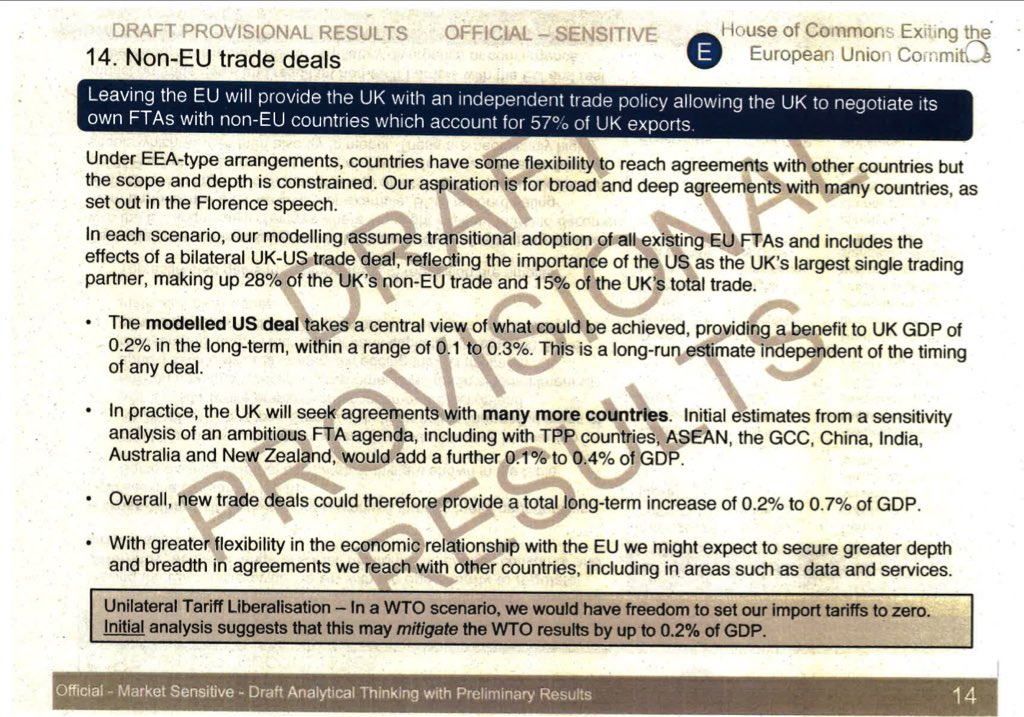

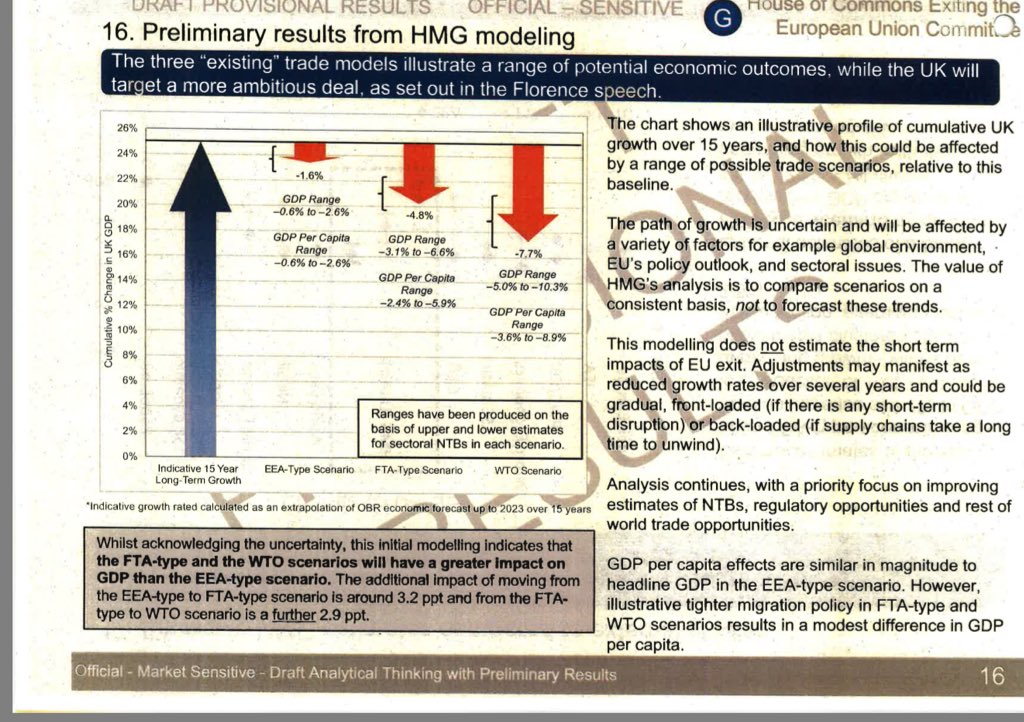

also modelled the Rees Mogg “unilateral tariff liberalisation” A+ 0.2%. Vs 5-10% GDP loss

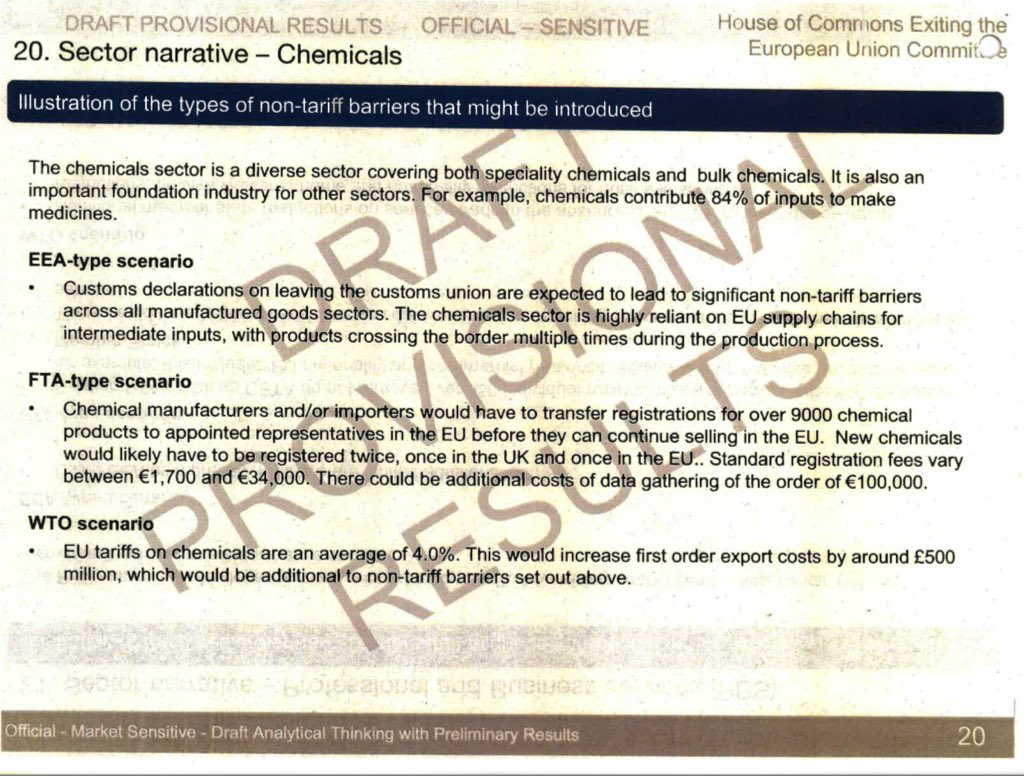

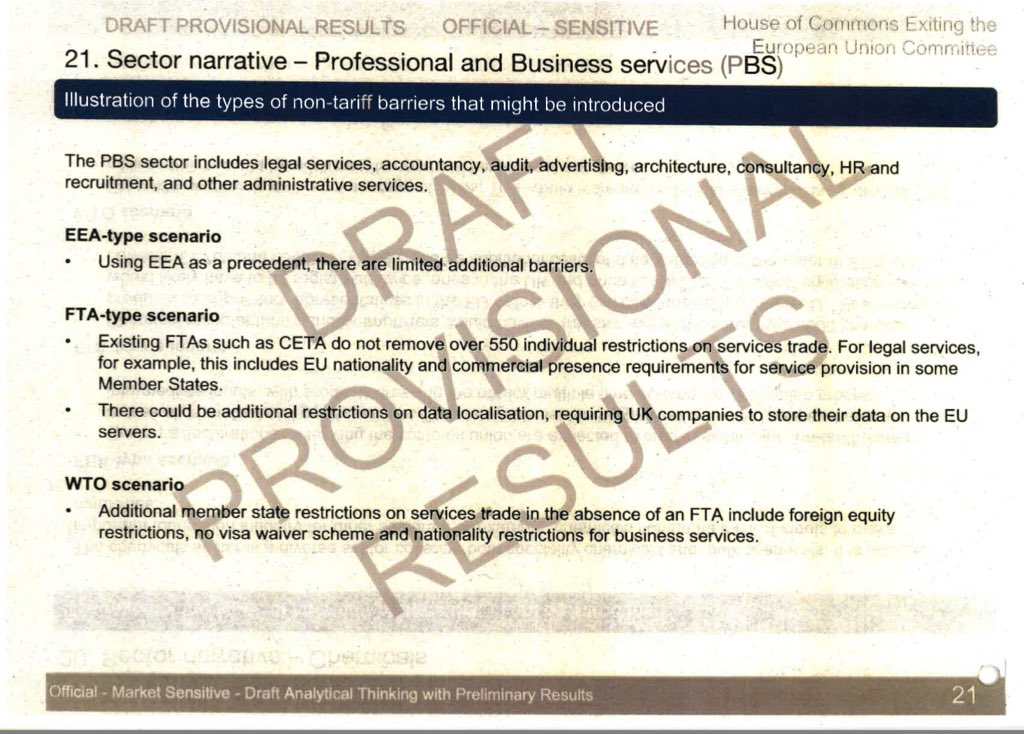

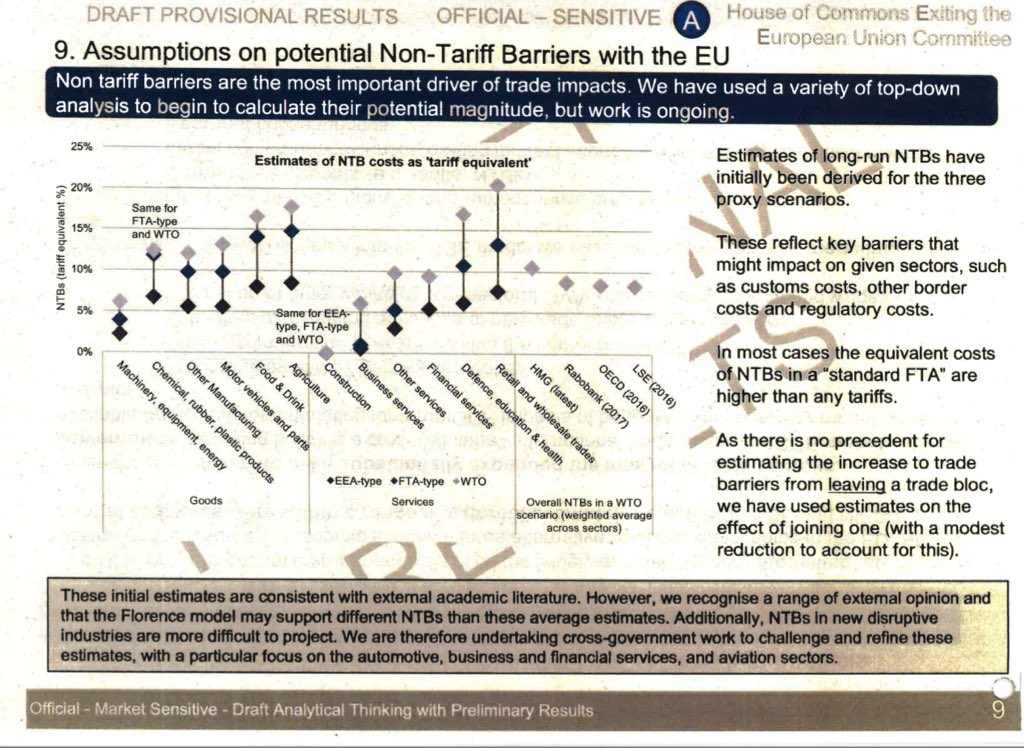

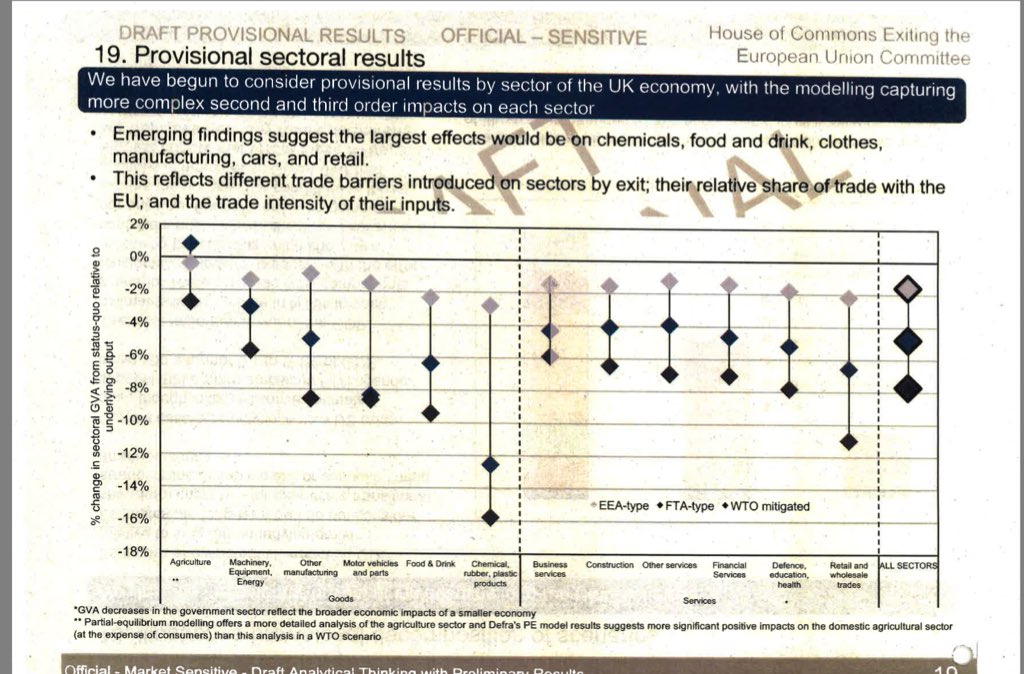

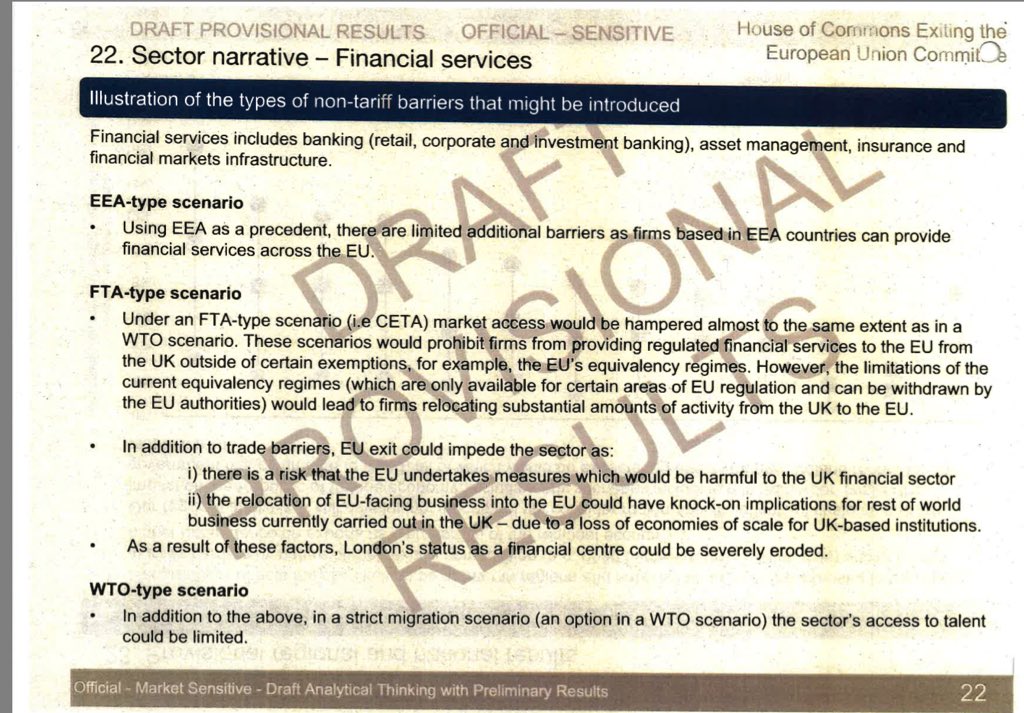

Even with an FTA “market access would be hampered almost to same extent as WTO”

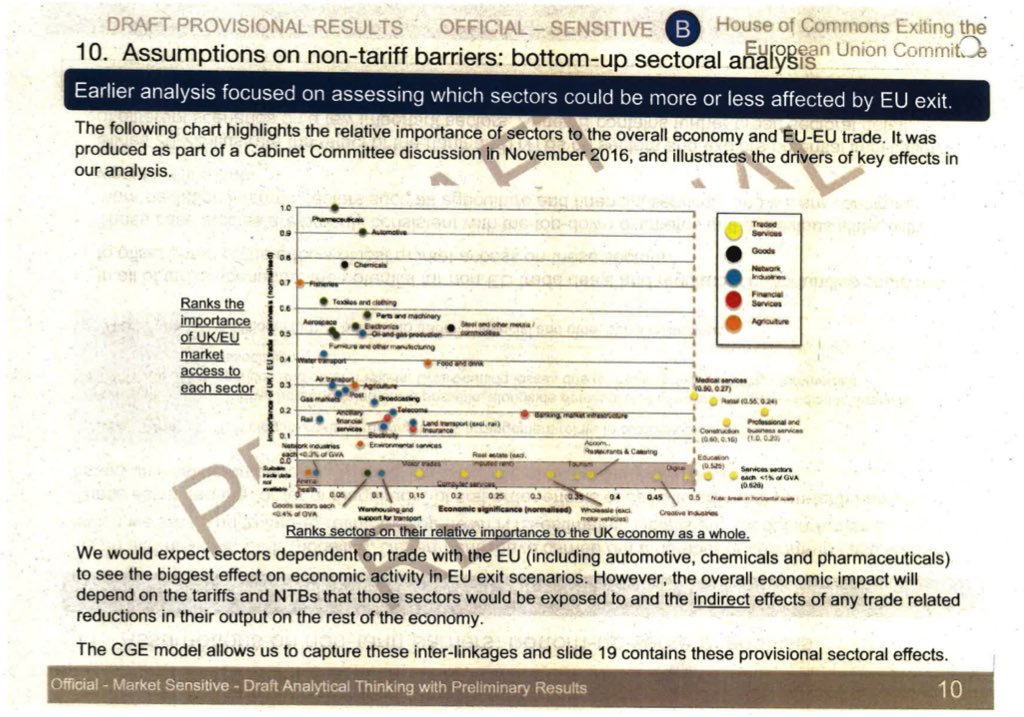

“London’s Status as a financial centre could be severely eroded”

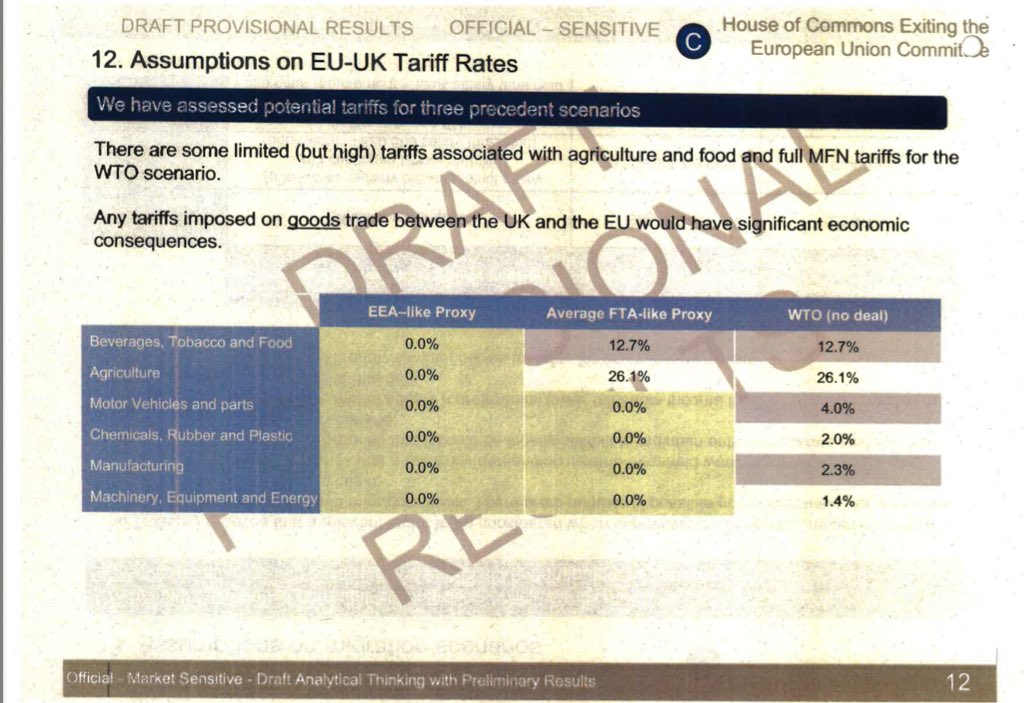

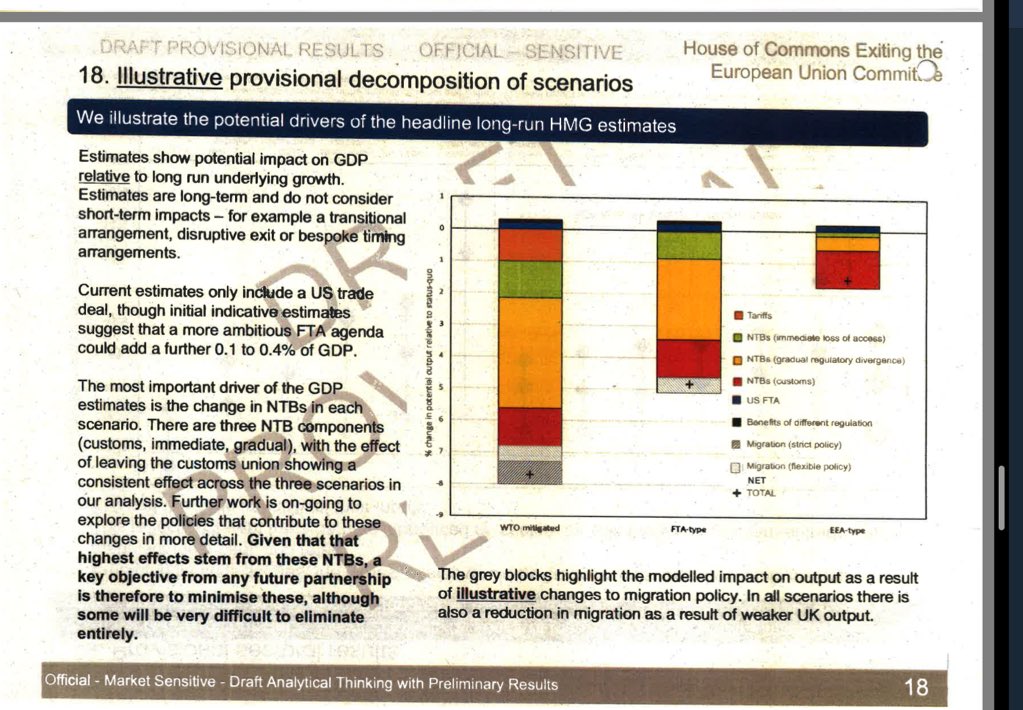

Clearly disputes the notion of any net “Brexit dividend”, alone (in yellow) outweighed by the fiscal impact of introduction of non tariff barriers (green)