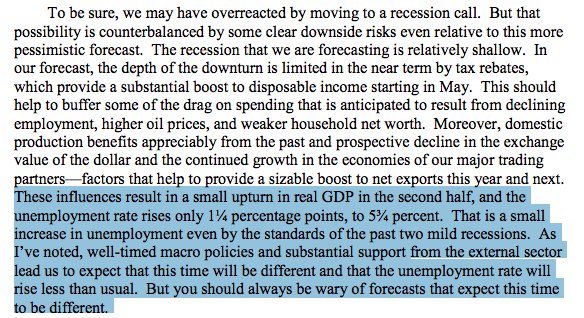

comes days after Bear Stearns rescue but real news --> Fed staff thinks America is in a recession

Fed cuts from 3% to 2.25% but 2 hawks - Plosser and Fisher - dissent

transcript: federalreserve.gov/monetarypolicy…

THREAD

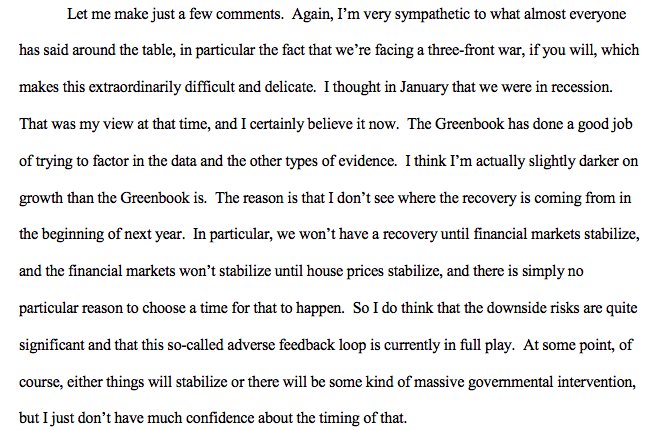

Bernanke: I'm more pessimistic. I don't see where the recovery comes from

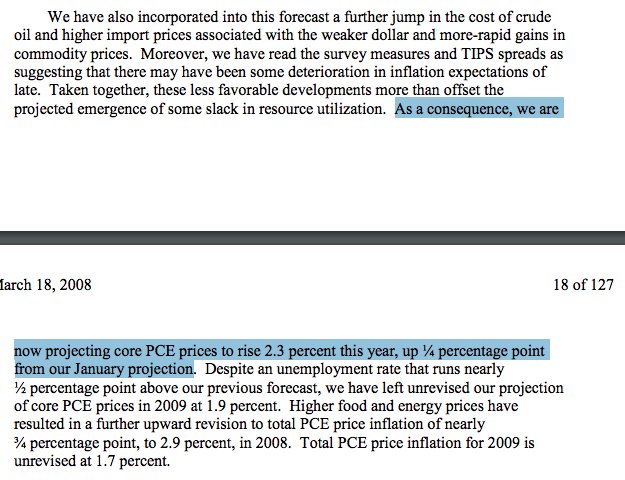

"I am increasingly concerned that, in our need to respond to signs of economic weakness, we risk losing our hard-won credibility on inflation"

"I believe inflation expectations no longer qualify as well anchored. Moreover, they no longer seem consistent with the credibility of even a 2 percent inflation objective."

"I’m just less comfortable with the inflation outlook...I wish we had the luxury of waiting for unambiguous evidence that expectations have lost their anchor. But if we wait until then, it will be too late."

"I’m also concerned that the public seems to perceive that the Fed

has effectively set aside one part of its mandate, price stability, in our all-out efforts to promote economic growth."

At this meeting says there is no way he will vote for more cuts

"market participants may not yet believe that we are as concerned as we ought to be about inflation risks and about risks with respect to the path of the exchange value of the dollar."

Later he would excoriate the Fed for talking about value of the $

"I just really can’t not react to the comments that you made, President Fisher...This was the statement that I think you made, and I think it is just plain wrong."

"Ninety-five percent of the inflation that we’re seeing is either the direct or the indirect effect of globally traded commodity prices—food, energy, and other commodities."

The economy is REALLY bad, the inflation risks are completely manageable, and there is a case for us to cut rates even more than 75 basis points as insurance against a very bad outcome.

"Mr. Chairman, I think this is a mistake"

"We cannot prevent this recession, and it’s doubtful to me that we could have or should have even if we had had perfect foresight...We can control inflation, and we can limit the extent to which uncertainty about our inflation intentions adds to market volatility.

"I believe the time has come to buy some insurance against our waning credibility about restraining inflation."

Warsh: US financial institutions will come out of this period stronger than ever

Geithner: Banking system is not undercapitalized and everyone stop talking about insolvency

That's it. That's the lesson. Promote policymakers who have demonstrated good judgment and get better outcomes. Keep people who were wrong far way from power.

/END

ft.com/content/a2110d…