Many reserve bank presidents want hike

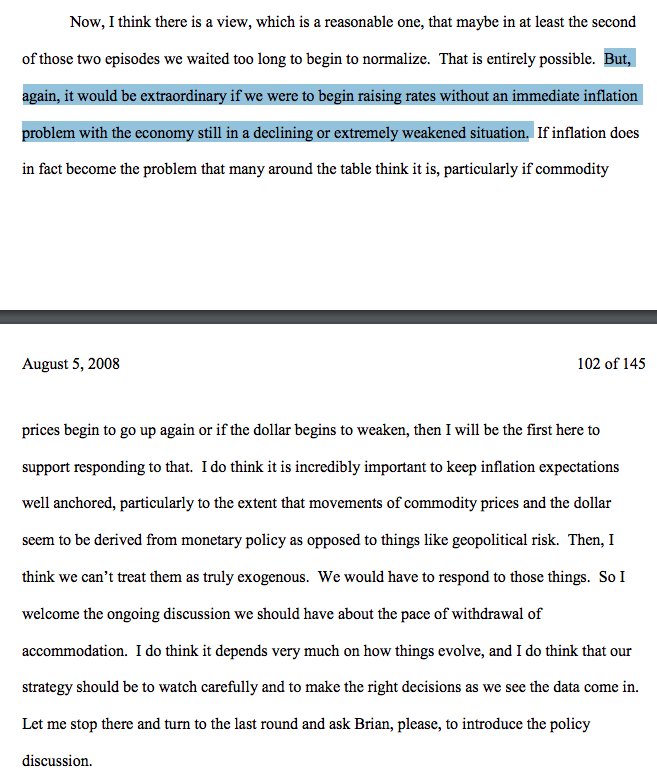

Bernanke: "it would be extraordinary if we were to begin raising rates without an immediate inflation problem with the economy still in a declining or extremely weakened situation." federalreserve.gov/monetarypolicy…

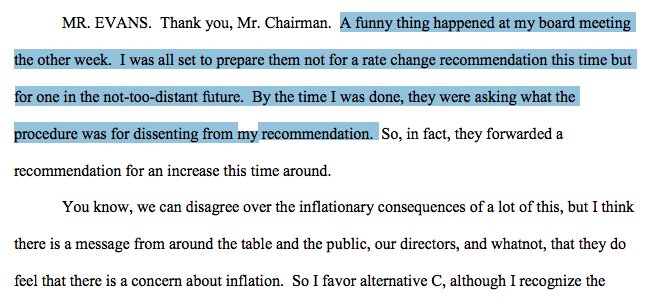

"By the time I was done, they [private board of directors] were asking what the procedure was for dissenting from my recommendation."

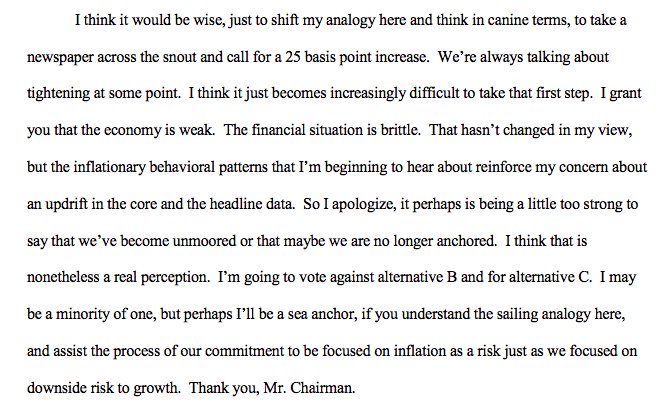

"I think it would be wise, just to shift my analogy here and think in canine terms, to take a newspaper across the snout and call for a 25 basis point increase."

"I went into my board recommending no change and got considerable push-back in discussion about how we dissent and what the consequences of doing that are. They are concerned about inflation."