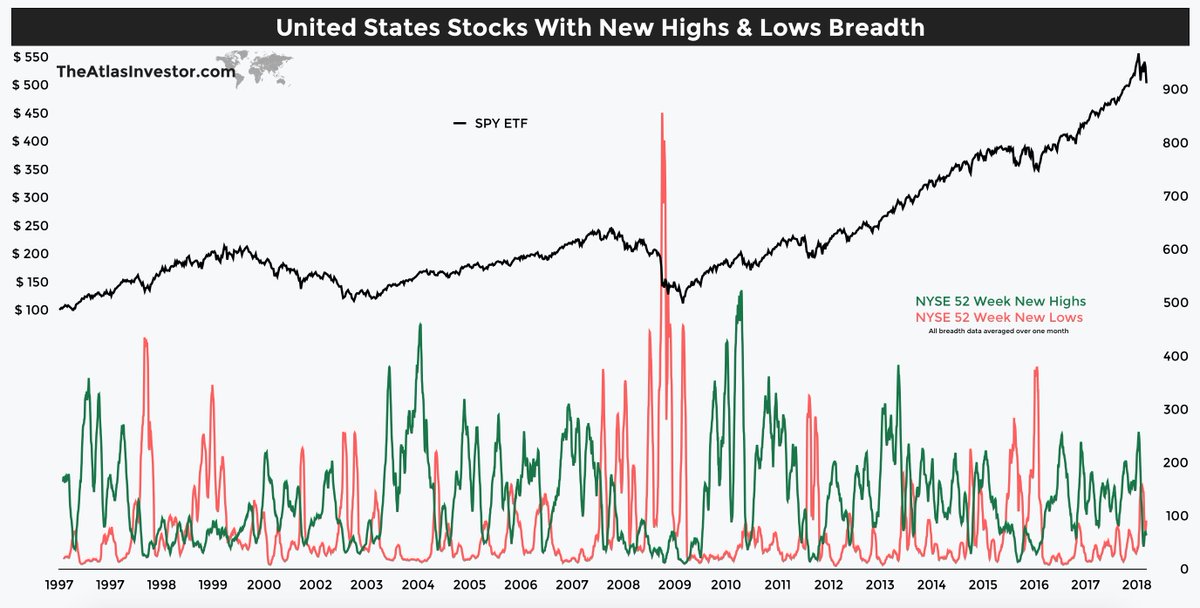

The answer depends on your timeframe and investment perspective. Are you a trader looking for a rally, or an investor looking for a multi-year bottom? $SPY

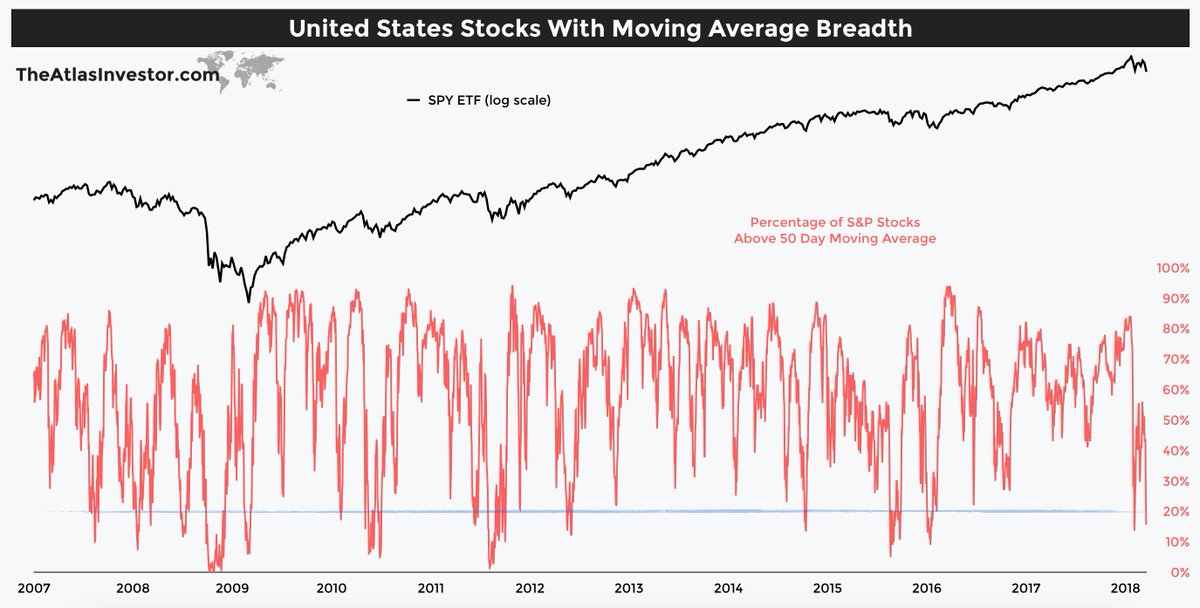

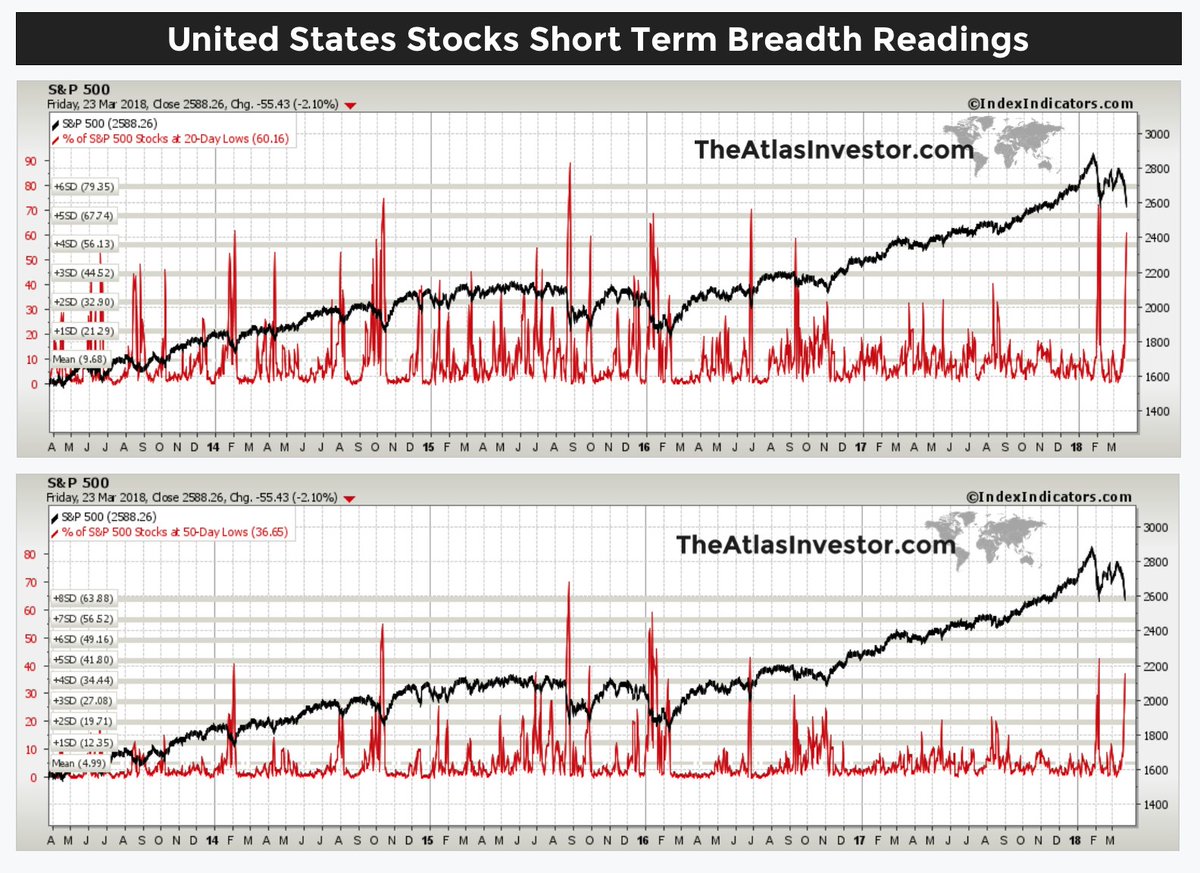

5 Day MA: 5.8%

10 Day MA: 6.2%

20 Day MA: 9.4%

50 Day MA: 13.9%

Short term breadth readings clearly show panic selling and oversold conditions, which usually — but not always — indicate a bounce is coming.

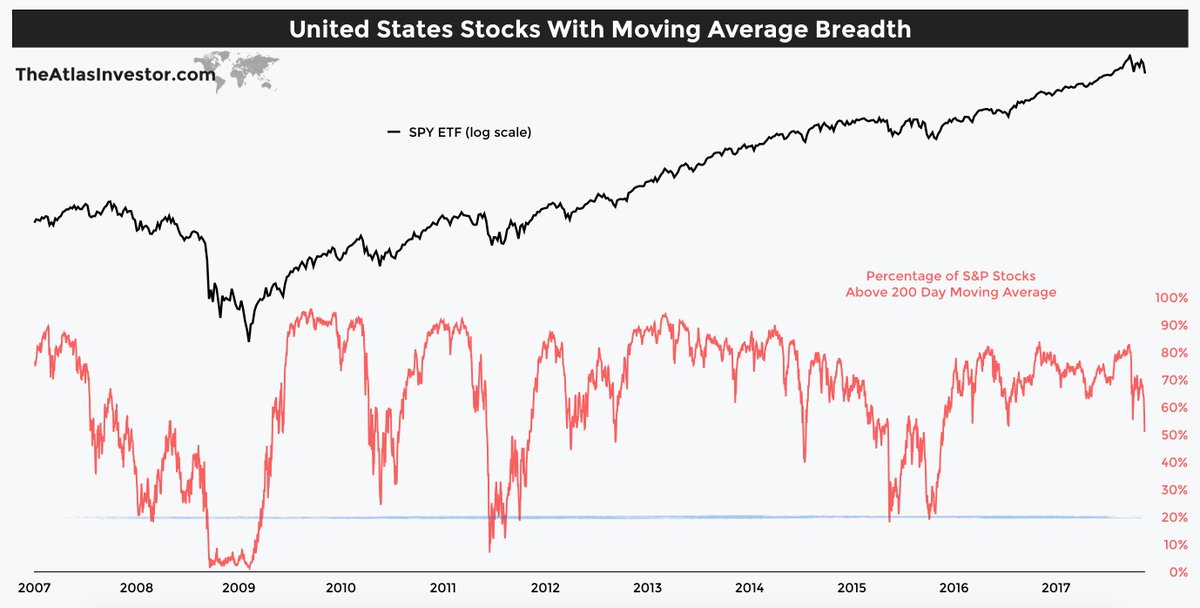

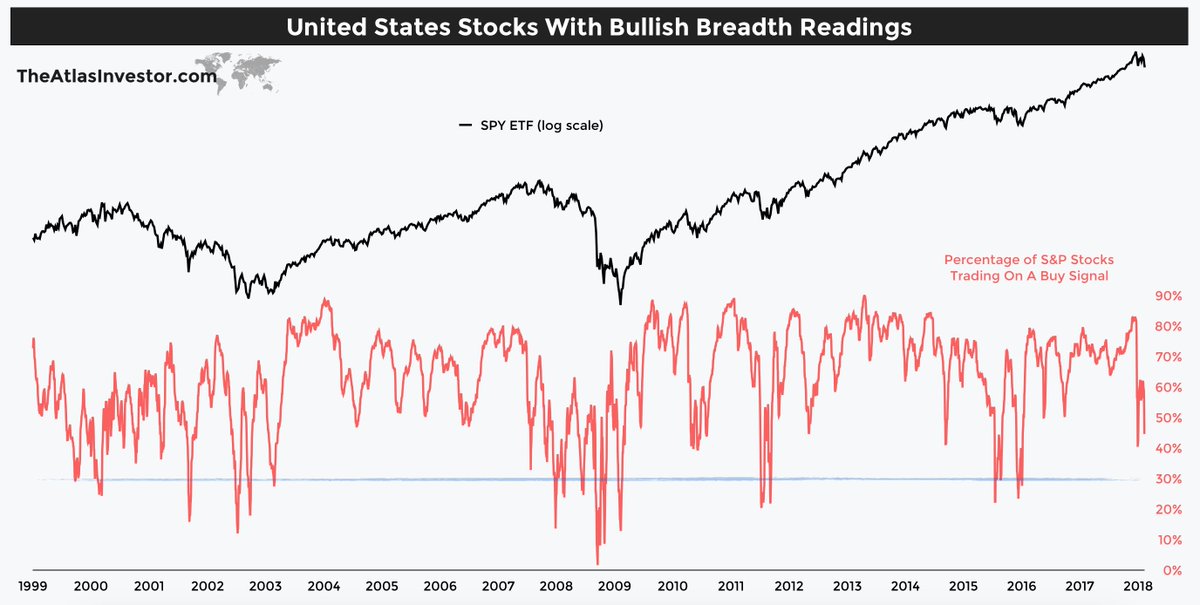

Percentage of $SPY components above the 200 day MA: 51%.

Major lows tend to occur as the reading drops below 20%.

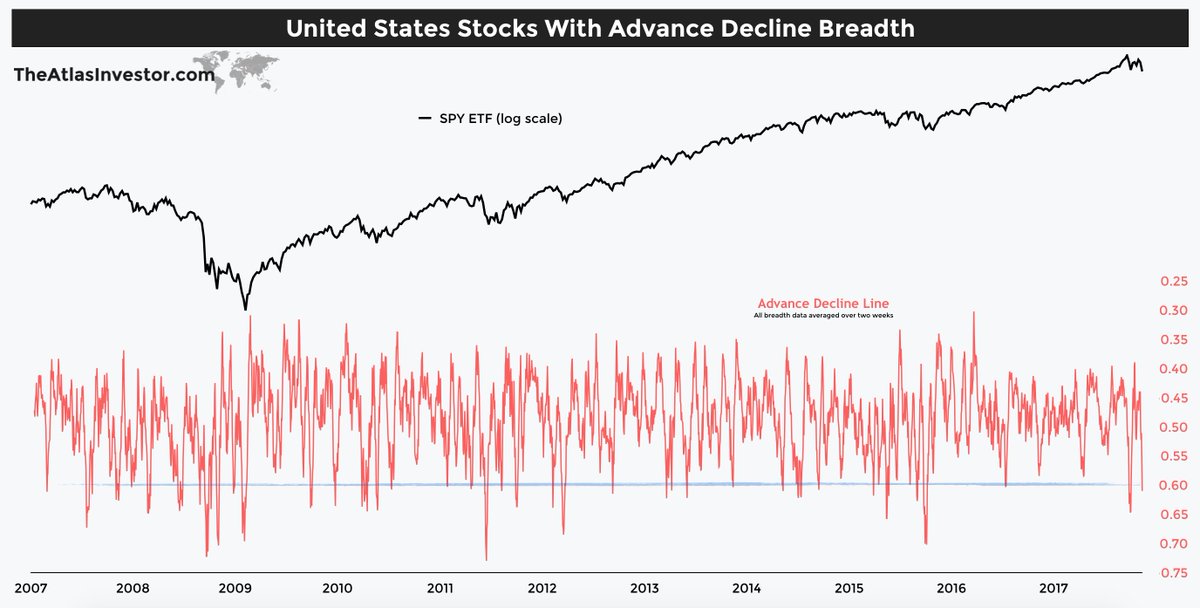

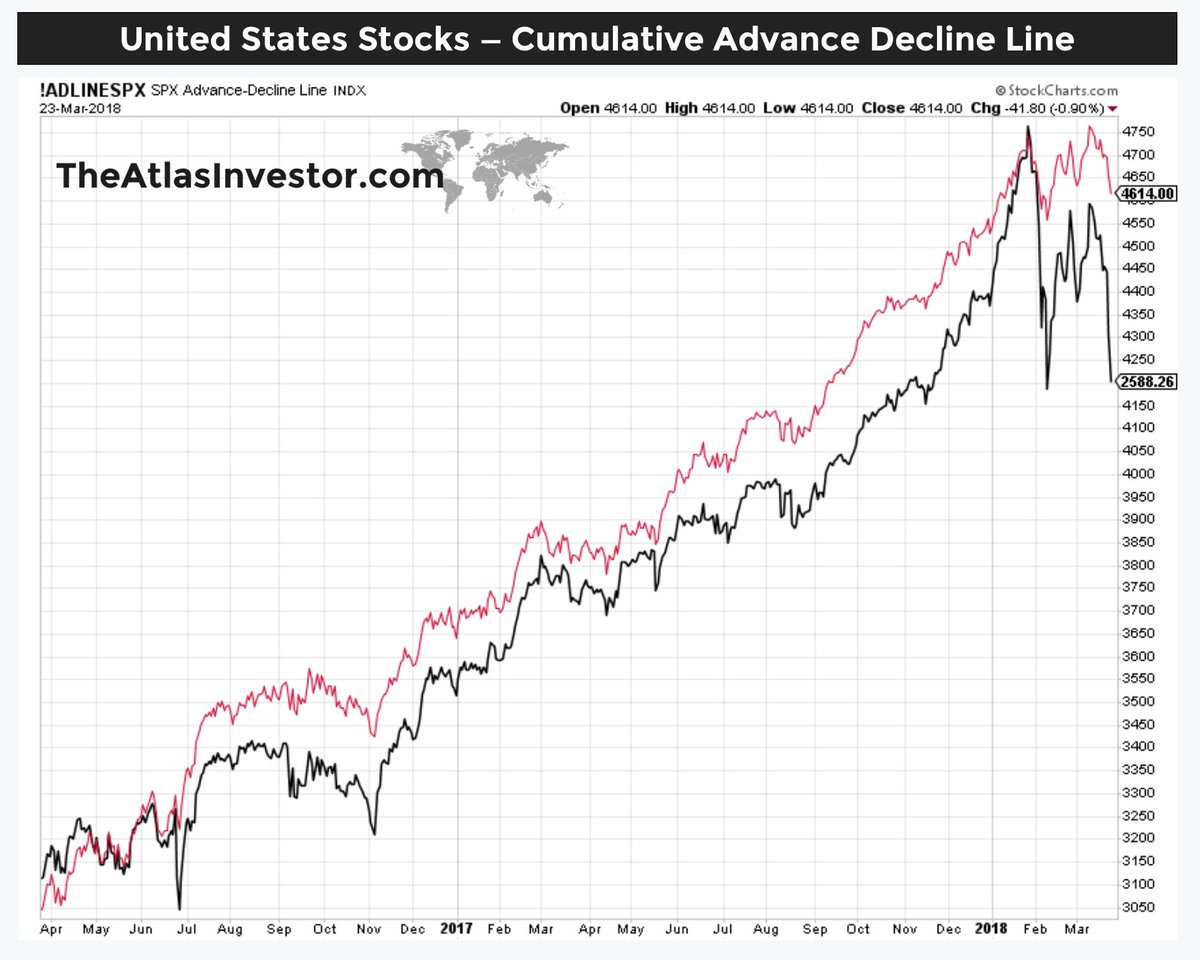

Once again a similar story here. When we average the AD Line and UP Volume over 10 trading days (two-week average), we can clearly see oversold readings suggesting a potential bounce ahead. $SPY

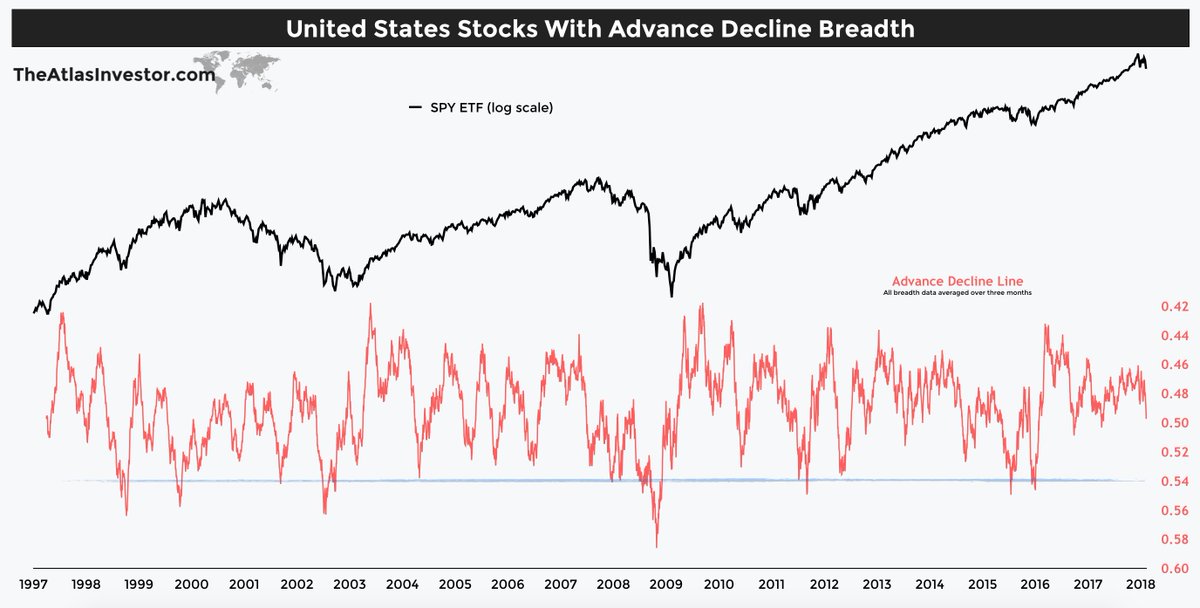

Just like when it comes to the percentage of stocks above MAs, this breadth indicator also signals that conditions are nowhere near oversold.

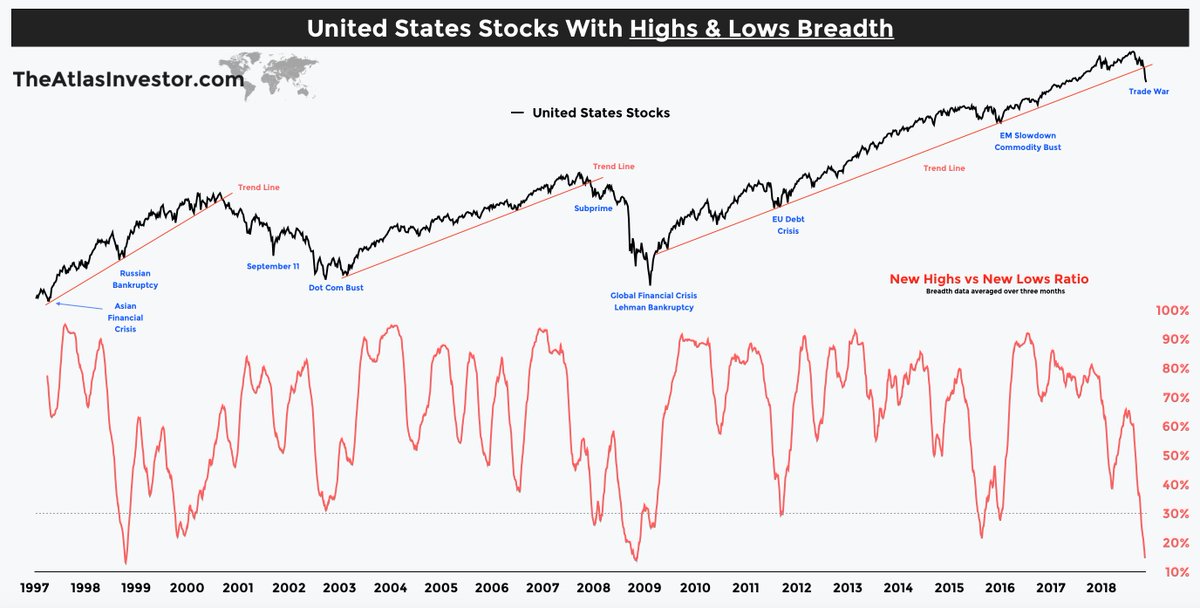

What about the New Highs and New Lows? Is this indicator oversold? Percentage of $SPY stocks at 20-day lows @ 60% & 50-day lows @ 37%.

Very oversold.

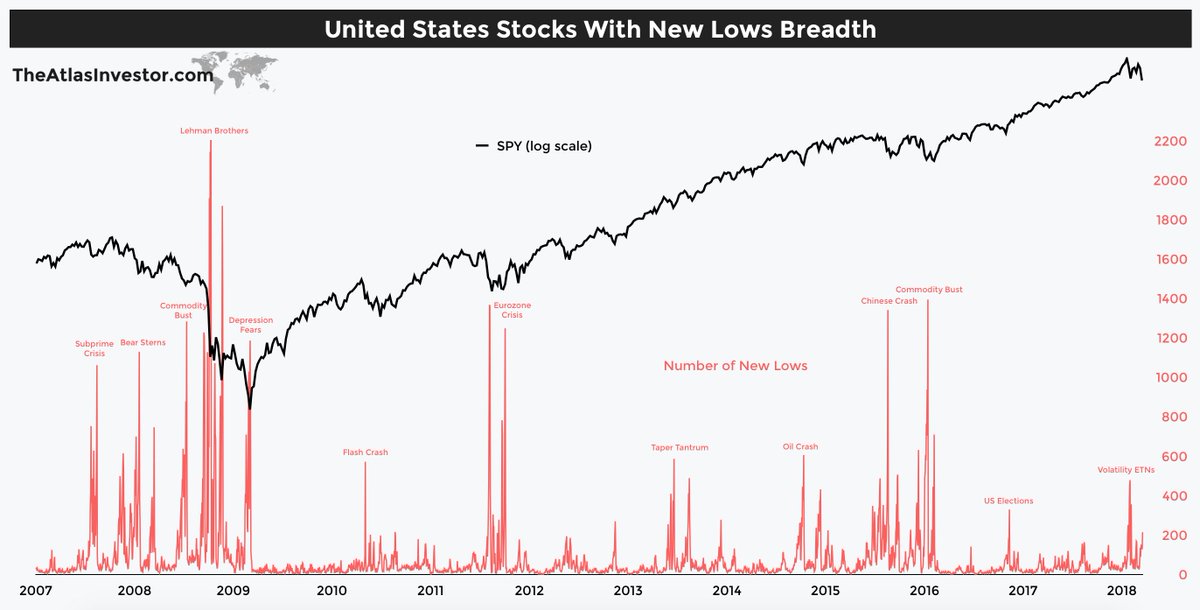

What were major panics? 1998, 2001, 2002/03, 2008/09, 2011, 2015/16.

They are good at charging for newsletter subscriptions, but not so good at profiting with "real money".

Historically, readings below 30% have marked significant lows. We are not there yet. Here is the thing. Do we have to get that oversold?

Not at all. Markets do not have rules.

You need someone accomplished level of expertise, who invests millions & millions of dollars on behalf of his clients. Someone who does this as a full-time job, with a solid track record.

theatlasinvestor.com/track-record