Mortgages (leverage) are a common use when investing property.

This isn’t anywhere as risky as a broker’s margin, because public assets have huge volatility.

If the property market in your area rises 5% p.a. but you have an investment with 80% LTV — your gross return will be 25% p.a.

After costs, taxes & fees maybe 15%!

These are the same people who never invested in property themselves and continue to return 3-6% per annum in capital markets (after taxes and costs).

Forget 15%, that is a double.

If you were smart you would have payed the debt down, rented your property, used tax writeoffs & achieved strong appreciation.

All 4 are forms of ROI — something the stock market doesn’t offer.

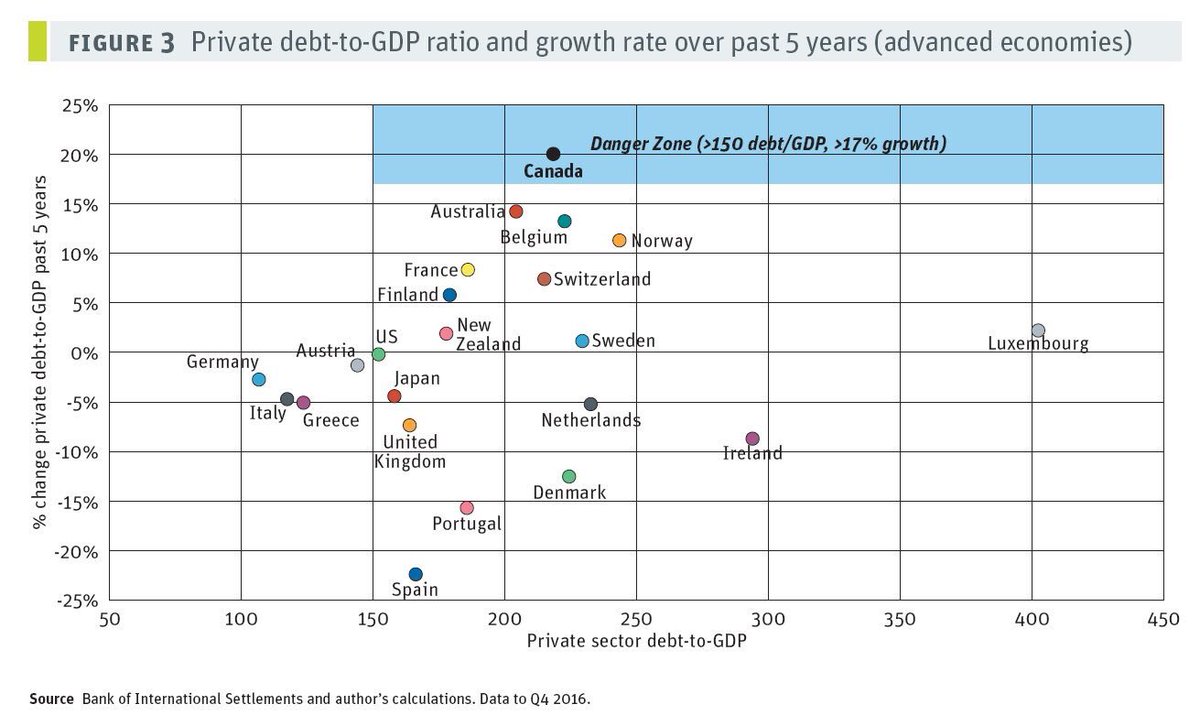

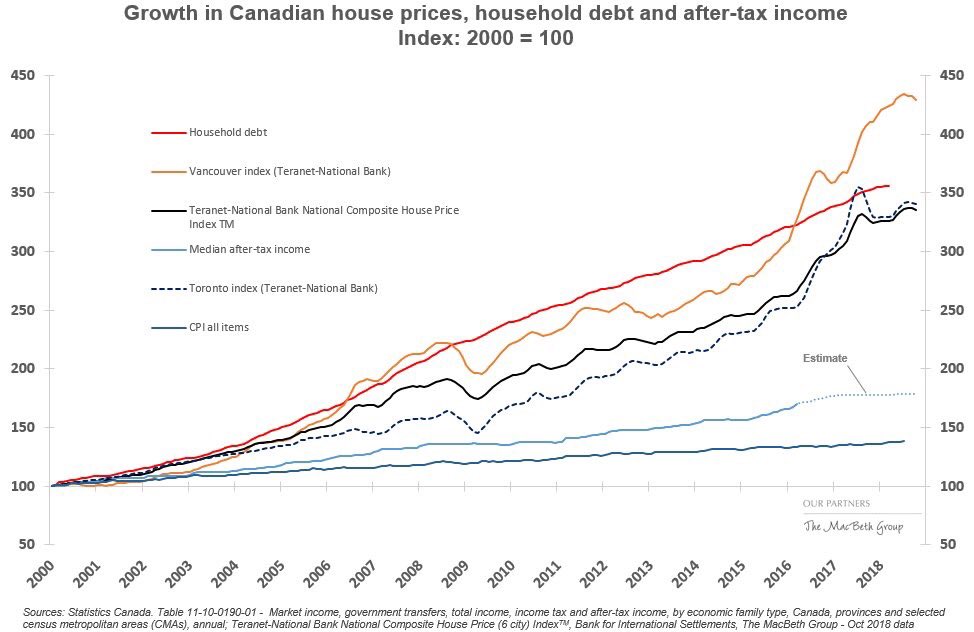

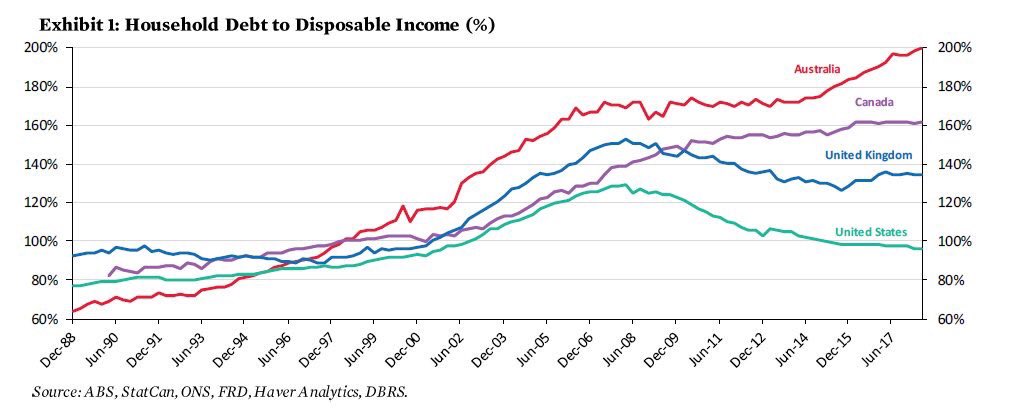

The problem is with the new comers, the people who missed out on the boom. They are borrowing large amounts of debt to purchase today.

So they are borrowing excessive amounts of debt at the wrong time — during the late cycle prior to a downturn.

It is a wonderful asset class, just like stocks or bonds, but only at the right time within the business & investment cycle.

But for those who bought a decade ago, during the 2008 panic — they have made a fortune and are relatively safe now. @hmacbe

No doubt this posses significant risks to the local #realestate market.

FinTwit is full of property bubble callers, which could soon be vindicated (but with totally wrong timing).

We will tell them they are RIGHT.

All they want to hear is that they were right, and they called it.

For rest of us investors, we ought to focus on achieving and growing wealth through wise long term investing.

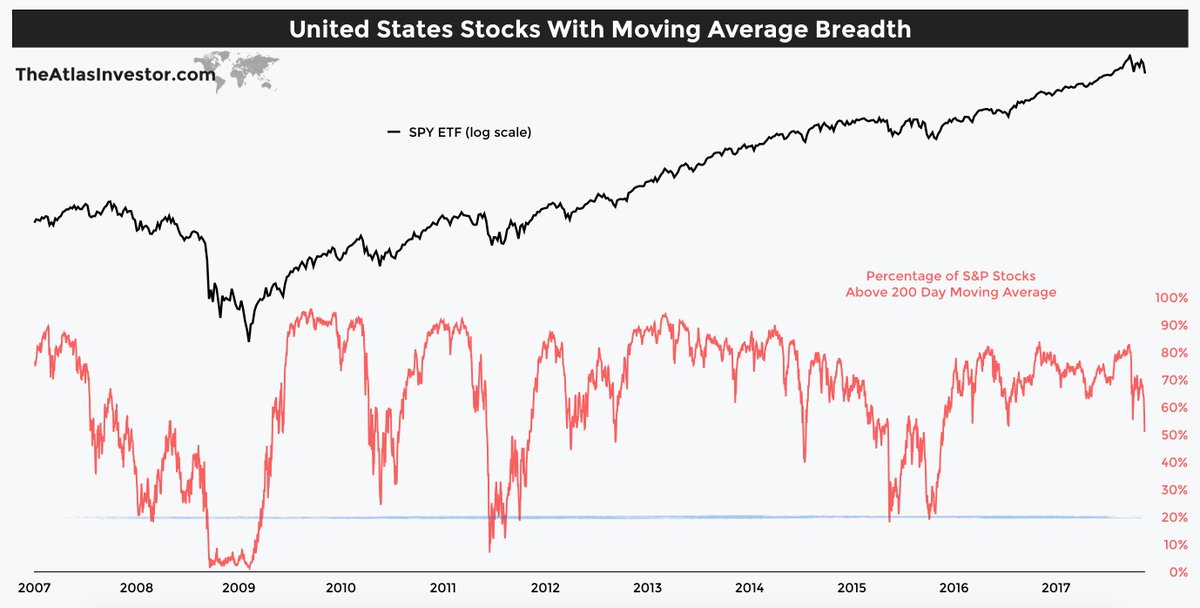

The pain will be felt by the late comers, the same kind that buy the top of a bull market in stocks.