Yesterday's gains = Today's capital.

Compound interest works like a fractal.

Each piece of interest eventually earns its own interest.

Fractals are powerful because their complexity comes from SIMPLE actions repeated over and over again.

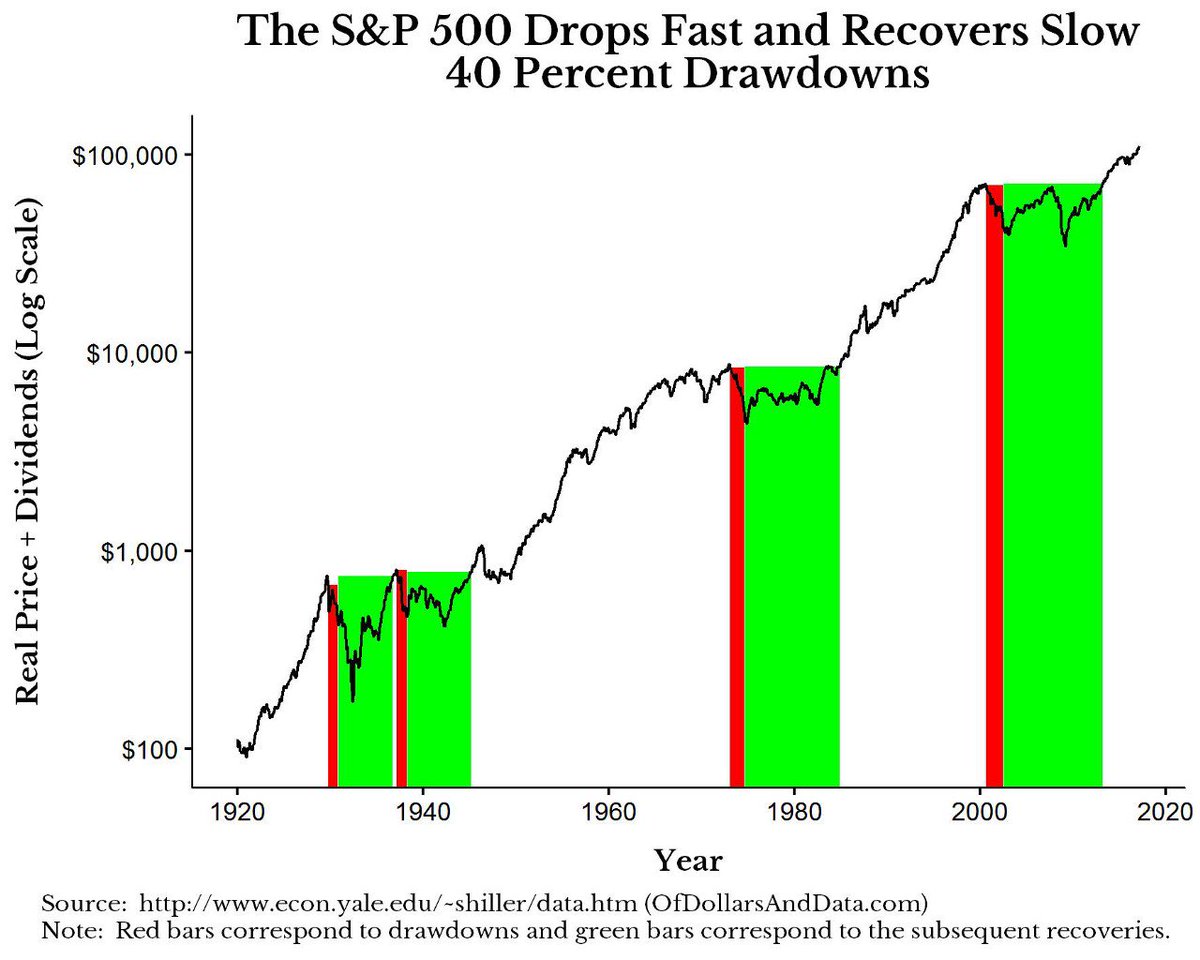

Berkshire has temporarily declined in value 30–50% MULTIPLE times in the last few decades.

Even with optimal investing behavior, you won’t always make money.

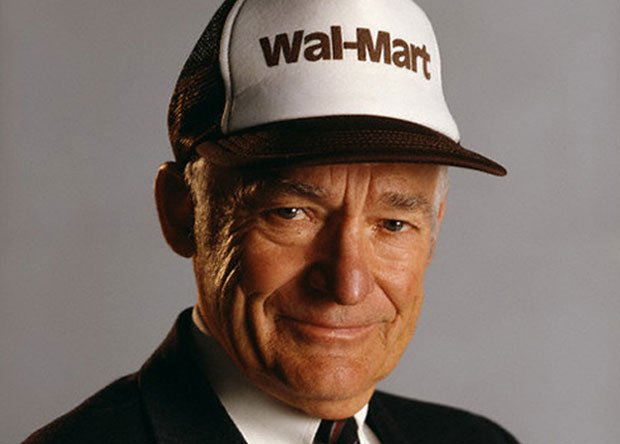

He created more wealth in the 20th century than almost anybody else.

What’s his secret?

A willingness to CHANGE his beliefs.

Success mattered more than being right.

Don’t sell during a panic.

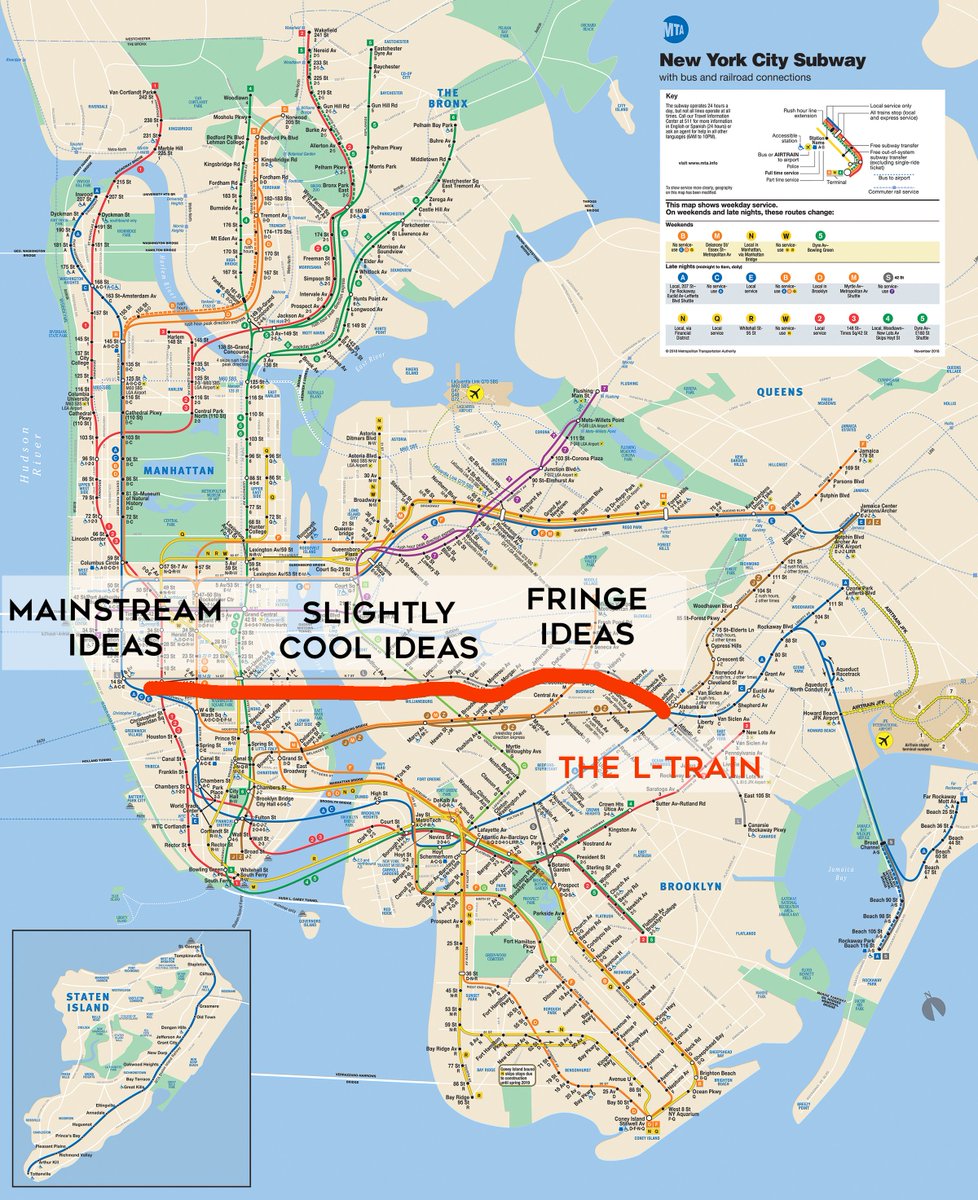

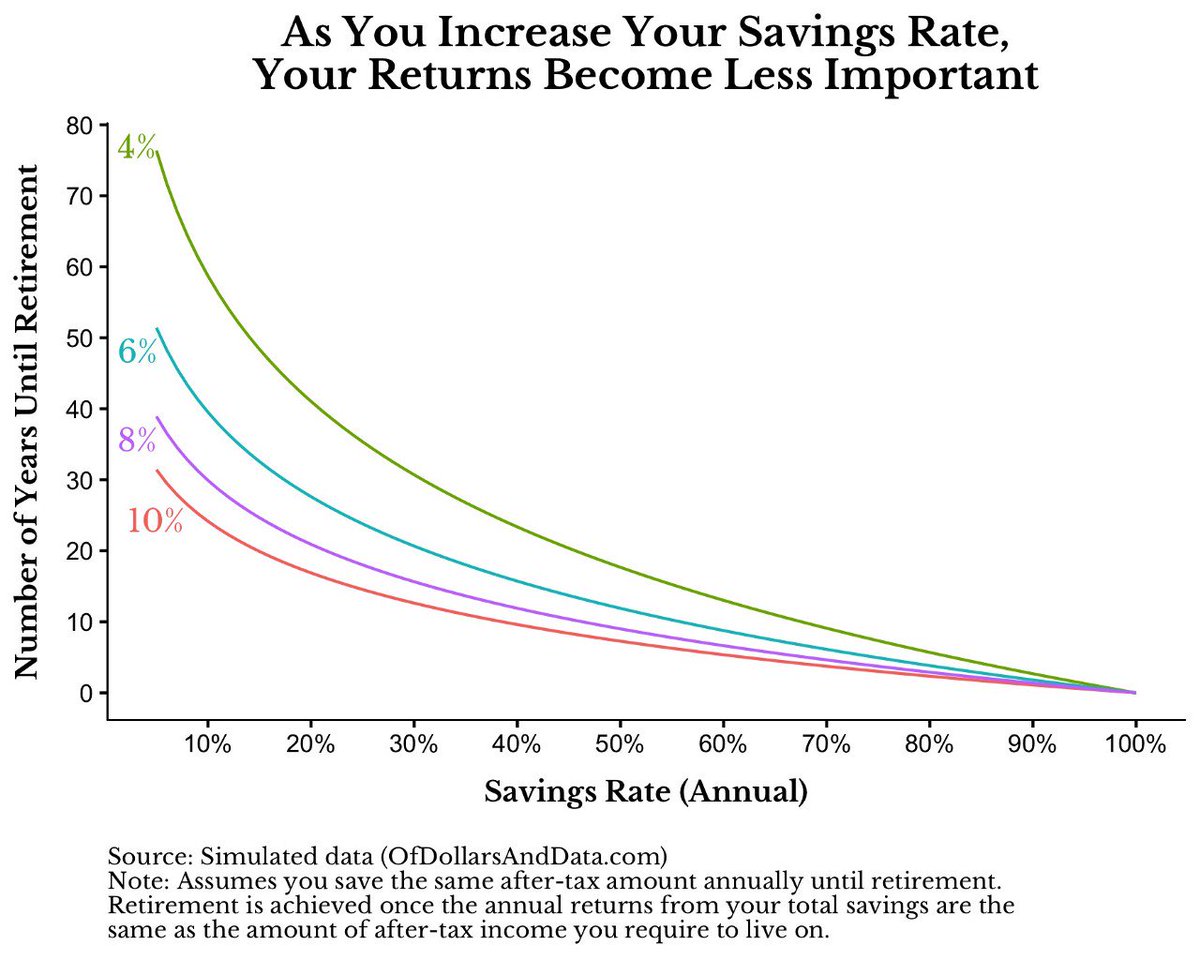

Increase your SAVINGS rate.

Acquire income-producing assets on a regular basis.

This will do wonders for your investment success.

20th-century events in America:

▶️ Two World Wars

▶️ The Great Depression

▶️ ~12 recessions and financial panics

▶️ Oil shocks

▶️ Flu epidemic

But the Dow ROSE from 66 to 11,497.

Even over longer holding periods, initial purchase prices matter.

HIGHER purchase prices imply LOWER returns.

Historically, the U.S. stock market has had long-term positive real returns for most of its history (regardless of valuation).

Quick drops.

Slow recoveries.

The earlier you start saving, the better.

At first, the benefits will be hard to notice.

But they’ll be impossible to ignore in the long run.

Good BEHAVIOR and COMPOUNDING can lead to huge results.

If you’re not familiar with his work, I recommend this post...

ofdollarsanddata.com/the-constant-r…