economist.com/britain/2018/0…

(On #predistribution, see: policy-network.net/pno_detail.asp… )

academia.edu/3842807/_What_…

policy-network.net/pno_detail.asp…

onlinelibrary.wiley.com/doi/abs/10.111…

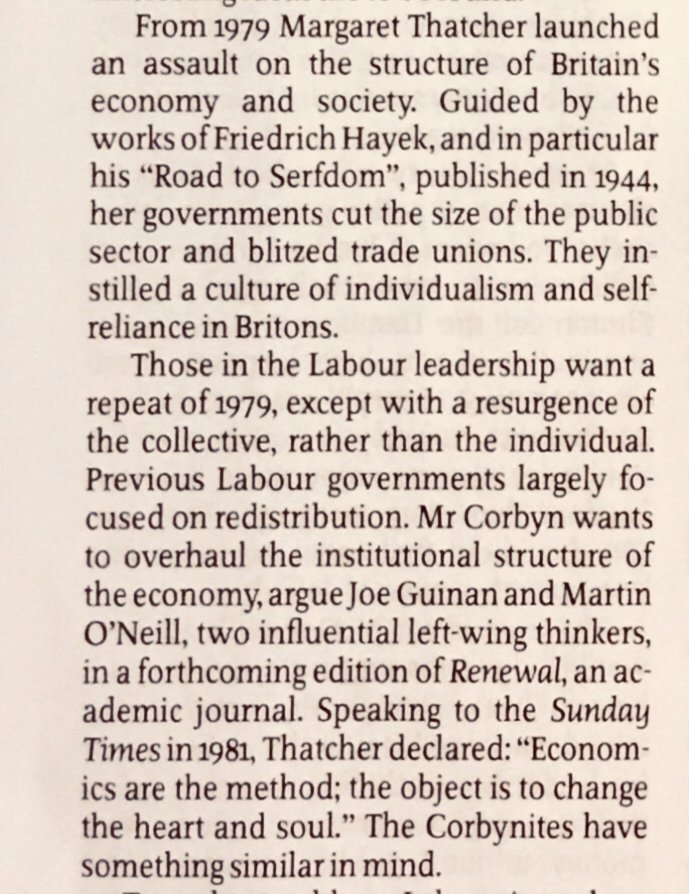

renewal.org.uk/articles/the-r…

@threadreaderapp unroll please