How to get URL link on X (Twitter) App

1/22 A key issue for institutional and mainstream adoption of decentralized blockchain is privacy

1/22 A key issue for institutional and mainstream adoption of decentralized blockchain is privacy

Today couldn't be a more bullish environment for $BTC from a fundamental / adoption perspective

Today couldn't be a more bullish environment for $BTC from a fundamental / adoption perspective

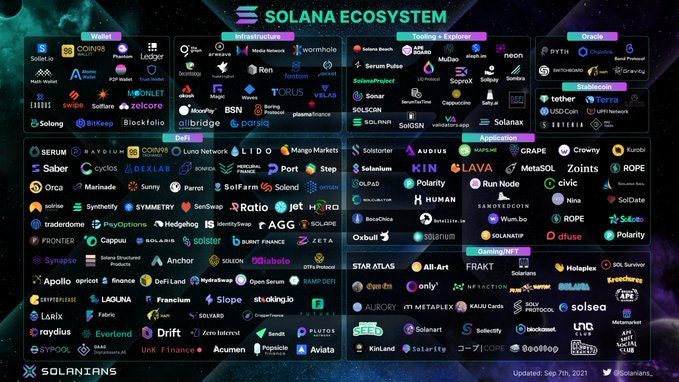

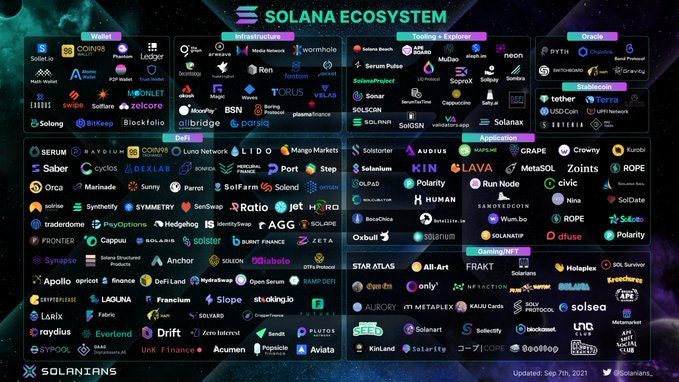

https://twitter.com/phantom/status/1438909746291957761?s=202/ And the entire $SOL ecosystem. The point is that there is a lot in this picture

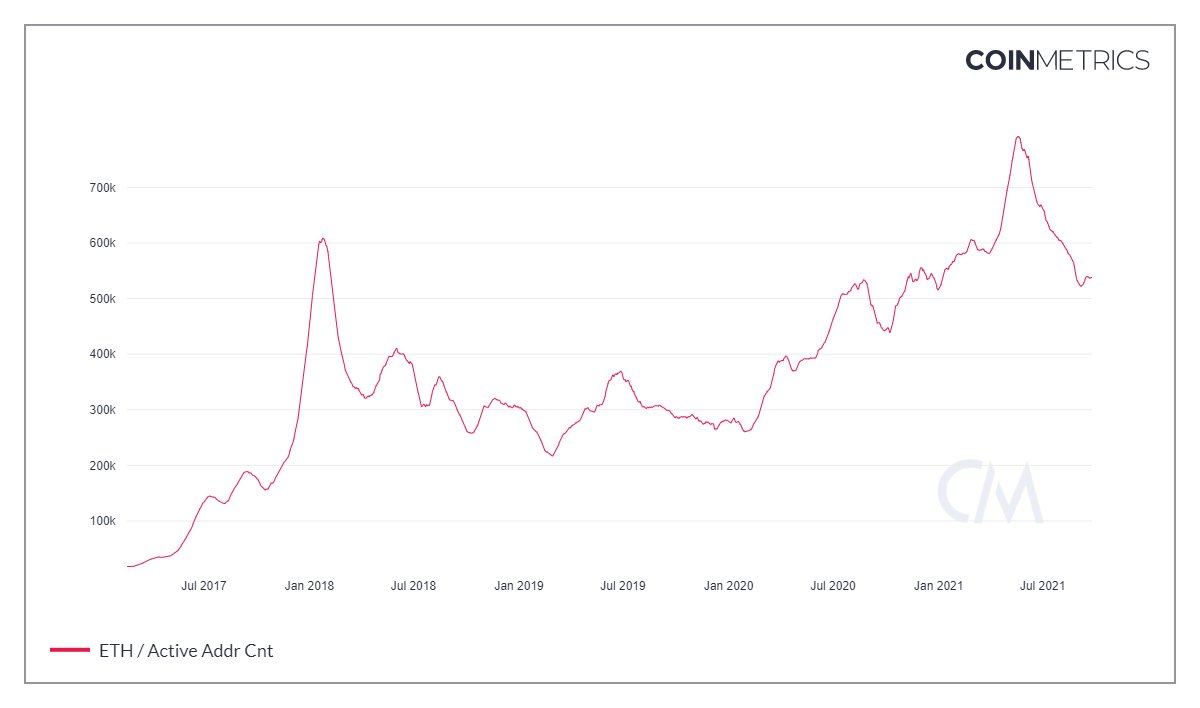

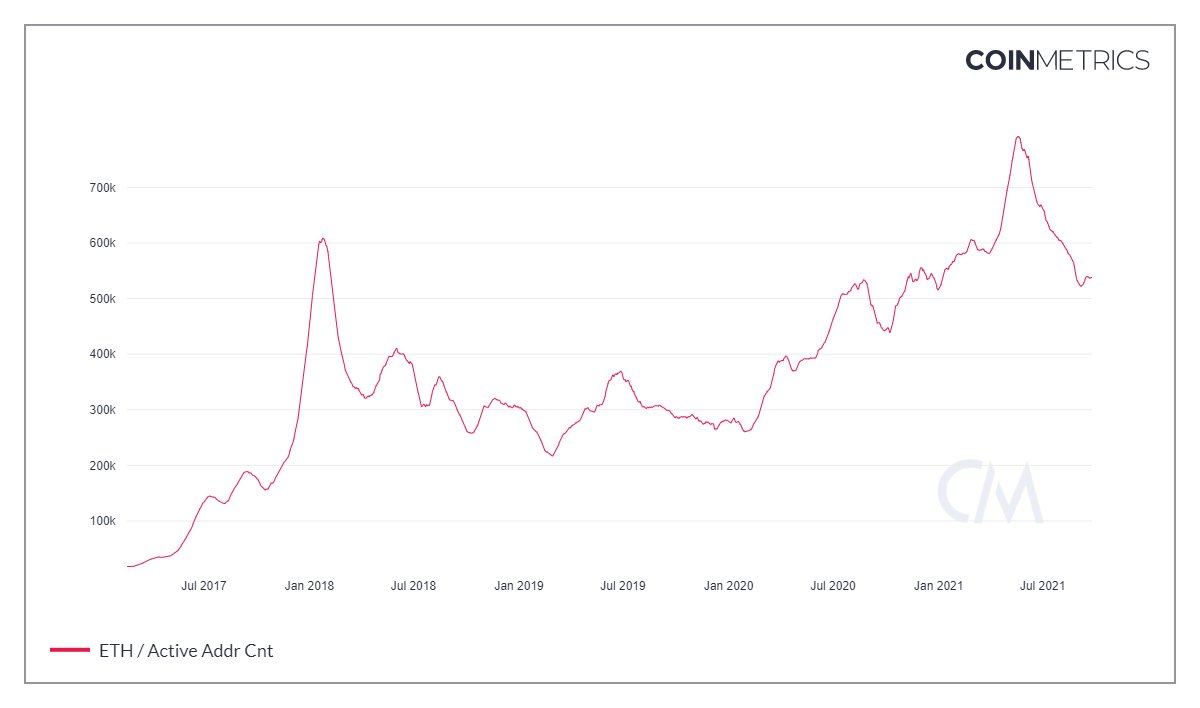

2/ Total value locked in DeFi protocols on #Ethereum hit all time highs recently. Currently at $124bn

2/ Total value locked in DeFi protocols on #Ethereum hit all time highs recently. Currently at $124bn

2/ #Bitcoin’s price from 2016-current is mapping shockingly well to 2010-2013

2/ #Bitcoin’s price from 2016-current is mapping shockingly well to 2010-2013

https://twitter.com/PeterLBrandt/status/1441485609487507456?s=20

This is right as fears of growth slowing down are coming up #jobs #ADP

This is right as fears of growth slowing down are coming up #jobs #ADP