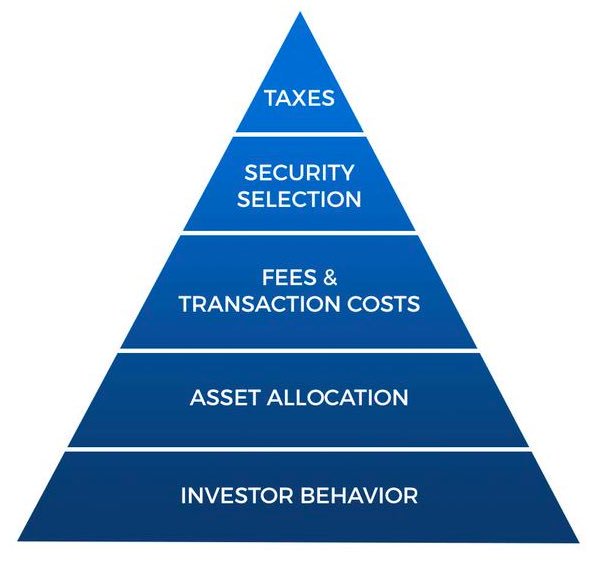

The finance industry talks too much about what to do, and not enough about what happens in your head when you try to do it.

-The Great Depression scared a generation for the rest of their lives.

-If you were born in 1970 the stock market went up 10-fold.

Keep that quote in mind when debating people’s investing views.

It helps, when making money decisions to constantly remind yourself that the purpose of investing is to maximize returns, not minimize boredom. Boring is perfectly fine.

Every big financial win or loss is followed by mass expectations of more wins and losses.

If there’s a common denominator in these, it’s a preference for humility, adaptability, long time horizons, and skepticism of popularity around anything involving money. Be prepared to roll with the punches.