To the man with only a hammer, every problem is a nail.

It’s fun to add new mental models to your own toolkit—

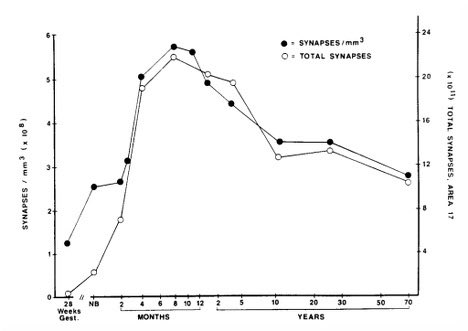

Then what follows is a precipitous pruning (as @mjmauboussin has noted)

The chart looks like this:

This short clip is...beautifully gross—and informative.

But when food gets scarce, warning signals in the form of chemicals ripple through, sending the single cells congregating into a single mega body.

Food = $ capital.

If you have friends that are or were bankers, lawyers, accountants or consultants there are quite a few over recent years that’ve tried startups or even VC or angel investing...

The main and obvious beneficiaries?

In recent years: real estate owners. Turning crappy Class C + Class B space into sought after incubators + co-working startup spaces. Vacancies down. Rents (or memberships) up.

How likely is that?...

Things got messy quickly.

But the byproduct of their detritus will be the fodder for the next wave to recombine into more useful things...

Sadly and too often the pressure of family expectations, significant others + in-laws often demand it...

Nobody knows.

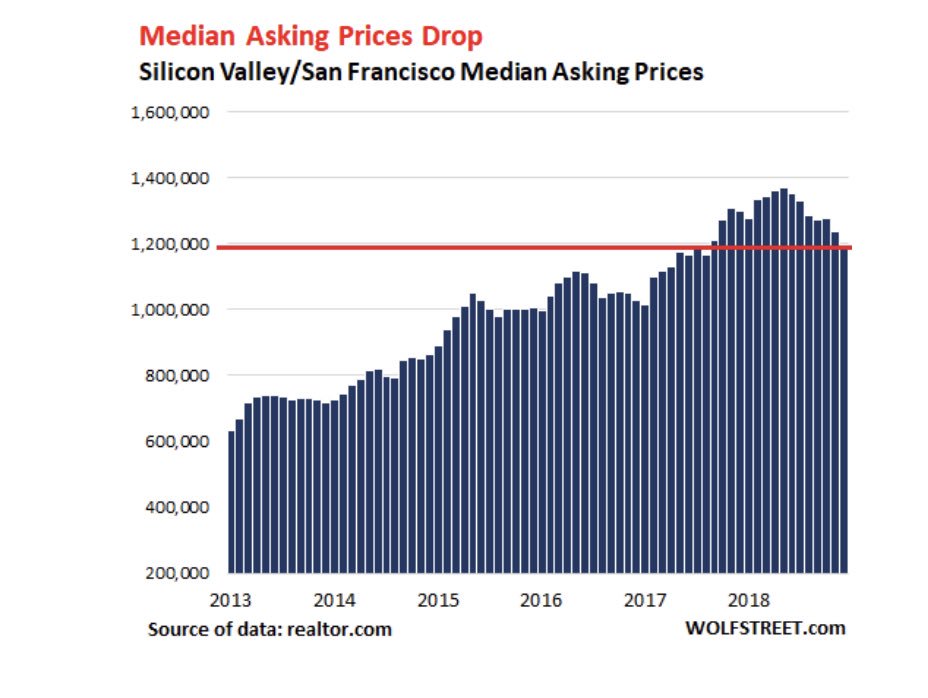

But everyone has a feeling something is awry.

My best measure of “when?” is based, in a Keynesian beauty contest way, on an expectation of other people’s expectations...

The answers vary widely.

Some incorporate anecdotes and references to macro economic forces....

Some point to central banker benevolence printing $ to stave off deflation, induce inflation, reduce unemployment, devalue currency against sovereign debt and interest due

About 3 years ago, the number crept up to 50%...

With all the anecdotes, weak signals + empirical evidence of experience and varied vantage points—

Today we are still shy of 80%.

Nature is beatifully gross—so are markets.