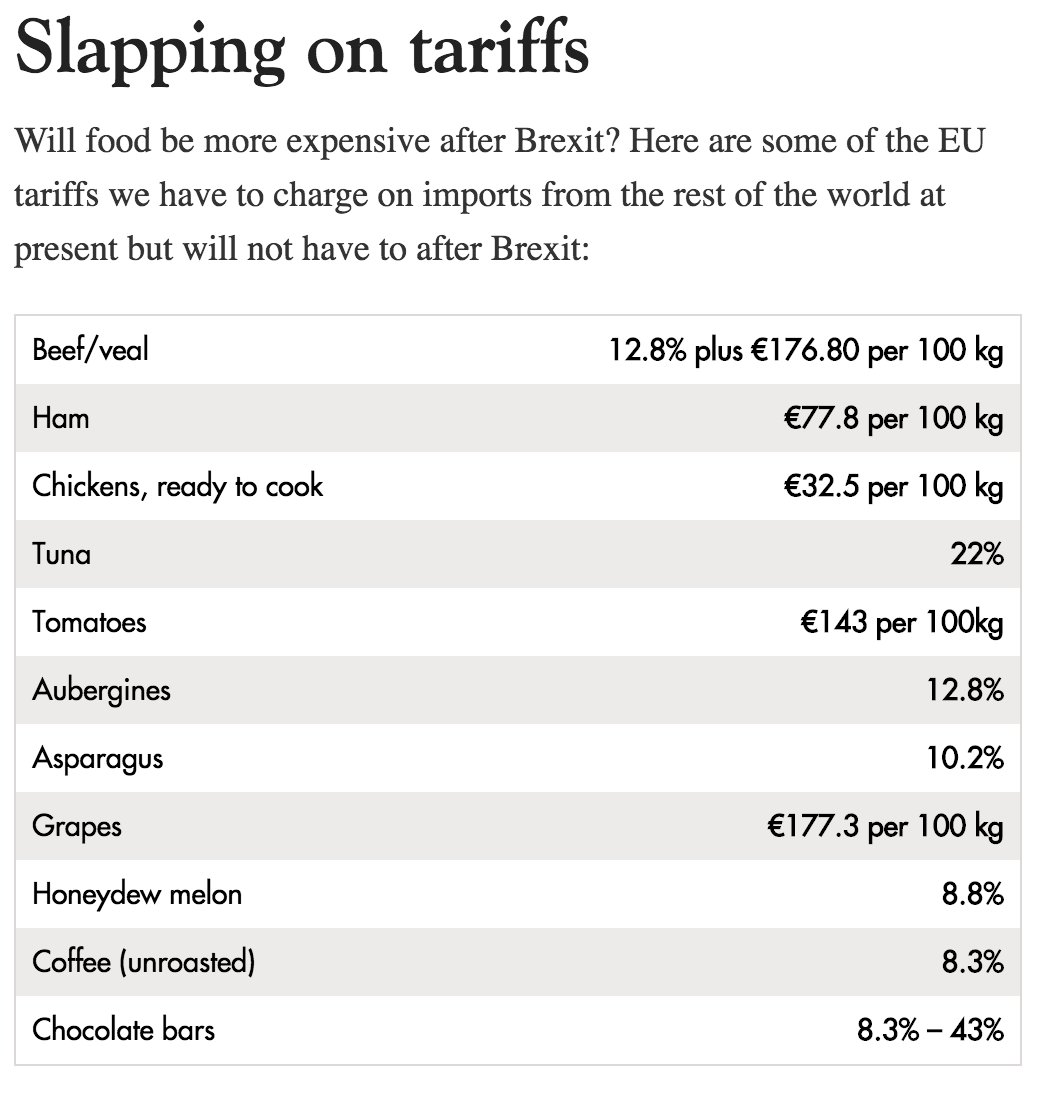

The @Spectator recently published this little list of tariffs.

The implication is that we will save significantly by not having to pay the tariffs shown. Will we?

There are a lot of items and I can't cover it all in one thread.

spectator.co.uk/2018/08/are-br…

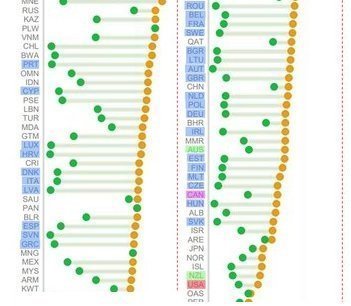

The graph in the previous tweet comes from this World Bank publication on Preferential Trade. I have annotated it to highlight EU countries. Here's that section zoomed in. It shows a bit more clearly how much of a differences trade preferences make.

documents.worldbank.org/curated/en/655…

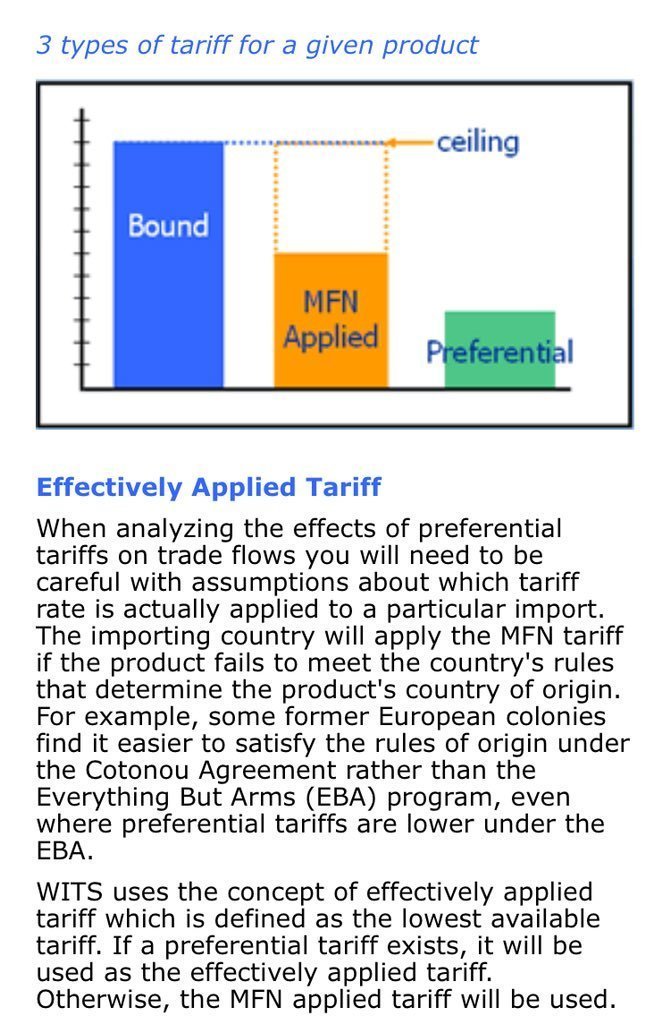

The Spectator list shows the EU's default MFN Applied tariff rates. They are the orange dots in the previous graph.

It is easy to assume that these tariffs on non-EU imports translate into potentially similar savings for the consumer. But do they?

wits.worldbank.org/wits/wits/wits…

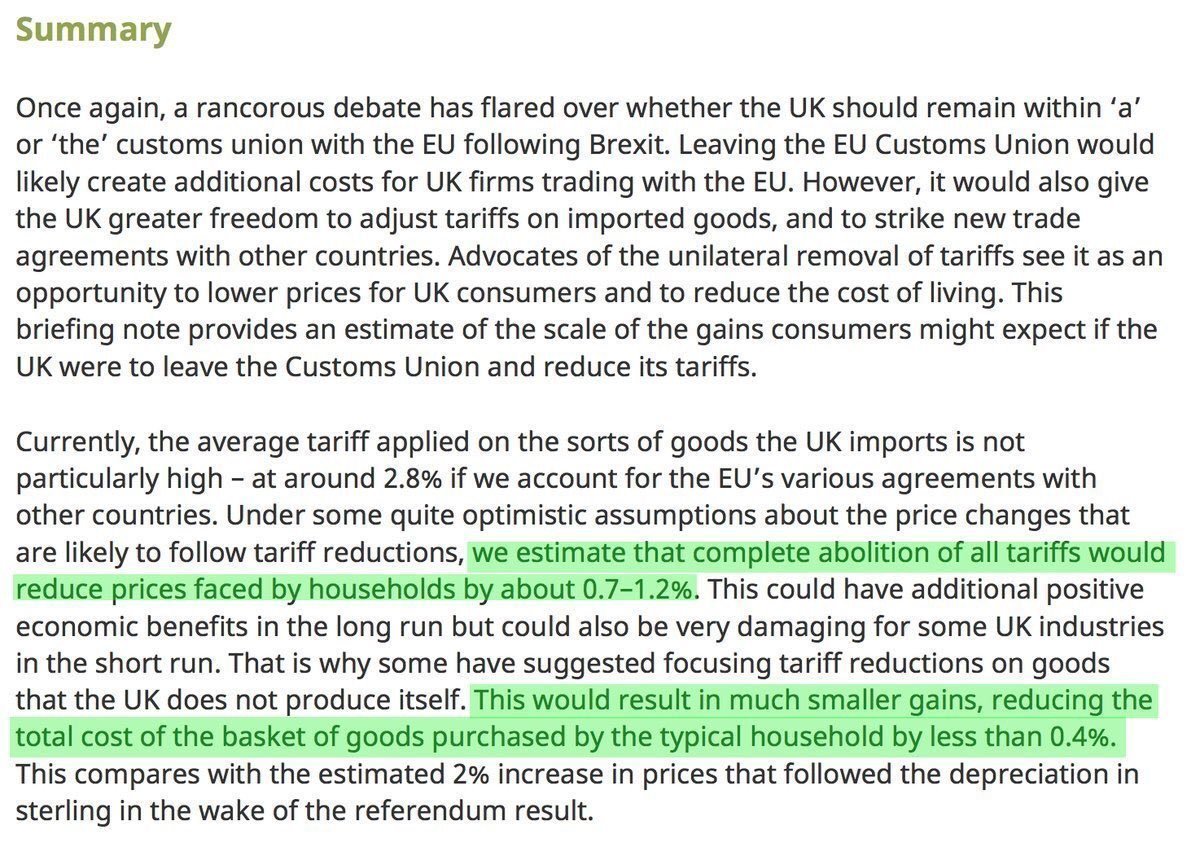

Simple arithmetic shows that the maximum potential saving by removing all tariffs would amount to a 1.2% (0.26*0.046=0.01196 =~1.2%) reduction in the CPI. However, a more realistic potential saving only amounts to a 0.4% saving. Here's why.

ifs.org.uk/uploads/public…

As I have shown in the past, the figures of 17-20% quoted by prominent leave campaigners are simply a fantasy.

But let's get back to this Spectator's list.

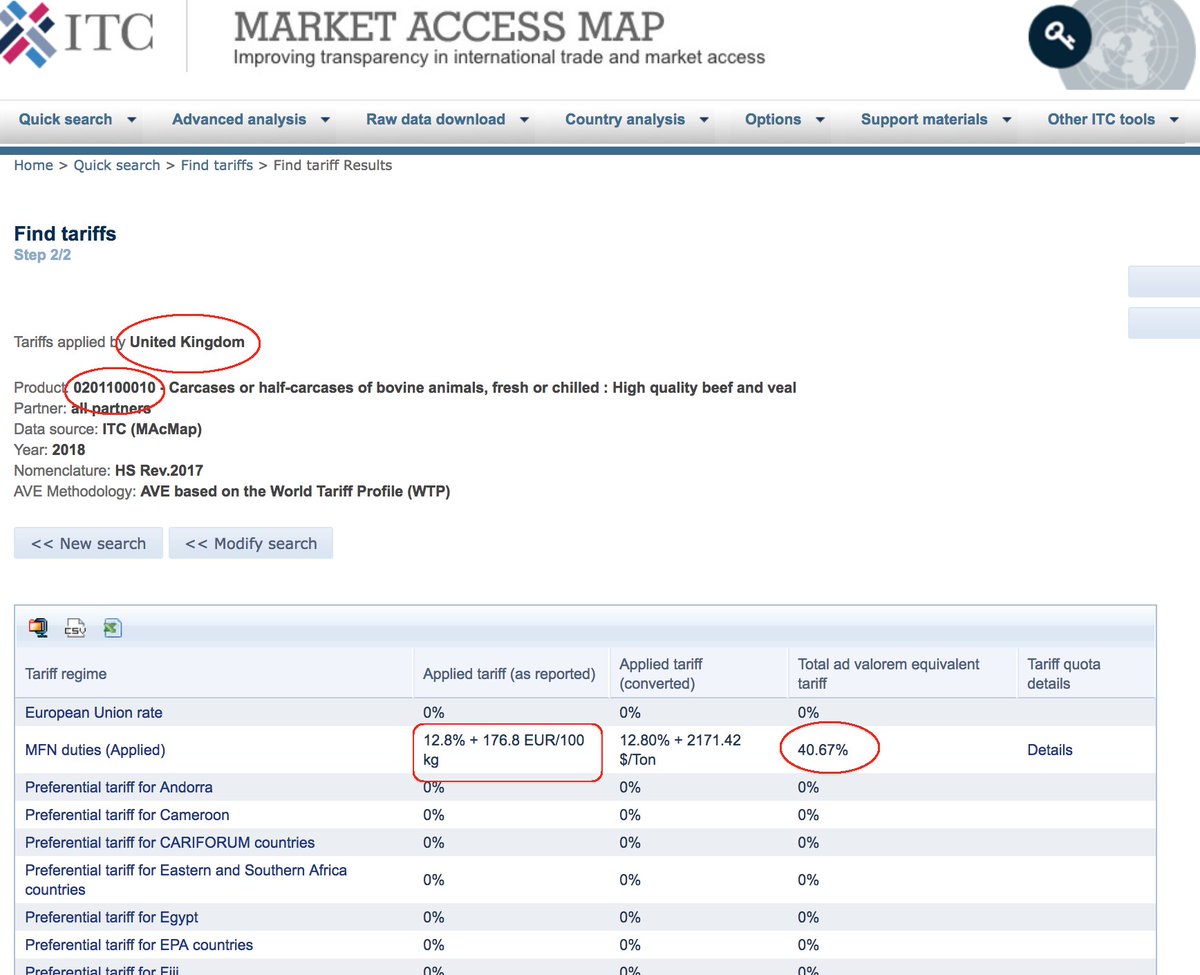

The 12.80% + €176.80 per 100kg translates into an Ad Valorem Equivalent (AVE) of about 41%. So what percentage of beef bought in the UK is subject to this tariff?

macmap.org/QuickSearch/Fi…

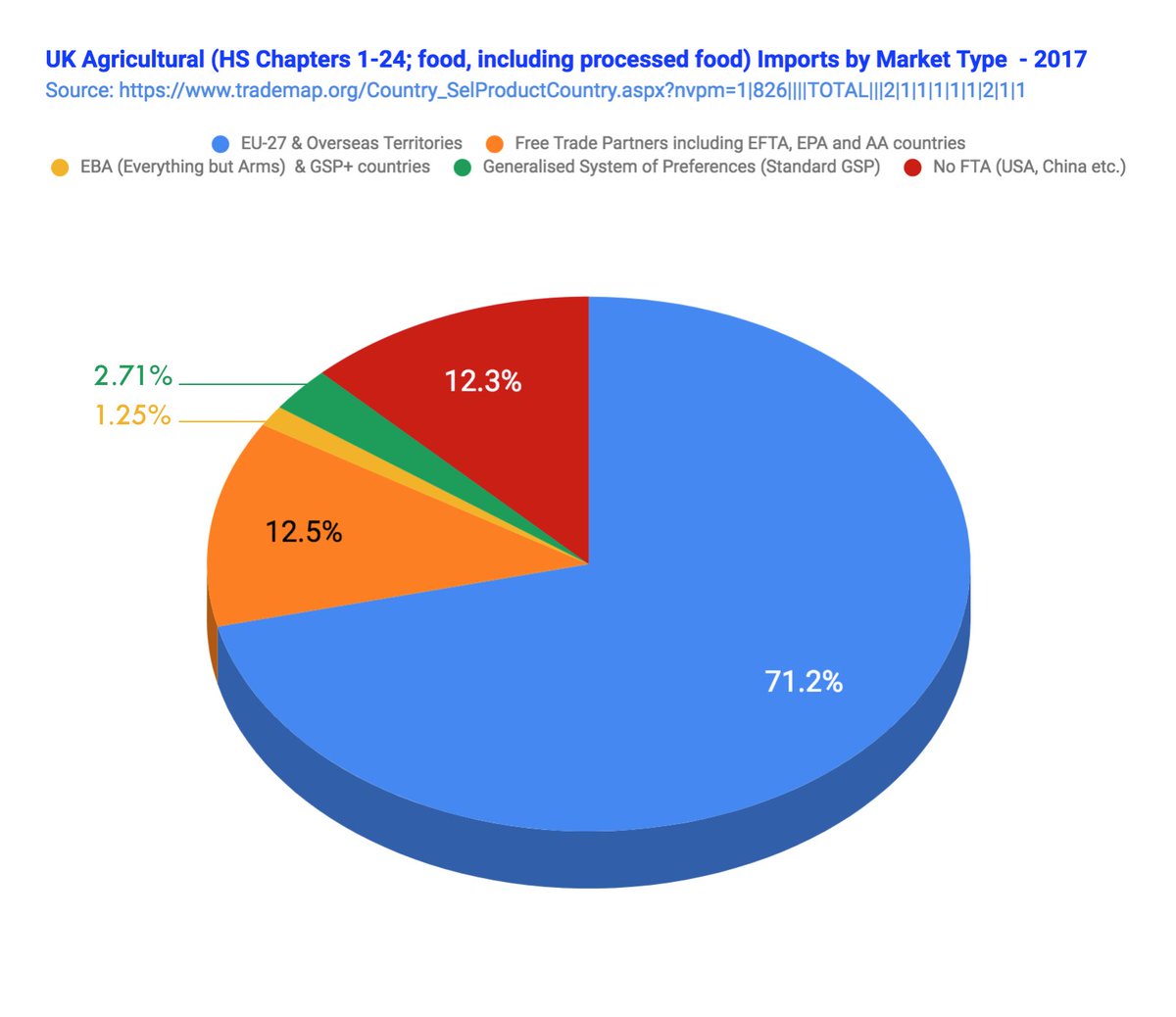

Well, we can get the figures on imports from several sources. For example TradeMap (trademap.org/Country_SelPro…).

But I want to look at imports and domestic supply. So I"m going to source from the Agriculture and Horticulture Development Board (AHDB).

beefandlamb.ahdb.org.uk/markets/indust…

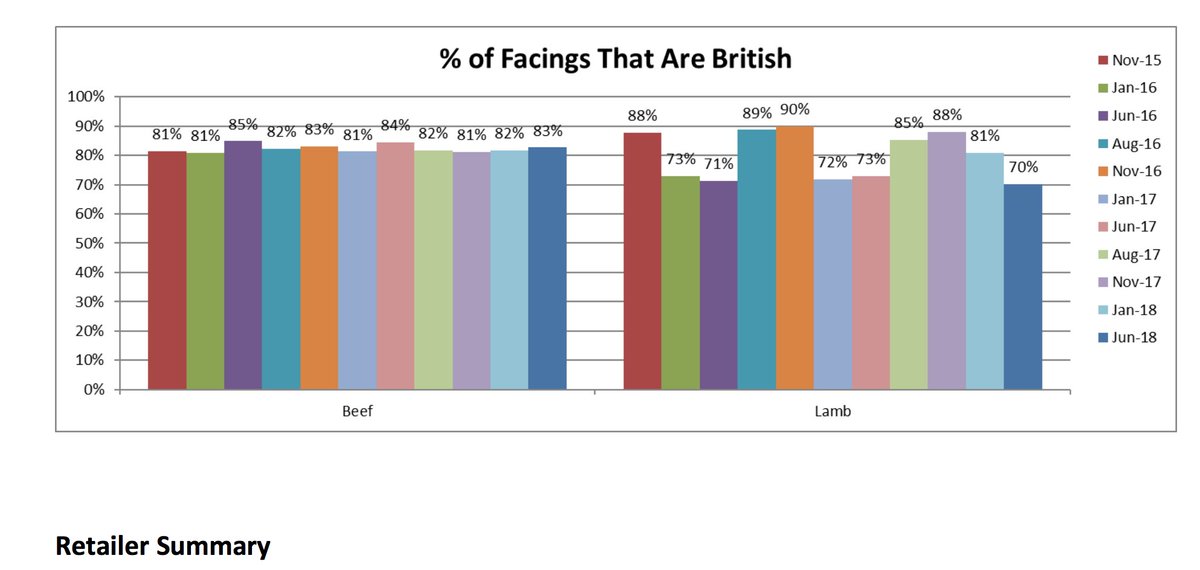

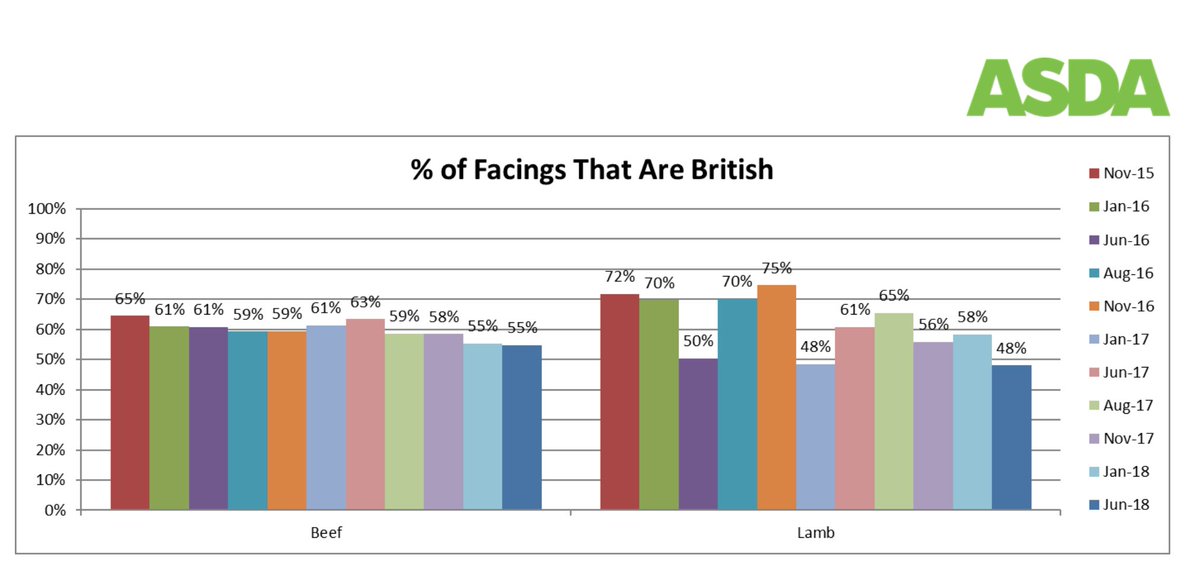

On the AHDB website there's an interesting survey of supermarkets. It looked at what percentage of labels for beef products indicated a British origin.

Here's ASDA. Approximately 60% of their beef is British. That's the lowest in the survey.

beefandlamb.ahdb.org.uk/wp-content/upl…

In that survey, I discovered that, in terms of price, Aldi was by far best supermarket to buy steak in. The average price in Aldi was well below the average market prices published on the AHDB website.

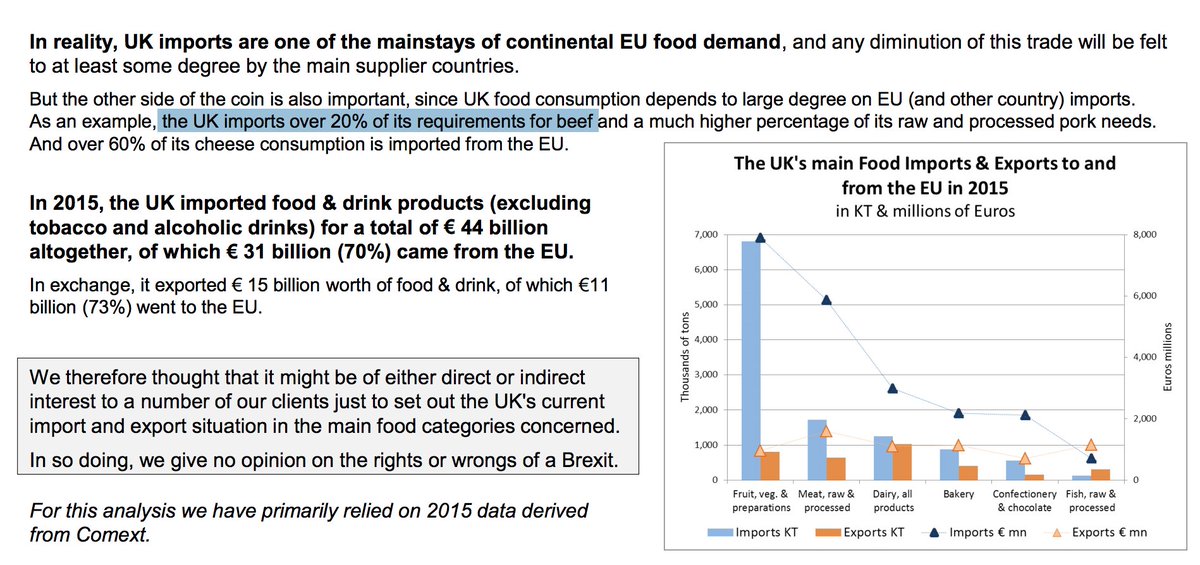

Of course, this doesn't include meat used by restaurants & fast food/ready meal products. Let's be generous and call it 20-25%. This seems to tally with the figure given in this report by GIRA. agricultura.gencat.cat/web/.content/d…

How much of what's imported is potentially tariffed?

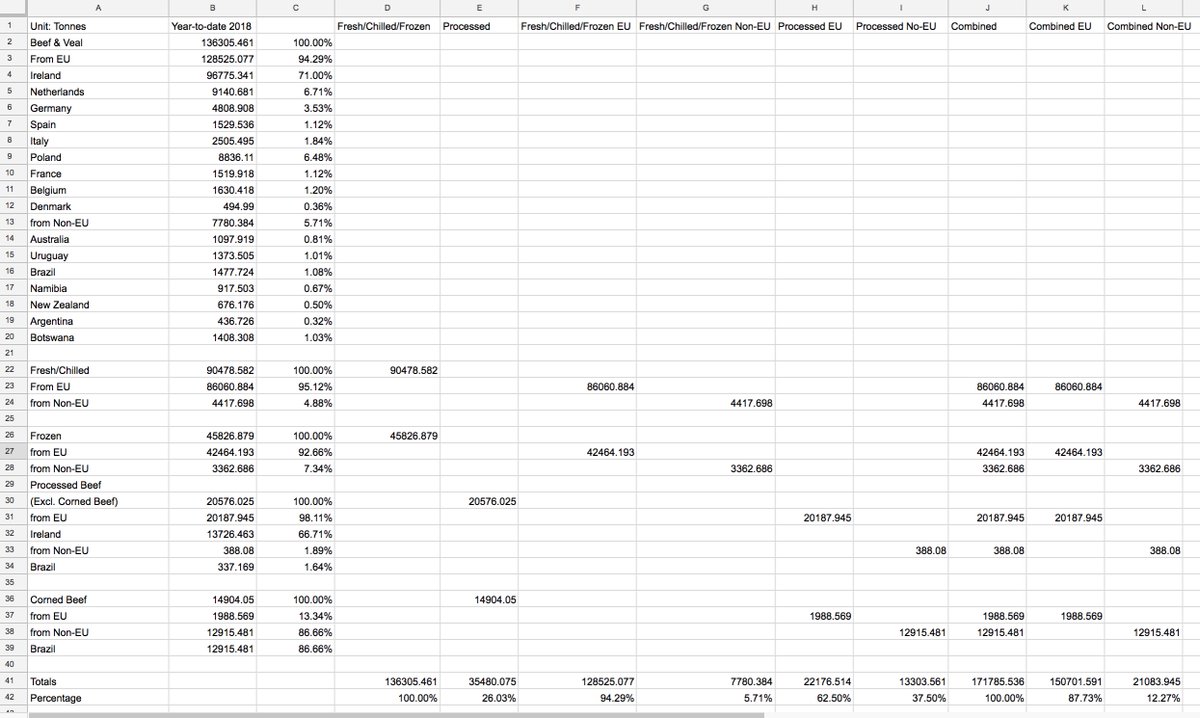

Handily the AHDB have produced a spreadsheet showing UK beef imports and exports in 4 categories. Chilled/Fresh, Frozen, Processed & Corned Beef. I've imported the data and worked out the percentages.

beefandlamb.ahdb.org.uk/wp-content/upl…

In summary, even if you include processed beef products 90% of the imported beef comes from the EU. For fresh/chilled/frozen beef it's more like 95%.

So we're left with about 5% of 25% = 1.25% of beef sold in the UK imported from outside the EU. How much is tariffed?

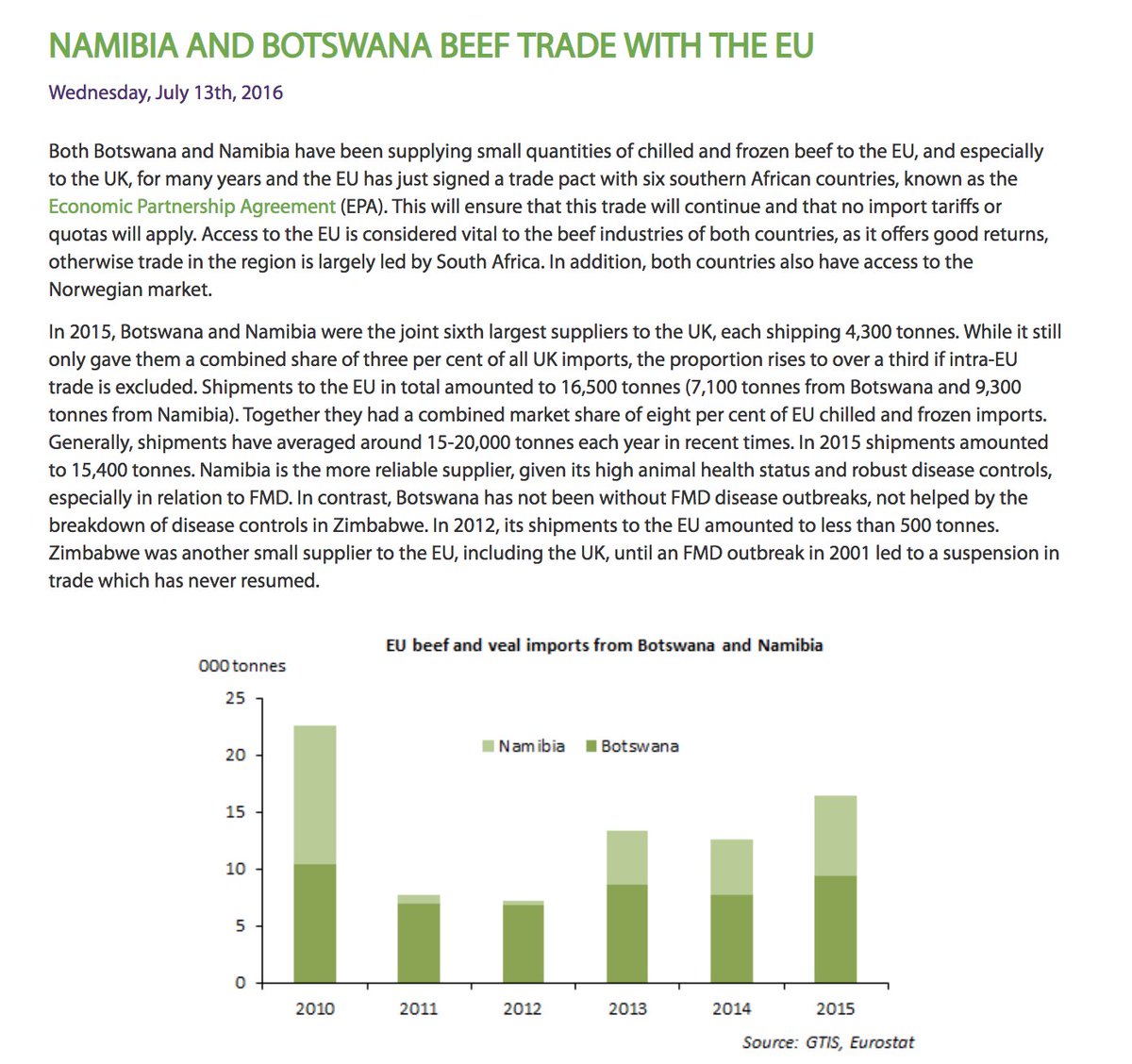

Both of these countries are in the Southern African Development Community which has an EPA with the EU. This means tariffs from these countries for all foods (including beef) is 0%.

What about the rest of the non-EU imports?

beefandlamb.ahdb.org.uk/market-intelli…

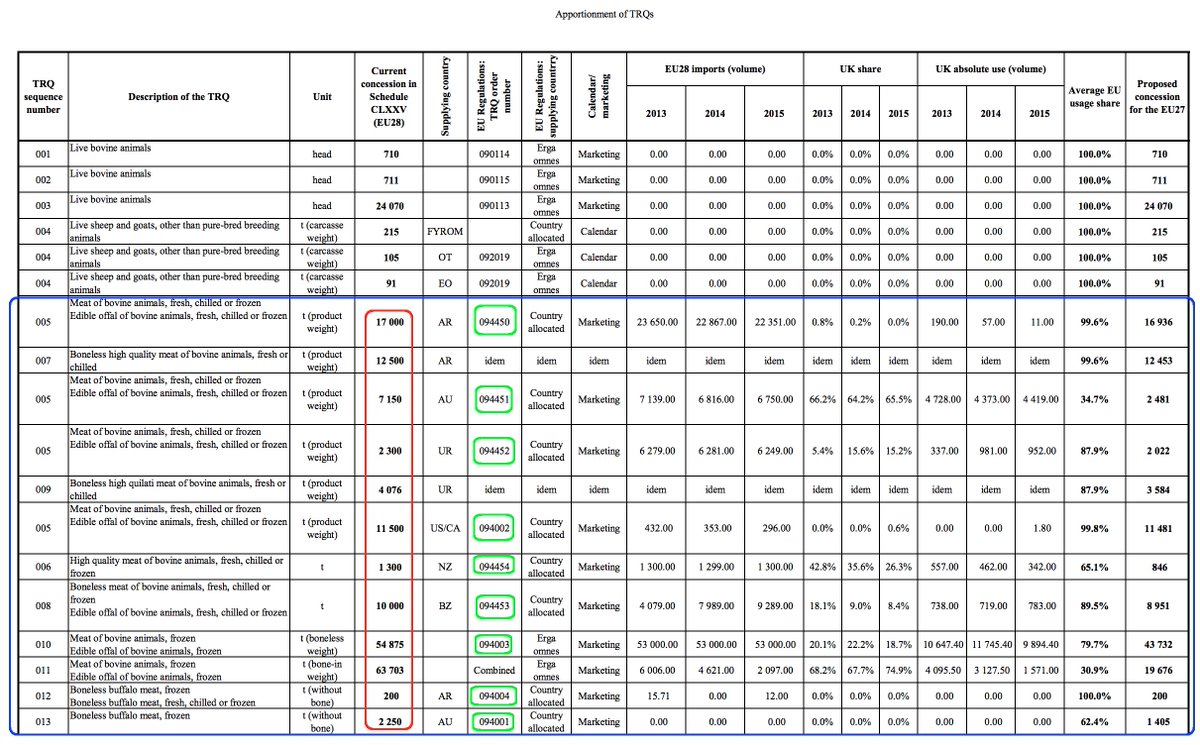

Most of the rest comes from Argentina, Australia, Brazil, NZ, Uruguay. Beef from those countries comes in under various quotas. Here's a summary of those quotas taken from the EU/UK TRQ division submission to the WTO.

src.bna.com/AA0

I looked into Argentine beef a while ago. There are 2 quotas used by Argentina the 0% HQB quota shared with Uruguay, USA, NZ and their own quota on a 20% ad valorem tariff. Half the MFN tariff. As the previous tweet shows Hardly any enters the UK.

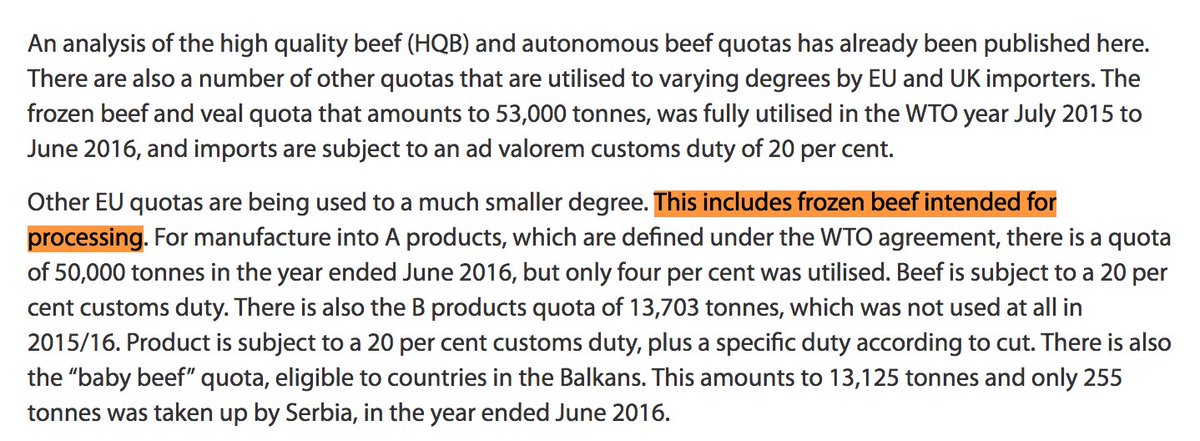

Likewise, the UK's take-up of non-EU beef imports from the other countries listed earlier is minimal. The main take up is from the quota for 63,703 tonnes which is exclusively for meant using in making certain processed meat products.

beefandlamb.ahdb.org.uk/market-intelli…

To summarise.

75-80% of beef consumed in the UK is produced domestically. Of the remainder, 90% of it comes from the EU and of the test between on third and half is tariff-free under quota or FTA the rest of a 20% duty under quota.

Doing the maths.

25% non-UK beef.

5% of that non-EU = 1.25%

~40% of that on zero duty leaves about 0.5% in beef consumed in the UK on a tariff of 20%.

That's 0.5% on half of the tariff quoted by the Spectator.

An average potential saving of 99.5+(0.5*1.20) = 0.1%.

But that's on import prices. Translated to retail prices, with unrelated costs and mark-ups, the potential saving is even smaller.

So that was beef. It's a similar story with the other items, and at some point, I'll go through them and append to this thread.

End Part 1.

1/3

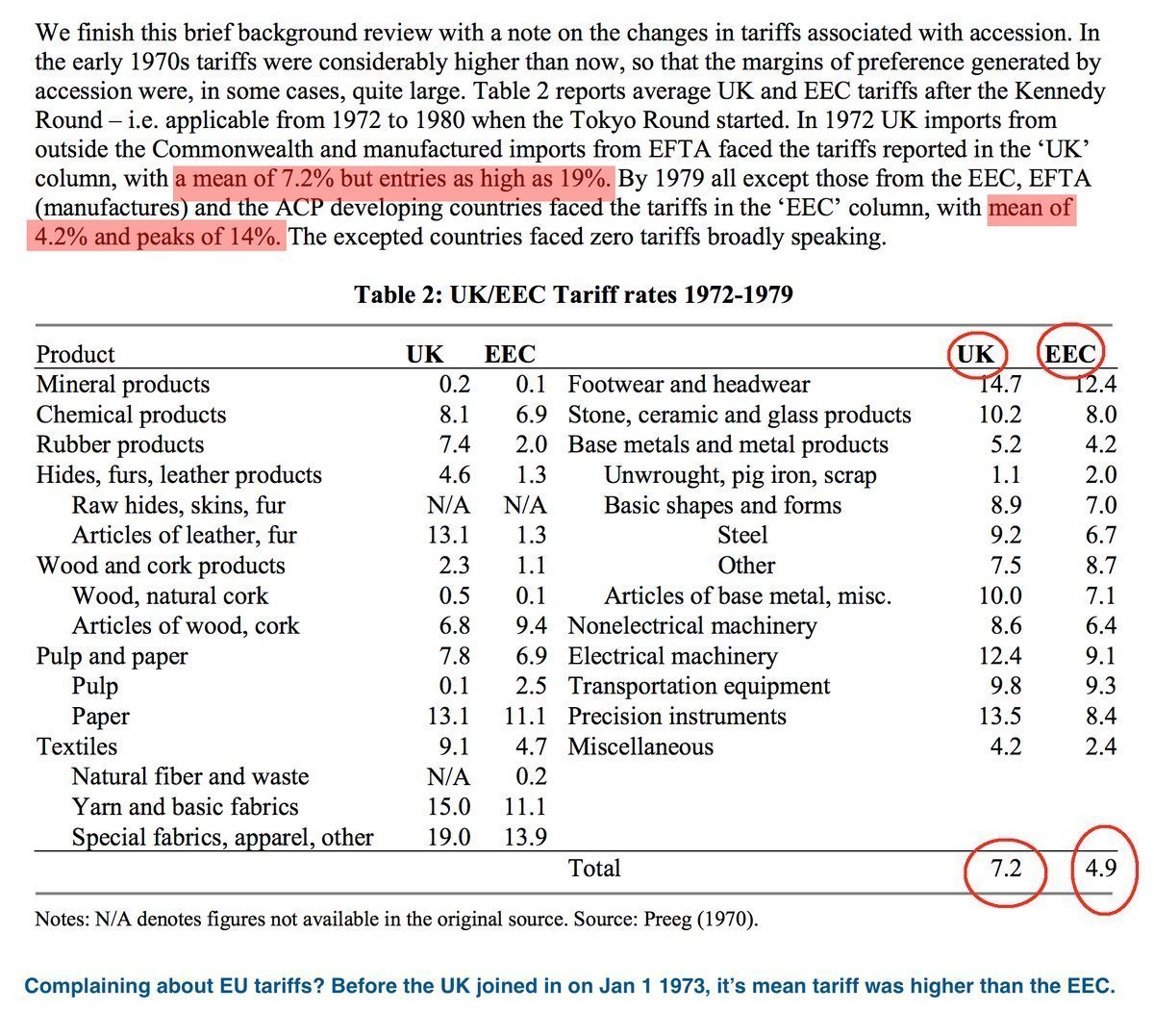

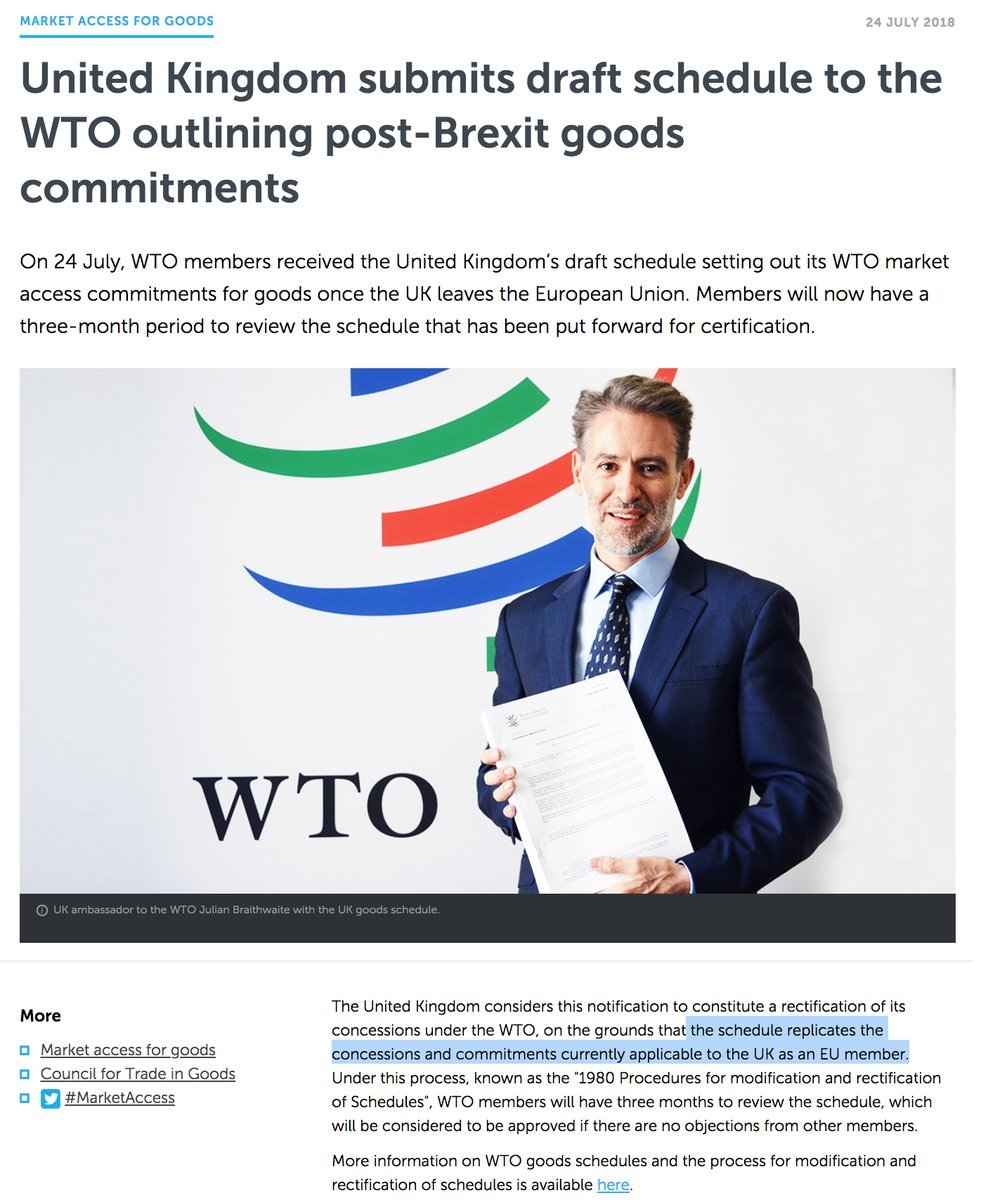

I forgot to mention. On 24 July the UK submitted its post-Brexit tariff MFN schedule to the WTO. It replicates the EU schedule exactly, even down to using Euros.

wto.org/english/news_e… …

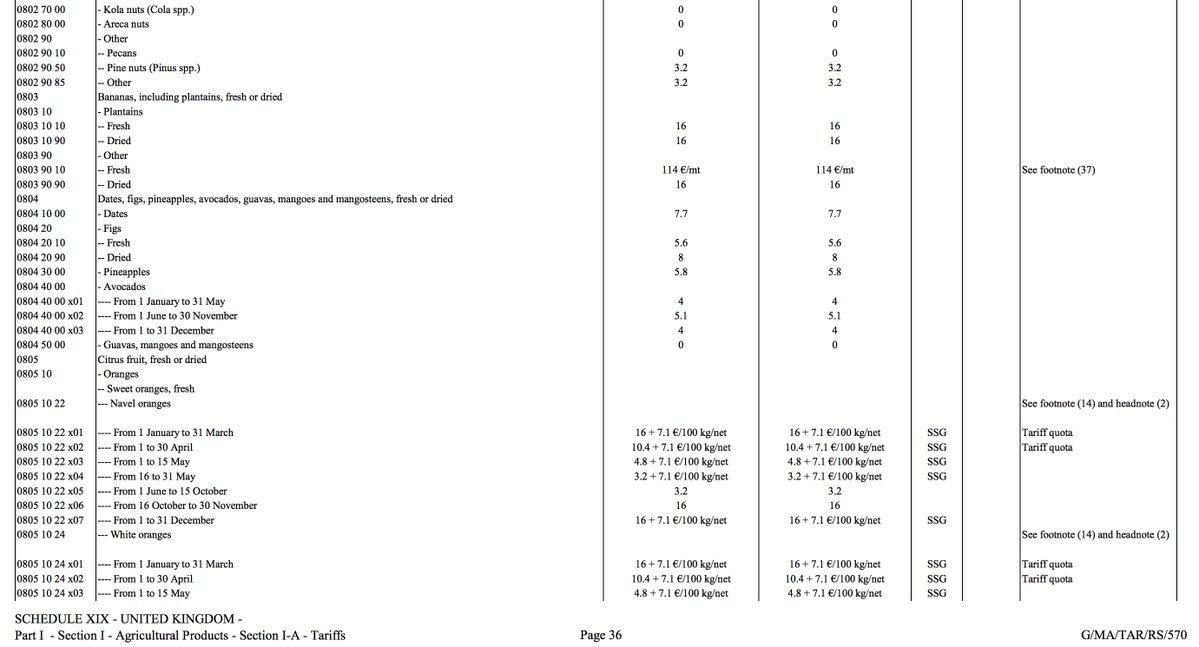

Eg: Oranges, same as EU

Interestingly if you look at the ERGA OMNES TRQ details (src.bna.com/AA0r ) the UK gets a 0% share!

Not that significant, as nearly all oranges came in on country-specific FTA quotas @ 0%

What about a no-deal Brexit?

src.bna.com/AA1

Even if you accept the Spectator's list at face value, we're not going to save anything because we're going to be applying exactly the same tariffs as we do now. But with no deal those tariffs will also apply to export from the EU & their FTA partners.

That's bad news!