Yesterday @JoshFrydenberg releases ridiculous Morrison-hostage-style video

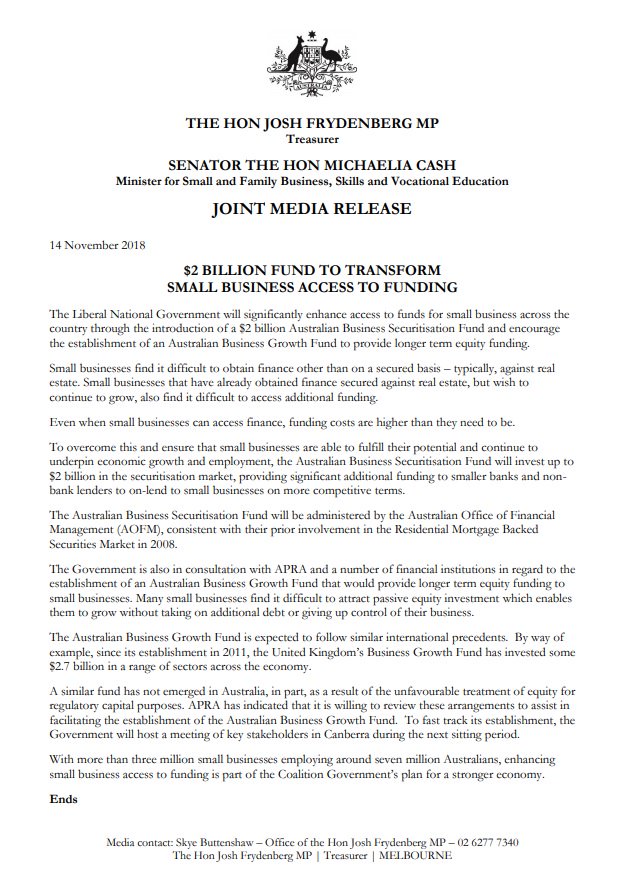

Today, he & @SenatorCash release a joint statement & Joshie does serious media on 2GB/Sky/ABC radio+tv/Courier Mail/6PR about $2 BILLION (there's that word again!)

#auspol

On ABC this am he said the hostage-video had 'achieved the desired result'- which was what? smoke & mirrors? Distraction from today's announcement?

What this means is: non-bank lenders who lend to small biz charge high rates bcuz it's high risk, their debt can't be sold on. So, Joshie wants to effectively buy their debt.

2gb.com/josh-frydenber…

Q.2 LNP values are LESS govt intervention, not MORE, so why secure volatile debt markets?

Q.3 Is this related to 'payday lenders'?

And, Joshie's pushing it for all it's worth, 8 tweets today about it so far!

Sorta, not exactly true, because people who work on an ABN are considered 'small business owners' - that includes taxi drivers, uber, professionals, tradies, contractors, consultants, etc

Small business 'employ 40% of the workforce' - mostly it is themselves, that knocks a lot of people out of the legitimate 'small business' category

If the big banks won't lend this money to small business, then why should non-bankers lenders?

If the economy is going so well, and business prospering, then why aren't the private sector doing this? Why does the govt need to be involved?

JF: 'Morrison'

Smith: actually Labor did it during the GFC

JF: yes

The difference was Labor invested in bricks & mortar not securing the debt of non-bank lenders, a volatile & risky financial environment.

So Joshie is drafting legislation to be presented to Parliament early in the new year. It'll need to be pretty tight I think cuz there's lotsa scope here for 'dodginess'

LNP seems to love giving BILLIONS to banks but only speaks in millions when funding to the drought or Headspace or Aged Care, etc.

A few more details on how it's being funded would be good too.

LNP's out-of-control spending needs to be reined in before they drain the Treasury dry - making it harder for those who govern next.

Australian Business Securitisation Fund

Australian Business Growth Fund

#auspol

We all know the LNP are cunning as shithouse rats, so keep an eye 'em

#auspol #insiders #thedrum @abc730 @independentaus @MichaelPascoe01 @andrewprobyn @albericie

#auspol