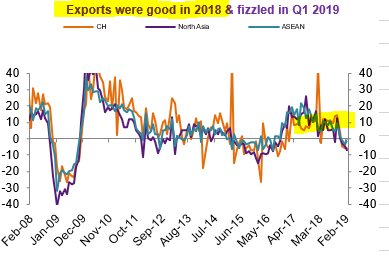

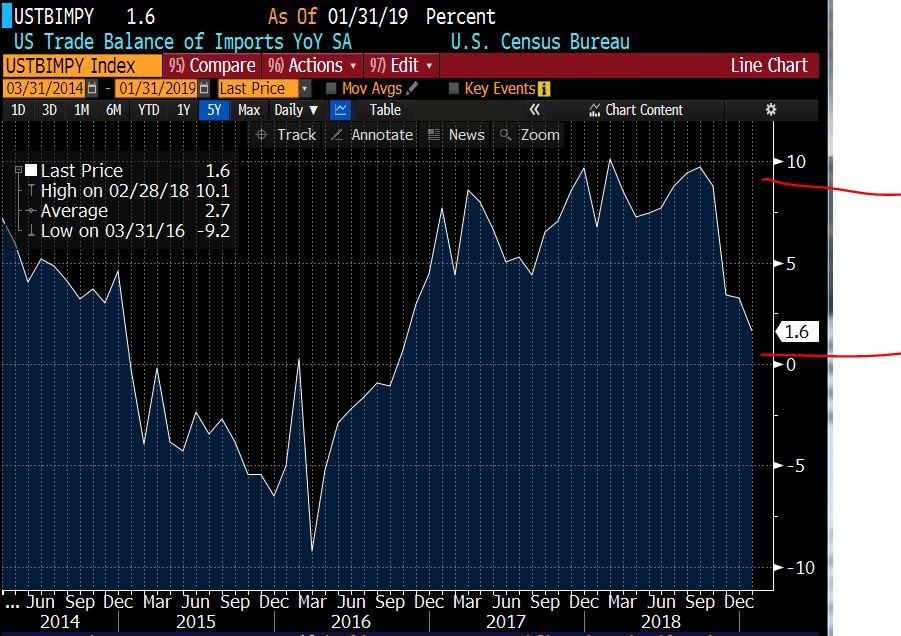

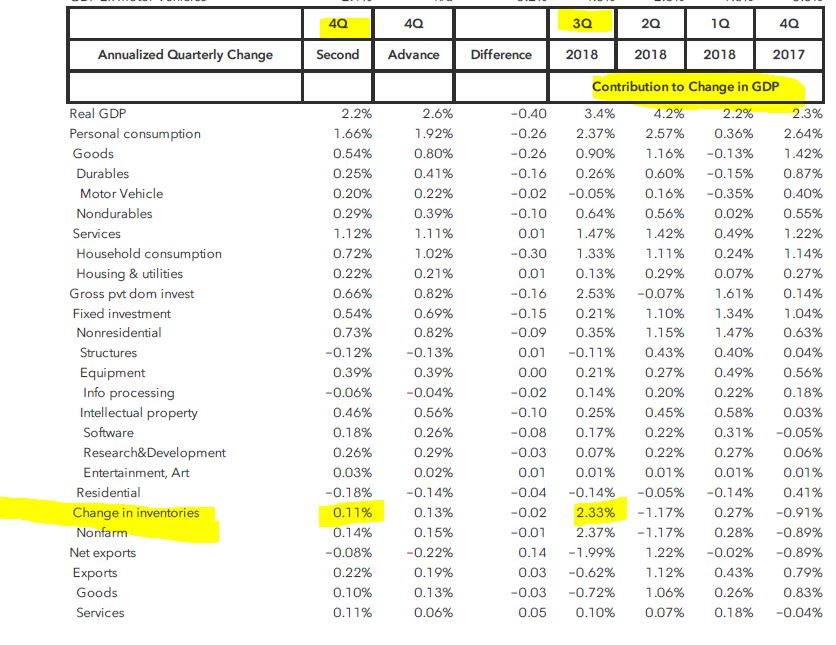

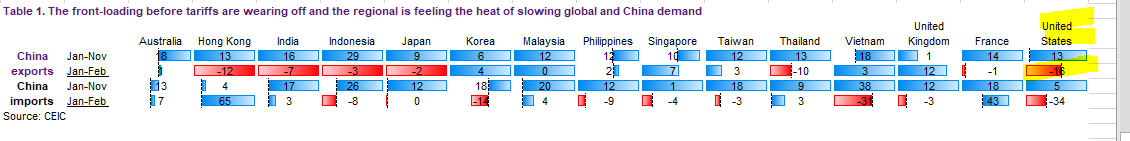

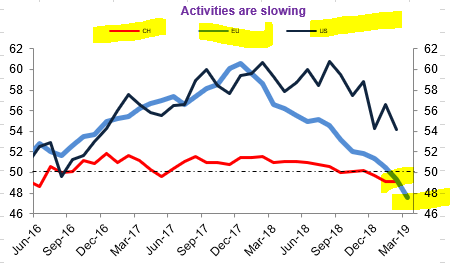

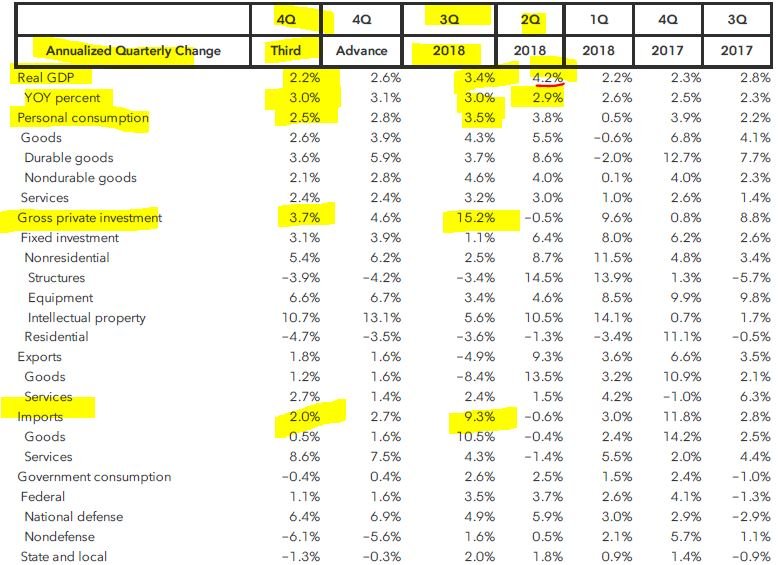

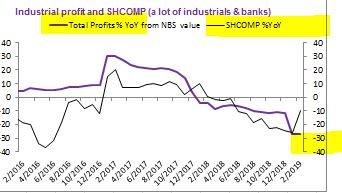

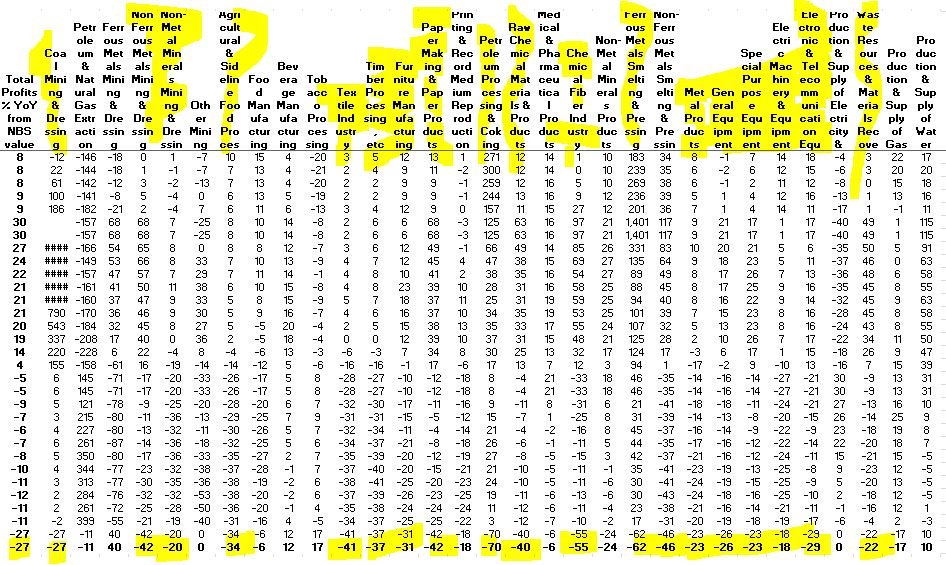

a) 2018 growth paid back in 2019 & it was superficially inflated by inventory build-up;

b) US growth impacted by inventory draw down & Asian IP weakened by excess supply & 📉demand.

Asian carriers have cargo traffic fall -12%YoY in February, following a Jan decline (Cathay already reported similar decline)

aircargoworld.com/allposts/cargo…