(A thread)

We generally inherit this financial laziness from parents. You can do better than them, no?

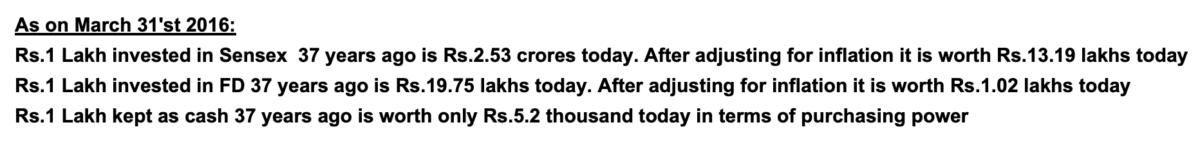

If you incorporate inflation and tax on interest income, your corpus is likely getting smaller every passing day.

Yes, do the math of compounding for FDs vs long term market returns and you’ll know. wisewealthadvisors.files.wordpress.com/2016/04/37-yea…

If you expect to live long, there’s no reason why you should stick with your money in FDs or bank savings account.

When you buy equities, you are investing into collective human ingenuity that’s called commerce.

Unless you imagine the world’s commerce coming to a halt, equities over long term will always give returns as businesses will always keep generating cash.

Buy a mutual fund instead that holds multiple stocks.

So if you own a passive fund, you are automatically diversified.

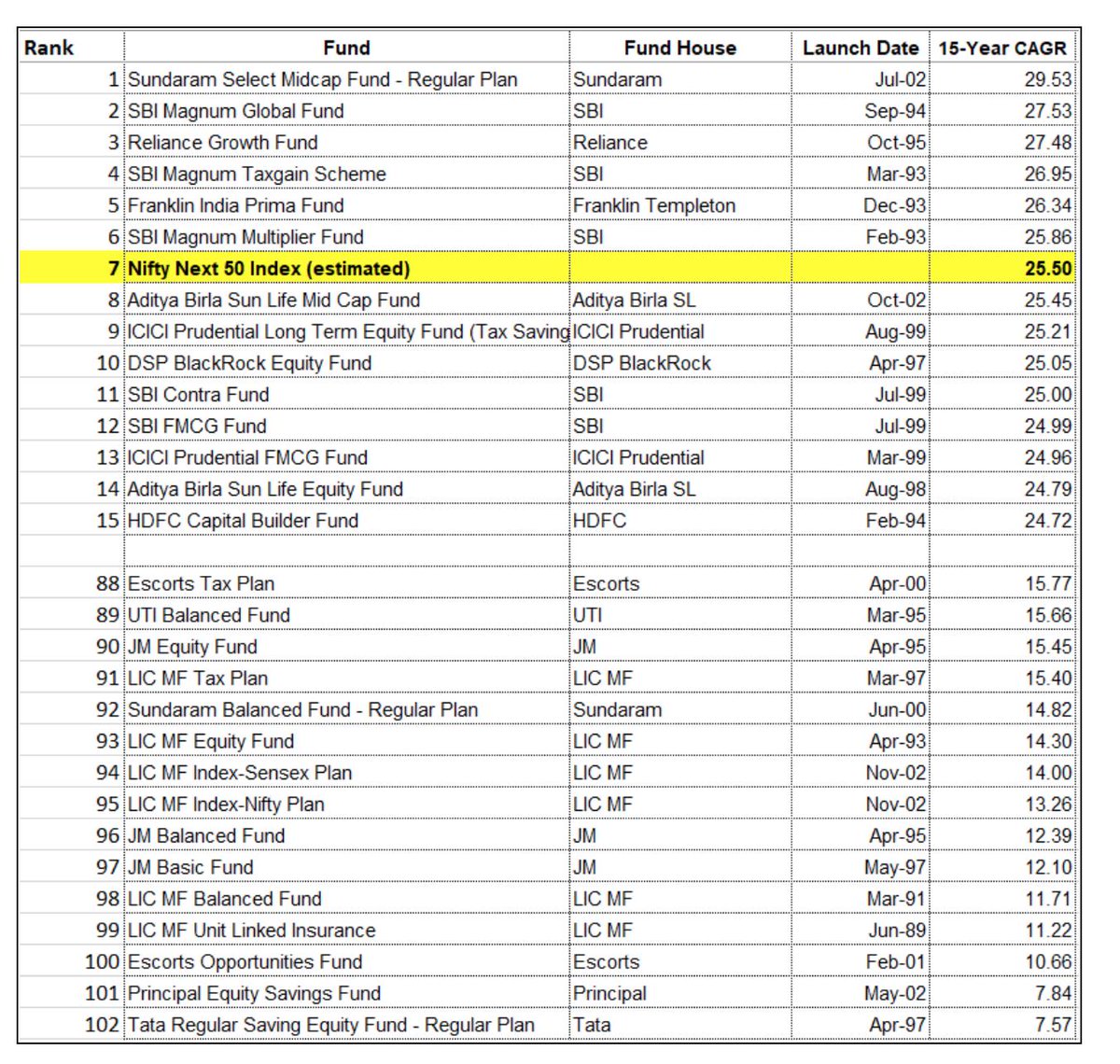

This is because the judgment of a single fund manager (unsurprisingly) turns out to be poorer than the collective judgment of millions of investors who buy and sell stocks directly. stayinvested.net/2018/03/26/ind…

If you are in India, passivefunds.in is a good website listing passive funds.

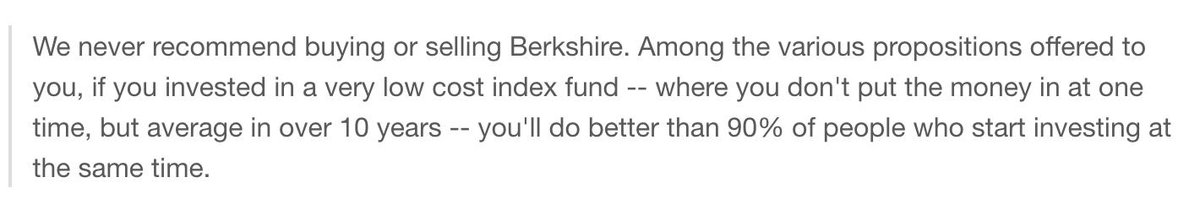

You don’t need to be a wizard to invest.

If investing is not your full-time job, simply trust the judgement of collective human wisdom and invest in a passive fund that tracks the collective stock market.