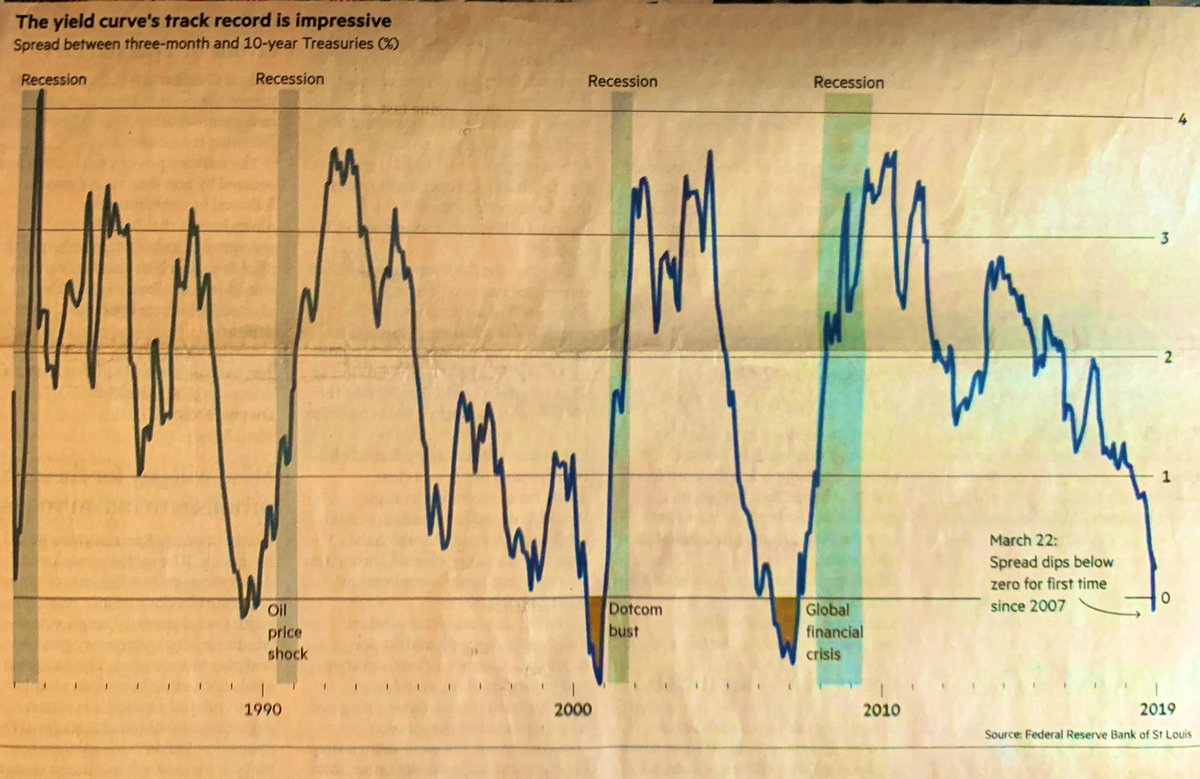

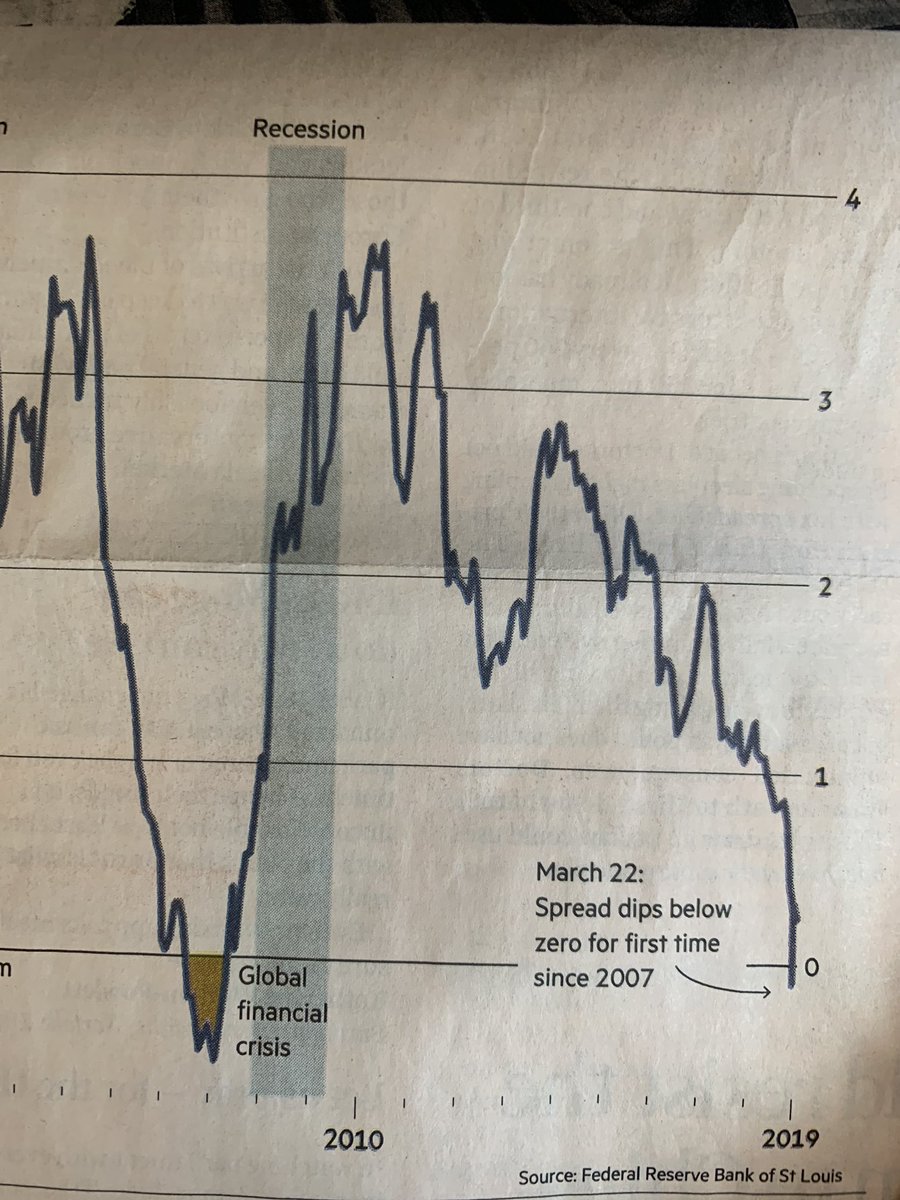

The last 40 years of financial crises have occurred right after treasury curves become inverted & spread dips below zero

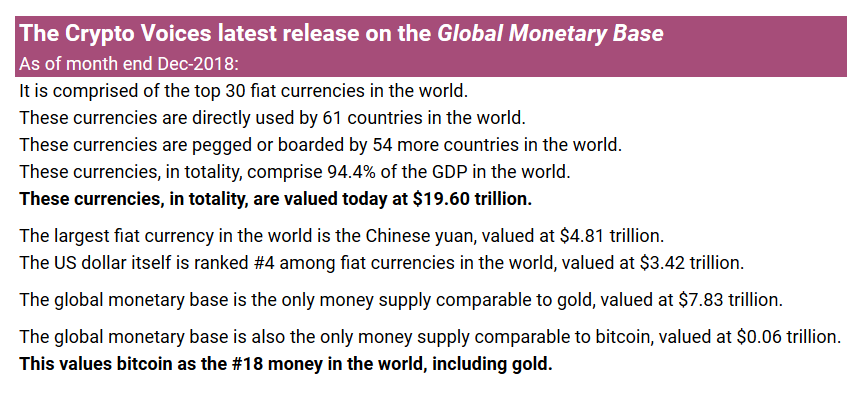

#Bitcoin was created shortly after the last time this happened

👇

We’ve gone from “garage band startups” to @Nasdaq @CMEGroup @DigitalAssets

“Long bitcoin short the banks” -@APompliano