-AWS for transportation is its final form

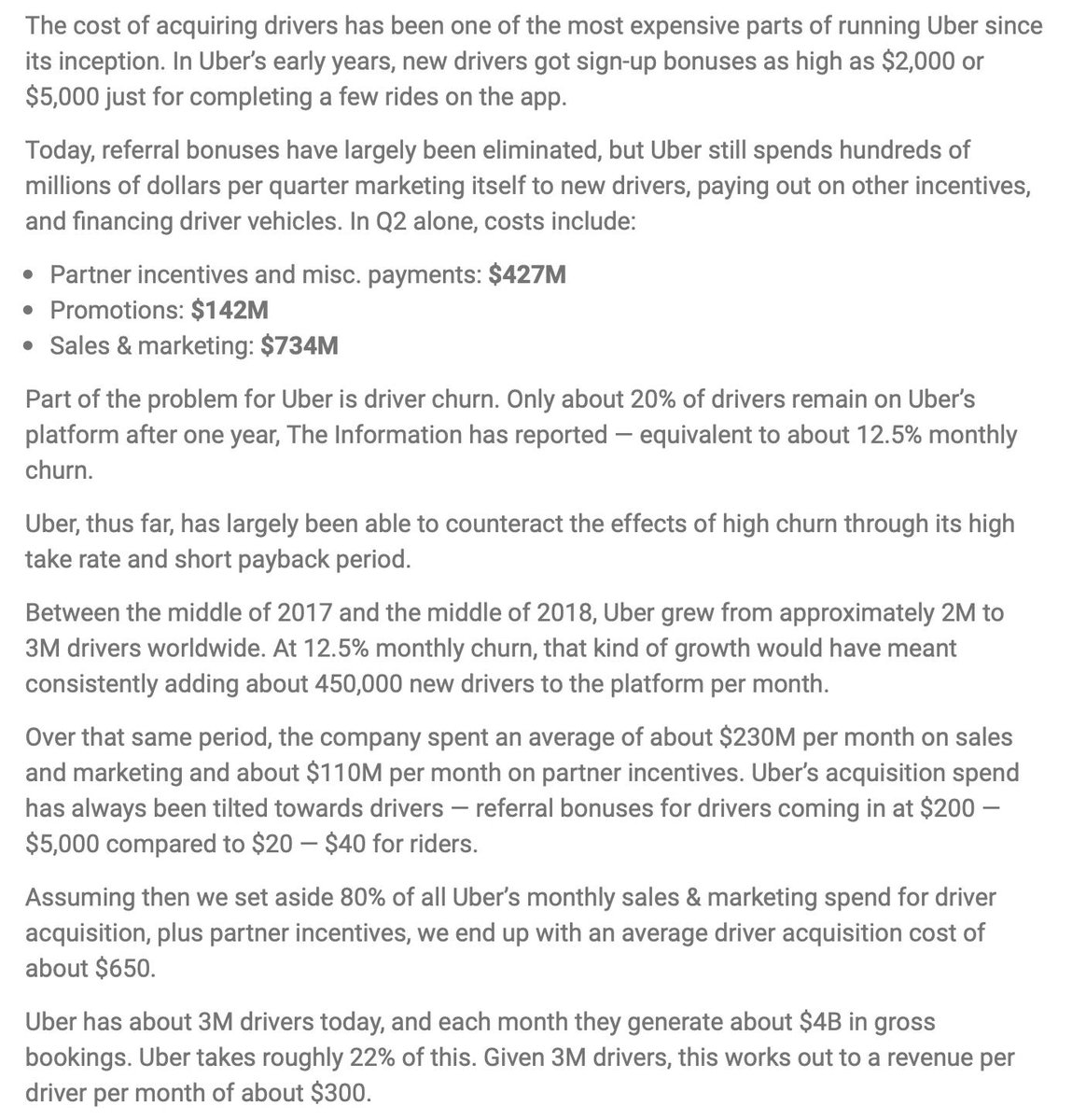

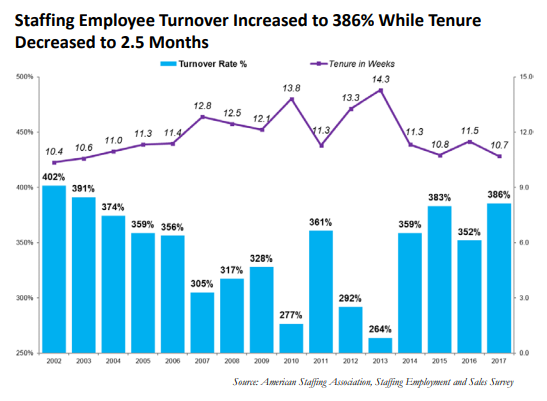

-It's a modern day temp agency; driver churn is 3-5x below industry avg

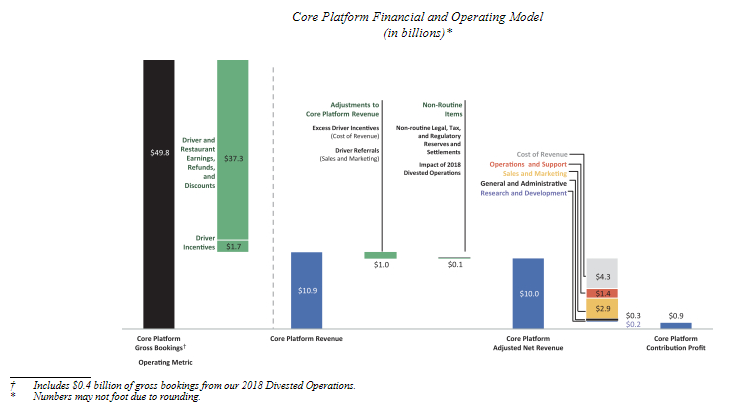

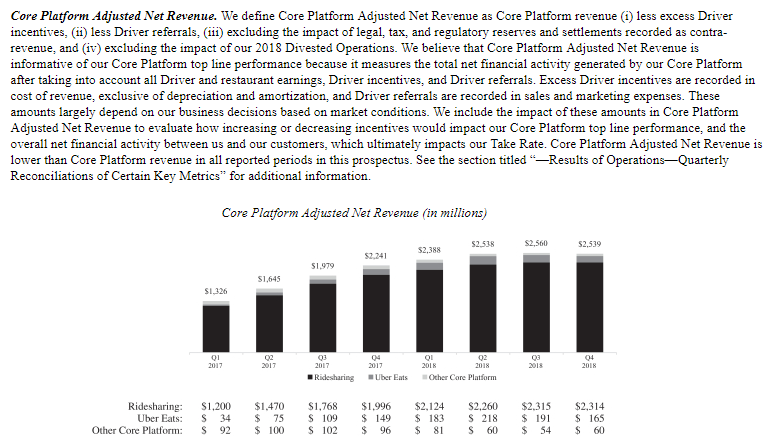

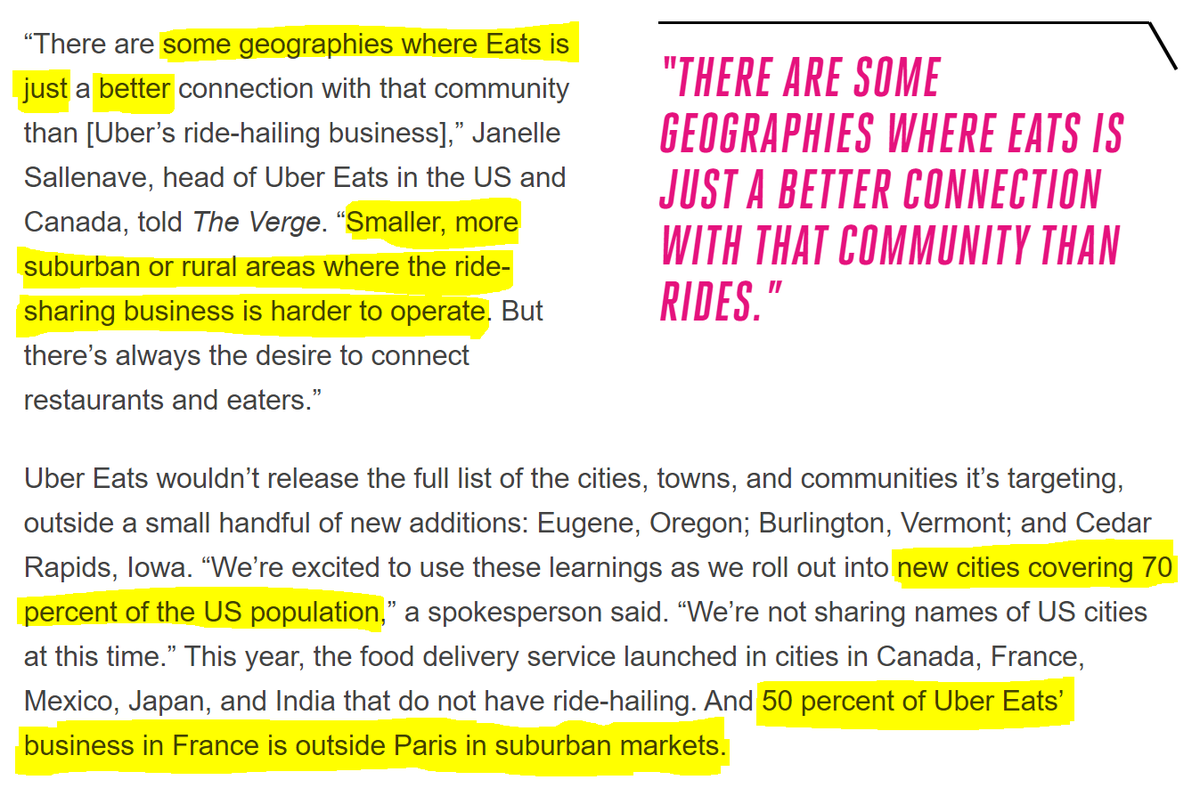

-Eats cities profitable in 4-6 quarters, aggressive expansion impacted 2H‘18, 40% of users are new to Uber, and is a wedge into last mile delivery

This a great deep dive comparing Uber and Lyft’s US vs International numbers:

Uber Eats rapid expansion in 2H ‘18 had a material impact, new Eats cities are profitable in 12-18 months, and the trend suggests 150-180 cities were profitable at the end of 2018.

"We decreased CAC by burning cash faster. We acquired more users in 2 weeks than if we burned the same amount of cash over 6 months"

medium.com/swlh/whats-so-…

theverge.com/2018/10/23/180…

-Lower pricing

-More demand

-Increased volume

-Lower pricing, etc

bloomberg.com/news/articles/…

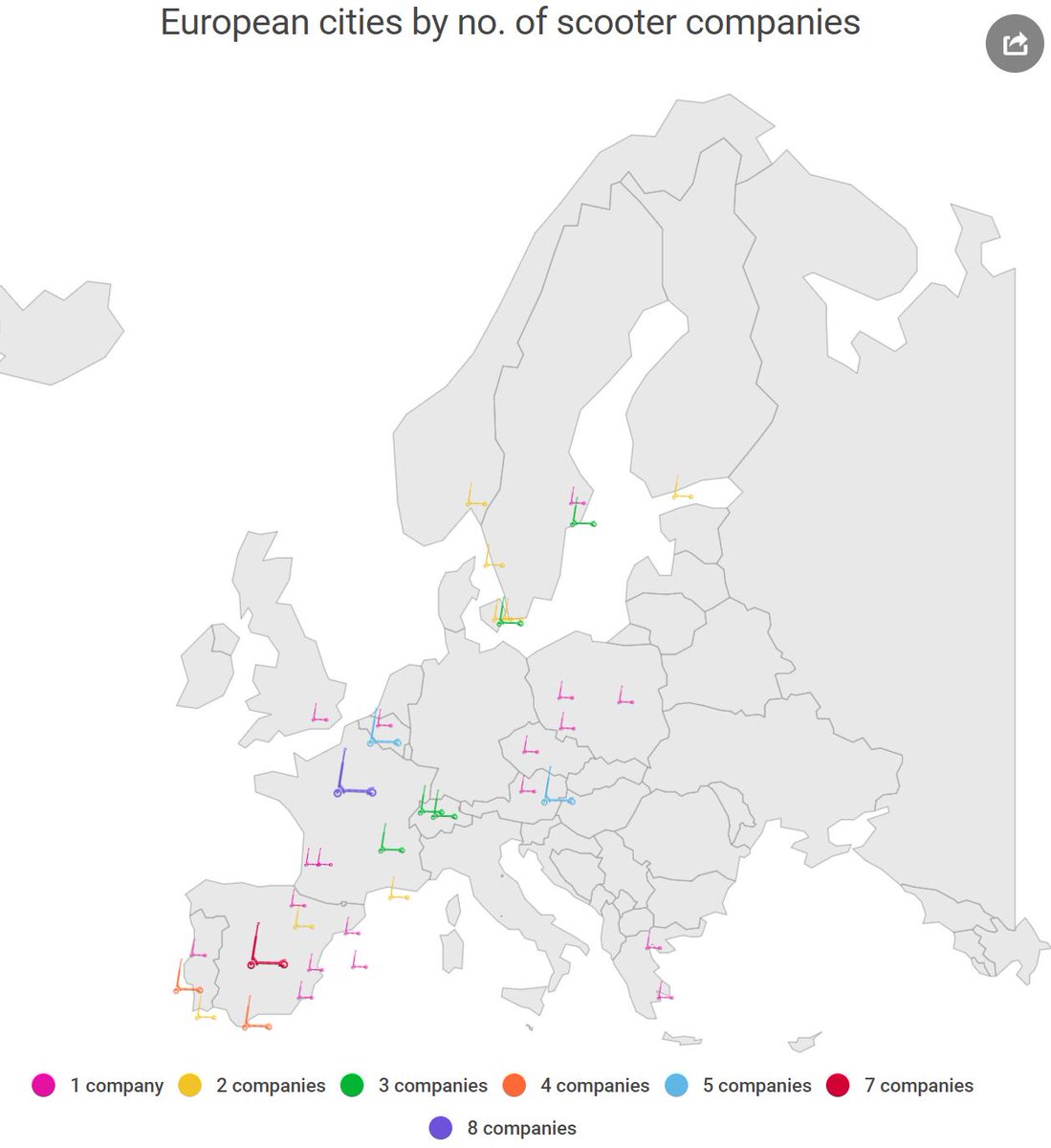

sifted.eu/articles/scoot…

(to illustrate, with $18.5B in cash + publicly traded equity {aka monopoly money}, Uber could buy Lyft)

wsj.com/articles/drivi…

techcrunch.com/2019/01/22/ube…

Great deep dive by Ben Thompson here:

stratechery.com/2018/ubers-bun…

-Eats (soon Eats Pooling/ads)

-Buses (Uber Pool is a precursor)

-Micromobility

-Last mile delivery

-Staffing

techcrunch.com/2018/12/10/ube…

techcrunch.com/2018/10/18/ube…

cbinsights.com/research/repor…

Uber's 80% annual driver churn sounds insane, but it's low compared to the 250-400% churn seen in the staffing industry. Uber's driver churn may always be high.

americanstaffing.net/staffing-resea…

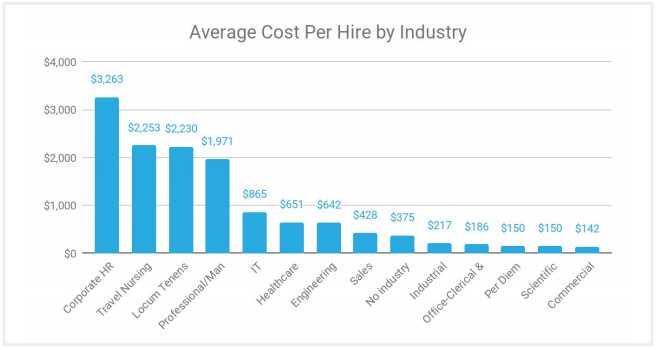

The cost and time to onboard temp workers can be very high and fluctuates significantly by industry.

staffinghub.com/wp-content/upl…

americanstaffing.net/staffing-resea…

Just like Amazon famously API'd itself, Uber's products are designed to let employees borrow and combine different components, allowing things like its routing algorithms to scale over every product, in every city.

medium.com/swlh/whats-so-…

"AWS for transportation" is a sexy pitch to investors, so is "AWS for physical labor"... both things Amazon can't touch

Q1 16: cbinsights.com/research/repor…

Q4 16/Q4 17: ft.com/content/7405bb…

Q1 17: cnbc.com/2017/12/07/ube…

Q2/3 17: nytimes.com/2017/09/23/tec…

Q1 18: foodandwine.com/news/ubereats-…

Q2 18: eater.com/2018/6/29/1751…

Q1 19: uber.com/cities; about.ubereats.com/en/cities