I'll tell you why "Snaps Created per Day" is the most important metric (matters more than DAUs), followed by my thoughts on Snap's camera and ad platforms, Bitmoji in a post-Facebook world, Snap's content strategy, and the Snap Map

Example: Advertisers pay for space in the Snap camera carousel or in a Snap Ad, which drives users to their browseable AR shop (in our outside Snap).

theverge.com/2018/7/10/1755…

digiday.com/marketing/dtc-…

“The liquor brand has doubled its spend on Snapchat... this year, the company has seen a swipe-up rate increase of 321%, as well as a 67% decrease in our cost per swipe-up”

digiday.com/marketing/jage…

piper2.bluematrix.com/sellside/Email…

Snapchat has 100M monthly users in North America, and Snap Ads reach 93M of them, aka 93% of NA users watch Stories.

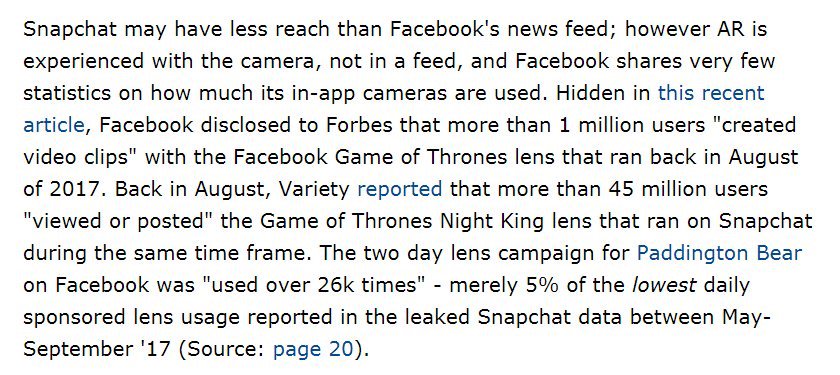

techcrunch.com/2018/10/17/fac…

seekingalpha.com/article/416650…

The redesign may have hurt Snapchat, but it accelerated Bitmoji adoption (mostly US/EU), which now exceeds 134M users.

Snap is building the tools and scale to become the cable network of augmented reality

nytimes.com/2018/06/14/mov…

Q1: 7

Q2: 11

Q3: 18

latimes.com/business/holly…

This goes for all Snap's ad units: Stabilizing/rising CPM's should quickly fall to profits.

inc.com/darren-heitner…

Morgan Stanley's Brian Nowak actually calls Google Maps "one of its most under-monetized assets".

barrons.com/articles/is-go…