Here's a thread on the Facebook Power Law and a look at how Snap could do up to $10 billion in revenue in the US alone in its current form.

marketwatch.com/story/snap-ear…

Snaps per Day is Snap's key metric, the US and EU are what matters for monetization, its ad prices are insanely low, and the market is not appreciating Bitmoji, Snap's AR platform, or the Snap Map.

North America: $146

Europe: $49

Asia Pacific: $17

Rest of World: $12

All FB's free cash flow comes from developed markets, and it likely loses money everywhere else.

nytimes.com/2019/01/30/tec…

stratechery.com/2017/the-super…

mobilemarketer.com/news/ad-age-sn…

Q1: 7

Q2: 11

Q3: 21

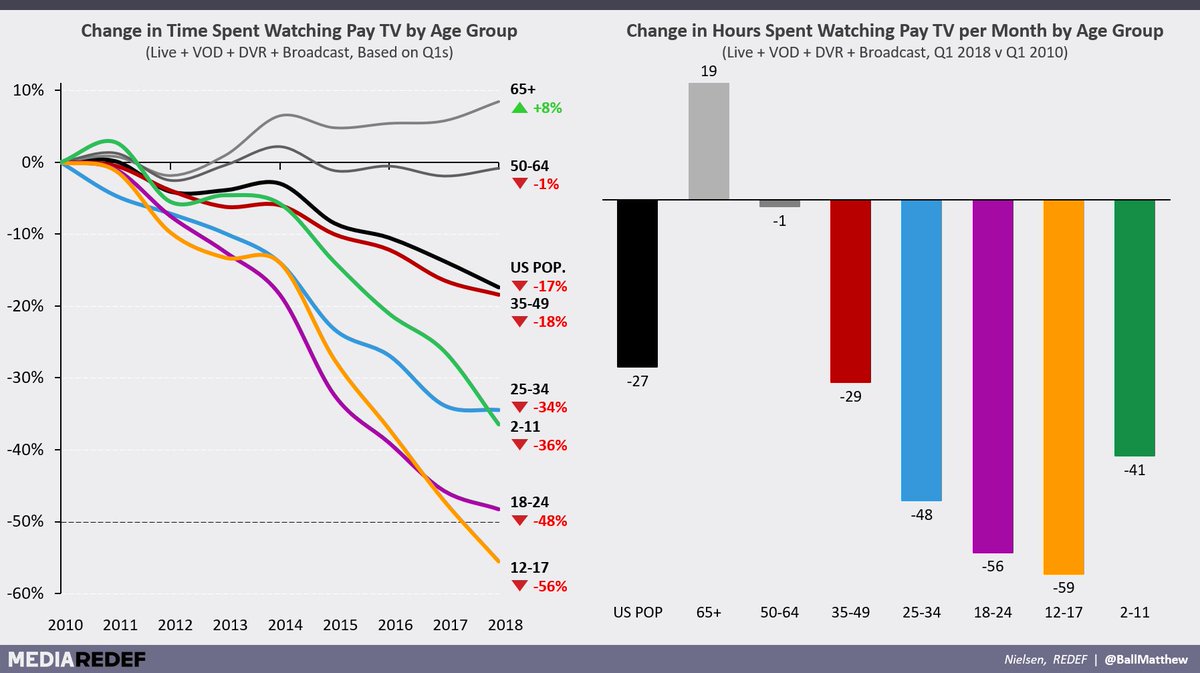

TV has also relied on increasing CPM's and ad load as reach declined the past decade, Could Snap do the same?

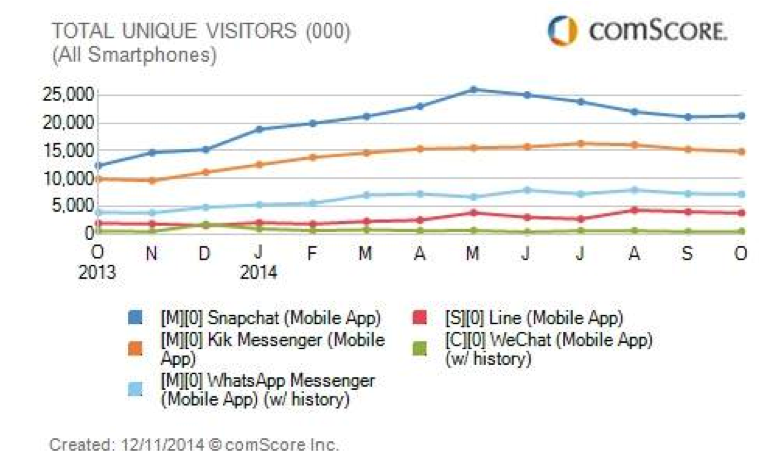

gigaom.com/2015/01/09/has…

twitter.com/search?q=snapc…

It's the key measure of Snap's network effect / competitive advantage

Snappables, Snap's AR games, were released in 2018, wonder what tractiion they're getting? 80M unique users played Tic-Tac-Toe in Q3, or ~43% of DAU's.

theverge.com/2018/7/10/1755…

Considering that, Android DAU's were likely down. The Android app rebuild is being slowly rolled out, which you could assume returns Snap to aggregate DAU growth when its widely released.

Snap stated it reaches 70% of 13-34 yr olds in the US w/ mobile video ads per month. NBC's Stay Tuned reaches 25-35 million per month, and 2/3 of those it can't reach elsewhere.

Snap's new Original Show "Dead Girls Detective Agency" reached more than 14 million unique viewers, and 40% of those who watched the first episode watched the entire season (seems low to me??)

pophorror.com/s2-of-the-dead…