Background: Housing Vancouver (2018-2027) is a 10-year housing strategy for the CoV to foster a diverse, vibrant community. /1

1. Create the "Right Supply" and address speculative demand;

2. Protect existing affordable housing for the future; and

3. Ensure support for vulnerable residents

Housing Vancouver commits to annual progress reporting (yay!) /2

Growth and Housing Market Demand: Strong fundamentals driving an active market, but some signs of future moderation

-CoV property market is active, with 7000 sales in 2018, slightly down from over 10,000 sales in 2017

/3

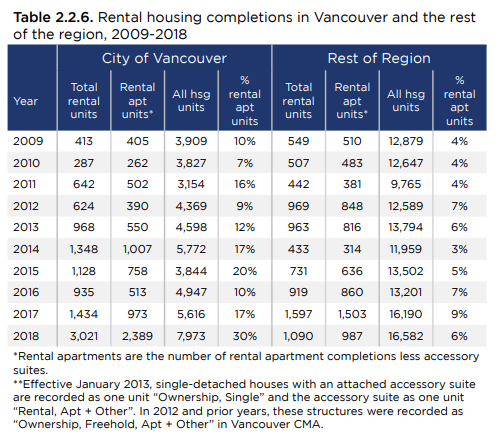

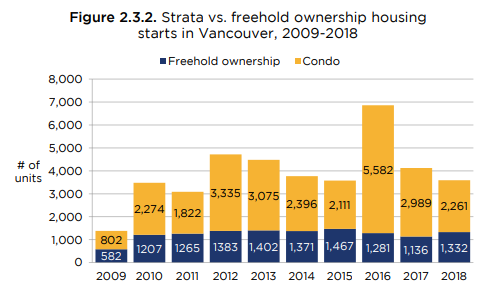

-Housing supply continues to grow in CoV, driven by above average starts and completions across all housing types (over 6,500 starts and nearly 8,000 completions in 2018) /8

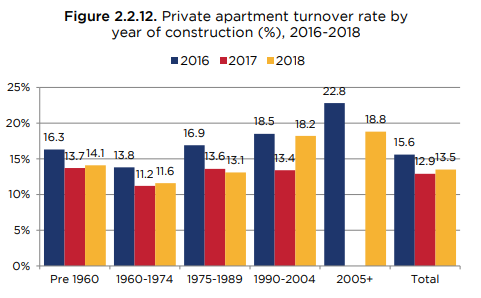

-Housing costs continue to rise across housing types: average private market rents increased by 6.4% between 2017 & 2018; Van East condos by 5.7% /12

-Units vacant and available on the market are more expensive than occupied units: in 2018, avg rent in private purpose-built rental (PBR) was approx 20% higher in vacant units than occupied units in Van. /13

These trends indicate potential risk to long-term diversity and resilience of our city, reinforcing the need for "Right Supply" of housing that meets the needs of all incomes /17

They're tracking high-level housing system indicators over the course of the strategy. Summary:

1. Prevent homelessness and create pathways to housing stability (track # of homeless) /18

3. Enhance Indigenous housing and wellness (# of Indigenous-owned social housing units, # of Indigenous households in core housing need) /19

5. Increase share of rental homes affordable to low- and moderate- incomes

(renter income distribution over time, distribution of rents) /20

8. Increase housing options in low-density neighbourhoods (density of dwelling units and net change in dwelling units by local area) /22

Progress Toward Housing Vancouver 10-year Targets

Each year, staff will report on whether CoV is meeting the new targets, prioritizing:

1. Shifting housing approvals toward rental housing for diverse incomes

/25

3. Delivering a diversity of housing for families, including apartments and ground-oriented housing forms /26

Overall, a total of 15.406 housing units have been approved toward the Housing Vancouver targets as of Dec. 31, 2018. /27

-shift in new housing approvals toward "Right Supply" in tenure, w/ 61% of total units available for renters

-over 5,300 new homes serving incomes under $80,000 per year, making up 35% of all approvals; however, /28

-not meeting overall purpose-built rental housing targets, with only 1,031 homes approved in 2018 (52% of target) /29

-528 temporary modular homes approved, rented at shelter rate ($375/month)

-highest level of laneway housing permits since 2009, 709 approved /30

-exceeding target for family-sized (2/3 bedroom) units, with 7,813 units approved /31

The plan has 110 priority actions for the first 3 years. Key action highlights:

-$38 million in revenue from 1st year of Empty Homes Tax

-Council approved Broadway Interim Rezoning Policy to curb land speculation /33

-404 temporary modular homes (TMH) tenanted in 2018, further 202 homes in development

/34

Note: I wrote about MIRHPP for the @georgiastraight here, great program: straight.com/news/1236246/j…

/35

-updates made to the Rental Housing Stock Official Development Plan to reduce threshold /36

-partnered with non-profit operator to open 100 additional warming center over-night spaces at Powell Street Getaway /37

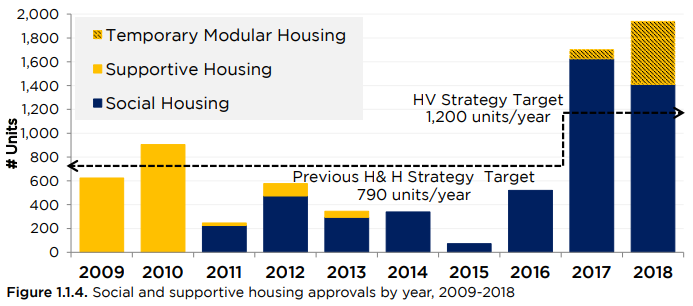

Previous Housing and Homelessness Strategy (2012-2021) set ambitious targets for housing growth, and city had reached 46% of social housing targets at the midway point in 2016. However... /41

Housing Vancouver targets aim to ensure that new homes appropriate match the diversity of household incomes in CoV.

Shelter rates: rents for $375, the shelter component of income assistance for incomes under $15k for singles and below $30k for families /44

Low-end of market rates: rents set to be affordable to incomes of $48k~71k for singles and $68~104k for families. Also set by BC Housing /45

This chapter breaks down the CoV housing stock, covering non-market, rental, and ownership housing as well as development processing times. /57

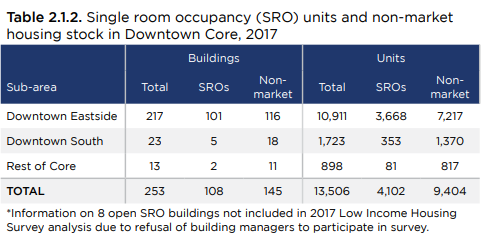

Inventory is tracked and monitored by the city, and can be found here: app.vancouver.ca/NonMarketHousi…

/58

Supportive housing is social housing with flexible supports that help individuals maintain housing stability, provided by on-site staff or outreach programs. /60

Indigenous non-profit groups operate these, geared for at risk populations.

Lu'Ma Housing and Vancouver Native Housing Society are the two Indigenous housing providers in CoV. /62

-a significant amount of NM housing that exists today made possible by fed and prov funding programs

-from 1960-1989, 15,796 units were created in CoV

-gradual declime in NM housing production because of end of fed gov't funding in 90s /66

-from 1990-2018, CoV created 10,100 NM housing units, making up approx 64% of NM created in previous 3 decades /67

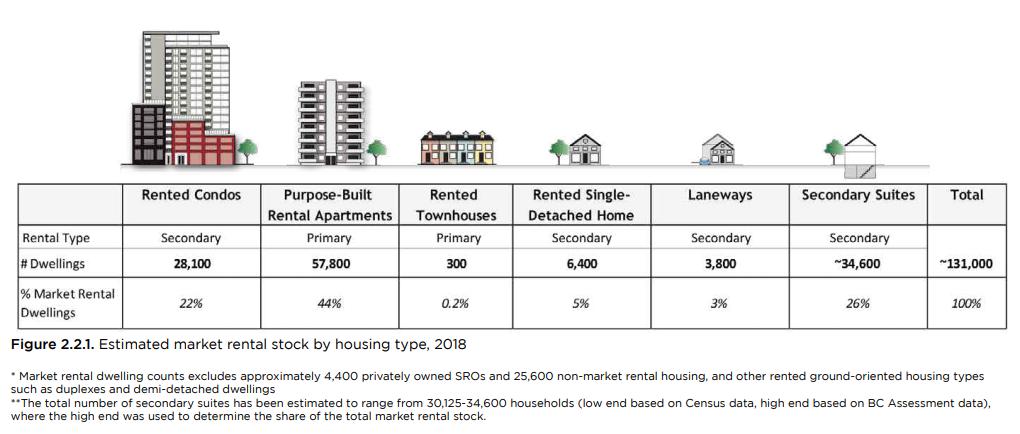

-non-subsidized properties rented to a tenant

-comprised of both primary (purpose-built) and secondary rental units (e.g. secondary suites, rented condos, rented houses etc.) /72

-Housing Vancouver includes a priority action to expand housing options in low-density areas (RS and RT zones)

-since 2016, the annual increase in number of dwelling units in low-density areas has been less than 1% of overall /90

Overview of housing demand in Vancouver, including economic trends, employment, population growth, migration, and market forces. /96

-in 2016, the proportion of non-migrants in the CoV was 25.8% of the population, which was lower than the Metro Van region (22.4% of the population), indicating that people moved within the CoV at a higher rate than the region as a whole /2