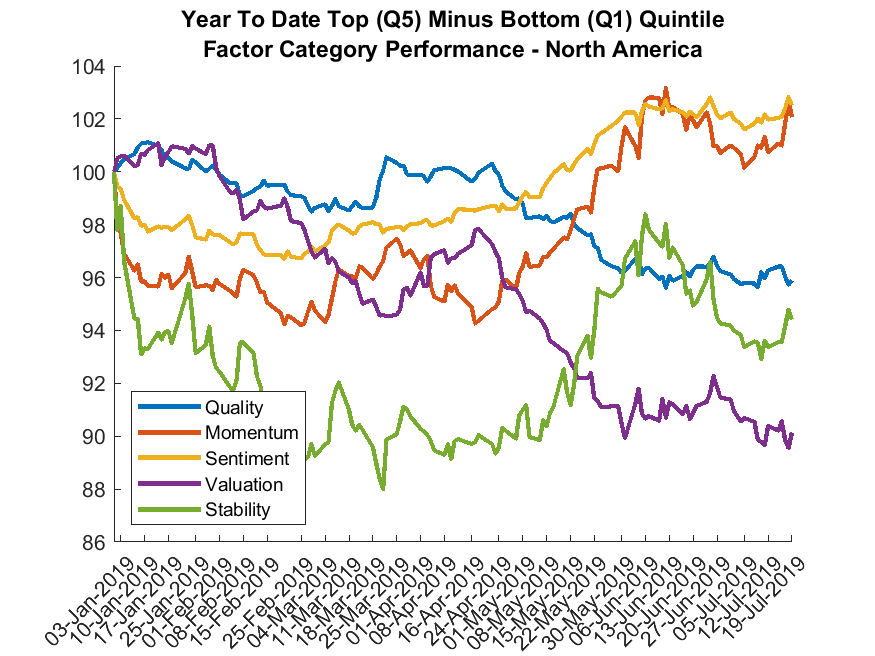

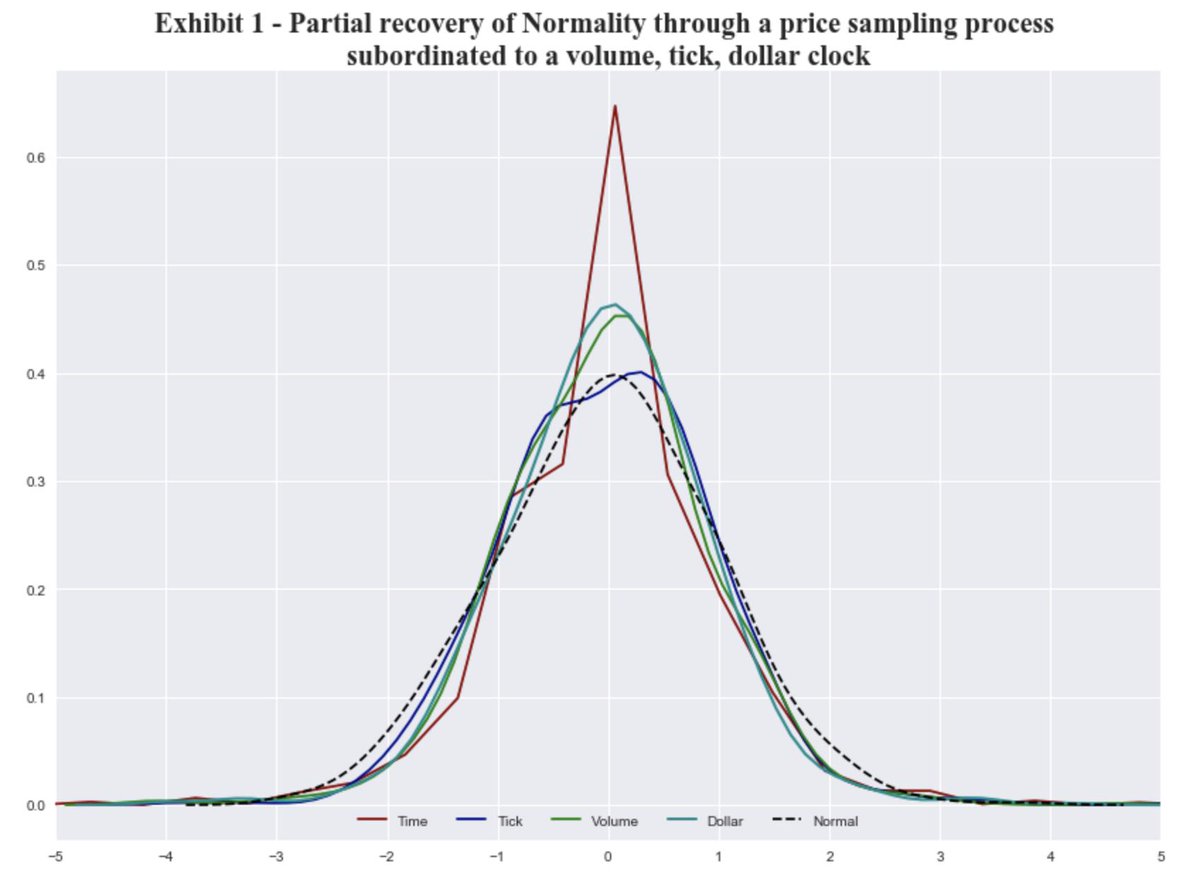

While doing research in 2006-2007, one of the interesting phenomenon I found was that sampling a data on a non-time-related domain created beneficial statistical properties.

(Image source: github.com/Jackal08/finan…; credit @JacquesQuant)

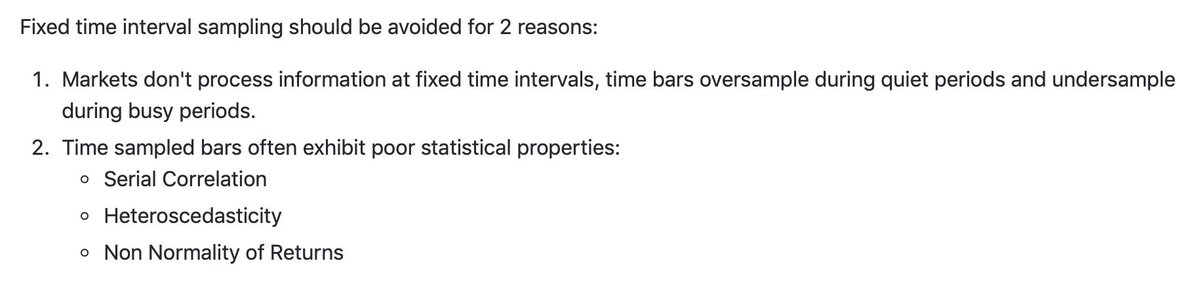

Paraphrasing from github.com/Jackal08/finan… (credit @JacquesQuant):

For example, an indicator in a fixed volume domain might appear *dynamic* in a fixed time domain.

But it might in others as well (e.g. rebalancing on a fixed accumulated variance vs fixed time horizon).

Back to the lab... 👨🔬

FIN.