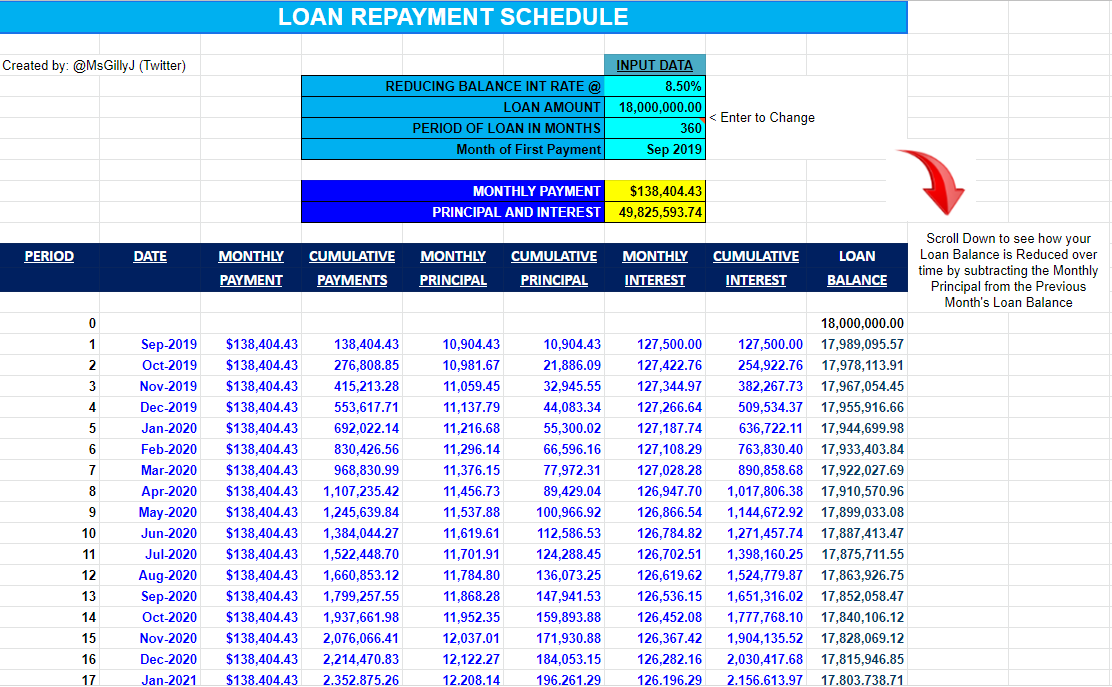

Check out the mortgage calculator I created here: bit.ly/2YD518c

Here are some questions you may be asking:

1. What is the down payment required?

2. Can I afford it?

3. What does the process entail?

4. What do I do first?

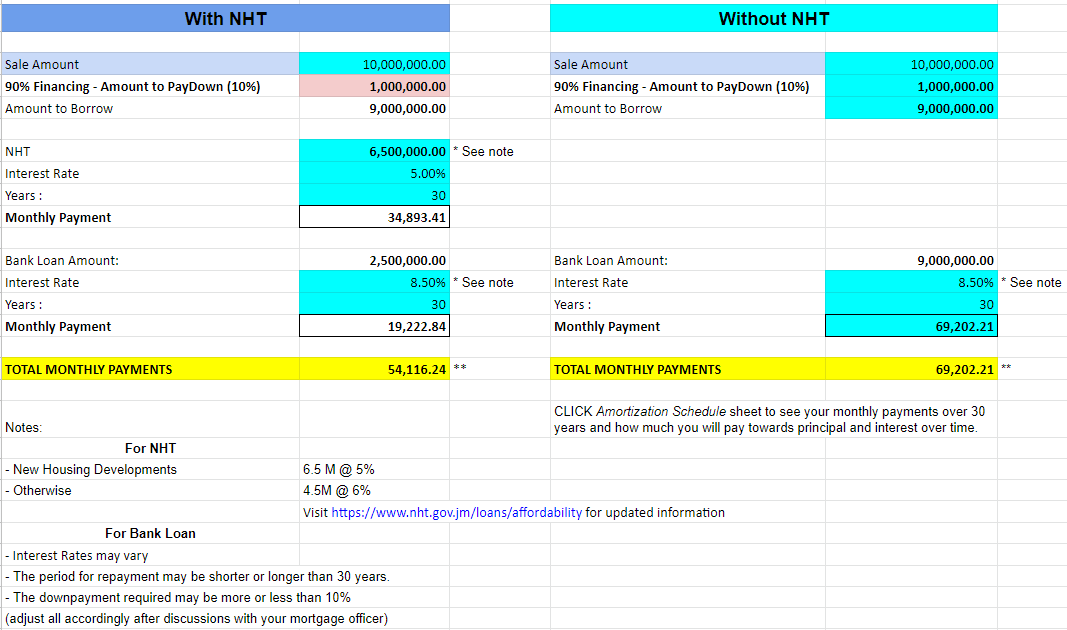

Do you have access to a NHT Benefit? If so you can qualify for up to J$6.5 M (or $13 M for joint applicants) towards the purchase of your home at a rate of 5% (for new properties). If not, the market rate is around 8%

If not I suggest you start doing some research on house prices by accessing the Sunday Gleaner Classifieds or contacting a Real Estate Agent from a reputable company to assist you in figuring out prices

To show that you are committed to the purchase and that you have some interest in the property, a bank will require you to make a payment to the seller (Typically done through a lawyer). This can range from 5 - 10% but banks like JN now have a 110% mortgage.

THIS IS IMPORTANT

If you are buying cash this question is a little easier to answer. You simply have to know the value of the house and budget about 15% of that value for additional fees and charges, not including the cost of doing any repairs.

1) The longer the repayment period, the lower the monthly payment

2) The lower the interest rate, the lower the monthly payment and

3) The larger the initial down payment made, the lower the monthly payments.

gillianajackson.com/the-first-time…

If you're interested in calculating the other fees and understanding what to do first (getting a pre-approval letter etc.) visit the link above.