microacquisitions.com/how-to-buy-sma…

Here are some main takeaways + my verdict 👇

Don’t have an idea? You don’t have to have one. Buy one.

Don’t know how to code? You don’t have to. Use revenue to outsource development.

Capital is not an excuse.

Namely:

- Validated demand

- Leverage debt/equity partners

- Focus on going from 1-10, not 0-1

Acquiring a business that has paying customers saves you the time and energy you would have spent trying to figure out if there was demand for it in the first place.

Acquiring skips that step altogether.

It’s easy to be blinded by your infatuation with your idea.

Acquiring forces you to take a truly unbiased and logical look at a business.

Buying a business doesn’t mean you have to fork over a big pile of cash or empty out your savings to buy outright.

In fact, it’s probably best if you don’t.

Use the profits to pay down debt and float until you can pay yourself and/or pay off your debt.

Going from 0 to 1 — building, validating, and launching something from scratch — isn’t everyone’s forte.

If maintaining, optimizing, and growing is though, acquiring might be a better option for you.

Maintaining, optimizing, and growing a business requires tried and true processes.

Managing multiple businesses makes this ring even truer.

Getting ready to sell can act as a forcing function to optimizing your business in ways it should have before.

Who knows the passwords? Yeah, that needs to be stored somewhere safer.

Spaghetti code? Yeah, that’s a liability.

I love the approach outlined in the course.

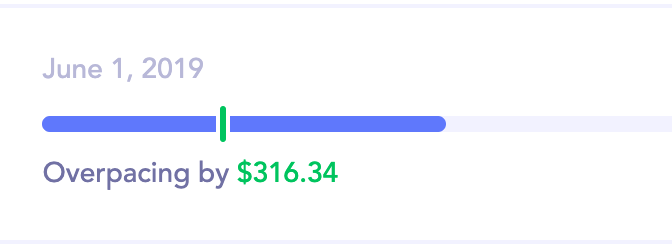

100% worth it. I follow the rule that I don’t have a budget for books — I buy whatever book looks interesting because if there’s ever something to overspend on, it’s on enabling and bettering yourself.

And that applies to courses too.

Get it: microacquisitions.com/how-to-buy-sma…

amazon.com/How-Capitalist…

Also excited to join the Rainmakers Club: microacquisitions.com/rainmakers/9rc…