There are plenty of hardware businesses that haven't created any software or SaaS advantages that create a barrier to entry. You know who they are.

1. Overpay; or

2. Miss an opportunity.

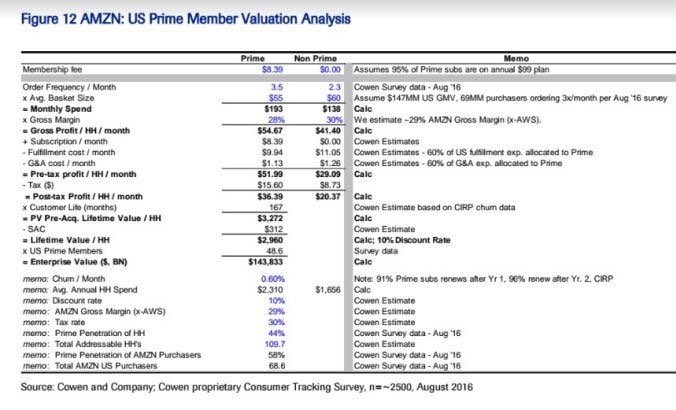

Divide $40B by 17.9M subscribers as of Q2 2019 = a valuation of $2,235 a subscriber. Really?

Expected Q3 churn is ~1.1M.

What's the value of the discounted cash flow? Here's a model:dskok.wpengine.netdna-cdn.com/wp-content/upl…

Is that $500M COGS or CAC? Or is it some of both?

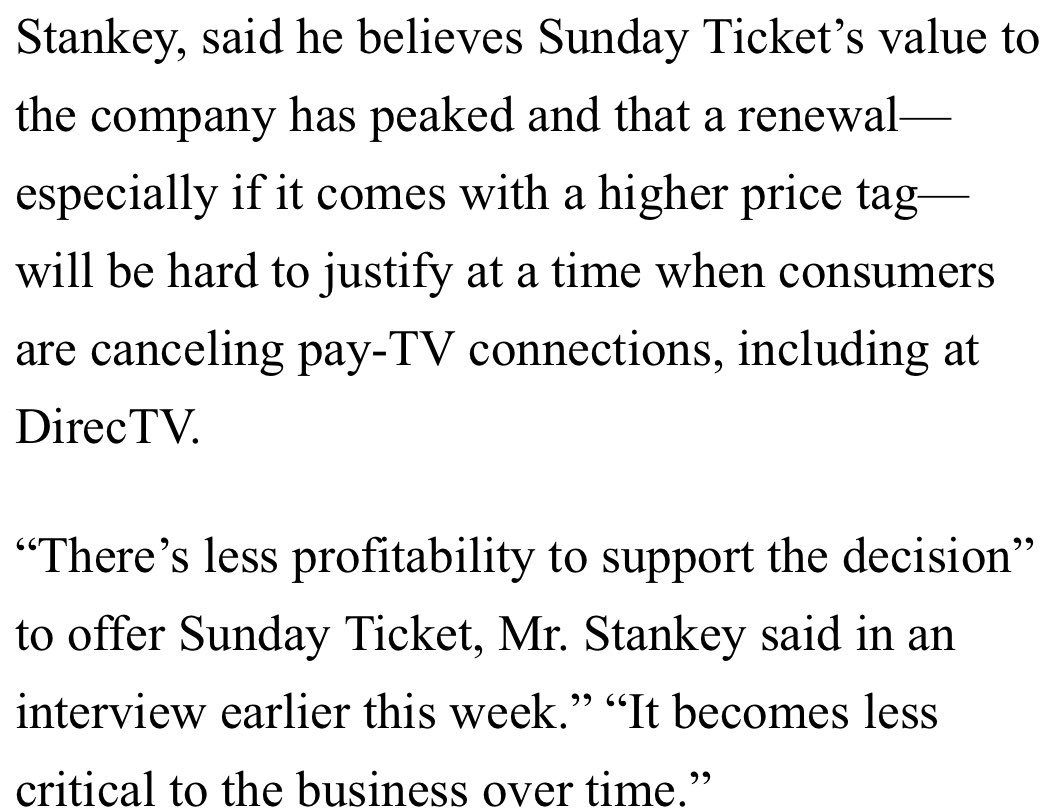

What do you need to know about the economics of bundles to manage this negotiation? google.com/amp/cdixon.org…

"Tren’s view is that the variables of the LTV formula are interdependent not independent...." abovethecrowd.com/2012/09/04/the…