Upon further consideration am now somewhat concerned about the fallout-cascade.

(a thread)

2/

(display from a great presentation forthcoming by @mfriedrichARK)

3/

4/

(And though the employees should push back they're not well-positioned to do so)

5/

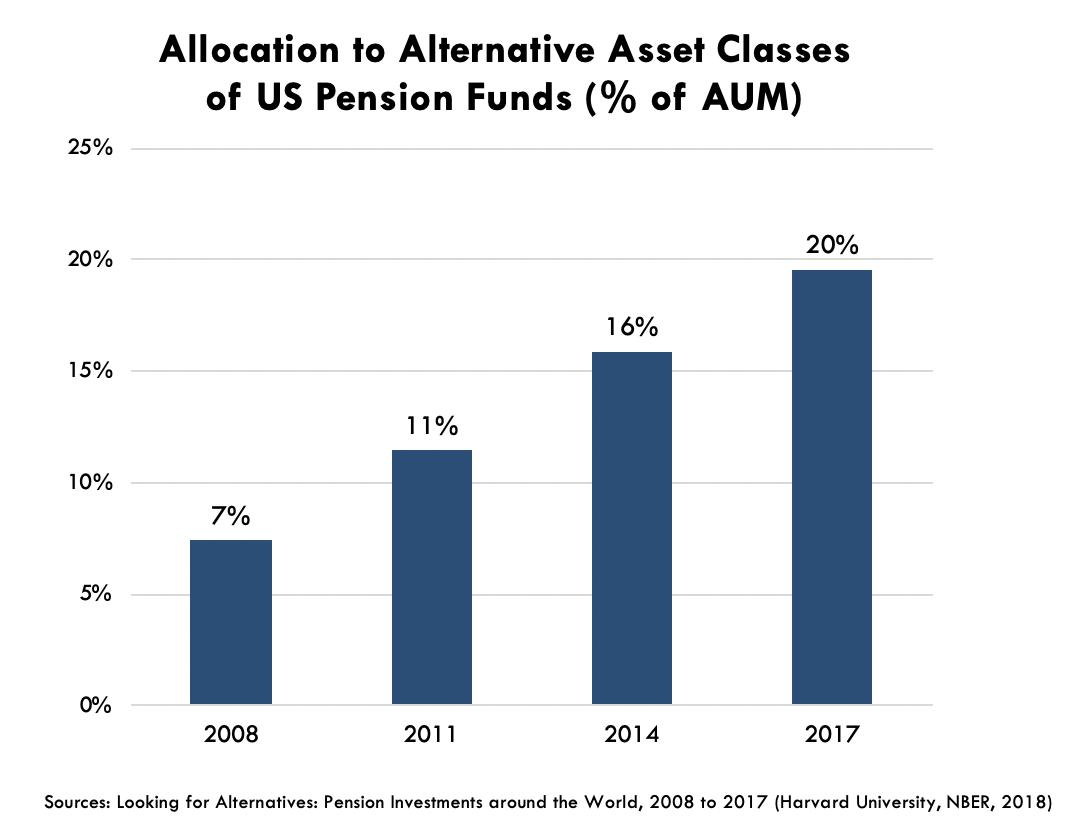

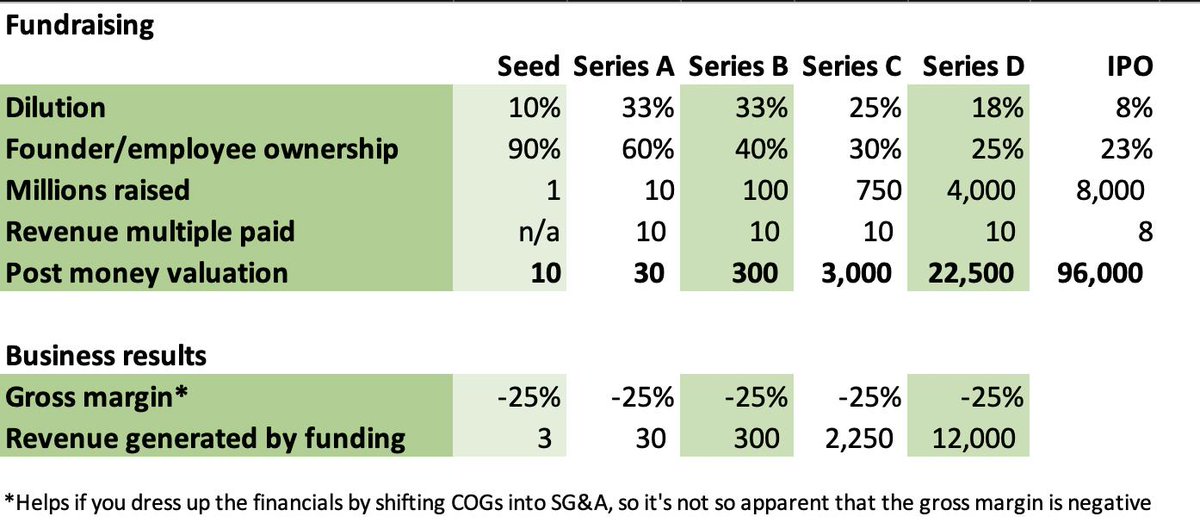

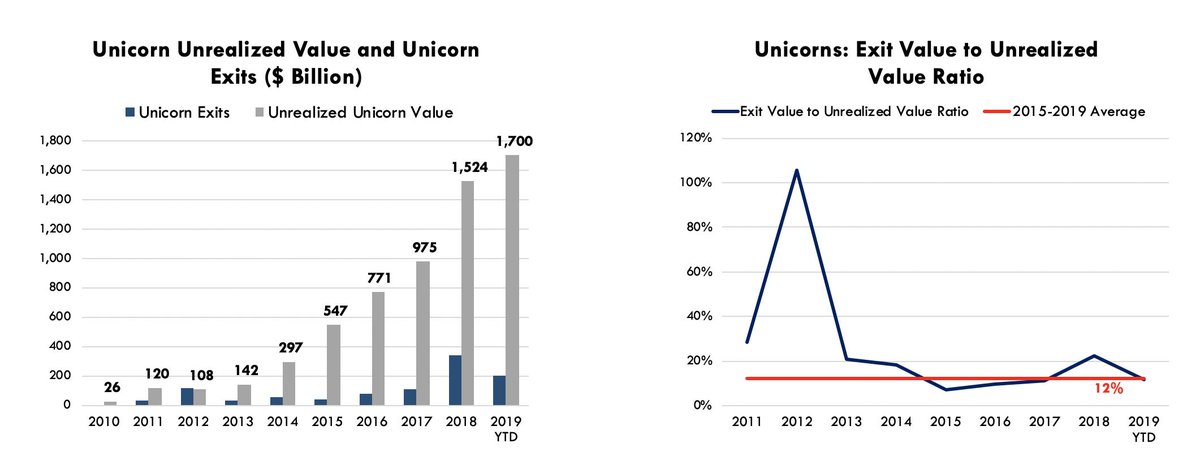

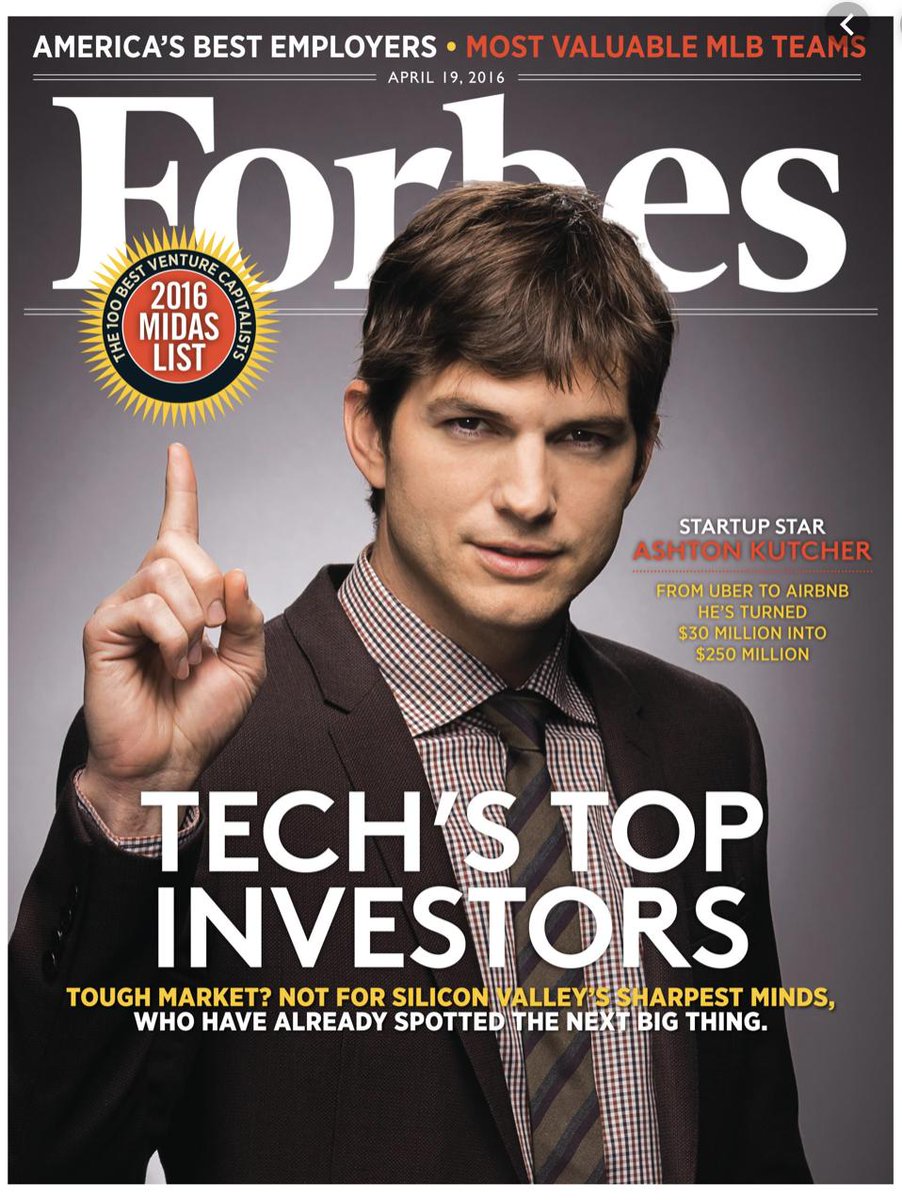

The problems: a surplus of capital, and the need to justify continual valuation mark-ups.

6/

7/

I convert $1 raised into $1 worth of 🛴 and fractionally onsell it into $0.75 of revenue before the 🛴 gets chucked in a lake.

Seems a bad business.

8/

9/

10/

11/

12/

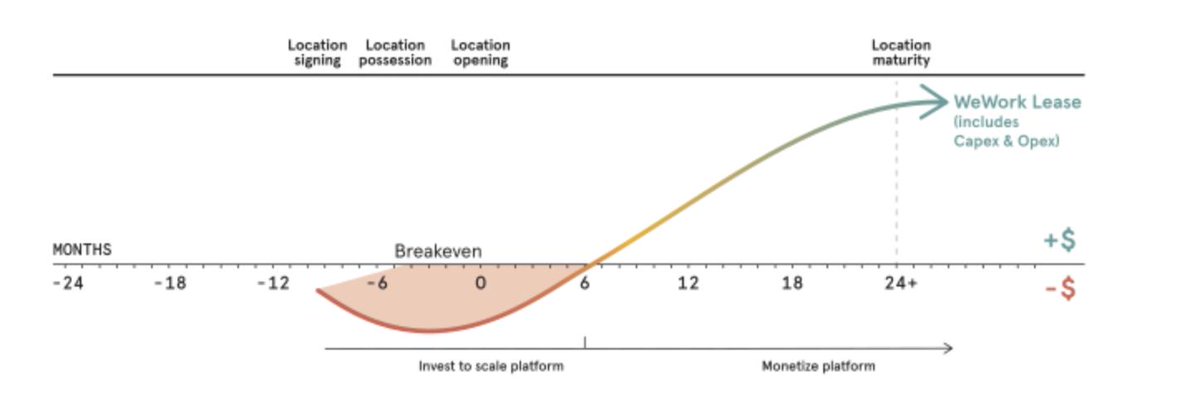

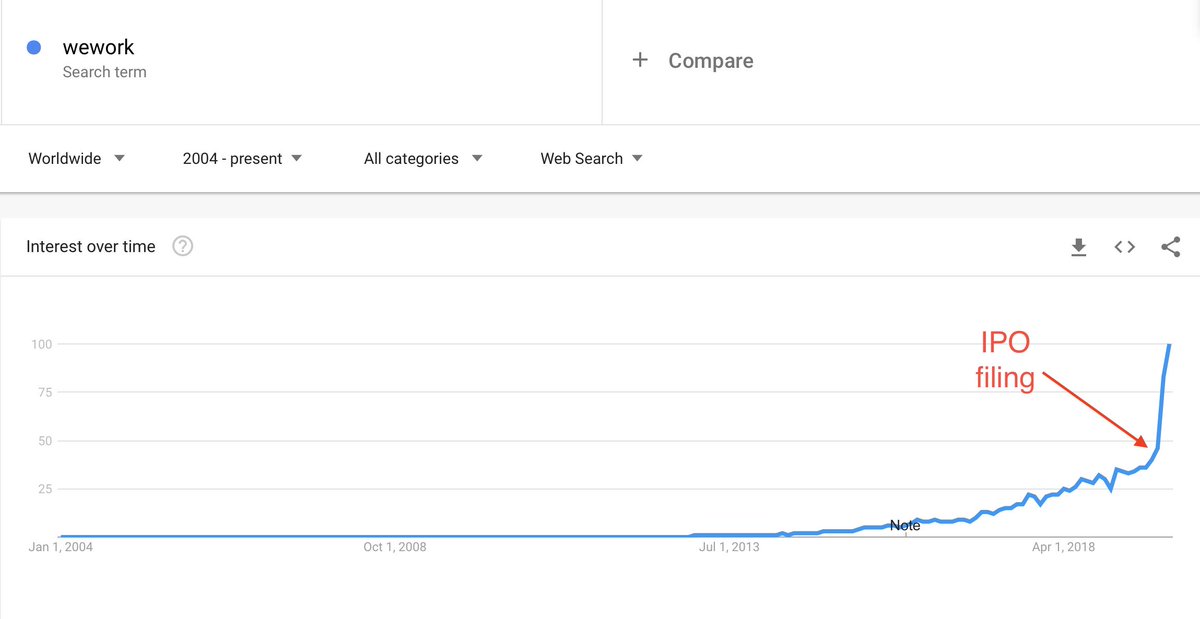

The Saudis finally balked at the valuation, forcing WeWork prematurely into public market scrutiny.

13/

14/

15/

16/

17/

18/

19/

20/

21/

22/

23/

24/

25/

26/

27/

28/

29/

30/

/fin