So, in theory, if I paid $40 for it, I should make a profit of $10, right?

Not really, because, as each day matures, the value of the option will change. Tomorrow it could be worth $30, and then I have made a paper loss of $10.

1) just wait and pay out the USD in future, at the prevailing GBPUSD spot rate at that time – this leaves me fully exposed to fx rate movements – good and bad

2) Convert some GBP to USD now, , and place it on deposit with a bank, so it matures to the

3) hedge my risk via an option or forward – so I can hedge my risk in case the market turns against me,

Ok, so how do we execute a halal FX option?

we have to pay $100 in one month’s time. Our base currency is GBP. The spot rate now is 1.24, and the forward rate is 1.30 (an assumption).

Let us consider 3 scenarios for the prevailing spot rate in one month’s time – let's fast forward one month

If the rate is 1.25, I have to use £80, and if the rate is 1.35, I have to use £74.07.

So my risk here is that the FX rate can fall (dollar strengthens), then I have to pay more GBP

So, I ask the seller to make an undertaking to me that, if the prevailing spot rate falls below 1.30 (the forward rate), then he will sell $100 to me in exchange for £76.92 at a rate of 1.30 (the exercise rate).

1) FX rate is 1.30 – I execute at the market rate and have to pay £76.92 to buy $100

2) FX rate is 1.25, the option kicks in (I am “in the money”), and I ask the seller to fulfil his promise, so I now only pay £76.92

We have a chance of saving £3.08.

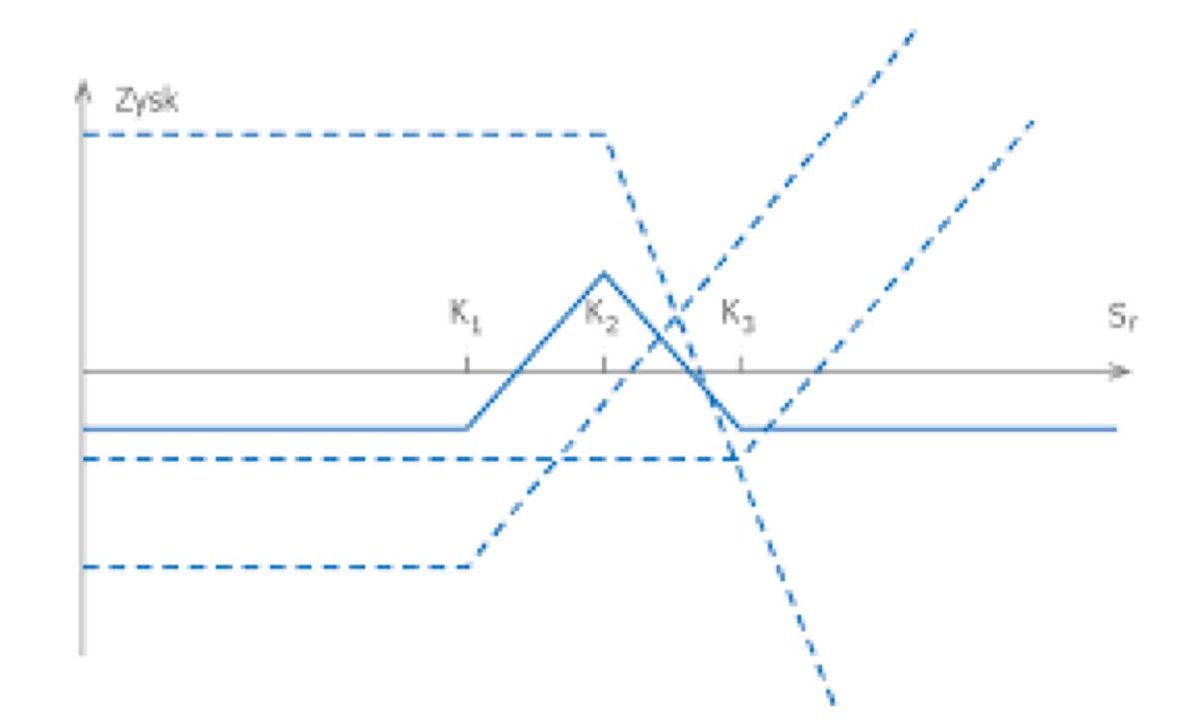

So, how much should we pay for the option? There is complex modelling to derive option pricing, but the economics is clear:

But that is a different topic!

1) The Waad is a Shariah compliant contractual form, it is a unilateral promise or undertaking

2) There is a real transaction that will occur in the future (if we are in the money) –

Compare this to the rain option where we were paid cash if it rained – there is no tangible sale transaction there.

The wording of the Islamic option would look like this:

I would be interested if anyone can explain to me how this FX option could be used for speculation?

And this is how we create a Shariah compliant FX option for hedging purposes.

What do you think? Any questions? Observations?