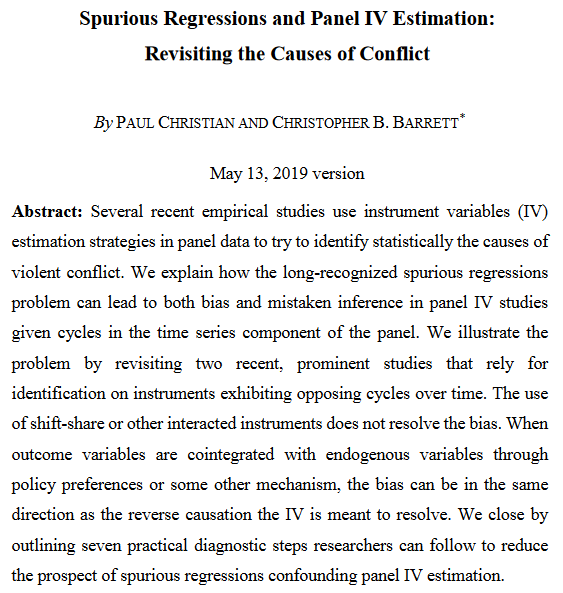

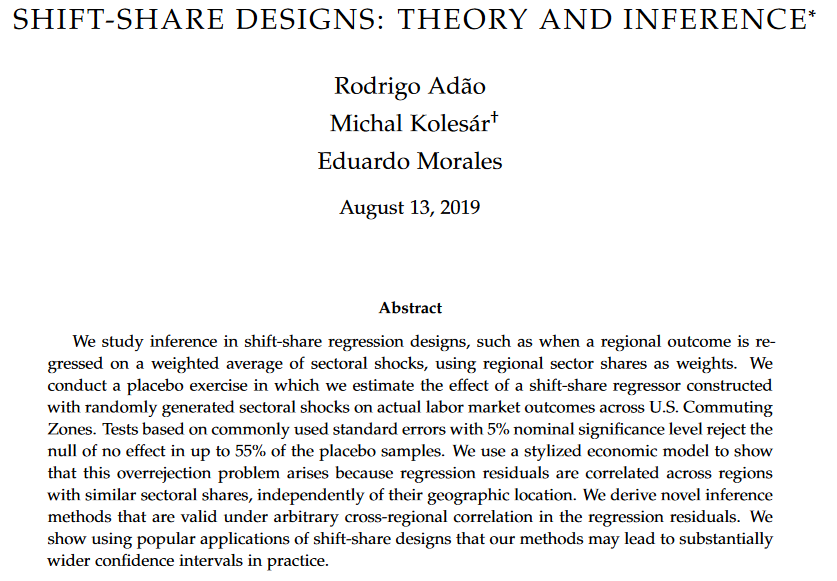

Today, we read the new @QJEHarvard by Adao, Kolesar & Morales who show us that many Shift-Share Designs produce too small confidence intervals (i.e. many false positives). A must-read for applied economists!

#econfriday

-> R package: github.com/kolesarm/Shift…

economics.harvard.edu/files/economic…

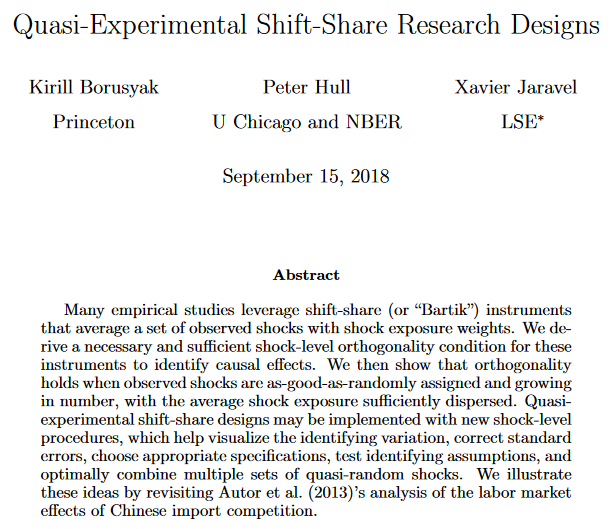

Borusyak, @autoregress & Jaravel recommend running/vizualising regressions at the shock level (where the identifying variation comes from):

mit.edu/~hull/bartik_0…

-> Stata package: mit.edu/~hull/bartik_0…

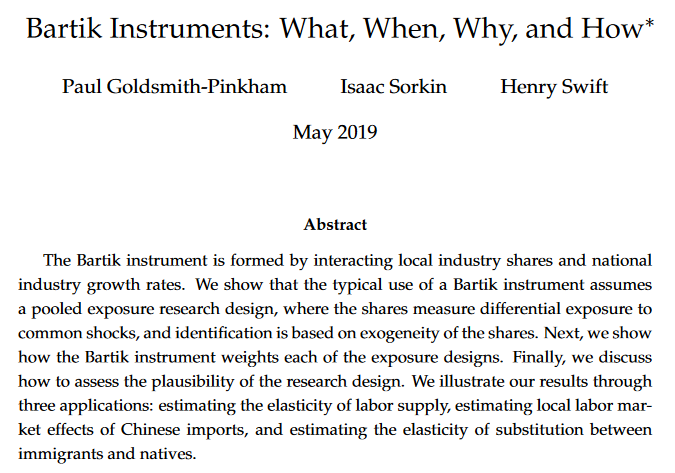

paulgp.github.io/papers/bartik_…

-> Stata package: github.com/paulgp/bartik-…

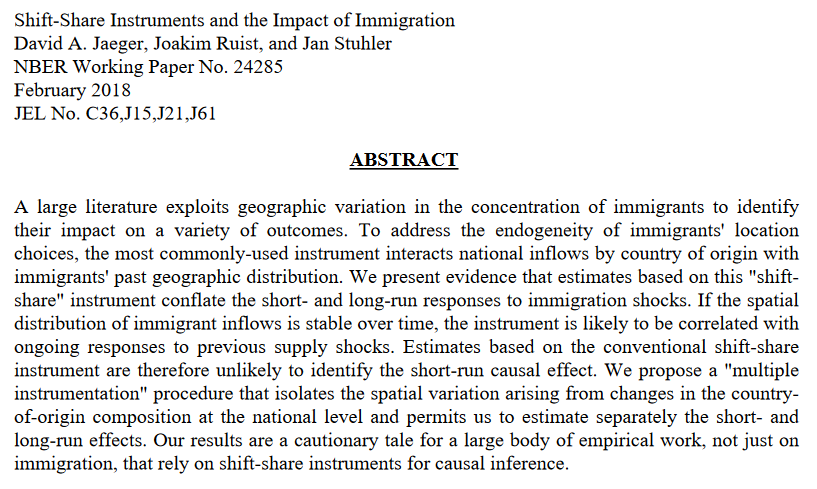

@DavidAJaeger, Ruist & Stuhler caution that these IVs can conflate long & short run effects if these shocks are serially correlated and affect the same units over time

nber.org/papers/w24285.…

bit.ly/31ehFaG