1. Start as young as possible, compounding is on your side. Compound interest has 4 elements & the most important is “time”.

2. The wise guys told me you’re the 5 people you hang around. Create a mastermind...

3. Have the basics in secondary skills such as taxes, accounting, business law, structuring, asset protection, etc.

4. In business one of the most important, but least discussed...

5. In real estate everything is negotiable including your entry price, your exit price, your cost of finance, your cost of rehab, your broker costs, your asking rent, etc.

7. Be bold, take risks, be creative, be daring, trying new things and don’t be afraid of going against the herd.

9. Another skill that’s underrated in today’s world of internet is networking, connections & business relationships.

10. Failure is part of the...

11. Don’t sell yourself short or sell out your integrity just to make a quick penny — keep your morals.

12. Don’t be afraid of...

13. In real estate the bank will your best partner. Don’t be offended when they don’t want to lend to you. They have 100s of risk managers working...

14. Master the 3 money skills...

15. Spending & saving is a personal finance mindset and positive habit development. You have to build the habits.

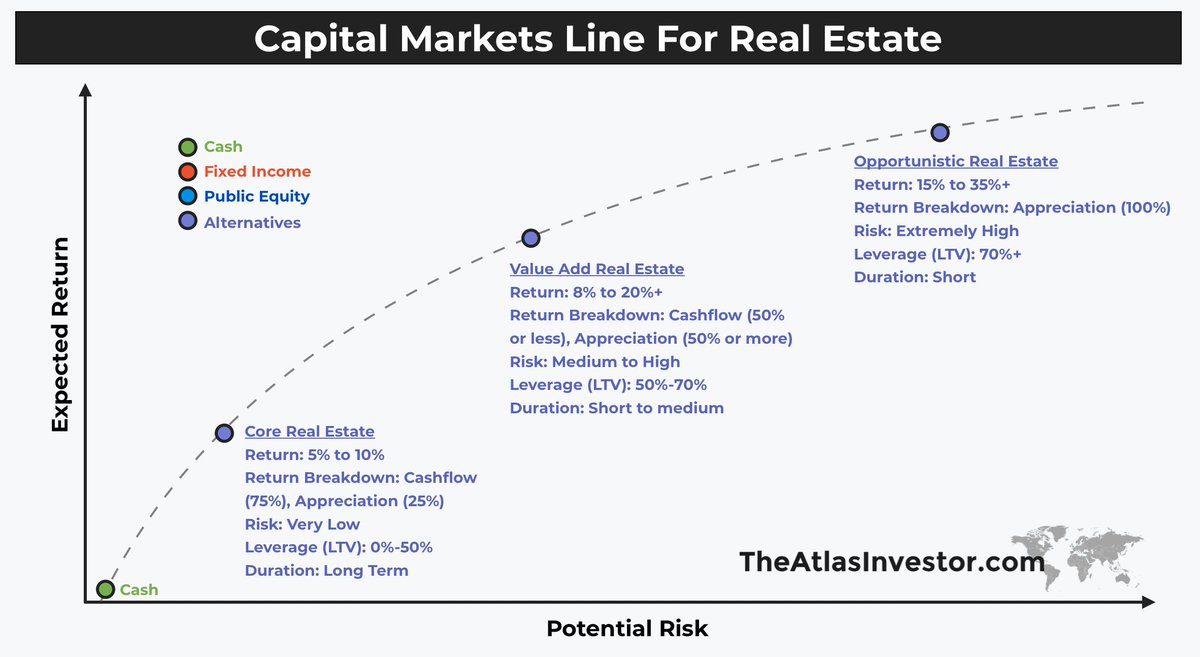

17. If you want mediocre returns like the majority, stock to stocks & bonds. If you want to compound at double digits, look elsewhere.

19. To save a lot of money you need to be in a growth & abundance mindset — not a penny pinching, scarcity mindset (which will damage your health & lifestyle in the long run).

22. If you’re planning to be financially free at 65, utilising 401k & IRAs (similar programs in other countries) is very wise. Do it!

24. Consumer debt linked to consumption of useless material things, is the cardinal sin of accumulating wealth.

25. Don’t buy crap, to impress the...

26. The golden rule to follow is that assets produce income, liabilities cost you income. Majority of your portfolio should be in assets.

27. Your house is not an asset, gold or bitcoin...

28. If you aren’t already doing so — track your net worth. Those who focus on their...

29. Have a budget, track your spending & plan your year out. You either stay on top of it & control your finances, or the it will control you.

31. Mentorship, books, special groups, seminars, journals, etc. Pay for the proper eduction!

Anyways, I just wrote all this from the top of the dome. No preparations, just free flow. I probably have another 30 plus to add, but time to go do some work.

Enjoy your weekend!