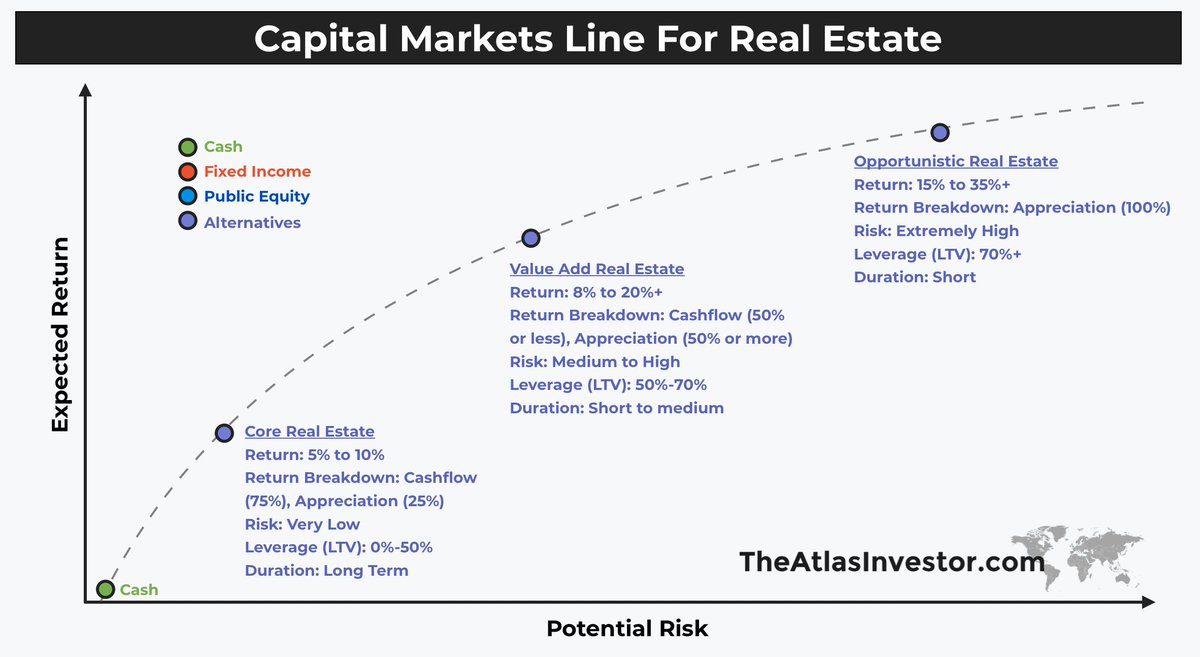

The classic public portfolio of stocks and bonds, at least in the US, is likely to disappoint the buy & hold investor. Stocks might do 3-4%, bonds half of that.

Buying an apartment, off the plan, with a view to rent it, is not really investing in real estate. I'd called that "getting suckered" by a developer.

In some ways, you are right. Risk is high & there are many moving parts to keep control of.

On top of all the other risks, you also have construction risks to consider.

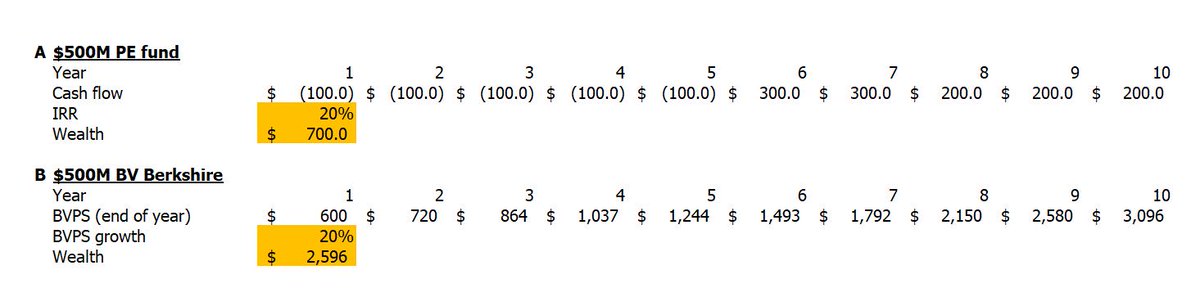

Developers with solid track records, who are 20 for 20 & finished projects even during downturns, make a lot more sense than throwing darts at the...

That is a metaphor for throwing millions at VC fund "ideas" to see if any, or at least one, works.

We've seen great VC investors during this tech boom, but as the cycle turns, things will look a whole lot different from now on.

The venture capital cycle seems to have turned with the WeWork drama...

...and cash continues to yield awfully low interest.

However, that is not where excesses exist, in my opinion. Private RE could end up outperforming, but not everything will work.

Deal selection is the KEY!