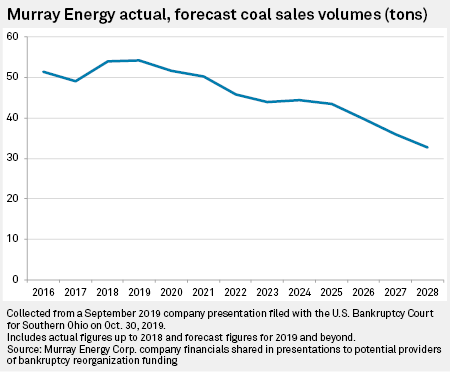

One big thing: Business plan assumptions project HUGE drop in expected coal production and revenues through 2028: spglobal.com/marketintellig…

It also plans to spend less at its mines: Murray forecast overall capital expenditures drops $245M in 2019 to $63M in 2028.