So a hold for the RBA at 0.75% but likely to iterate low rates, which is a global story.

Where is the growth? Totally wanted!

We got a double Ds problem - debt & worsening demographic. CB rate cuts, trade-deals etc are just smoothing the structural downturn 👈🏻

Both state & Caixin show slowing services 👈🏻

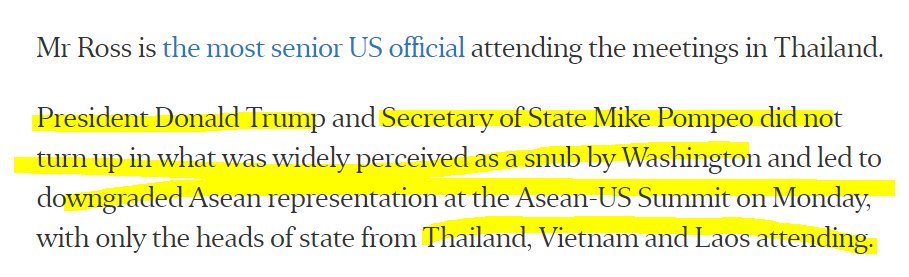

👇🏻👇🏻👇🏻

thejakartapost.com/seasia/2019/11…

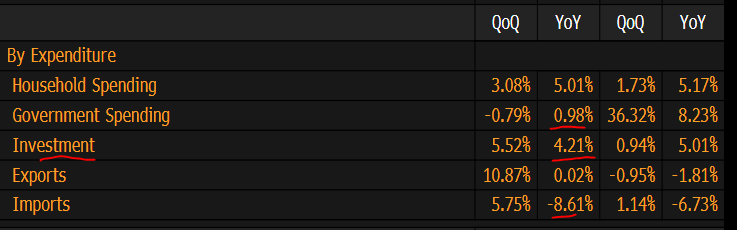

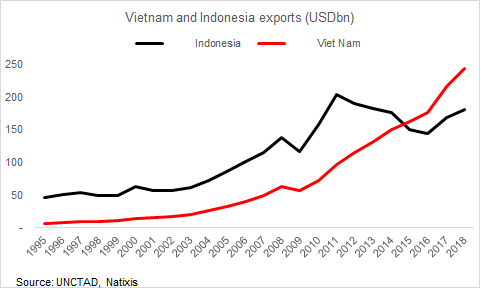

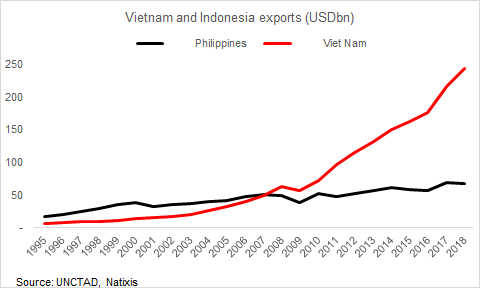

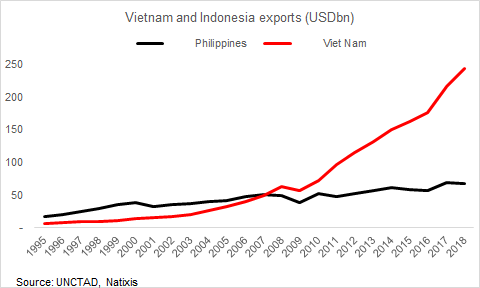

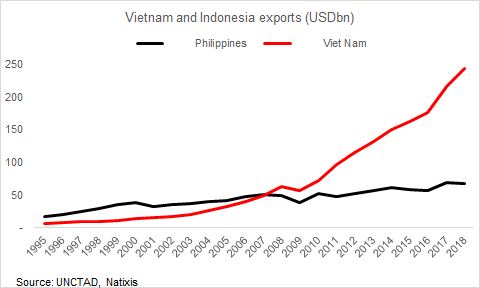

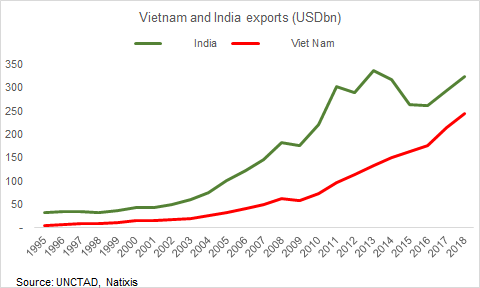

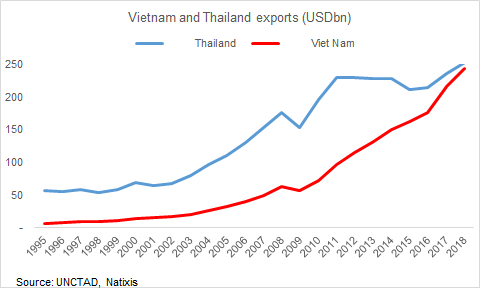

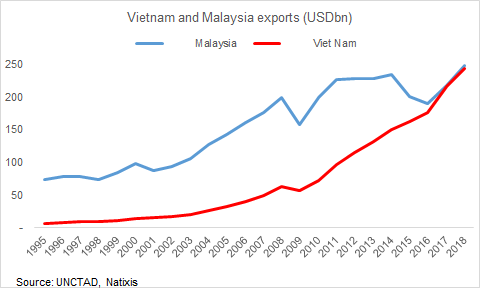

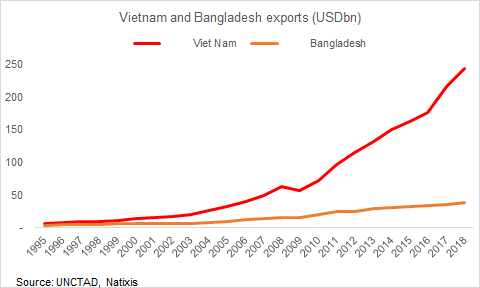

a) When u see a country reporting export growth, ask, WHAT IS THE LEVEL VS 5YRS AGO? If it's the same & u see growth, then u know that competitiveness has DECLINED despite cyclical trends

b) Exports matter. A structural decline means an erosion of competitiveness. Yep

a) If they tell u this is the WORLD BEATING INDEX (China in 2019), ask them, if I gave u 100 bucks 10 years ago, what's the level now?

b) If it's the same, then the growth u see is just CYCLICAL & u haven't accumulated wealth 👈🏻

So pay attention. Do not let people fool u w/ the volatility of prices. Watch the level & deflate that by CPI👈🏻