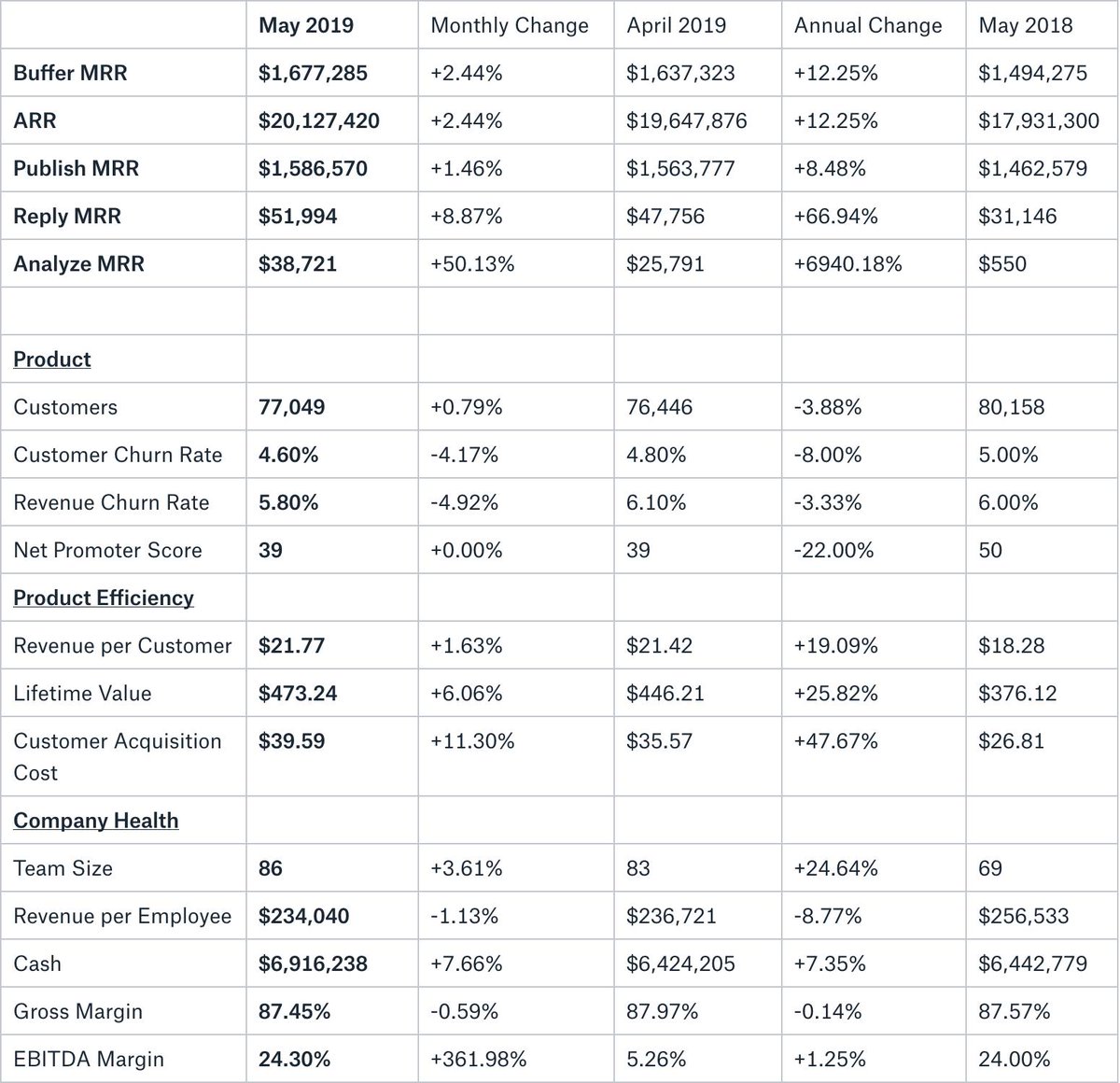

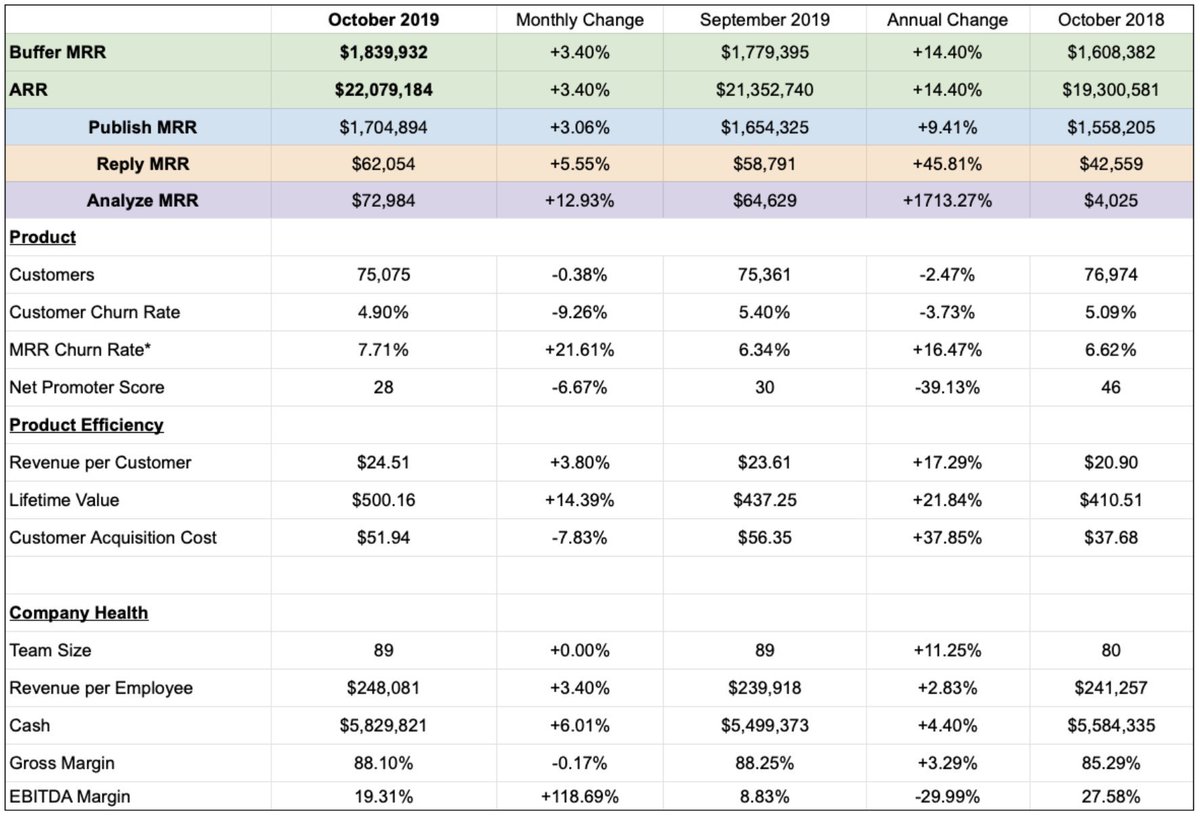

- We crossed a key milestone of $22m in ARR 👌

- Our highest monthly growth rate in around 1.5 years 🚀

Thread with more thoughts ⬇️

- We launched Instagram Stories scheduling, which drove around $33k in MRR growth.

- We transitioned some customers from legacy to current pricing, which brought around $15k MRR growth.

(this isn't a typical month)

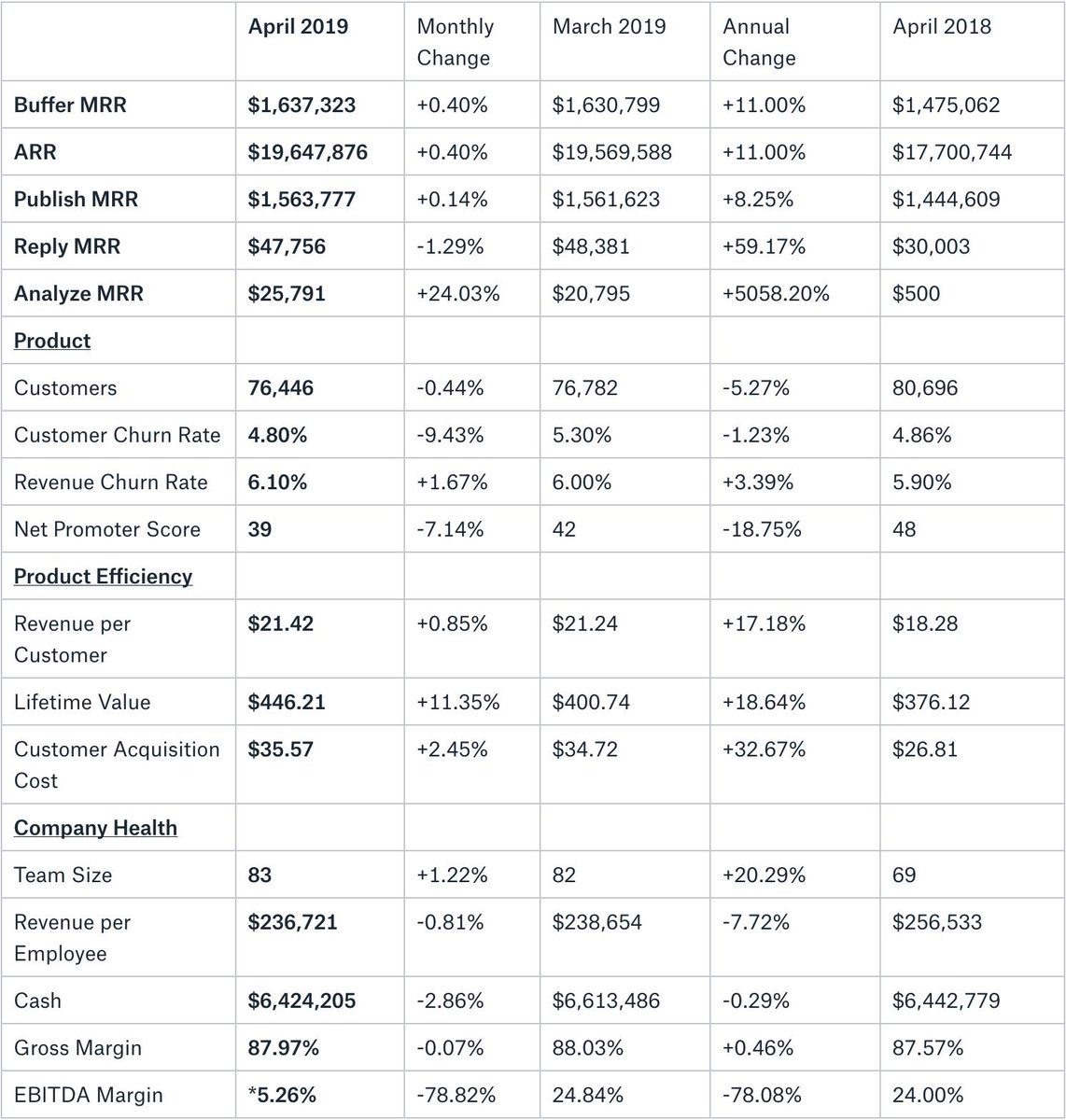

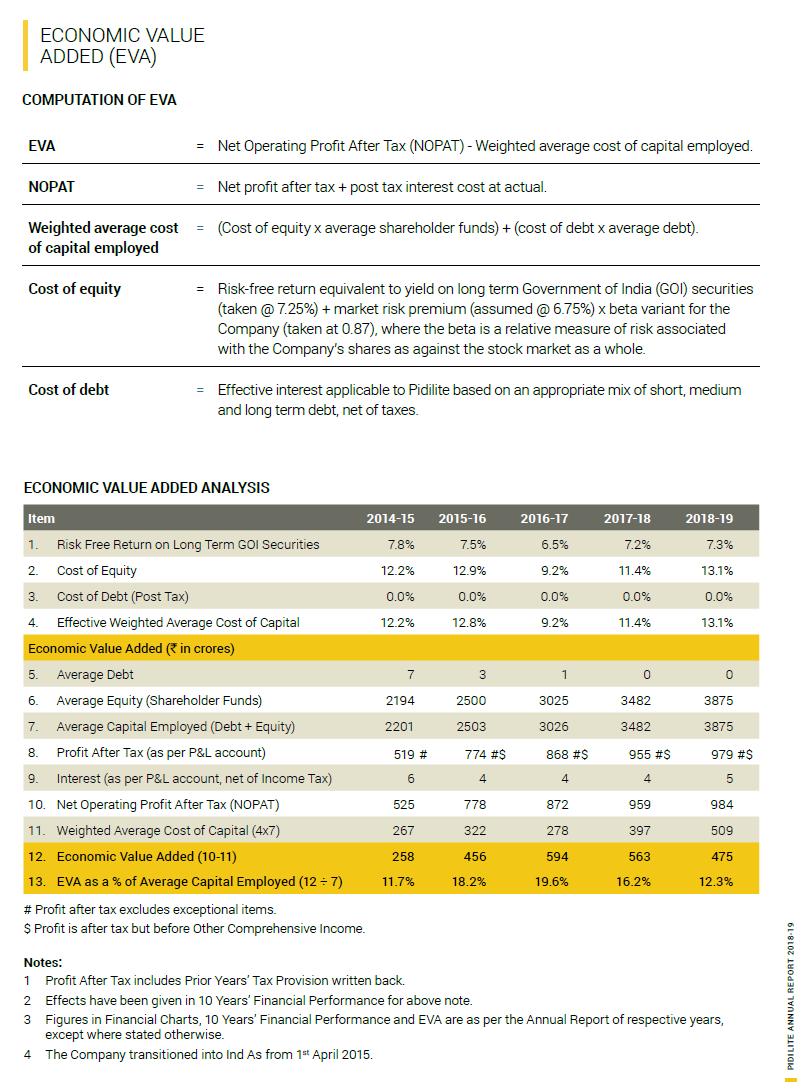

We are truly a multi-product company now, and each product is at a different stage of the product lifecycle, with varying growth (% and $).

It's a huge company milestone, and personally very reassuring, that we have significant separate revenue streams.

With that in mind, we saw a very nice uptick in ARPU of almost $1.

We're a SaaS co with 75,000 paying customers, more than almost any public SaaS co. But we can do much better on revenue.

We're experimenting on ways to spend to grow faster, but haven't yet found predictable and repeatable ways to do that. Once we do, we'll likely reduce the ratio.

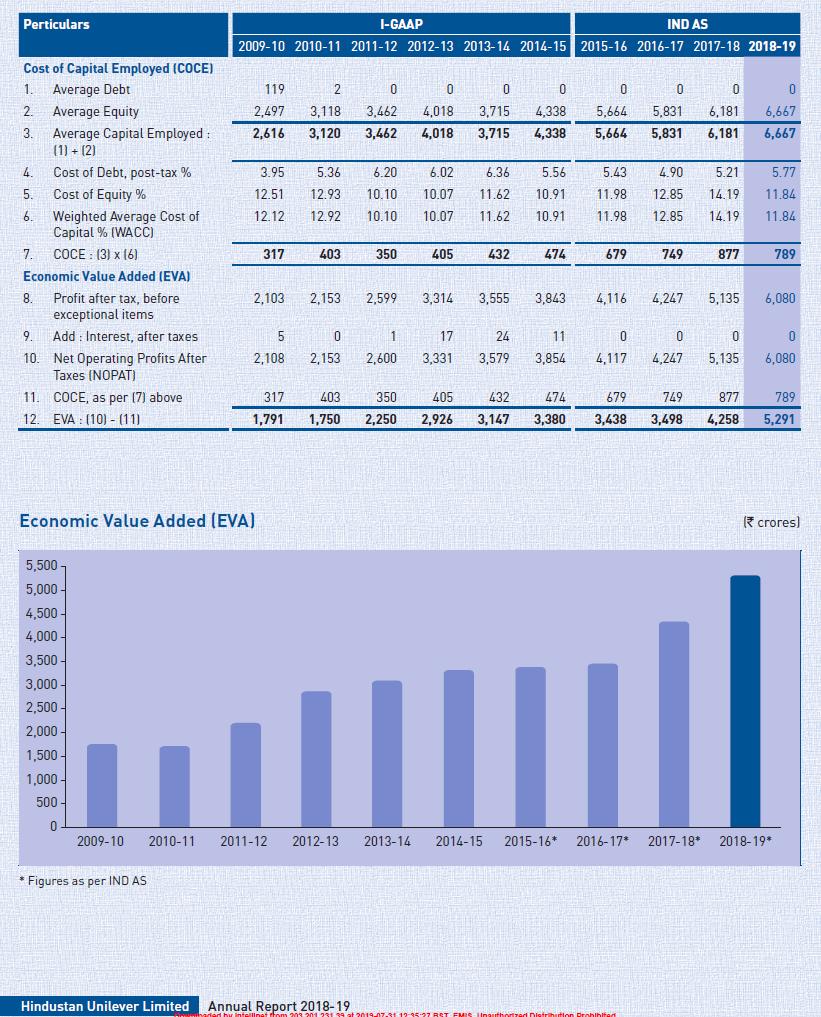

Combined with our EBITDA margin of ~20%, this is a powerful indication of the efficiency and health of our business.