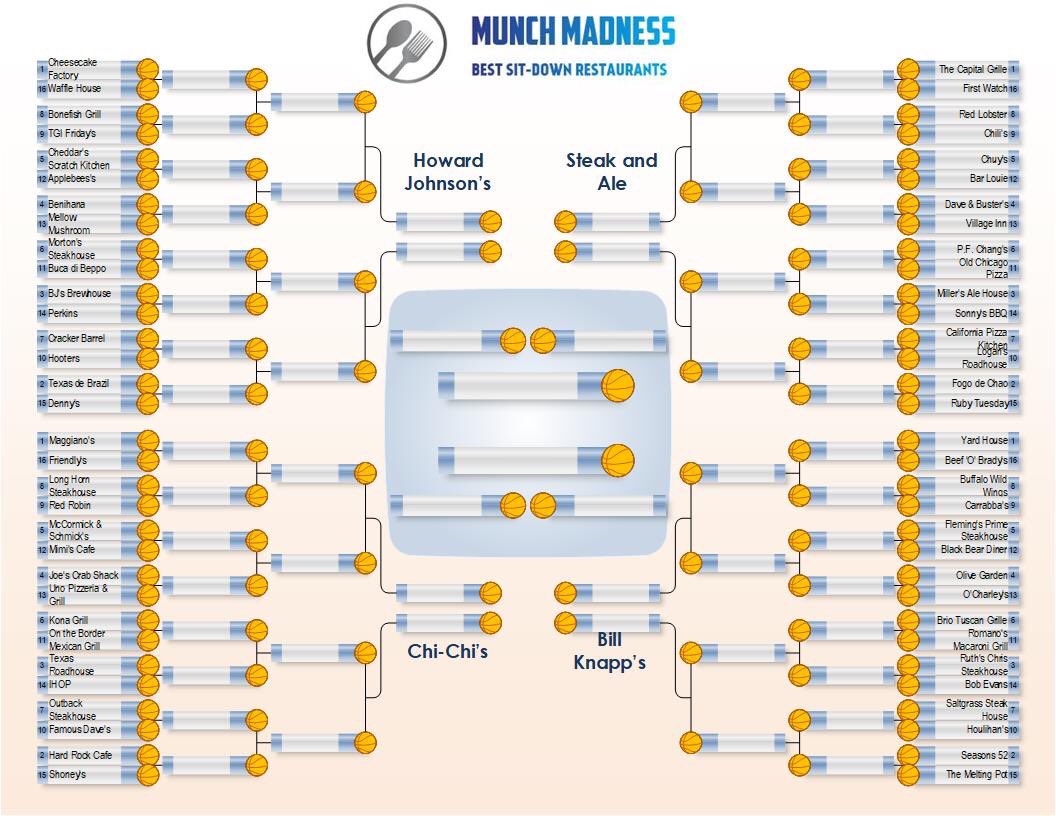

Restaurants Unlimited Inc.

Kona Grill

Perkins and Marie Callender's

PGHC Holdings Inc.

Bertucci's Holding Inc.

Real Mex

Cafe Holdings Corp.

RMH Franchise Holdings Inc.

Taco Bueno

Why?

PGHC Holdings Inc.

Bertucci's Holding Inc.

Real Mex

Cafe Holdings Corp.

RMH Franchise Holdings Inc.

Taco Bueno

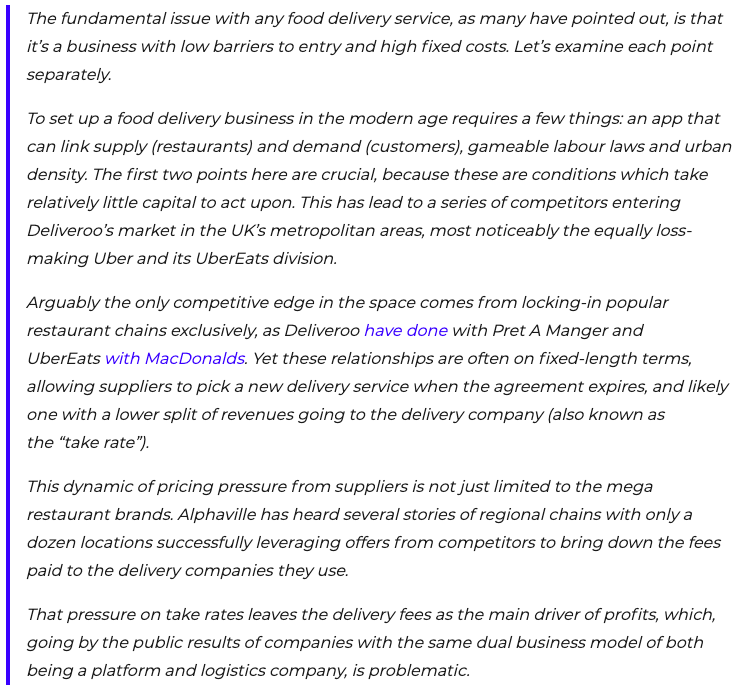

Why all the distress?

Challenges confronting the “casual dining” restaurant segment.✅

Too much competition.✅

Senior management changes. ✅

Ever-changing strategy & poorly executed growth. ✅

Increased/increasing labor costs. ✅

Too much debt (and default) ✅.

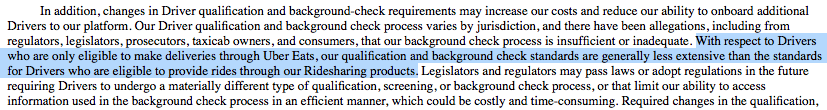

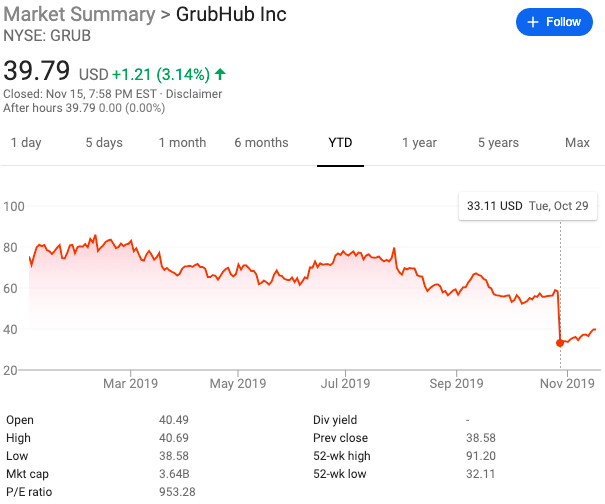

This week's chapter 11 filing of Houlihan's shines a light on another factor: THIRD-PARTY DELIVERY.💥

It also had $42.3mm in secured debt (CIT Bank NA) and unsecured debt of approximately $30.7mm (with trade debt of $8.2mm).

It had 80+ locations just 2 years ago.

eaterypulse.com/2019/09/01/hou…

Who eats these delivery fees, we wonder?!?

"34%. That’s the percentage of restaurant customers in the 35-to-54 age range who are the most likely to dine out often. That number is down from 41% in 2007."

forbes.com/sites/lisettev…

retaildive.com/news/walmart-p…

techcrunch.com/2019/11/14/tar…

cnbc.com/2019/11/15/sto…

For more content like this, check us out at petition.substack.com. Cheers!