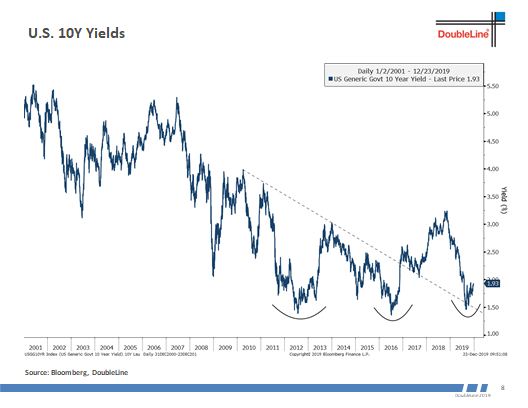

#arollingloangathersnoloss #yieldstarvation

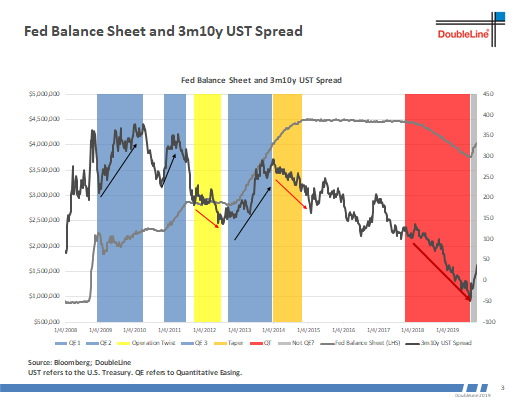

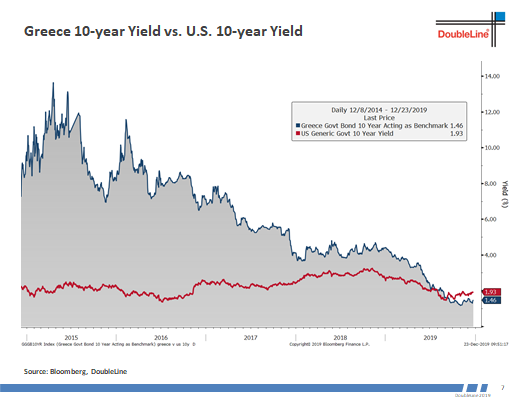

#aRollingLoanGathersNoLoss #YieldCurve #CentralBanks

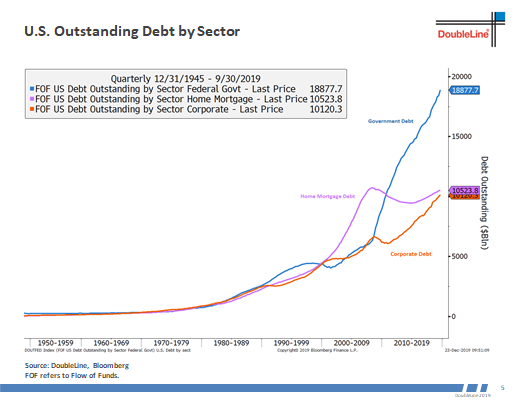

#arollingloangathersnoloss #USD #macro #risk #rates

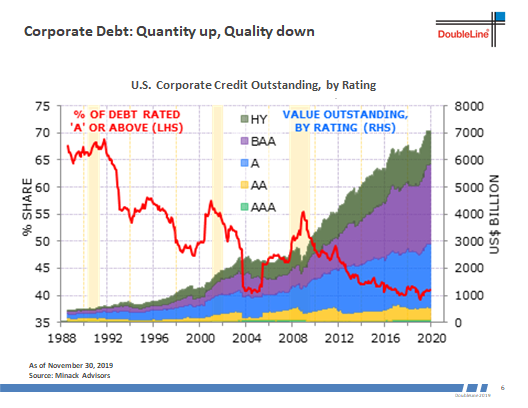

Corporate debt has really put on the turbo chargers.” – Jeffrey Gundlach

#arollingloangathersnoloss #credit #risk

#arollingloangathersnoloss #credit #rates #bonds #risk

#arollingloangathersnoloss #rates #risk

#arollingloangathersnoloss #rates #risk #macro