What is it and how can it help you live a better life?

This idea has been germinating in my mind for months and I have been meaning to share here recently, but life has been hectic...apologies.

//A thread

#FinanceTwitterJa

There very well may be economic theories to explain this more succinctly, but I don’t know of any so I came up with the name.

The period of time, typically within in 1 generation, when a country develops fast enough to create significant wealth for many of its citizens — Me 😬

Examples:

- USA (post WW2 - Baby Boomers)

- Germany (post WW2)

- Asian Tigers (1960 - now)

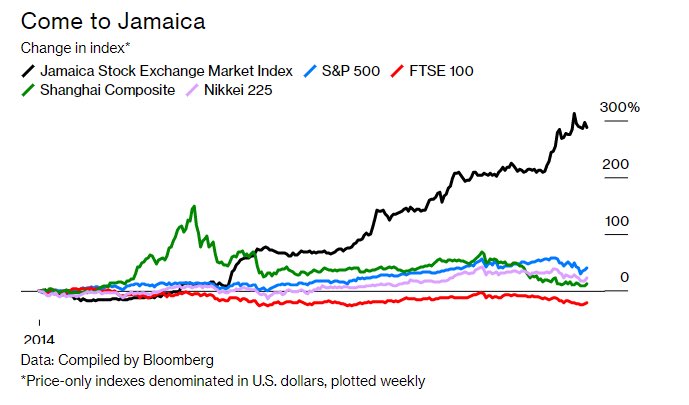

- Jamaica (2017/18 - ???)

After WW2, the US had the GI Bill - en.m.wikipedia.org/wiki/G.I._Bill

That provided cheap loans (for mortgages, businesses), cheap land & free college tuition among many other benefits. An entire generation of wealth was created.

It is the largest poverty reduction the world has seen in modern times. Now China has more billionaires than the US - cnbc.com/2016/02/24/chi…

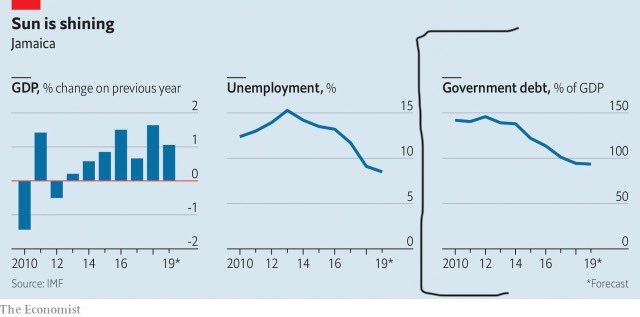

10 years ago, GOJ owed about $1.47 for every $1 that we all earned. Within 10 years that has fallen to $0.96 to $1.

Through 3 administrations (Golding, PSM & Holness), GOJ took hard decisions.

Before we could even qualify for the privilege of getting an IMF deal, we had to hit some pre-requisites. We had to sell Air Jamaica, Sugar Company & do JDX.

Air JA (2009) posted a $9B loss. Ie GOJ had to find $9B for Air JA.

Student Nutrition got $1.9B.

So when GOJ paid $9B to cover Air JA’s losses, they were literally taking food out of the mouths of students.

mof.gov.jm/documents/docu…

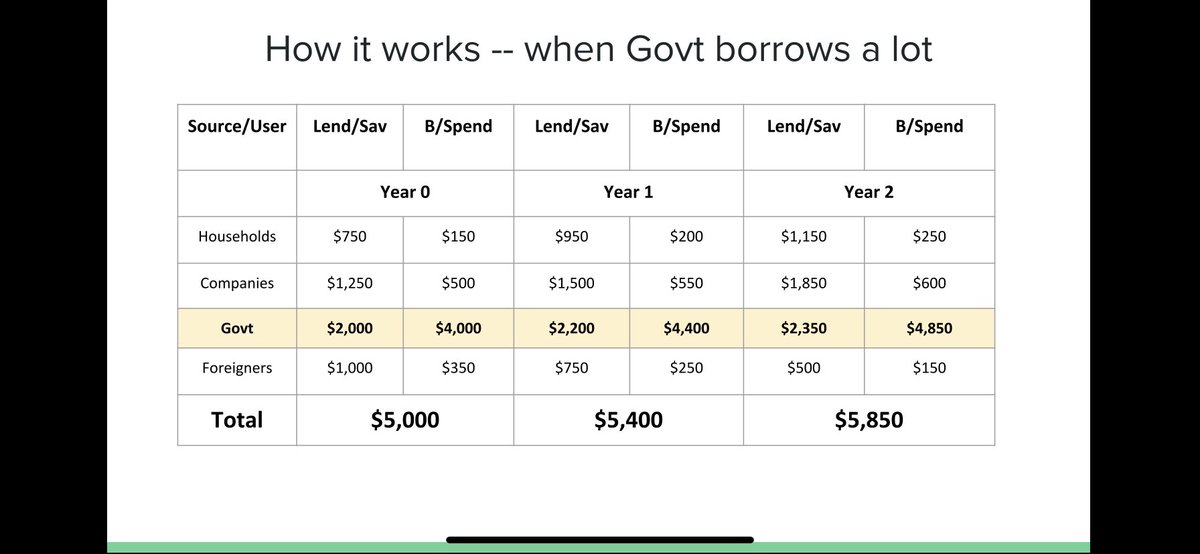

So imagine a scenario where Gov’t borrows a lot, see table below.

Notice that when that happens, the overall financial system expands slower. There is less money going back to households in the form of wages which prevents them from saving as much which further...

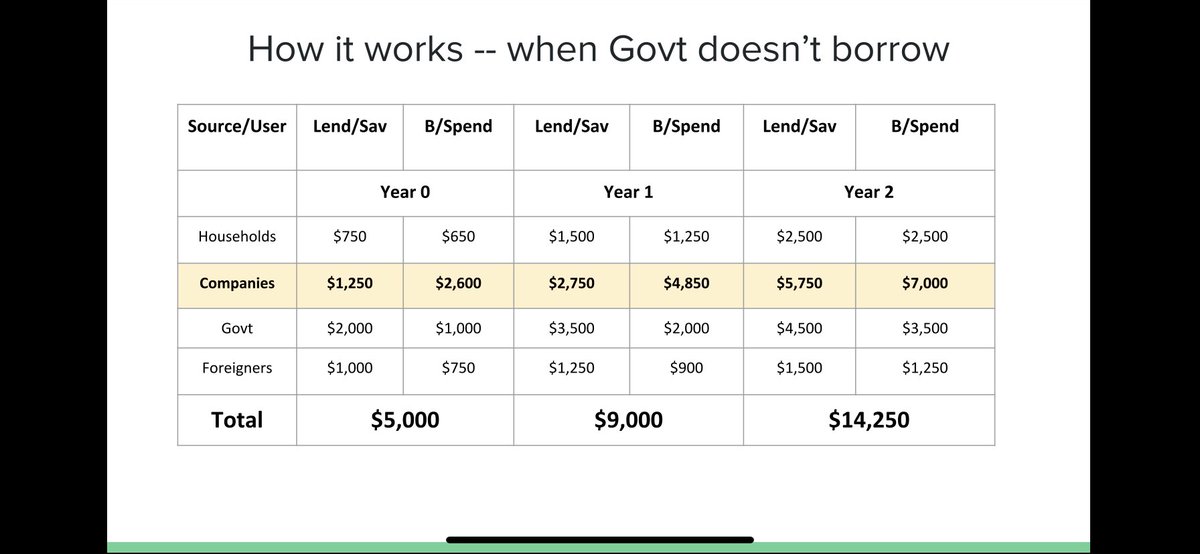

Consider the other scenario when the government doesn’t consume most of the saving. In this scenario, companies borrow more. This is what a healthy financial system looks like.

So back to the original question in the first tweet — how can you benefit?

- Invest in your financial literacy. Understand and learn about finance.

- Keep an eye out for opportunities to start a company.

Make sure you understand our local stock market and invest. Even if you are starting with just a small amount. Even $100.

I wrote an entire thread on this 👇🏽👇🏽

Keep in mind that with all opportunities for reward there is risk. Risk/Reward are tightly linked.

We are entering a new Jamaica where our generation can create a lot...

It can be squandered away with political expediency. This is why I am so strident in my defense of our progress.

We have an opportunity that few get. We need to safeguard it and protect it vigorously. One way is to spread knowledge.

These windows don’t come along very often. If we take advantage of this, we could change JA forever...finally.

Jamaica 🇯🇲 Land We Love.