@dmuthuk @Gautam__Baid @iancassel @IntrinsicInv

@GavinSBaker @saxena_puru

Few of my takeaways in the thread below.

csinvesting.org/wp-content/upl…

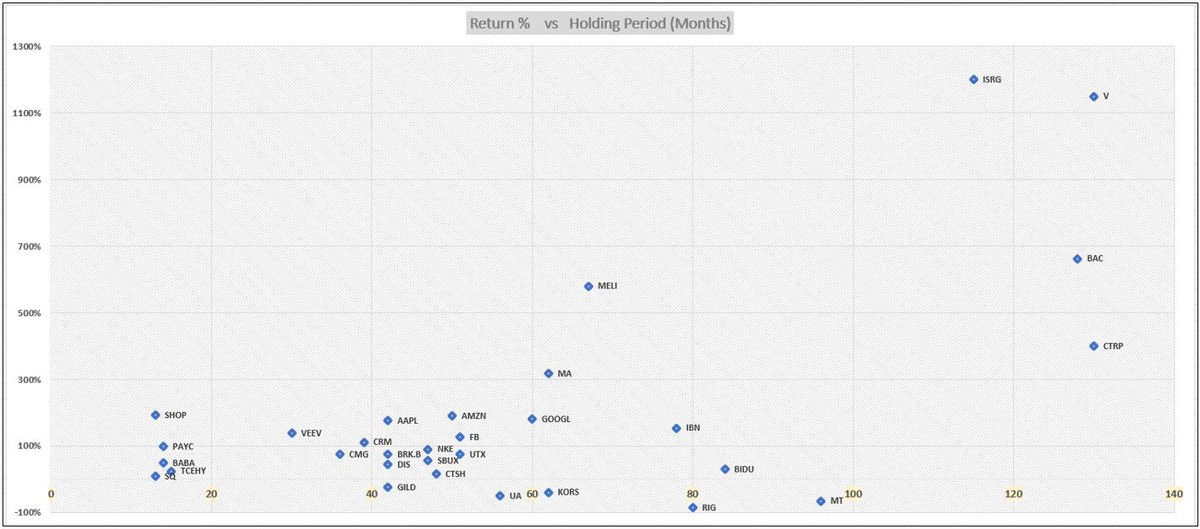

"The success of the Coffee Can program depends entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with."

Few I could think of.

2) Gives enough importance to Valuations on why their purchase at this price would give them good returns - Company severely undervalued based on their long-term

3) Understands that creation of Business value takes time (and that they don't strictly follow Qtrly/Yrly timelines) and that Stock prices will eventually

4) Identifies the few criteria that really matters for that particular business/industry and only reacts when those metrics are materially changing (for the worse).

6) Holding them for a very long time (while keeping in mind all of the above).

END.