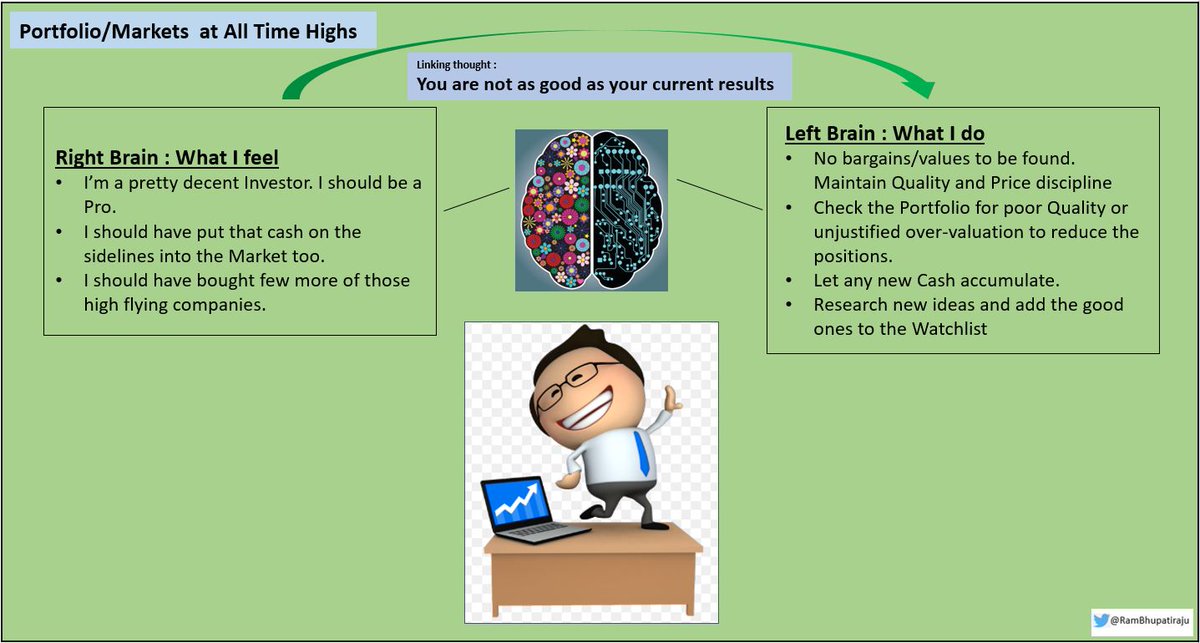

I'm firmly in the camp that believes that investing is as much behavioral as it is intellectual/analytical (assuming Tech/Reg lowered the Information & other type of edges).

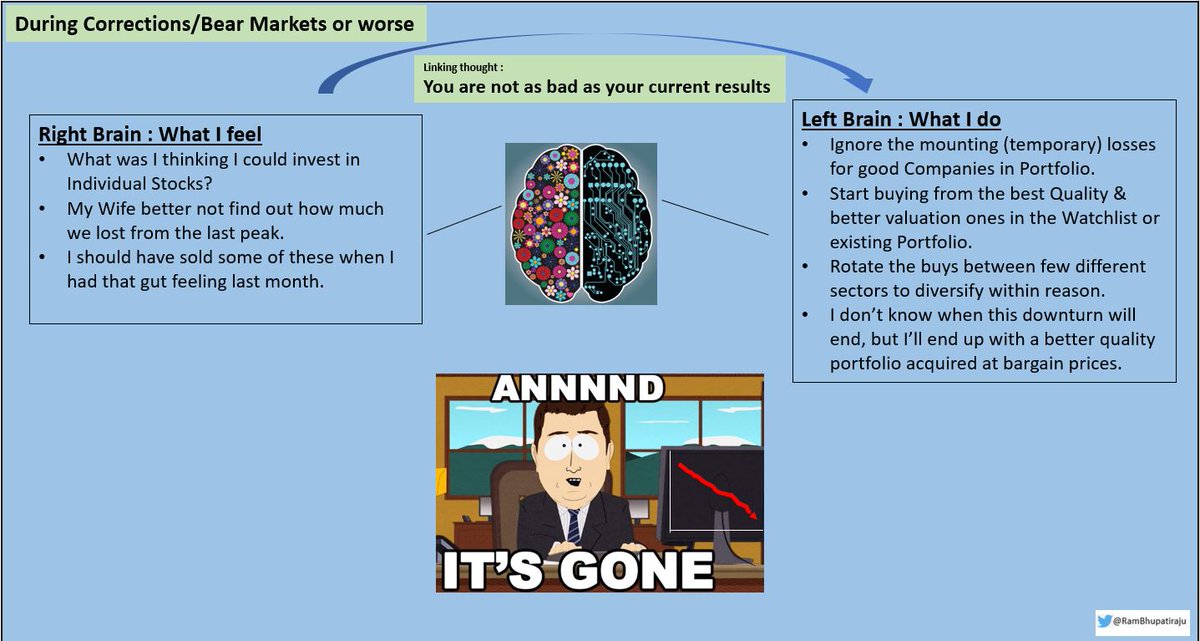

In short, separating the actions from the emotions & not doing things that seem comfortable at the moment but actually detrimental to the long-term plans.

When things are going terrible - a little less sulking, and building up the courage/conviction and taking actions that you're going to be proud of in few years when things are back to normal.

@awealthofcs @iancassel @IntrinsicInv @BluegrassCap @Gautam__Baid @GavinSBaker @JohnHuber72 @saxena_puru @ROIChristie @TMFJMo @OphirGottlieb @TihoBrkan

When everyone is doing high-fives, is when it's better to be folding your hands & think.

When everyone is running scared, is when it's better to stay calm & think.

When things are normal, feel free to mix with the crowd & have fun.

Thank you for reading. 🙏

/END.