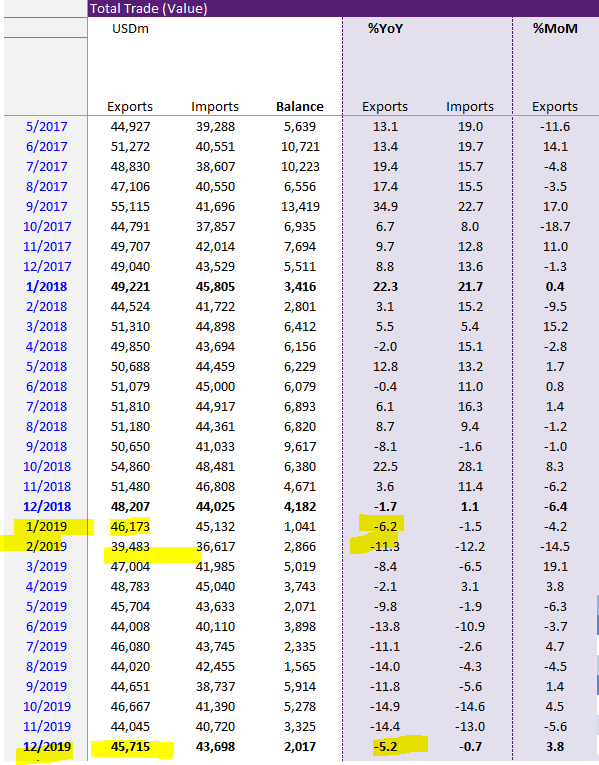

South Korea 1st 20-day exports FELL -0.2%YoY from -2% in December. Chips up +8.7% but to China falls -4.7%.

Also Korea PPI went positive to +0.7% from negative -0.1%.

Overall, chip & low base leading the recovering. So what is a low base???

In 2018, average monthly exports was 50,405

In 2019, average monthly exports was 45,194

A DROP of -10.3% so the ave of 2019 easy to beat in 2020

Not only was 2019 underwhelming we got Feb data abysmal, partly because of the lunar calendar.

So that's the base, what about seasonality?

That is the most effective way to basically infect all sectors related to going out & having fun!!👈🏻👈🏻