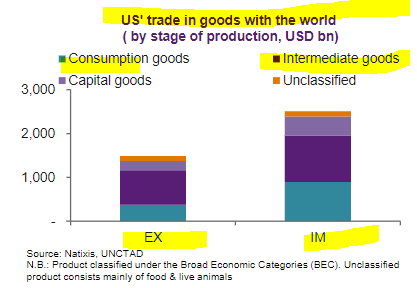

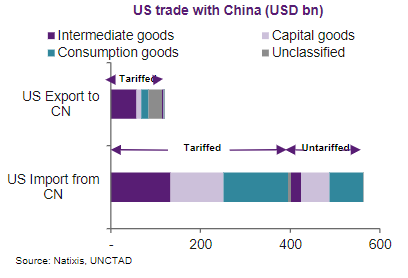

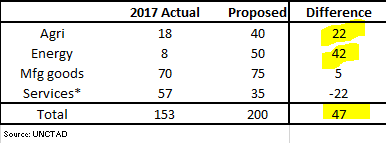

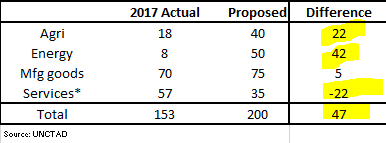

Gross data: The US is the #1 importer in the world of 2.6trn 👇🏻

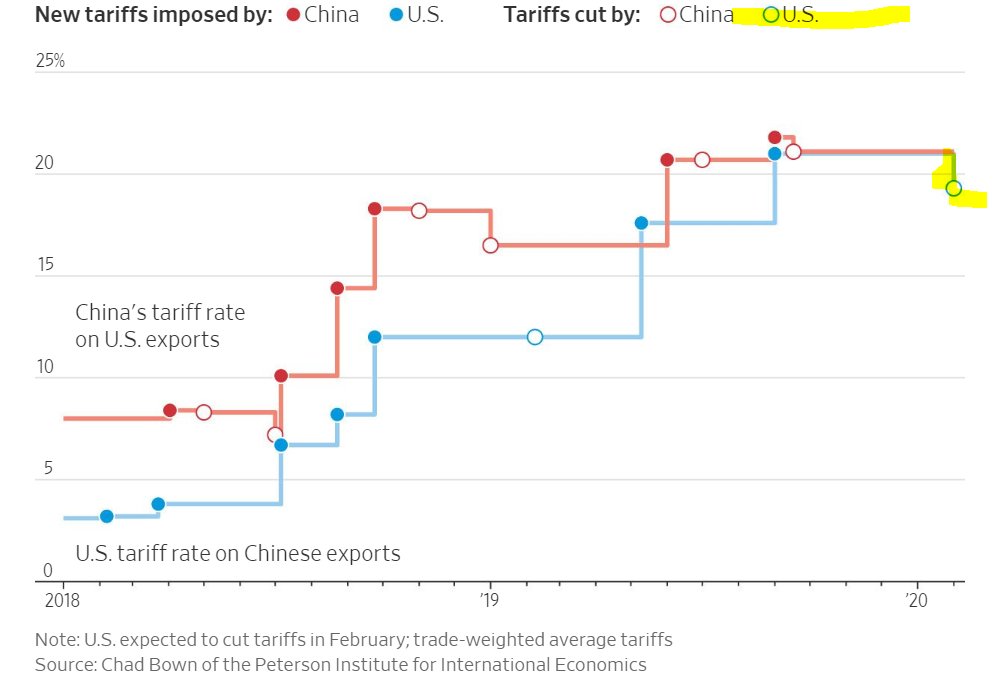

a) pass on to consumers; b) if not, erosion of profit so try to arbitrage that via asking exporters to lower prices or find alternative places to import!

The question is:

What is the US strategic plan to not just diversify supply chain but also COMPETE w/ China in the decades ahead?