We are at that point now. 1/

Clearly, there is no space on Twitter for my framework, but I have written extensively in GMI about it.

Everything else could be tuned out - Elections, Brexit, Tech earnings, Phase 1 Trade etc. All noise.

The coronavirus is that.

It is an enormous demand shock to the world and has investors gripped in concerns of this potentially awful pandemic.

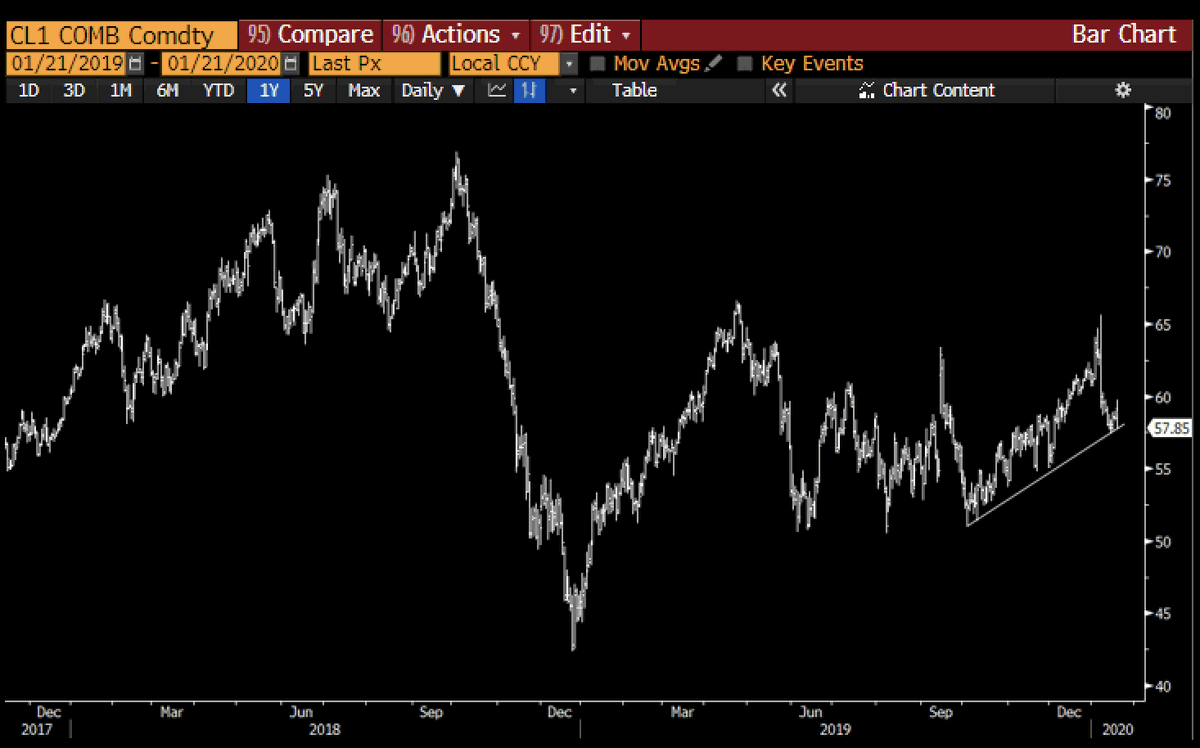

The commodity markets rightly got the signal fast too.

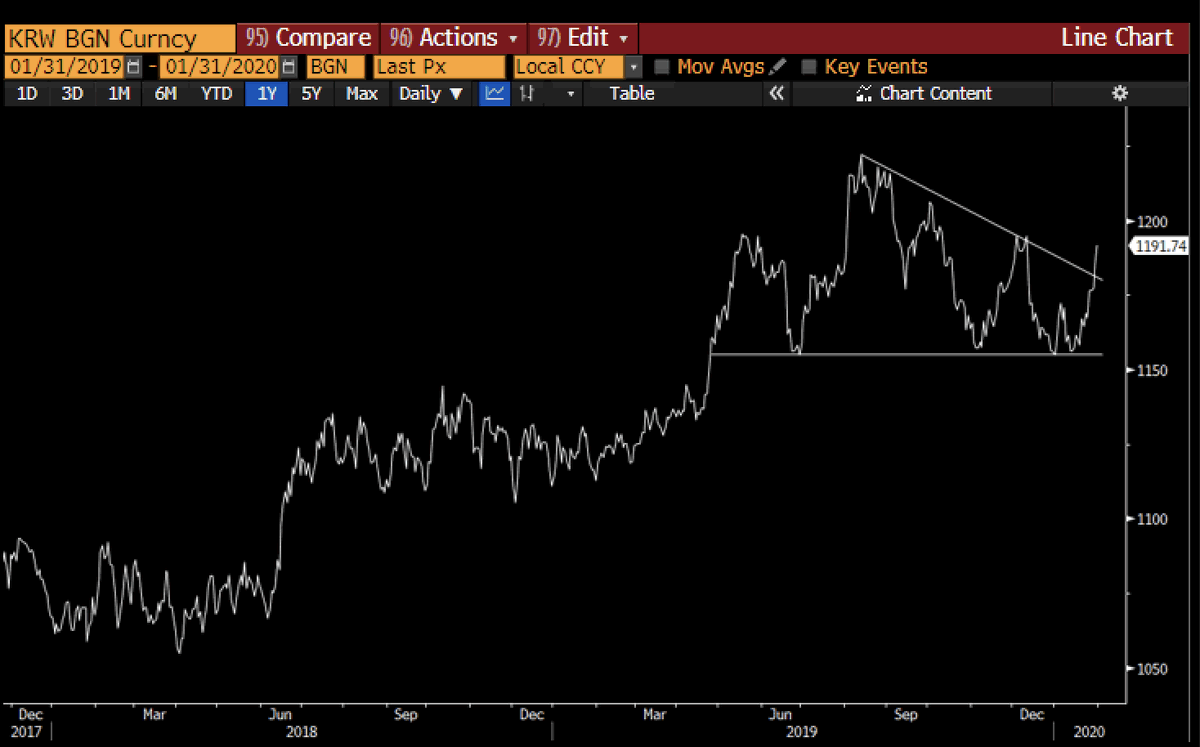

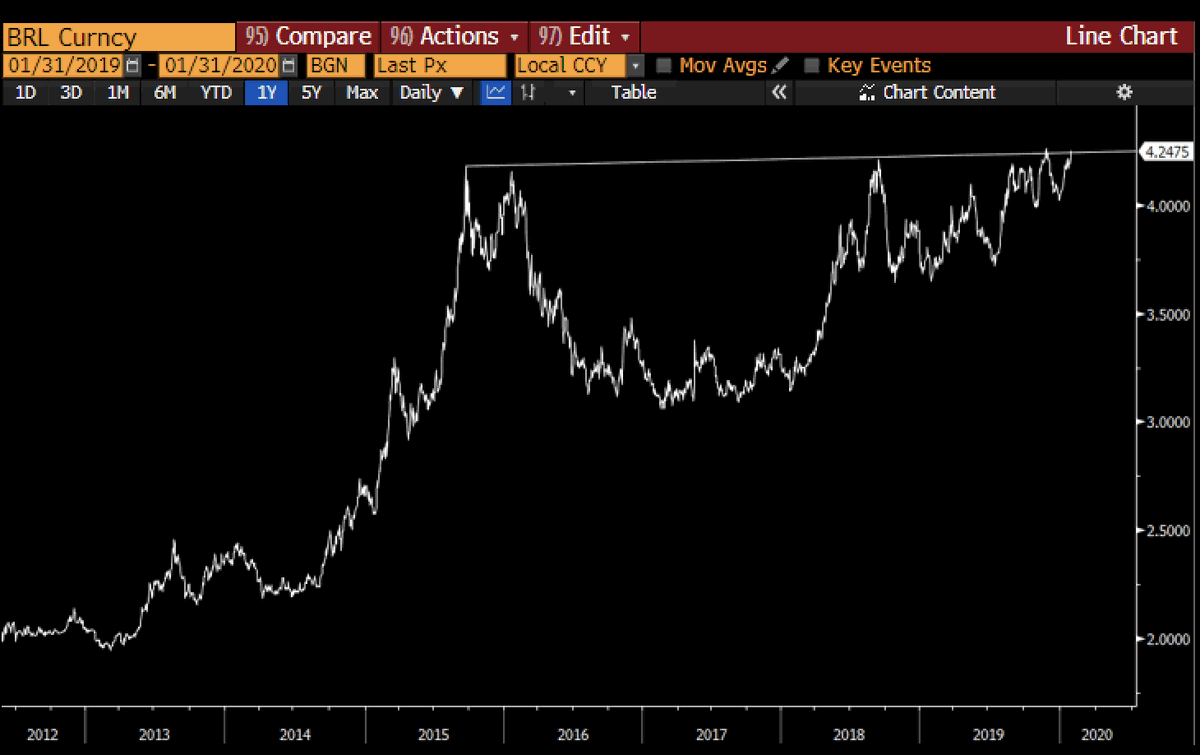

The knock-on effects are now spreading slowly into the currency markets. That is where I think where the next phase lies...

Good luck.