But first I want to stop and explain why this initial strategy was so helpful to me.

Protect against a financial crisis is too broad and abstract.

Once your money is on the line you have a big motivation to learn and improve.

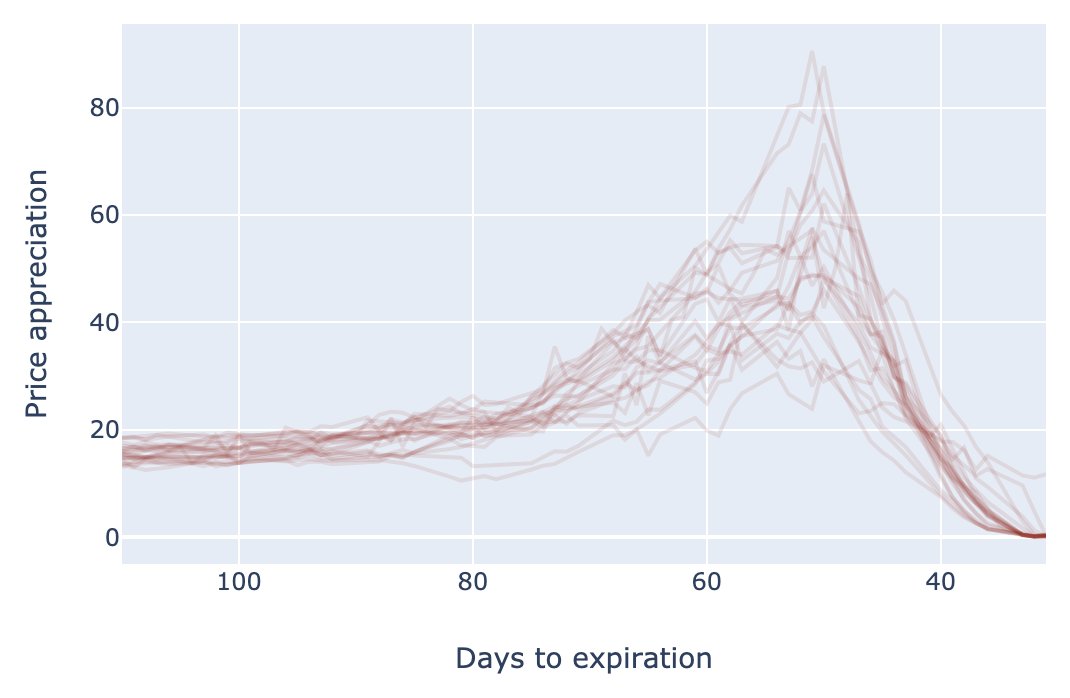

Buying side: 30% out of the money 2-month put might be ok given certain conditions but not under all conditions.

I needed to know X, Y in X% OTM given Y days to expiration given current conditions (implied vol, interest, etc).

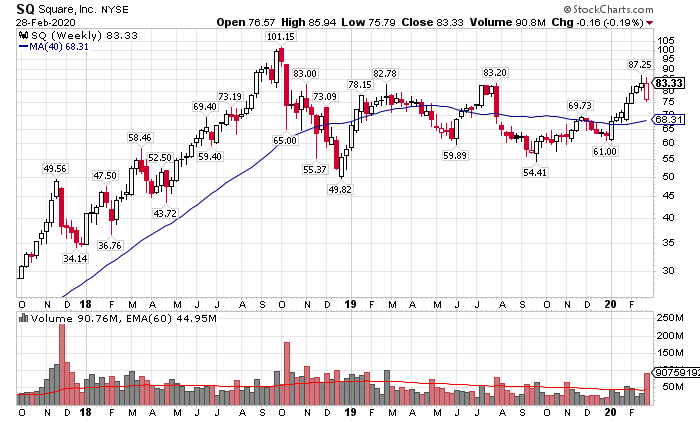

To start, I needed data.

After searching a bit I decided to buy it from historicaloptiondata.com

Maybe I could have found better deals but I did not want to spend too much time shopping around.

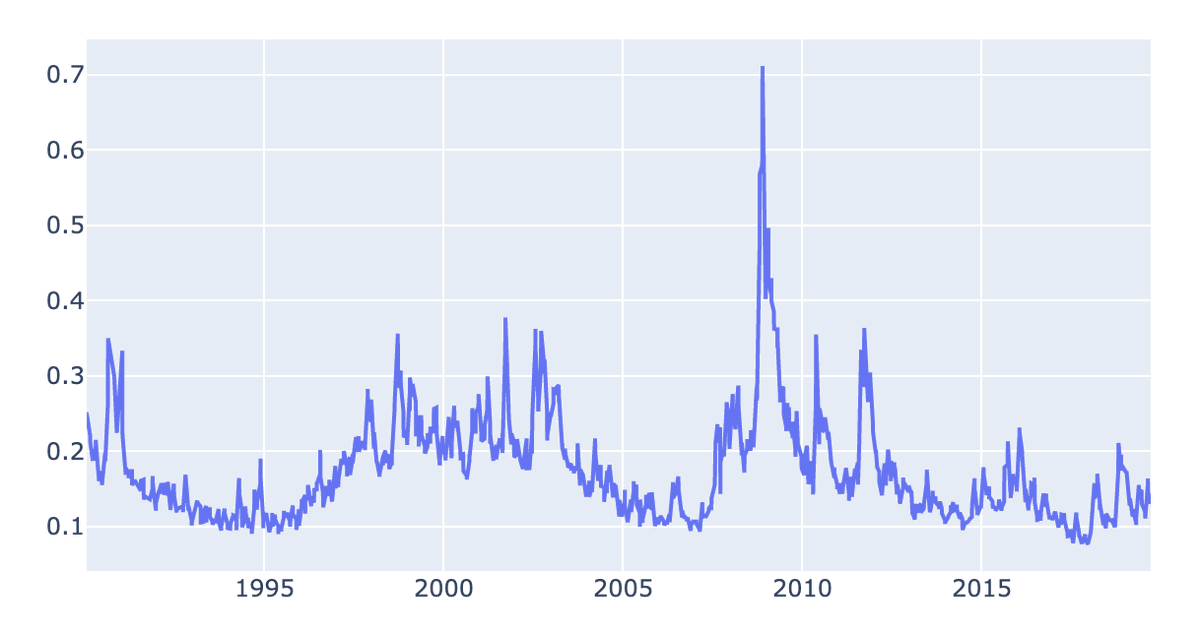

So my first task was to compute the implied volatility data from the price data using a vanilla Black-Scholes model.

After a quick search I found some libraries that claimed to do it but I did not find one that seemed well maintained/documented.

This actually took more time than I expected as my optimization kept diverging for some combinations of strike, expiration and price.

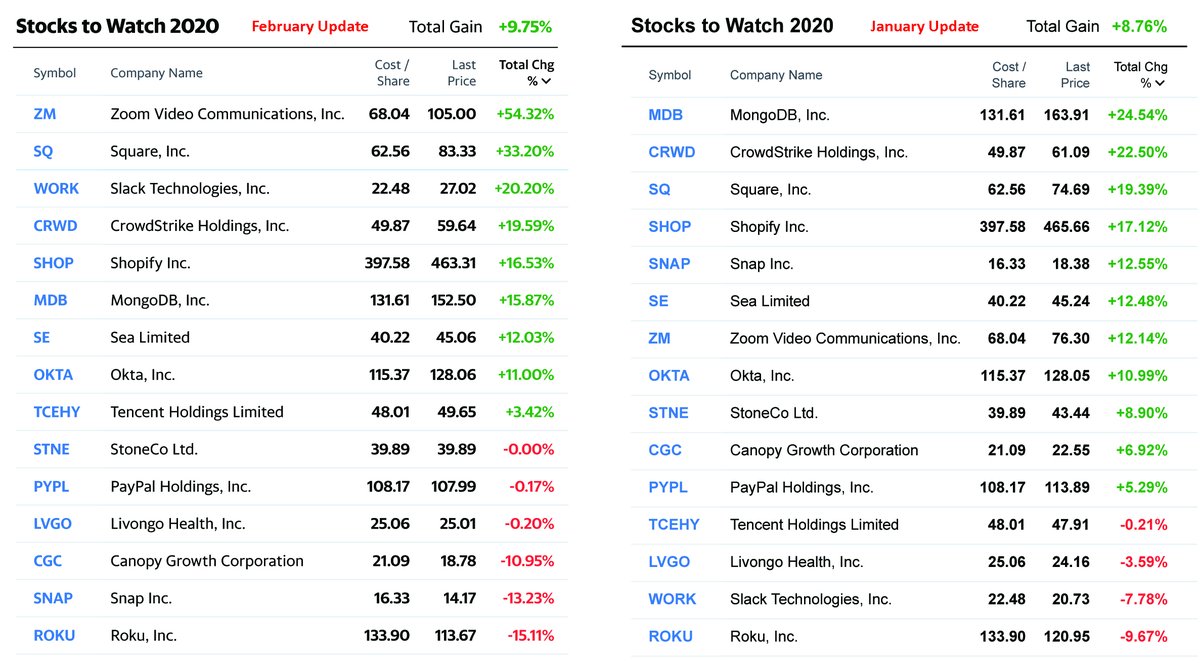

More than enough to cover the loss at the remaining parts of the portfolio, which is the point of all this. I will resume the thread later.

It was amazing to see how a tiny 0.5% of the portfolio can add a 17.5% slice into your overall portfolio but also how quickly it can disappear.

Not because of the financial results but because I could learn in practice how stressful it can be if you are not psychologically prepared.

It is NOT about making a quick profit when things move in your favor.

I will continue to update the technical part when things calm down. Let's see what the next week brings.

"It was the Fed’s first emergency rate cut since 2008 at the height of the financial crisis, underscoring how grave the central bank views the fast-evolving situation."

reuters.com/article/us-usa…

Anyway, this needs to be taken into account.

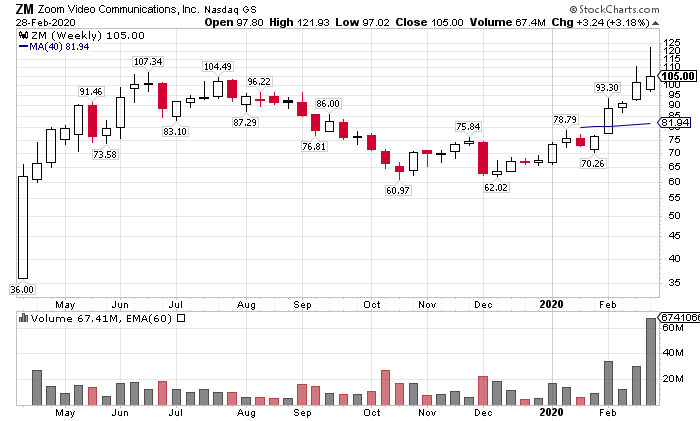

Out of nowhere all the liquidity disappeared. I knew that something big happened just by looking at the prices. Only later I realized what happened.

If you were in, you can realize part of the profit and continue the game. More on that later.

thefelderreport.com/2016/08/15/wor…