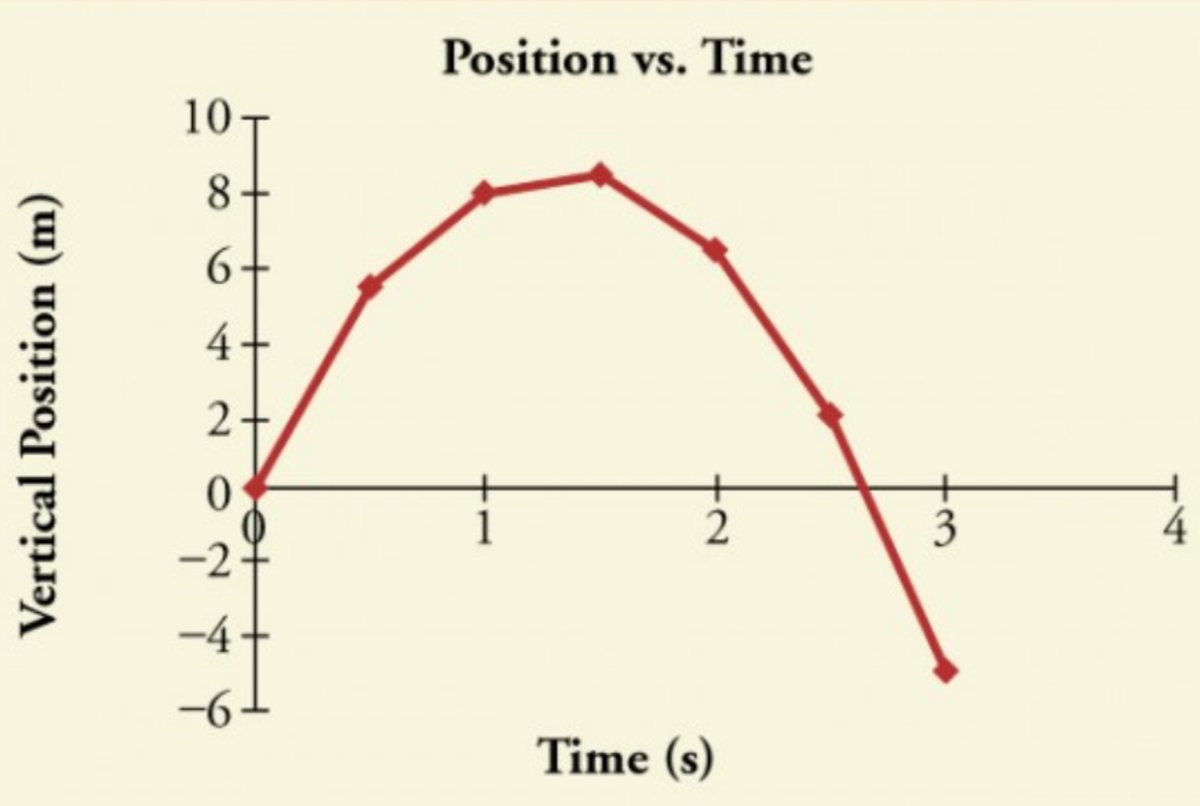

The markets under Obama kept going up in a straight line, because it was powered by something: good policies, sound fundamentals. The power in a jet or rocket can counteract gravity...

But as soon as Trump took over, he cut the engines. Without good policy fundamentals, the rocket is no longer a rocket. It's a ballistic missile. It keeps going up (but more slowly); then it starts to flatten; then it starts coming down again. ...

OK, so why am I going to the trouble of laying this out, other than to bitch about Trump (which is a fine enough reason to open one's mouth, but)?

Because Republicans will pretend the economy was doing GREAT under Trump, + just got coldcocked by Covid-19.

Which is untrue...

TBF, the markets are falling more STEEPLY than they would have, bec of corona. But they were heading there anyway. The pandemic is just a downdraft, pushing an already-decelerating economy downward more quickly. But rockets can overcome downdrafts; ballistic missiles can't...

So don't let anyone sell the lie that the Trump economy was great until corona hit. It wasn't. It was falling. Covid-19 is just a downdraft that sped up what already was happening.

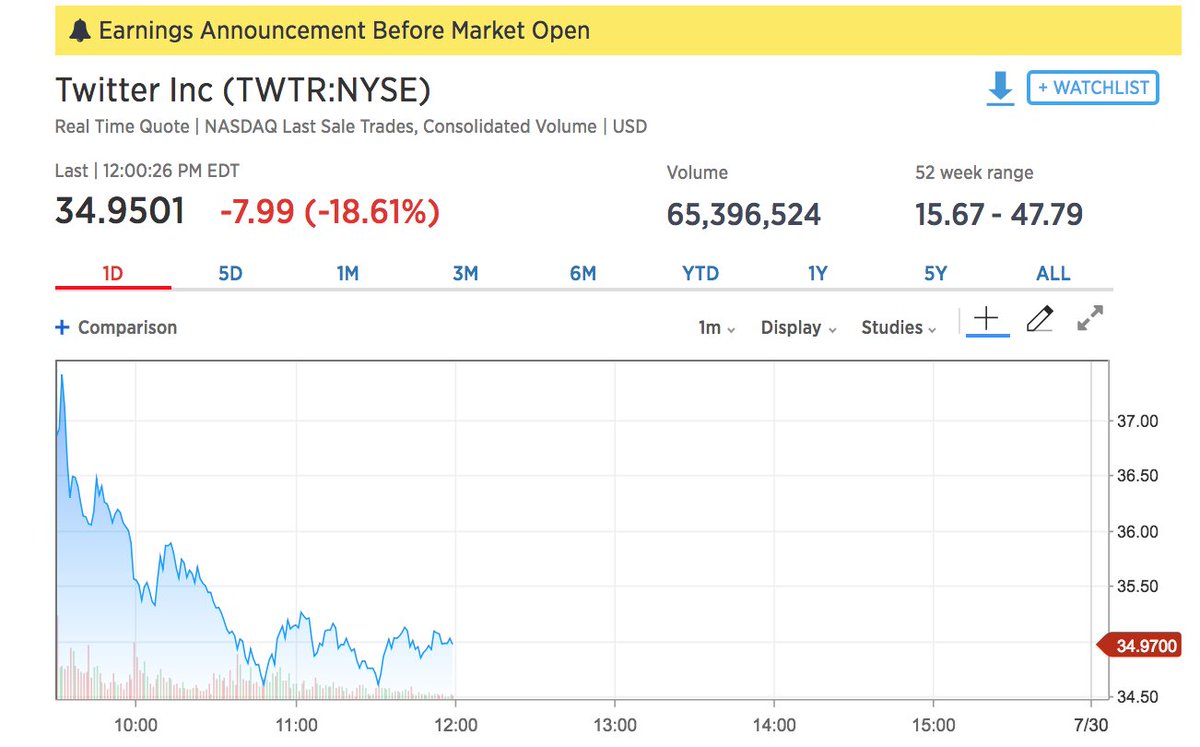

The VIX (top of thread) measures that turbulence. It's BUMPY, + will remain bumpy. ...

Trump's money men (esp Mnuchin) have foreseen the inevitable ballistic arc for a long time. But they were banking on the end of the (gravity's) rainbow not becoming widely apparent until AFTER the election.

Then: Covid.

Which explains the Administration's Covid response...

It's easy to say that the Administration's entire Covid response has been about saving the economy, not saving lives. That's why SecTreas Mnuchin is more prominent on the corona team that HHSSec Azar is. ...

But it's more nuanced than that. Trump's $ men already know they can't SAVE the economy. All they're really trying to do is POSTPONE ITS COLLAPSE UNTIL AFTER NOV.

Which is leading them to make really bad decisions that will make the recession worse. ...

Fiscal stimuli would help, but not by November. The GOP already passed huge tax cuts; there's not much juice left, even if House Ds went along with another. And direct government spending projects, on infrastructure or a new WPA etc., won't take effect before the election.

So because they care about the election, not the economy, GOP will not willingly enact new government spending programs now, in time to start helping people next year.

Instead, they turned immediately to the other category of economic stimulus: monetary tools. ...

Much of the effect of monetary stimuli (playing around with the money supply, central bank interest rates, etc.) is psychological. Eg: reduce interest rates, and investors feel like there's more leeway to risk a little, spurring investment.

For that reason, you get the most bang-for-your-buck from monetary stimuli by using them... theatrically. Tease an interest rate cut for a week or two, to get investors' attention, then enact that cut, to make them feel like they're expectations have been met + all is well.

Or, when there's a shock to the market of some kind, respond immediately by liberalizing available credit a little. It's less about the credit actually stimulating the economy, more about reassuring investors that the government is doing the right things to promote stability.

And, of course, monetary stimuli are finite. You can only cut interest rates so much. You can only dump so much money into the economy before triggering massive, harmful inflation. ...

For those reasons, monetary stimuli normally are used sparingly and, even when not sparingly, at least timed for maximum effect. The Fed and Treasury, in other words, usually don't fire until they see the whites of their eyes.

But this Administration knows the economy tanking is inevitable, and was inevitable even before coronavirus. Their only focus is on postponing that inevitable collapse until after November.

So instead of being tactical with monetary stimulus, they shot all the bullets, all at once:

Immediately dumped $1.5T into the money supply.

Then cut interest rates to near zero.

AND IT ISN'T WORKING.

And it's not working largely because they didn't play the necessary psychological games first. They didn't tease their monetary stimuli for maximum psychological effect. Instead, they panicked and pulled the trigger while the enemy was still on the far side of the hill.

And it's not working largely because they didn't play the necessary psychological games first. They didn't tease their monetary stimuli for maximum psychological effect. Instead, Trump panicked and pulled the trigger while the enemy was still on the far side of the hill.

And they've shot their wad. They held nothing in reserve. With inflation, central bank interest rates now are below zero. Increase the money supply much more, and we'll get a very ugly stagflation.

Which means there are no games we can play to save jobs, businesses, investments. All we have left is FISCAL policy: government borrowing lots of money (which at current interest rates is free r.n., so: cool!), then spending it on things that create jobs and stimulate demand.

Query: which party do you associate with "borrowing lots of money and spending it on things that help people"?

Because that's the only thing that will save us from a full-on Great Depression.

Bringing this endless thread back to where it started:

The Wall Street "fear index", and the Dow's trajectory even before Covid, are screaming that recession (or worse) is imminent; that the problem won't go away even if Covid does; ...

... and that this Administration is not only responding ineffectively, but responding HARMFULLY, because its sole focus right now isn't on preventing or at least mitigating collapse, but on merely POSTPONING collapse until after the election.

I draw three conclusions from all of the above:

1. Only Democrats can save us from something very ugly, because like it or not, the Democratic Party is the only organization positioned NOW to start spending federal $ in sufficient quantities. (Green New Deal, anyone?)

2. If the rich want to preserve their wealth, they'd better wake the fuck up to the reality of Point 1 above. Even if the nominee is Sanders. Wise, wealthy conservatives should be flooding Dem coffers right now, all the way down the ballot.

...

3. For the rest of us: Wall St doesn't just affect the rich. Wealth trickles up, but poverty trickles DOWN. So as you plan/save/spend/make life choices, don't assume the bumpy economy will end when Covid does. It won't. It's gonna be a VERY bumpy ride, for a VERY long time.

So, beloveds:

Hunker down.

Wash your hands.

Help each other.

Babysit each others' kids.

Try to diversify your income sources.

If you're rich or in Congress, spend wildly; otherwise, sparingly and wisely.

Save an emergency fund if you can.

Hang in there.

Elect Democrats.