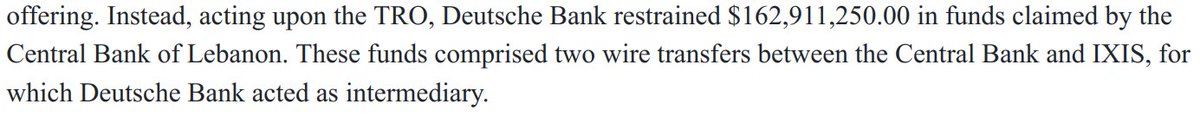

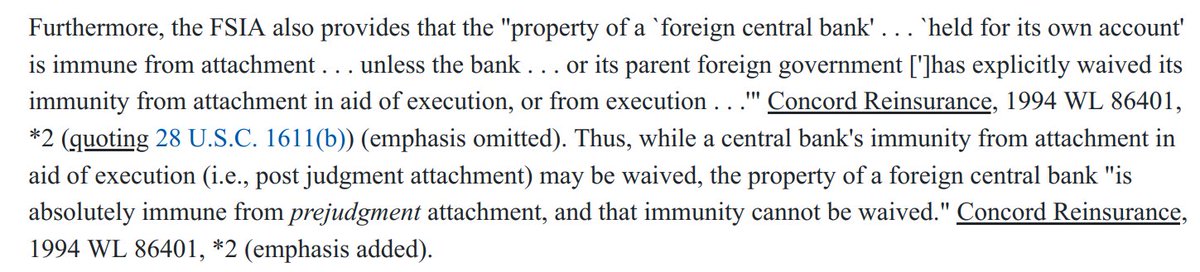

Pre-judgement attachment is when an asset is restrained pending trial/judgement by a court to protect a plaintiff's ability to collect if it wins.

Post-judgement attachment is when the asset is seized to make good on an award/judgement already made by a court.

casetext.com/case/sal-v-rep…