Just in March, has outperformed the index by ~15%. Here's AMZN's historical return:

5-yr CAGR +37%

10-yr CAGR +30%

20-yr CAGR +18%

From IPO +36%

I will discuss the whole business, why I am bullish, and the possible risks.

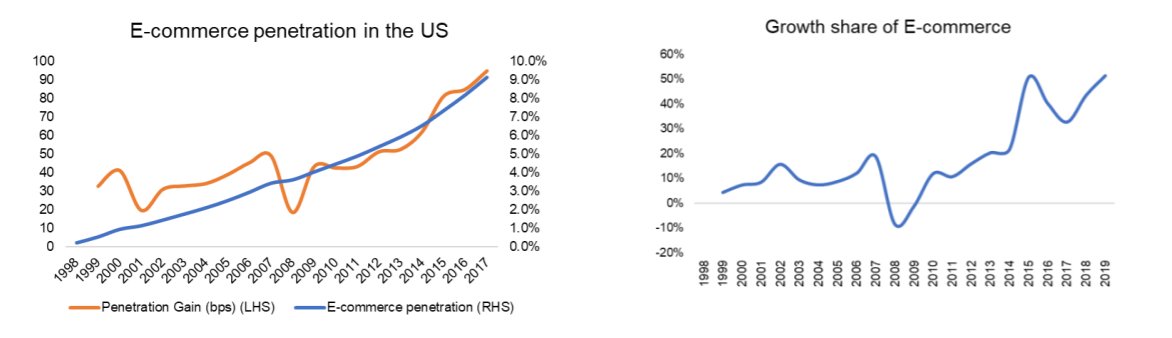

COVID-19 will quicken the shift even further.

A) Will be (Is it already) too big?

In 10 years, will be ~10% of US retail. was at 12% of US retail at its peak.

There will be lots of noise, but nothing damaging is unlikely to happen to from regulatory perspective

B) Is retail profitable?

I believe Yes for 3P, No for 1P.

How much? It's complicated. But I'll explain.

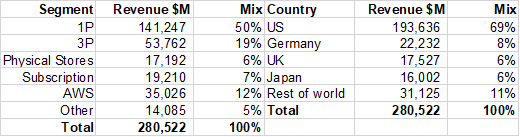

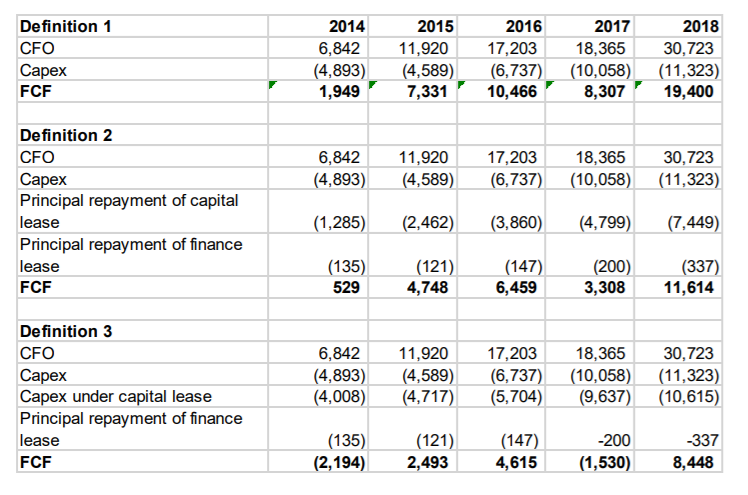

Let's talk about 1P first. doesn't disclose profitability by business segment. They disclose by North America, International, and AWS. So we will have to..

You may think I am conservative. But when I am forced to play guessing game, I want to err on the side of caution.

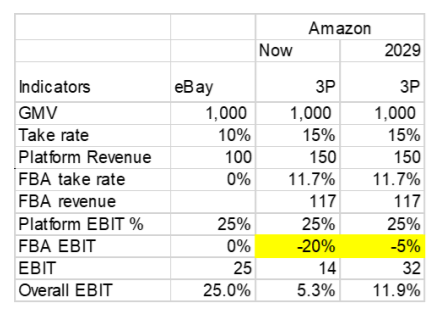

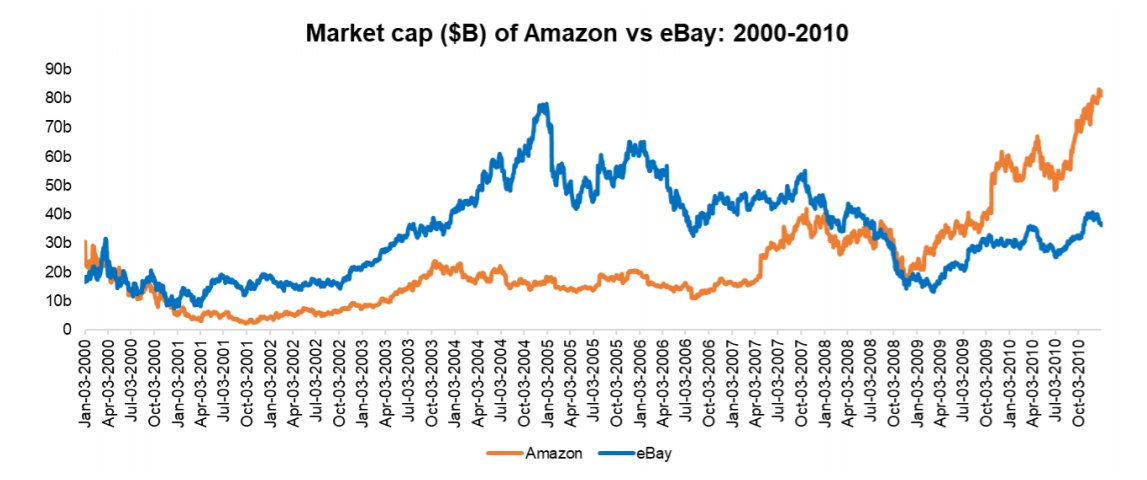

, has 3P business. 3P, just like them, is a marketplace connecting buyers and sellers.

's take rate is ~15%, 's take rate in 2018 was 26.7%. But there's a caveat...

So big takeaway from retail:

1P doesn't matter much.

3P does.

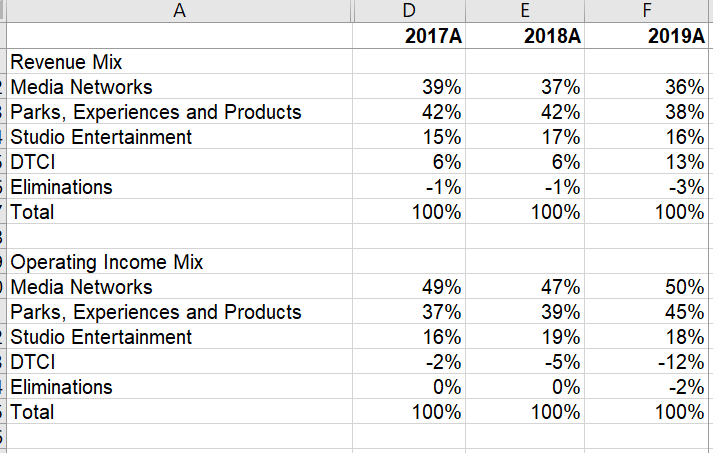

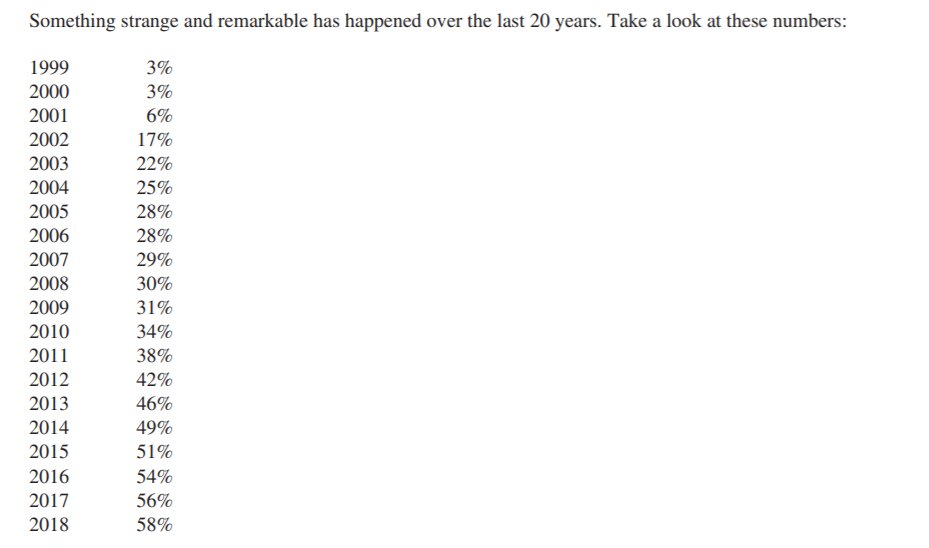

Also, look at this table from @JeffBezos letter in 2018. this is 3P as % of retail GMV.

Half of subscription revenue comes from Prime membership.

In 2015 letter, @JeffBezos said, "“We want Prime to be such a good value, you’d be irresponsible

not to be a member."

"Once you become a Prime

member, your human nature takes over. You want to leverage your $79 as much as possible." (Now it's $119/yr)

Prime, FBA, marketplace, and logistics have created a wide and defensible moat for retail platform which does and will drive profitability through subscription and advertising (will discuss later)

Prime is a GREAT platform to launch all sorts of ancillary services and grab a greater wallet share.

So how profitable is the subscription segment? A LOT.

I estimate EBIT margins to be ~40%. Here's how.

The other half (Music, Video, Audible etc) is obviously not such high margin business. I assumed -20% EBIT margin for this half of the business.

So the segment EBIT margin: ~50%*100% + ~50%*(-20%) = ~40%

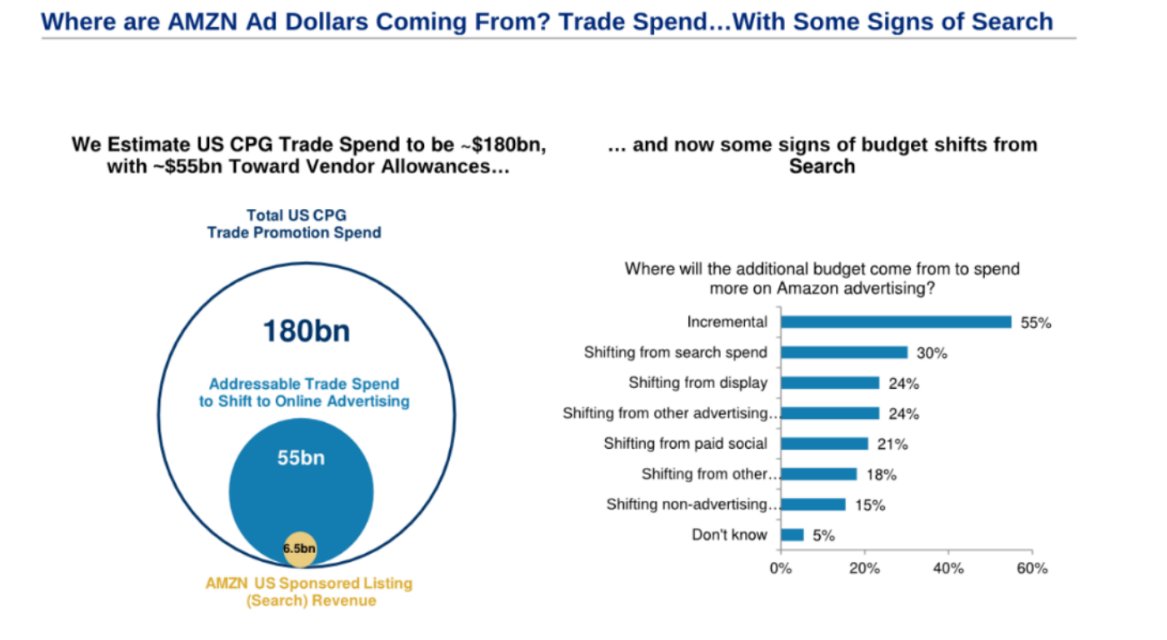

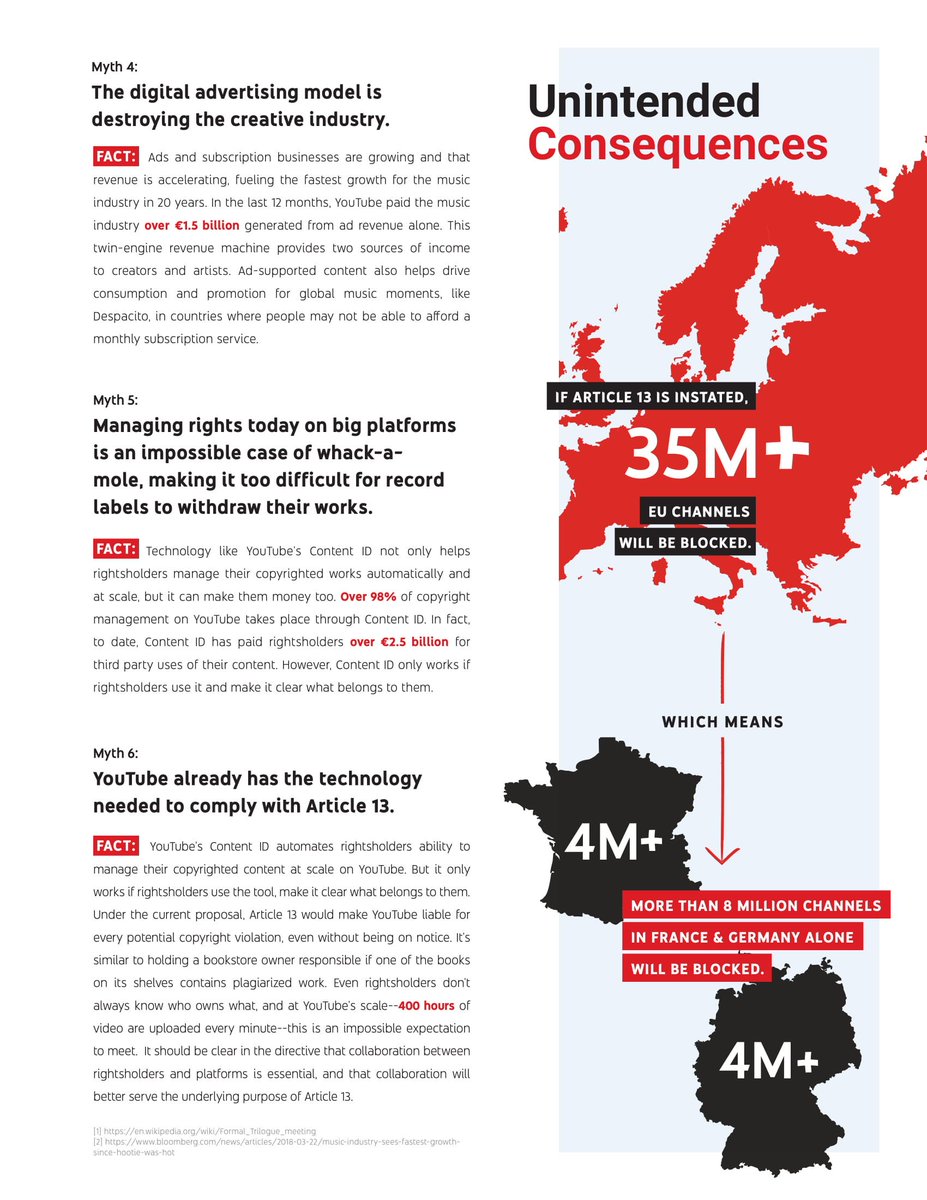

Relevant TAM for ad is NOT just global digital ad market, which itself is $130 B market dominated by and .

5-yr avg EBIT margins for was ~43%. 's core commerce (~60% ad revenue) margin hovered between 35-55%. I assume ~40% EBIT margin for .

What about the rest 20%? throws a lot of darts at the wall (e.g. AMZN payment)...

So, Ad: 80% of other segment, EBIT margin: 40%

The rest: 20% of other segment, EBIT margin -50%

Overall margin for other segment: ~22%

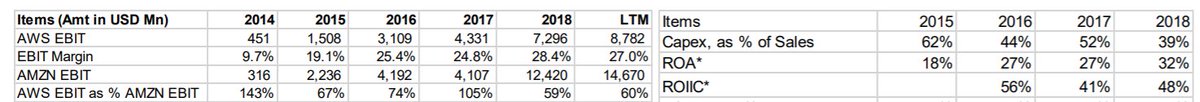

$1 T. Here's how:

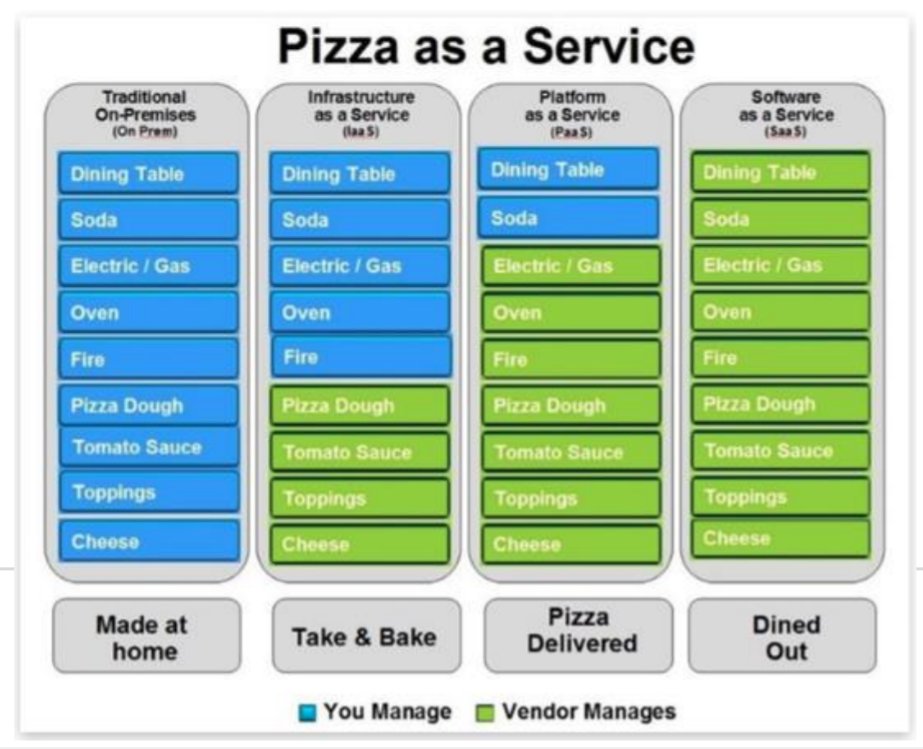

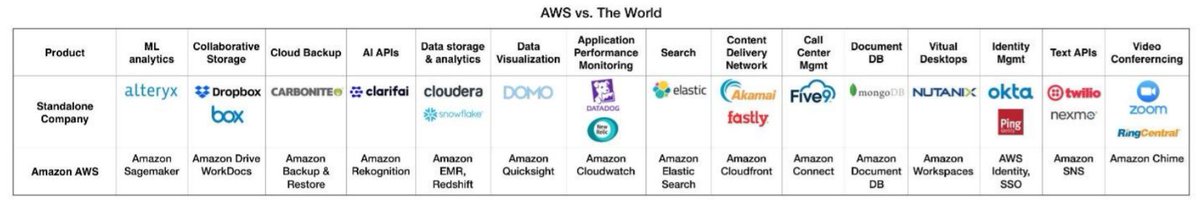

Global IT spending: $2.8 T (IDC est)

Cloud TAM, excl. SaaS: $1 T (Bernstein)

Shift from on-prem to cloud 60-70% (JPM)

Current AWS relevant TAM $700 B

Assuming 3% IT spending growth, $1 T TAM in 2030

So current competitive dynamics does not concern me.

There are obviously lots of risks. Escalating shipping costs, failure in international markets, degrading customer experience because of increased ad load, antitrust concerns come to mind.

Remember, take investment decisions on your own.

RT if you learned something.