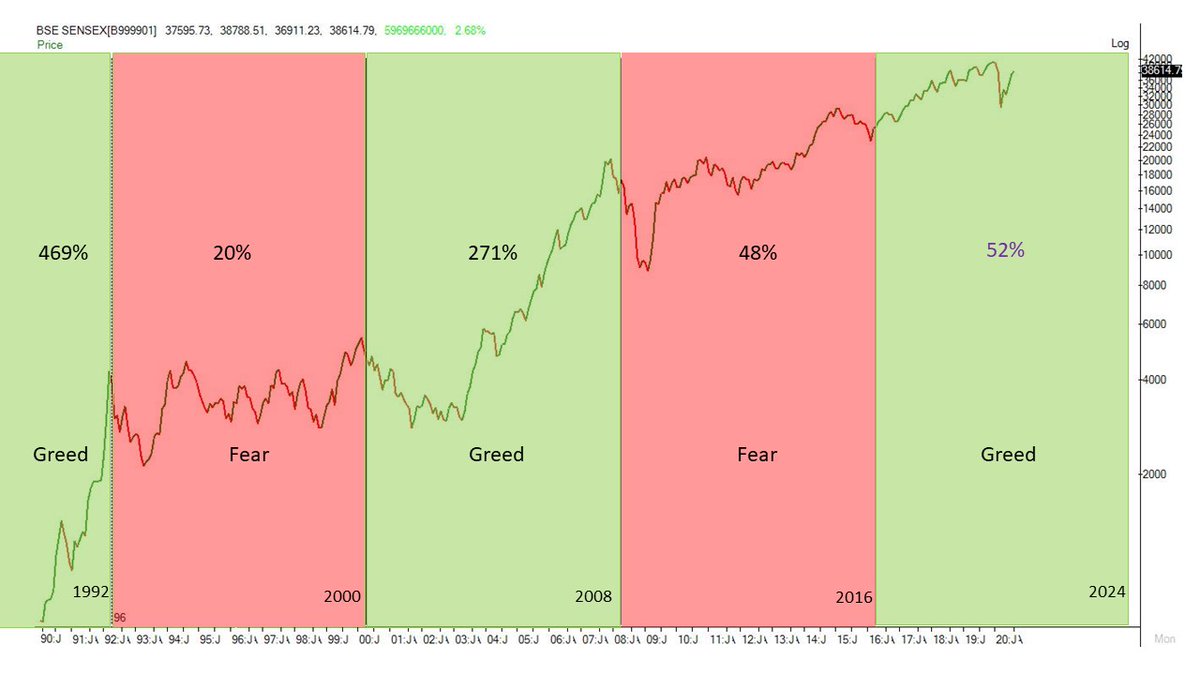

All #Sensex #BearMarkets in #OneChart

Most of us have never seen a market crash like this earlier. But it doesn’t mean markets haven’t fallen like this ever before. Take a look at all the bear markets and you will get my point.

#coronacrash #markets #bandkarobazaar

Most of us have never seen a market crash like this earlier. But it doesn’t mean markets haven’t fallen like this ever before. Take a look at all the bear markets and you will get my point.

#coronacrash #markets #bandkarobazaar

1. The 1992 crash was the first one for Indian stock markets. It took just 36 sessions for the Sensex to fall by 40% from all-time highs.

2. The bear market after the Dotcom bubble burst in 2000 was the longest. Sensex dropped 56% from all-time high and took 405 sessions or 19 months to bottom out.

3. The crash in 2008 was the severest of all. Sensex plunged 61% from all-time high and knocked out most investors brutally.

4. The 2015 bear market was the least fatal of all. Sensex dropped 23% from all-time high on the back of currency crisis in emerging market economies.

4. The 2015 bear market was the least fatal of all. Sensex dropped 23% from all-time high on the back of currency crisis in emerging market economies.

5. The Corona crash is the most recent of all bear markets. Sensex has fallen a maximum of 33% in 47 trading sessions. We are in the middle of this crash and don’t know how far or how long it will take to bottom out.

I hope this chart gives you a better perspective on the past market crashes and enables you to take better decisions in future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh